Liability pet owners must carefully evaluate the financial impact of liability coverage versus using Buy Now Pay Later (BNPL) options for managing unexpected pet-related expenses. Liability insurance provides predictable protection against claims and damages, reducing the risk of significant out-of-pocket costs. BNPL schemes may offer short-term convenience but can lead to accumulating debt and interest, complicating overall money management for pet care.

Table of Comparison

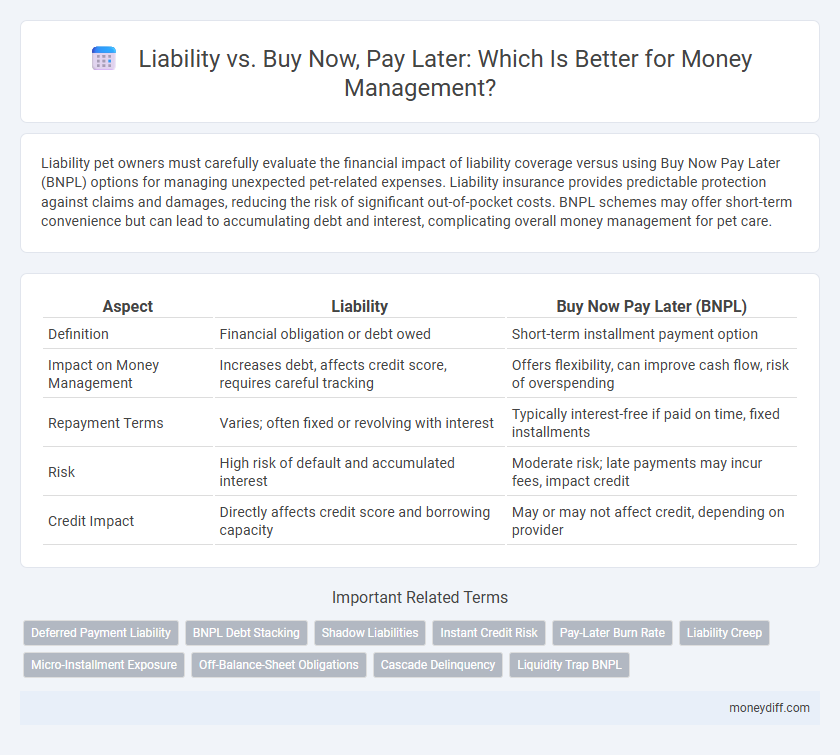

| Aspect | Liability | Buy Now Pay Later (BNPL) |

|---|---|---|

| Definition | Financial obligation or debt owed | Short-term installment payment option |

| Impact on Money Management | Increases debt, affects credit score, requires careful tracking | Offers flexibility, can improve cash flow, risk of overspending |

| Repayment Terms | Varies; often fixed or revolving with interest | Typically interest-free if paid on time, fixed installments |

| Risk | High risk of default and accumulated interest | Moderate risk; late payments may incur fees, impact credit |

| Credit Impact | Directly affects credit score and borrowing capacity | May or may not affect credit, depending on provider |

Understanding Liability in Personal Finance

Liability in personal finance refers to the legal obligation to repay debts or financial commitments, impacting net worth and cash flow. Buy Now Pay Later (BNPL) services create short-term liabilities by deferring payments, potentially increasing debt if not managed carefully. Understanding the distinction helps in effective money management by balancing immediate purchasing power with long-term financial responsibility.

What Is Buy Now Pay Later (BNPL)?

Buy Now Pay Later (BNPL) is a payment solution allowing consumers to purchase goods or services immediately and pay for them in installments over time, often without interest. Unlike traditional liabilities, BNPL plans are designed to be short-term financial commitments but can accumulate fees or affect credit if payments are missed. This method offers convenience for money management but requires careful budget planning to avoid unintentional debt.

Liability: Traditional Debt vs. Modern BNPL Options

Traditional debt liabilities, such as credit cards and personal loans, often involve fixed interest rates and long-term repayment schedules that impact credit scores and financial stability. Buy Now Pay Later (BNPL) models offer short-term, interest-free installments that can enhance cash flow but may lead to overextension due to lack of rigorous credit checks. Understanding the implications of these liabilities is crucial for effective money management and minimizing financial risk.

Financial Risks: Liability vs. BNPL

Liability in financial management refers to obligations or debts that individuals or businesses are legally required to repay, whereas Buy Now Pay Later (BNPL) services offer short-term credit with deferred payment options, often leading to increased financial risks due to lack of strict credit checks. BNPL can create hidden liabilities as users may accumulate multiple payment obligations across platforms, increasing the chance of missed payments and credit score damage. Effective money management requires recognizing BNPL usage as potential liabilities that can spiral into long-term financial burdens if not monitored carefully.

Impact on Credit Score: Liability vs. BNPL

Liability from traditional credit accounts directly affects credit scores through utilization rates and payment history, making timely payments essential. Buy Now Pay Later (BNPL) services often avoid immediate credit inquiries and typically do not report to credit bureaus unless payments become severely delinquent, resulting in a less direct impact on credit scores. However, missed BNPL payments can damage credit ratings similarly to traditional debt, underscoring the importance of responsible money management across both options.

Managing Cash Flow: Liability Approaches vs. BNPL Flexibility

Liability management strategies prioritize structured repayment schedules to maintain predictable cash flow and avoid excessive debt accumulation. Buy Now Pay Later (BNPL) offers flexible payment options that can enhance short-term liquidity but may risk long-term financial stability if not managed responsibly. Effective cash flow management requires balancing the disciplined approach of liabilities with the convenience and potential cash flow benefits of BNPL services.

