When managing liability for unexpected expenses, choosing between a bank overdraft and a cash advance app is crucial. Bank overdrafts often come with higher fees and stricter repayment terms, increasing financial risk, while cash advance apps offer more flexible access to funds but may charge higher interest rates or service fees. Evaluating the cost, convenience, and impact on credit is essential to minimize liability effectively.

Table of Comparison

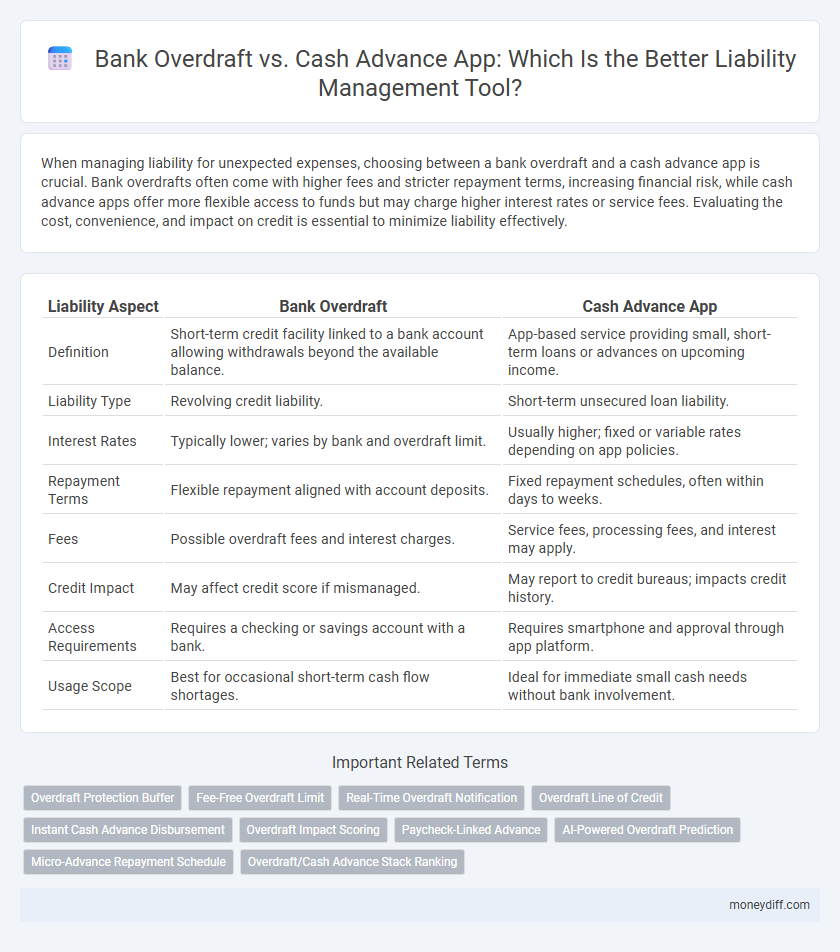

| Liability Aspect | Bank Overdraft | Cash Advance App |

|---|---|---|

| Definition | Short-term credit facility linked to a bank account allowing withdrawals beyond the available balance. | App-based service providing small, short-term loans or advances on upcoming income. |

| Liability Type | Revolving credit liability. | Short-term unsecured loan liability. |

| Interest Rates | Typically lower; varies by bank and overdraft limit. | Usually higher; fixed or variable rates depending on app policies. |

| Repayment Terms | Flexible repayment aligned with account deposits. | Fixed repayment schedules, often within days to weeks. |

| Fees | Possible overdraft fees and interest charges. | Service fees, processing fees, and interest may apply. |

| Credit Impact | May affect credit score if mismanaged. | May report to credit bureaus; impacts credit history. |

| Access Requirements | Requires a checking or savings account with a bank. | Requires smartphone and approval through app platform. |

| Usage Scope | Best for occasional short-term cash flow shortages. | Ideal for immediate small cash needs without bank involvement. |

Understanding Bank Overdrafts: Definition and Mechanism

A bank overdraft occurs when an individual withdraws more money from their bank account than the available balance, creating a short-term liability owed to the bank. This facility allows account holders to access funds up to an approved limit, with interest charged on the overdrawn amount, typically calculated daily. Understanding the mechanism, overdrafts act as revolving credit linked directly to the checking account, distinguishing them from fixed-term loans or cash advances through apps.

