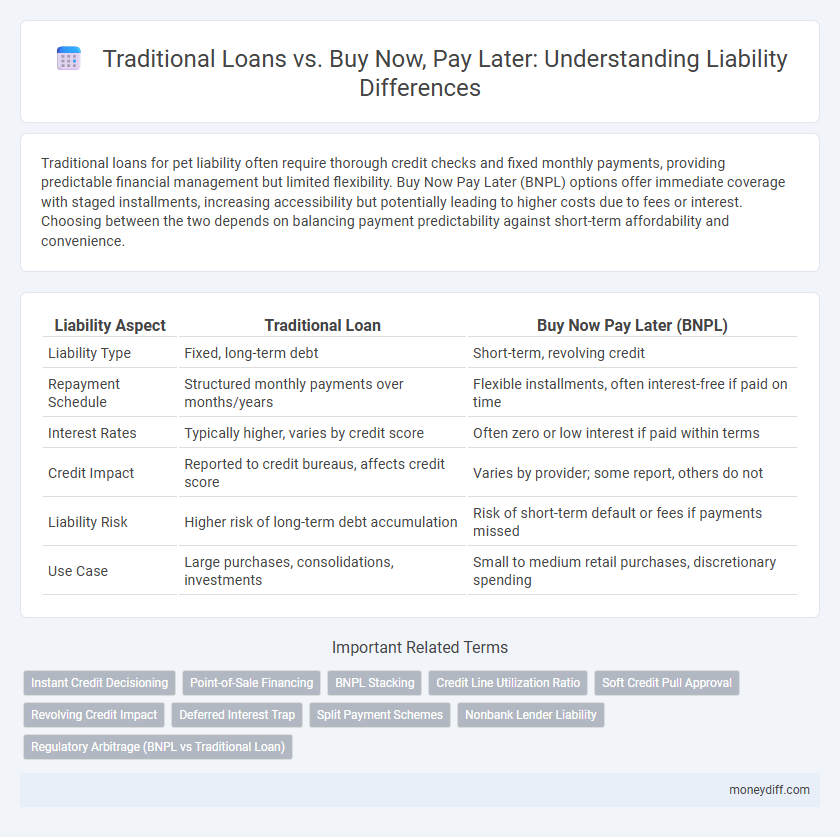

Traditional loans for pet liability often require thorough credit checks and fixed monthly payments, providing predictable financial management but limited flexibility. Buy Now Pay Later (BNPL) options offer immediate coverage with staged installments, increasing accessibility but potentially leading to higher costs due to fees or interest. Choosing between the two depends on balancing payment predictability against short-term affordability and convenience.

Table of Comparison

| Liability Aspect | Traditional Loan | Buy Now Pay Later (BNPL) |

|---|---|---|

| Liability Type | Fixed, long-term debt | Short-term, revolving credit |

| Repayment Schedule | Structured monthly payments over months/years | Flexible installments, often interest-free if paid on time |

| Interest Rates | Typically higher, varies by credit score | Often zero or low interest if paid within terms |

| Credit Impact | Reported to credit bureaus, affects credit score | Varies by provider; some report, others do not |

| Liability Risk | Higher risk of long-term debt accumulation | Risk of short-term default or fees if payments missed |

| Use Case | Large purchases, consolidations, investments | Small to medium retail purchases, discretionary spending |

Understanding Liability: Traditional Loans vs Buy Now Pay Later

Traditional loans create long-term liability through fixed monthly payments and accumulated interest over the loan term, impacting credit scores and debt-to-income ratios significantly. Buy Now Pay Later (BNPL) services offer short-term, often interest-free liability but risk higher default rates due to minimal credit checks and fragmented repayment schedules. Understanding these differences helps consumers manage financial obligations and potential impacts on creditworthiness effectively.

Key Differences in Liability Structures

Traditional loans create a fixed liability on the borrower's balance sheet, requiring regular principal and interest repayments over a set term, impacting credit scores and debt-to-income ratios. Buy Now Pay Later (BNPL) services, while offering short-term deferred payments, often do not appear as formal liabilities on credit reports, leading to less immediate impact on credit metrics but potential hidden financial obligations. The key difference lies in transparency and reporting: traditional loans are fully disclosed liabilities with structured repayment schedules, whereas BNPL liabilities may be less visible yet still influence long-term financial stability.

