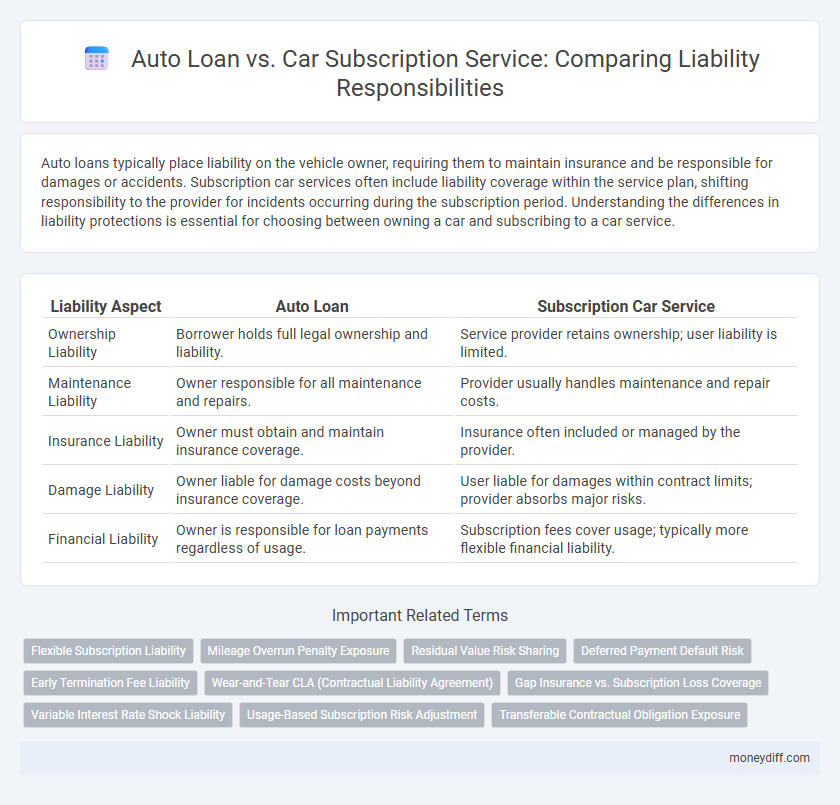

Auto loans typically place liability on the vehicle owner, requiring them to maintain insurance and be responsible for damages or accidents. Subscription car services often include liability coverage within the service plan, shifting responsibility to the provider for incidents occurring during the subscription period. Understanding the differences in liability protections is essential for choosing between owning a car and subscribing to a car service.

Table of Comparison

| Liability Aspect | Auto Loan | Subscription Car Service |

|---|---|---|

| Ownership Liability | Borrower holds full legal ownership and liability. | Service provider retains ownership; user liability is limited. |

| Maintenance Liability | Owner responsible for all maintenance and repairs. | Provider usually handles maintenance and repair costs. |

| Insurance Liability | Owner must obtain and maintain insurance coverage. | Insurance often included or managed by the provider. |

| Damage Liability | Owner liable for damage costs beyond insurance coverage. | User liable for damages within contract limits; provider absorbs major risks. |

| Financial Liability | Owner is responsible for loan payments regardless of usage. | Subscription fees cover usage; typically more flexible financial liability. |

Understanding Liability in Auto Loans vs Subscription Car Services

Liability in auto loans typically falls on the vehicle owner, who is responsible for insurance, maintenance, and any damages during the loan period. Subscription car services shift much of the liability to the provider, as the service usually includes insurance coverage, maintenance, and roadside assistance within a single monthly fee. Understanding these distinctions is crucial for consumers deciding between ownership responsibilities and the convenience of subscription-based liability management.

Key Differences in Legal Responsibility

Auto loan liability typically falls on the borrower who is responsible for loan payments and vehicle damages, while subscription car service liability often shifts some responsibility to the service provider for maintenance and insurance. In auto loans, the owner is legally accountable for accidents and damages, whereas subscription agreements frequently include coverage that limits the subscriber's direct liability. Legal responsibility differences hinge on ownership rights, with auto loans conferring full ownership and subscription services offering temporary use without full ownership burdens.

Liability Coverage in Traditional Auto Loans

Traditional auto loans require the borrower to obtain auto insurance that includes comprehensive liability coverage, protecting against bodily injury and property damage claims in accidents. This liability coverage is mandated by lenders to minimize financial risks, ensuring that damages caused by the driver are compensated up to policy limits. Unlike subscription car services, where liability often shifts to the provider, traditional auto loan liability remains primarily the borrower's responsibility.

Subscription Car Services: Who Bears the Risk?

In subscription car services, liability typically falls on the service provider rather than the user, as the subscription model retains ownership and maintenance responsibilities under the company's insurance policy. Users generally face limited personal liability, often constrained to stipulated usage agreements and caps on damages. This model shifts the risk burden to the provider, who assumes responsibility for accident claims, vehicle damage, and third-party liabilities during the subscription period.

Accidents and Damages: Liability Comparison

Auto loans typically place liability for accidents and damages on the vehicle owner, who must maintain insurance coverage and bear repair costs or deductible payments. Subscription car services often include insurance as part of the service, transferring much of the financial responsibility for accidents and damages to the provider, reducing the subscriber's direct liability. This differentiation makes subscription services a lower-risk option in terms of personal financial exposure to liabilities arising from vehicle incidents.