What Are Cash Advance Apps? Overview and Functionality

Cash advance apps provide short-term, small-dollar loans allowing users to access funds prior to their next paycheck, often without traditional credit checks. These apps function by linking to a user's bank account, automatically deducting repaid amounts, and charging minimal fees compared to bank overdraft penalties. Unlike bank overdrafts that incur high interest and fees when accounts are overdrawn, cash advance apps offer a more flexible, transparent solution for immediate liquidity while managing liability exposure.

Comparing Liability: Bank Overdrafts vs Cash Advance Apps

Bank overdrafts typically carry higher liability risks due to accumulated interest and overdraft fees imposed by banks, potentially leading to substantial debt if not managed carefully. Cash advance apps offer more transparent, short-term borrowing with fixed fees, reducing the likelihood of escalating liabilities but often featuring higher costs for repeated usage. Evaluating the liability impact requires considering the frequency of use, interest rates, and repayment terms associated with each option.

Interest Rates and Fees: Which Option Costs More?

Bank overdrafts typically have lower interest rates compared to cash advance apps, but they often include fees such as overdraft charges and daily penalties that can accumulate quickly. Cash advance apps usually charge higher interest rates or fixed fees per transaction, but they provide quicker access to funds without requiring a linked bank account. When evaluating liability costs, overdrafts may be more affordable if managed carefully, while cash advances tend to be more expensive due to higher interest rates and fees.

Impact on Credit Score: Overdraft vs Cash Advance Liabilities

Bank overdraft liabilities typically result in lower immediate credit score impacts compared to cash advance apps, which often report as short-term loans or credit card cash advances, triggering higher credit utilization ratios. Overdrafts may only affect credit reports if the account becomes severely delinquent, whereas cash advances affect credit scores through increased revolving credit usage and potential higher interest rates. Understanding the reporting differences is crucial for managing credit risk and maintaining a healthy credit profile.

Repayment Terms: Flexibility and Risks

Bank overdrafts typically offer flexible repayment terms with interest charged only on the overdrawn amount, while cash advance apps often require full repayment within a shorter, fixed period, increasing the risk of financial strain. Overdrafts may include fees based on usage and can adjust credit limits, providing some repayment adaptability, whereas cash advance apps usually impose high fees and interest rates if repayments are late. Understanding these differences is crucial for managing liability and avoiding excessive debt burden.

Consumer Protection and Regulatory Differences

Bank overdrafts and cash advance apps present distinct liability risks due to differing consumer protection frameworks and regulatory oversight. Bank overdrafts are regulated under established banking laws and offer protections like transparent fee disclosures and error resolution processes, whereas cash advance apps often operate under less stringent regulations, increasing potential liability for consumers due to higher fees and fewer safeguards. Understanding these regulatory distinctions is crucial for managing financial liabilities and ensuring consumer rights are upheld.

Long-Term Financial Health: Overdrafts vs Cash Advances

Bank overdrafts typically carry lower interest rates and flexible repayment terms, which can help maintain better long-term financial health by avoiding excessive debt accumulation. Cash advance apps often impose higher fees and interest rates that can quickly escalate liability, potentially harming credit scores and increasing financial stress. Choosing overdrafts over cash advances provides a more sustainable solution for managing short-term liquidity without compromising future financial stability.

Managing Liability: Best Practices for Borrowers

Effective management of liability involves understanding the differences between bank overdrafts and cash advance apps, as both impact credit risk and repayment obligations differently. Bank overdrafts often carry lower interest rates but strict limits tied to existing bank accounts, while cash advance apps offer quick access to funds with higher fees and shorter repayment terms, affecting overall debt burden. Borrowers should monitor usage, maintain timely payments, and assess cost structures to minimize financial liability and avoid negative credit consequences.