Psychological Traps: The Lure of BNPL Compared to Liability

Liability in money management often entails a clear, structured repayment plan, fostering disciplined financial behavior, whereas Buy Now Pay Later (BNPL) services exploit psychological traps by promoting immediate gratification and deferred payment, increasing the risk of overspending. BNPL appeals to consumer psychology through minimal upfront costs and frictionless approval, masking the true financial obligation and leading to accumulated debt without traditional credit checks. Understanding these behavioral pitfalls helps individuals recognize how BNPL can inflate liabilities beyond manageable levels, undermining long-term financial stability.

Long-Term Financial Health: Liability or BNPL?

Liability in money management refers to debts or financial obligations that require repayment, affecting credit scores and long-term financial stability. Buy Now Pay Later (BNPL) services offer short-term credit but can lead to increased liabilities if payments are delayed or missed, risking higher interest charges and potential debt accumulation. Prioritizing long-term financial health means managing liabilities responsibly and avoiding over-reliance on BNPL to prevent jeopardizing creditworthiness and financial security.

Hidden Costs: Liability Fees vs. BNPL Charges

Liability fees often include interest rates and penalties that can accumulate rapidly, increasing the total repayment amount beyond initial expectations. Buy Now Pay Later (BNPL) services may appear cost-effective upfront but can contain hidden charges such as late fees, account management fees, or increased costs for extended payment periods. Understanding these hidden costs is crucial for effective money management and avoiding unexpected financial burdens.

Smart Money Management: Choosing Between Liability and BNPL

Smart money management involves evaluating liabilities carefully, especially when considering Buy Now Pay Later (BNPL) options that can increase short-term debt without interest if paid on time. While traditional liabilities like loans and credit cards carry structured repayment schedules and potential interest, BNPL offers flexibility but can lead to hidden fees or impact credit scores if mismanaged. Prioritizing liabilities with clear terms and manageable repayment plans fosters financial stability, making informed BNPL usage a strategic component in budgeting and debt management.

Related Important Terms

Deferred Payment Liability

Deferred payment liability in Buy Now Pay Later (BNPL) plans represents a financial obligation that impacts cash flow management by deferring immediate payment but increasing future debt. Effective money management requires tracking these liabilities to avoid accumulation of unpaid balances that may affect credit scores and overall financial health.

BNPL Debt Stacking

Liability in money management often increases with Buy Now Pay Later (BNPL) services due to debt stacking, where multiple BNPL payments accumulate simultaneously, creating a higher total repayment burden. This stacking effect can obscure the true scope of financial obligations, making it challenging to manage liabilities effectively and increasing the risk of default.

Shadow Liabilities

Shadow liabilities, often overlooked in money management, represent hidden financial obligations that can impact long-term fiscal stability more severely than Buy Now Pay Later (BNPL) commitments, which are typically transparent and time-bound. Proper identification and accounting of shadow liabilities are crucial to avoid underestimated risk exposure compared to the structured repayment schedules common in BNPL services.

Instant Credit Risk

Buy Now Pay Later (BNPL) services present a unique liability profile by enabling instant credit risk through deferred payment options without thorough credit checks. This immediacy increases potential default rates, complicating traditional liability management and requiring advanced risk assessment models to mitigate financial exposure.

Pay-Later Burn Rate

Pay-Later burn rate significantly increases liability by accelerating debt accumulation through deferred payments, often leading to higher interest charges and financial strain over time. Managing cash flow effectively requires monitoring this burn rate to avoid unsustainable debt levels associated with Buy Now Pay Later (BNPL) services.

Liability Creep

Liability creep occurs when small, incremental debts from Buy Now Pay Later (BNPL) services accumulate unnoticed, leading to a significant increase in overall financial obligations. This hidden buildup of liabilities can distort money management strategies, making it harder to maintain an accurate picture of personal or business financial health.

Micro-Installment Exposure

Micro-installment exposure in Buy Now Pay Later (BNPL) services increases short-term liabilities by fragmenting payment obligations into smaller, manageable amounts that can accumulate and impact credit profiles. Effective money management requires monitoring these incremental liabilities to avoid overextension and maintain financial stability.

Off-Balance-Sheet Obligations

Liability in money management often presents as on-balance-sheet obligations, whereas Buy Now Pay Later (BNPL) arrangements typically create off-balance-sheet obligations, impacting financial transparency and risk assessment. Off-balance-sheet treatment of BNPL liabilities can obscure true debt levels, complicating credit evaluations and regulatory oversight.

Cascade Delinquency

Liability in money management emphasizes clear responsibility for debt repayment, whereas Buy Now Pay Later (BNPL) options often obscure this through staggered payments, increasing the risk of cascade delinquency. Cascade delinquency occurs when missed BNPL payments trigger subsequent defaults, escalating overall financial liability and undermining credit stability.

Liquidity Trap BNPL

Liability in traditional finance restricts liquidity by binding assets to fixed repayment schedules, whereas Buy Now Pay Later (BNPL) services can exacerbate liquidity traps by encouraging overspending without immediate cash outflow, leading consumers into greater debt cycles. BNPL's deferred payment structure often masks true financial obligations, reducing apparent liquidity and complicating effective money management.

Liability vs Buy Now Pay Later for money management. Infographic

moneydiff.com

moneydiff.com