Understanding liabilities versus digital debt is crucial for effective money management. Liabilities represent traditional financial obligations such as loans and mortgages, while digital debt includes newer forms like credit card balances and buy-now-pay-later services accessible online. Properly differentiating these helps individuals prioritize repayments and maintain better control over their overall financial health.

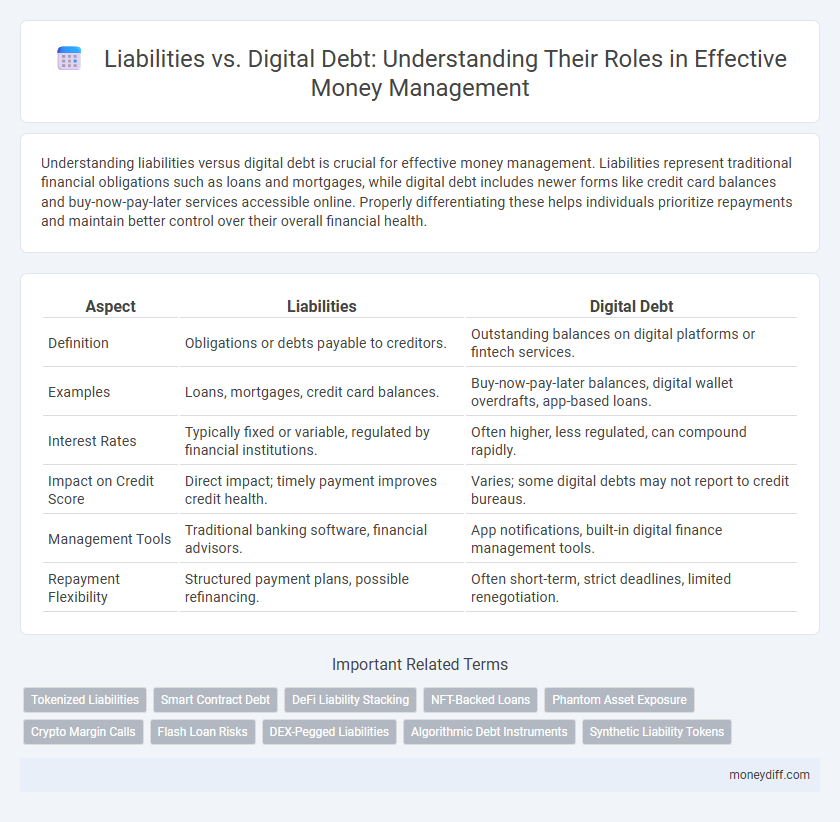

Table of Comparison

| Aspect | Liabilities | Digital Debt |

|---|---|---|

| Definition | Obligations or debts payable to creditors. | Outstanding balances on digital platforms or fintech services. |

| Examples | Loans, mortgages, credit card balances. | Buy-now-pay-later balances, digital wallet overdrafts, app-based loans. |

| Interest Rates | Typically fixed or variable, regulated by financial institutions. | Often higher, less regulated, can compound rapidly. |

| Impact on Credit Score | Direct impact; timely payment improves credit health. | Varies; some digital debts may not report to credit bureaus. |

| Management Tools | Traditional banking software, financial advisors. | App notifications, built-in digital finance management tools. |

| Repayment Flexibility | Structured payment plans, possible refinancing. | Often short-term, strict deadlines, limited renegotiation. |

Understanding Traditional Liabilities in Money Management

Traditional liabilities in money management encompass obligations such as mortgages, credit card balances, and personal loans that represent legally binding debts owed to creditors. These liabilities impact cash flow by requiring scheduled payments that reduce available capital and influence credit scores, affecting future borrowing capacity. Understanding the structure and terms of traditional liabilities is essential for effective financial planning and maintaining a balanced debt-to-income ratio.

The Rise of Digital Debt in the Modern Economy

The rise of digital debt represents a significant shift in money management, where liabilities increasingly stem from online credit, subscription services, and buy-now-pay-later schemes. Traditional liabilities like mortgages and personal loans are now complemented by digital financial obligations, complicating balance sheets and credit risk assessments. This evolution demands enhanced financial literacy and innovative tools to track both physical and digital debts effectively.

Key Differences Between Liabilities and Digital Debt

Liabilities represent traditional financial obligations like loans, mortgages, and credit card balances, while digital debt refers to obligations arising from digital platforms such as buy-now-pay-later services, cryptocurrency loans, and online subscription fees. Unlike conventional liabilities tracked by formal institutions, digital debt often lacks regulatory oversight and may involve higher interest rates or hidden fees, increasing financial risk. Effective money management requires understanding these key differences to balance traditional liabilities with the emerging complexities and flexibility of digital debt.

How Digital Debt is Reshaping Financial Responsibilities

Digital debt, driven by online loans, buy-now-pay-later services, and cryptocurrency liabilities, is reshaping financial responsibilities by introducing new forms of obligations that are often less regulated than traditional liabilities. Unlike conventional liabilities such as mortgages and credit card debt, digital debt can accumulate rapidly due to instant access and high-interest rates embedded in many digital lending platforms. This shift demands updated money management strategies prioritizing transparency, digital footprint monitoring, and proactive debt control to prevent financial overload.

Evaluating the Risks of Traditional Liabilities vs Digital Debt

Evaluating the risks of traditional liabilities versus digital debt requires understanding their impact on cash flow stability and credit risk. Traditional liabilities, such as mortgages and credit card debt, often come with fixed payment schedules and established interest rates, providing predictability but potential long-term financial strain. Digital debt, including peer-to-peer loans and buy-now-pay-later services, can introduce higher interest variability and increased default risk, necessitating careful assessment of repayment terms and platform credibility for effective money management.