Insurance Obligations Under Both Models

Auto loan agreements typically require borrowers to maintain full insurance coverage to protect against liability risks, ensuring financial responsibility if an accident occurs. Subscription car services often include insurance in the monthly fee, shifting liability coverage obligations from the user to the service provider. Understanding these insurance obligations is crucial for managing liability exposure in both auto financing and subscription models.

Contractual Liability Clauses Explained

Contractual liability clauses in auto loan agreements typically hold the borrower responsible for damages, losses, and payments associated with the vehicle, including defaults or accidents. Subscription car services often limit liability through detailed contracts that specify user responsibilities, coverage limits, and indemnification terms, shifting some risks away from the service provider. Understanding these clauses is critical for consumers to assess financial exposure and legal obligations in both financing models.

Impact on Personal Financial Liability

Auto loans typically increase personal financial liability because the borrower is solely responsible for monthly payments and loan default consequences, including damage to credit scores. Subscription car services often limit personal financial liability since the subscription model includes maintenance, insurance, and depreciation costs rolled into a fixed monthly fee, reducing exposure to unexpected expenses. However, terminating a subscription early or violating terms can still result in financial penalties impacting personal liability.

Dispute Resolution for Liability Issues

Dispute resolution for liability issues in auto loans typically involves traditional legal proceedings or arbitration agreed upon in the loan contract. Subscription car services often include built-in mediation or arbitration clauses within their agreements to streamline resolving liability disputes. Understanding the specific terms related to liability and dispute mechanisms in each contract is crucial for effective resolution and minimizing potential legal costs.

How Liability Influences Total Cost of Ownership

Liability directly impacts the total cost of ownership in both auto loans and subscription car services by determining the scope and amount of financial responsibility for damages or accidents. Auto loans typically require owners to maintain full insurance coverage, which includes liability, increasing monthly costs and potential out-of-pocket expenses during claims. Subscription services often bundle liability coverage, reducing unexpected liabilities but potentially raising subscription fees, thereby influencing overall affordability and financial risk management.

Related Important Terms

Flexible Subscription Liability

Flexible subscription car service liability often limits users' financial responsibility to a fixed monthly fee, reducing exposure compared to traditional auto loans where borrowers remain fully liable for loan repayment and vehicle depreciation. Subscription models typically include insurance and maintenance in the fee, shifting liability risks away from the consumer and providing a more predictable and manageable cost structure.

Mileage Overrun Penalty Exposure

Auto loan agreements typically place full liability for mileage overruns on the borrower, often resulting in costly penalties when exceeding agreed limits, whereas subscription car services usually include mileage caps with clear overrun fees outlined in the contract. Subscribers face predictable liability exposure for excess mileage, while auto loan borrowers risk higher, less transparent costs tied to vehicle depreciation and contract stipulations.

Residual Value Risk Sharing

Auto loan liability typically transfers residual value risk to the borrower, who must cover depreciation costs upon sale or payoff, whereas subscription car services assume residual value risk, protecting users from market fluctuations and unexpected depreciation. This difference results in more predictable financial exposure for subscribers compared to borrowers who face potential out-of-pocket losses if the vehicle's residual value declines.

Deferred Payment Default Risk

Auto loan liability involves deferred payment default risk where borrowers may fail to meet fixed monthly installments, potentially leading to repossession and credit damage. Subscription car service liability reduces deferred payment default risk by often incorporating flexible payment structures and bundled insurance, minimizing financial exposure for users.

Early Termination Fee Liability

Early termination fee liability differs significantly between auto loans and subscription car services, with auto loans typically requiring borrowers to pay remaining loan balance plus interest if the vehicle is returned early. Subscription car services often include fixed early termination fees within the contract, simplifying cost predictability but potentially increasing overall liability compared to traditional auto loan settlements.

Wear-and-Tear CLA (Contractual Liability Agreement)

Auto loan agreements typically place wear-and-tear liability on the borrower, requiring compensation for damages beyond normal usage under the Contractual Liability Agreement (CLA). Subscription car services often include wear-and-tear coverage within the monthly fee, minimizing user liability and shifting maintenance responsibilities to the provider.

Gap Insurance vs. Subscription Loss Coverage

Auto loans often require gap insurance to cover the difference between the car's market value and the outstanding loan balance in case of total loss, minimizing financial liability for the borrower. Subscription car services typically include subscription loss coverage, which protects users from liability related to vehicle damage or loss without the need for separate gap insurance.

Variable Interest Rate Shock Liability

Auto loans with variable interest rates expose borrowers to interest rate shock liability when fluctuating rates significantly increase monthly payments, potentially leading to higher default risk. Subscription car services typically mitigate this liability by offering fixed monthly fees that cover maintenance and insurance, reducing unexpected cost burdens for consumers.

Usage-Based Subscription Risk Adjustment

Auto loan liability primarily depends on loan balance and vehicle depreciation, while subscription car service liability shifts towards usage-based risk adjustment, where fees reflect individual driving behavior and mileage. Usage-based subscription models integrate telematics data to dynamically adjust risk profiles, reducing financial exposure by aligning liability costs with actual vehicle use.

Transferable Contractual Obligation Exposure

Auto loan liability involves direct, transferable contractual obligations where the borrower remains fully responsible for loan repayment and potential default risks. Subscription car service liability shifts exposure to the provider, limiting customer responsibility to periodic fees without long-term financial obligation or asset depreciation concerns.

Auto Loan vs Subscription Car Service Liability for liability. Infographic

moneydiff.com

moneydiff.com