Choosing the Right Option: Factors to Consider for Liability Management

When managing liability, choosing between a bank overdraft and a cash advance app involves evaluating interest rates, repayment terms, and impact on credit scores. Bank overdrafts typically offer lower interest rates but may impose strict fees and limits tied to account history, while cash advance apps provide quick access to funds with variable costs and less stringent approval processes. Understanding the total cost of borrowing and potential consequences for your financial health ensures effective liability management.

Related Important Terms

Overdraft Protection Buffer

Bank overdraft offers an overdraft protection buffer that prevents transactions from being declined by allowing accounts to temporarily exceed their balance, minimizing liability risks for both consumers and financial institutions. In contrast, cash advance apps typically provide immediate access to funds without a buffer, often resulting in higher liability exposure due to fees and faster depletion of available credit.

Fee-Free Overdraft Limit

A fee-free overdraft limit on a bank account allows customers to temporarily spend beyond their balance without incurring immediate charges, reducing the liability impact compared to a cash advance app that often imposes higher fees and interest rates. Managing liabilities through a fee-free overdraft helps maintain cash flow flexibility while minimizing unexpected financial costs.

Real-Time Overdraft Notification

Real-time overdraft notification in bank overdraft services alerts account holders instantly upon reaching or exceeding zero balance, minimizing unexpected fees and improving financial liability management. Cash advance apps typically lack real-time alerts, increasing the risk of unnoticed debt accumulation and higher liability exposure.

Overdraft Line of Credit

Bank overdraft functions as a pre-approved line of credit linked to a checking account, allowing consumers to cover transactions exceeding their account balance without immediate repayment. Unlike cash advance apps, which typically offer short-term loans with higher fees and interest rates, overdraft lines of credit provide a more structured liability option with potentially lower cost and flexible repayment terms.

Instant Cash Advance Disbursement

Bank overdrafts typically involve predetermined credit limits with potential interest charges accruing over time, while cash advance apps offer instant cash advance disbursement that can increase short-term liability quickly due to higher fees and immediate repayment terms. Choosing between these liabilities requires careful assessment of cost, flexibility, and repayment speed to manage financial impact effectively.

Overdraft Impact Scoring

Bank overdraft impacts credit scoring by indicating short-term liquidity issues, often resulting in lower credit scores due to the risk of insufficient funds. In contrast, cash advance app usage typically affects credit scores less directly, as these apps rely on alternative data rather than traditional banking overdraft reports for liability assessment.

Paycheck-Linked Advance

Paycheck-linked advances from cash advance apps create short-term liabilities by providing funds against future wages without traditional bank overdraft fees, allowing users to manage cash flow before the next paycheck. Unlike bank overdrafts that charge interest and overdraft fees, paycheck-linked advances often feature fixed or low fees, reducing unpredictable liabilities and improving financial planning.

AI-Powered Overdraft Prediction

AI-powered overdraft prediction in bank accounts enhances liability management by accurately forecasting potential overdraft events, reducing unexpected fees and improving cash flow control. Compared to cash advance apps, this technology leverages machine learning algorithms to analyze spending patterns and prevent overdraft liability proactively.

Micro-Advance Repayment Schedule

Bank overdrafts typically incur interest charges based on the outstanding balance and are repayable on demand, while cash advance apps offer structured micro-advance repayment schedules with fixed installment amounts and specified due dates. These repayment terms reduce the risk of accumulating excessive liability compared to variable bank overdraft interest, providing clearer short-term financial obligations for users.

Overdraft/Cash Advance Stack Ranking

Bank overdrafts typically carry lower interest rates and longer repayment terms compared to cash advance apps, which often impose higher fees and immediate repayment obligations, making overdrafts a more cost-effective liability option for short-term financing. Prioritizing overdrafts over cash advance apps reduces overall liability costs and financial risk due to the structured repayment plans and regulatory oversight associated with overdraft protection.

Bank Overdraft vs Cash Advance App for liability. Infographic

moneydiff.com

moneydiff.com