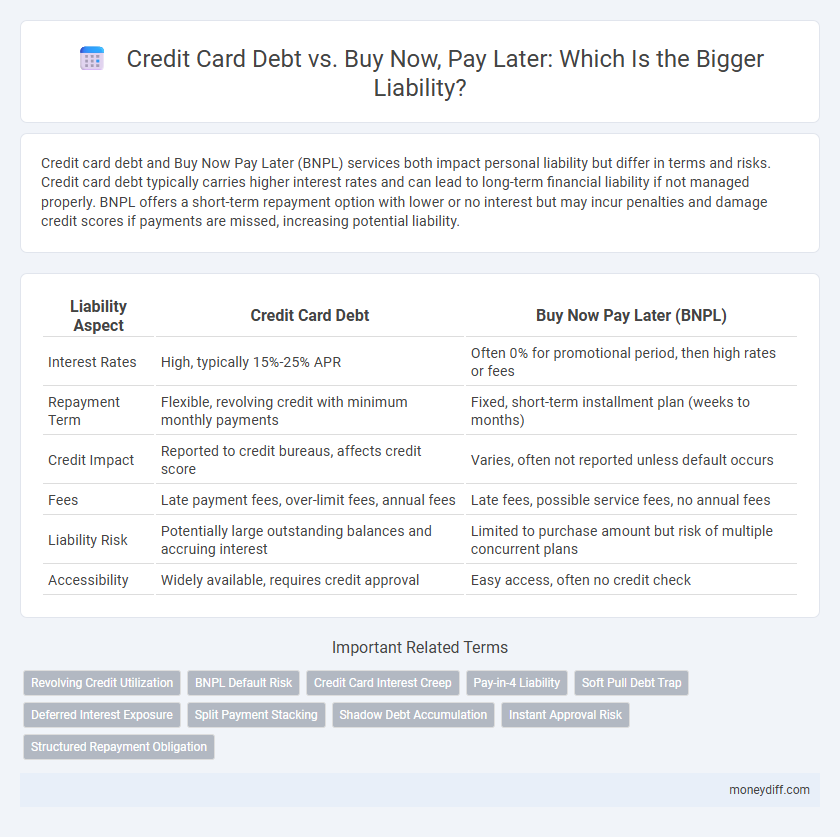

Credit card debt and Buy Now Pay Later (BNPL) services both impact personal liability but differ in terms and risks. Credit card debt typically carries higher interest rates and can lead to long-term financial liability if not managed properly. BNPL offers a short-term repayment option with lower or no interest but may incur penalties and damage credit scores if payments are missed, increasing potential liability.

Table of Comparison

| Liability Aspect | Credit Card Debt | Buy Now Pay Later (BNPL) |

|---|---|---|

| Interest Rates | High, typically 15%-25% APR | Often 0% for promotional period, then high rates or fees |

| Repayment Term | Flexible, revolving credit with minimum monthly payments | Fixed, short-term installment plan (weeks to months) |

| Credit Impact | Reported to credit bureaus, affects credit score | Varies, often not reported unless default occurs |

| Fees | Late payment fees, over-limit fees, annual fees | Late fees, possible service fees, no annual fees |

| Liability Risk | Potentially large outstanding balances and accruing interest | Limited to purchase amount but risk of multiple concurrent plans |

| Accessibility | Widely available, requires credit approval | Easy access, often no credit check |

Understanding Credit Card Debt and BNPL as Liabilities

Credit card debt and Buy Now Pay Later (BNPL) are both financial liabilities that represent money owed to creditors with potential interest and fees impacting the borrower's credit score and financial health. Credit card debt typically accrues compound interest and may include penalty fees, while BNPL plans often offer interest-free installments but can impose late fees and affect creditworthiness if payments are missed. Understanding the terms, repayment schedules, and impact on credit reports is essential for managing these liabilities and avoiding long-term financial strain.

Key Differences Between Credit Card Debt and Buy Now Pay Later

Credit card debt involves borrowing funds with ongoing interest accrual and potential fees if balances are not paid in full each month, increasing overall liability. Buy Now Pay Later (BNPL) offers short-term installment payments without traditional interest but may include late fees and affect credit scores if unpaid, presenting a different risk profile. The main difference lies in credit card debt's revolving nature versus BNPL's fixed repayment schedule, impacting how liabilities accumulate and are managed.

Interest Rates: Credit Cards vs Buy Now Pay Later

Credit card debt typically carries higher interest rates, often ranging from 15% to 25% APR, which can significantly increase the liability if balances are not paid in full monthly. Buy Now Pay Later (BNPL) services usually offer lower or zero interest rates during the repayment period but may impose high late fees or penalty interest rates if payments are missed. Understanding the difference in interest structures between credit cards and BNPL plans is essential for managing financial liability effectively.

Impact on Credit Score: Credit Card Debt vs BNPL

Credit card debt directly affects credit scores by increasing credit utilization ratios and requiring on-time payments to maintain or improve the score. Buy Now Pay Later (BNPL) services often do not report to credit bureaus unless payments are missed, resulting in less immediate impact on credit scores but potential risk if defaults occur. Managing credit card debt responsibly typically builds credit history, whereas BNPL can lead to untracked liabilities that may negatively affect creditworthiness if not managed properly.

Payment Flexibility and Terms Comparison

Credit card debt typically offers revolving credit with minimum monthly payments based on outstanding balances and variable interest rates, allowing borrowers flexible payment schedules but potentially higher long-term costs. Buy Now Pay Later (BNPL) plans usually provide fixed installment payments over a short-term period with zero or low interest, enhancing payment predictability but limiting repayment flexibility. Comparing these liabilities, credit cards deliver adaptable payment options suited for ongoing expenses, whereas BNPL is designed for specific purchases with structured terms.