Managing Cash Flow: Liabilities Versus Digital Debt

Managing cash flow requires careful differentiation between liabilities and digital debt, as liabilities represent traditional financial obligations like loans and accounts payable, while digital debt encompasses online credit balances and digital payment platform credits. Prioritizing repayment of high-interest digital debt can prevent excessive fees and improve liquidity, whereas managing liabilities often involves scheduled payments that impact long-term financial stability. Monitoring both types through integrated financial tools enhances overall cash flow management by providing real-time visibility into all outstanding obligations.

Financial Planning Strategies for Liabilities and Digital Debt

Effective financial planning strategies for liabilities and digital debt involve prioritizing high-interest obligations to minimize overall financial burden. Utilizing budgeting tools and debt repayment plans can help manage credit card debt, digital loans, and other liabilities systematically. Integrating digital debt tracking apps enhances oversight, enabling timely payments and reducing the risk of default in personal money management.

Impact of Digital Debt on Personal and Business Credit

Digital debt significantly affects both personal and business credit by increasing outstanding obligations that can lower credit scores and reduce borrowing capacity. Unlike traditional liabilities, digital debt often includes high-interest online loans and buy-now-pay-later services, leading to faster accumulation of unpaid balances. This growing digital financial exposure can hinder creditworthiness and limit future financing opportunities for individuals and businesses alike.

Tools for Tracking and Mitigating Liabilities and Digital Debt

Effective money management requires precise tools for tracking and mitigating liabilities and digital debt, including budgeting apps like Mint and YNAB that monitor expenses and outstanding balances in real time. Debt management platforms such as Tally and Undebt.it offer strategies to prioritize high-interest liabilities, automate payments, and reduce overall debt burden efficiently. Integration with banking APIs allows for updated liability statuses, facilitating proactive financial decisions and minimizing the risk of accumulating unmanageable digital debt.

The Future of Money Management: Integrating Liabilities with Digital Debt

The future of money management demands a seamless integration of traditional liabilities and emerging digital debt to enhance financial accuracy and accountability. Leveraging advanced fintech solutions and blockchain technology enables real-time tracking and management of liabilities alongside digital debts, optimizing cash flow and risk assessment. Enhanced data analytics and AI-driven insights will empower individuals and businesses to make informed decisions, balancing traditional obligations with digital borrowing for sustainable financial health.

Related Important Terms

Tokenized Liabilities

Tokenized liabilities transform traditional debt into digital assets, enhancing transparency and liquidity in money management by enabling real-time tracking and trading on blockchain platforms. This innovation reduces risk exposure and increases flexibility compared to conventional liabilities, offering a streamlined approach to managing digital debt portfolios.

Smart Contract Debt

Smart contract debt represents a form of digital liability arising from decentralized finance agreements, often characterized by automated obligations that can escalate rapidly due to programmable interest rates and collateral requirements. Unlike traditional liabilities, smart contract debt demands real-time monitoring and risk assessment, as its immutable nature can lead to unforeseen financial exposure if market conditions shift abruptly.

DeFi Liability Stacking

DeFi liability stacking intensifies digital debt risks by accumulating multiple layers of decentralized borrowing, amplifying potential financial exposure and repayment obligations. This compounding effect distinguishes DeFi liabilities from traditional liabilities, requiring advanced risk management strategies for sustainable money management.

NFT-Backed Loans

NFT-backed loans represent a unique form of digital debt where non-fungible tokens serve as collateral, merging traditional liability concepts with emerging blockchain assets. Effective money management requires understanding the risks and obligations associated with these liabilities, as defaulting on NFT-backed loans can lead to the irreversible loss of valuable digital assets.

Phantom Asset Exposure

Phantom asset exposure in liabilities refers to hidden or unrecognized digital debt that inflates perceived financial health while masking underlying obligations. Effective money management requires identifying these intangible liabilities to prevent over-leveraging and ensure accurate asset-liability matching.

Crypto Margin Calls

Crypto margin calls represent a critical form of digital debt that directly impacts liabilities by requiring immediate collateral to cover leveraged positions in volatile markets. Unlike traditional liabilities, these obligations can rapidly escalate due to price fluctuations, increasing financial risk and complicating overall money management strategies.

Flash Loan Risks

Liabilities represent traditional financial obligations, while digital debt, including flash loans, poses unique risks due to their instant, uncollateralized nature and potential for rapid, large-scale exploits on blockchain platforms. Flash loan risks can lead to significant financial losses and systemic vulnerabilities in decentralized finance (DeFi) ecosystems, amplifying the challenge of managing digital liabilities effectively.

DEX-Pegged Liabilities

DEX-pegged liabilities represent obligations tied to decentralized exchange assets, differing from traditional digital debt by being inherently linked to volatile crypto liquidity pools and tokenized collateral. Effective money management requires understanding these liabilities' real-time valuation risks and integrating smart contract conditions governing repayment and collateralization.

Algorithmic Debt Instruments

Algorithmic debt instruments introduce a new dimension to liabilities, leveraging automated smart contracts to incur and manage digital debt efficiently. Unlike traditional liabilities, these instruments enable real-time tracking, dynamic adjustment of debt terms, and reduced counterparty risk, transforming money management through increased transparency and programmable repayment structures.

Synthetic Liability Tokens

Synthetic Liability Tokens represent a novel approach to digital debt by tokenizing real-world financial obligations on blockchain platforms, enabling transparent, programmable, and tradable liabilities. Unlike traditional liabilities, these tokens facilitate efficient money management through automated settlement processes, reduced counterparty risk, and enhanced liquidity in decentralized finance ecosystems.

Liabilities vs Digital Debt for money management. Infographic

moneydiff.com

moneydiff.com