Hidden Fees: What to Watch Out For

Credit card debt often carries hidden fees such as annual fees, late payment penalties, and high-interest rates that can significantly increase overall liability. Buy Now Pay Later (BNPL) services may appear interest-free but can include surprise fees like late payment charges and account reinstatement costs, which compound liabilities quickly. Consumers should scrutinize the terms and conditions of both options to avoid unexpected financial burdens.

Financial Behaviors and Overspending Risks

Credit card debt often leads to higher interest rates and compound fees, exacerbating liability and increasing the risk of overspending due to immediate credit availability. Buy Now Pay Later (BNPL) services typically offer interest-free short-term installments, which can encourage impulsive purchases but may result in multiple overlapping liabilities if payments are missed. Both financial behaviors require disciplined budgeting to avoid escalating debt obligations and long-term negative impacts on credit scores.

Legal Protections and Consumer Rights

Credit card debt offers stronger legal protections under the Truth in Lending Act, including clear disclosure of interest rates and the right to dispute unauthorized charges, whereas Buy Now Pay Later (BNPL) plans often lack comprehensive federal regulatory oversight, potentially exposing consumers to hidden fees and less transparent terms. Consumer rights for credit card holders include the ability to limit liability for fraudulent transactions, while BNPL users may face varying protections depending on the service provider and state laws. Understanding these differences is crucial for managing liability and protecting financial health when choosing between credit card debt and BNPL options.

Long-Term Financial Implications of Both Options

Credit card debt typically incurs high-interest rates, leading to escalating liability and prolonged repayment periods that can strain long-term financial health. Buy Now Pay Later (BNPL) options often offer interest-free installments but may result in hidden fees and encourage overspending, potentially increasing overall financial liability if not managed carefully. Evaluating the cumulative cost and repayment terms of both is crucial to minimizing long-term debt liability and preserving creditworthiness.

Choosing the Best Option for Responsible Liability Management

Credit card debt typically carries higher interest rates and can quickly accumulate, making it a riskier liability if not managed carefully. Buy Now Pay Later (BNPL) services often offer interest-free periods, providing a short-term liability option with potentially lower financial impact. For responsible liability management, choosing BNPL for manageable purchases and reserving credit cards for emergencies can optimize debt control and minimize long-term financial burden.

Related Important Terms

Revolving Credit Utilization

Revolving credit utilization significantly impacts liability management when comparing credit card debt to Buy Now Pay Later (BNPL) plans, as credit card balances directly affect the utilization ratio on credit reports, influencing credit scores. In contrast, BNPL typically does not report utilization rates as revolving credit, potentially reducing immediate impacts on credit scores but requiring careful management to avoid accumulating hidden liabilities.

BNPL Default Risk

Buy Now Pay Later (BNPL) services present a higher default risk compared to traditional credit card debt due to less stringent credit checks and shorter repayment periods. Lenders face increased liability exposure as BNPL defaults can quickly accumulate, impacting consumer financial stability and overall credit market health.

Credit Card Interest Creep

Credit card debt often leads to higher long-term liability due to interest creep, where interest compounds rapidly and increases the total amount owed beyond initial purchases. In contrast, Buy Now Pay Later plans typically offer fixed, interest-free periods that help limit the growth of financial liabilities if payments are made on time.

Pay-in-4 Liability

Pay-in-4 liability limits consumer risk by dividing total purchase amounts into four equal installments without accruing interest, contrasting with credit card debt that often carries high-interest rates and potential fees. This structured repayment reduces the chance of excessive debt accumulation commonly associated with credit cards, providing clearer liability management.

Soft Pull Debt Trap

Credit card debt often involves soft pulls that don't immediately affect credit scores, potentially luring consumers into a debt trap through repeated small credit inquiries and increased spending capacity. Buy Now Pay Later (BNPL) services also use soft pulls, but the lack of robust credit checks can mask accumulating liabilities, increasing the risk of unnoticed debt buildup and financial strain.

Deferred Interest Exposure

Credit card debt typically incurs deferred interest charges if balances are not paid in full within the promotional period, increasing overall liability exposure. Buy Now Pay Later (BNPL) services often offer interest-free periods but can lead to hidden deferred interest risks and late fees that escalate financial liability if payments are missed.

Split Payment Stacking

Credit card debt often results in higher liability due to accumulating interest and fees, whereas Buy Now Pay Later (BNPL) services enable split payment stacking that can help spread out payments without immediate interest, reducing short-term financial burden. However, misuse of BNPL stacking risks increasing overall liability if multiple payment plans overlap and are not managed carefully.

Shadow Debt Accumulation

Credit card debt and Buy Now Pay Later (BNPL) plans both contribute to shadow debt accumulation, obscuring the true extent of consumer liabilities by spreading repayments across multiple accounts without transparent aggregation. This hidden debt can escalate financial risk as individuals underestimate their cumulative obligations, leading to potential defaults and credit score damage.

Instant Approval Risk

Credit card debt typically involves instant approval risks that can lead to high-interest liabilities if balances are not managed promptly, while Buy Now Pay Later (BNPL) services offer immediate credit with fragmented payments but may lack stringent credit checks, increasing the risk of accumulating unmanageable debt. Both financing options carry liability concerns, as instant approvals can encourage overspending and result in significant financial obligations.

Structured Repayment Obligation

Credit card debt imposes a continuous structured repayment obligation with varying interest rates and minimum monthly payments, often leading to prolonged financial liability. Buy Now Pay Later (BNPL) offers fixed, short-term installment plans that clearly define repayment schedules and reduce the risk of accumulating long-term debt liability.

Credit Card Debt vs Buy Now Pay Later for Liability. Infographic

moneydiff.com

moneydiff.com