Interest Rates and Hidden Costs: A Liability Perspective

Traditional loans often carry fixed or variable interest rates that compound over time, resulting in predictable but potentially high total liabilities; hidden fees such as origination charges and prepayment penalties can increase overall debt. Buy Now Pay Later (BNPL) services typically offer zero or low interest rates but may include late payment fees and shorter repayment periods that can escalate financial liability if payments are missed. Evaluating interest rates alongside these concealed costs is essential to accurately measure the total liability risk associated with each financing option.

Impact on Personal Financial Health

Traditional loans often result in long-term liabilities with fixed monthly payments and interest accrual, impacting personal financial health by potentially limiting cash flow and increasing debt burden. Buy Now Pay Later (BNPL) services typically offer short-term, interest-free installments but can encourage impulsive spending, leading to unexpected liabilities and credit score risks if payments are missed. Both options influence financial liability differently; traditional loans provide structured debt management, while BNPL requires careful budgeting to avoid negative credit impacts.

Legal Obligations and Consumer Protections

Traditional loans create clear legal obligations for borrowers, including fixed repayment schedules and interest charges regulated by lending laws. Buy Now Pay Later (BNPL) services often involve less stringent legal frameworks, with varying levels of consumer protections depending on jurisdiction. Consumers using BNPL may face limited rights regarding dispute resolution and debt collection practices compared to traditional loan agreements.

Managing Repayment Responsibilities

Traditional loans require borrowers to manage fixed monthly installments with interest, creating predictable but long-term liabilities affecting credit scores and debt-to-income ratios. Buy Now Pay Later (BNPL) offers shorter-term, often interest-free repayment options, potentially increasing spending but risking missed payments that can lead to fees and negative impacts on credit. Effective management of repayment responsibilities in both options is crucial to maintaining financial stability and minimizing liabilities.

Liabilities and Credit Score Implications

Traditional loans create a fixed liability on the borrower's credit report, impacting debt-to-income ratios and credit utilization, which directly influence credit scores. Buy Now Pay Later (BNPL) plans often carry a lower immediate liability but may lack consistent credit reporting, potentially resulting in minimal impact on credit scores unless payments are missed. Understanding the liability accumulation and credit score implications of each option is critical for managing long-term financial health and creditworthiness.

Flexibility vs Commitment: Assessing Liability Risks

Traditional loans impose fixed repayment schedules and established interest rates, creating rigid liability commitments that may strain cash flow. Buy Now Pay Later (BNPL) offers flexible payment options with short-term obligations, but hidden fees and potential default risks can increase overall liability exposure. Assessing these models requires balancing predictable long-term debt against adaptable yet potentially costly short-term liabilities.

Long-Term Liabilities: Which Option Weighs More?

Traditional loans typically represent long-term liabilities with fixed repayment schedules and interest rates, impacting a company's or consumer's balance sheet over several years. Buy Now Pay Later (BNPL) options usually classify as short-term liabilities or off-balance-sheet items, potentially minimizing visible long-term debt but increasing short-term financial obligations. Evaluating long-term liabilities, traditional loans generally weigh more heavily due to their extended duration and financial commitment linked to principal and interest payments.

Choosing the Right Option for Your Financial Liability

Traditional loans typically involve fixed monthly payments and interest rates that contribute to long-term financial liability, requiring thorough credit checks and commitment. Buy Now Pay Later (BNPL) services offer short-term, interest-free installments but may lead to increased liability if payments are missed or extended, impacting credit scores. Evaluating your repayment ability, interest costs, and credit impact helps determine the optimal choice for managing your financial liability effectively.

Related Important Terms

Instant Credit Decisioning

Traditional loans typically involve lengthy credit evaluations that increase liability exposure due to delayed decisions, whereas Buy Now Pay Later (BNPL) offers instant credit decisioning, reducing risk by quickly assessing consumer creditworthiness. Instant credit decisioning technology in BNPL platforms minimizes liability by enabling real-time fraud detection and dynamic credit limits tailored to individual financial profiles.

Point-of-Sale Financing

Traditional loans create a fixed liability with scheduled monthly payments and interest, impacting credit scores and debt-to-income ratios over time. Buy Now Pay Later (BNPL) services offer short-term, often interest-free liabilities tied directly to individual purchases, posing less long-term credit risk but potentially leading to fragmented debt management at the point of sale.

BNPL Stacking

Buy Now Pay Later (BNPL) stacking significantly increases consumer liability risk compared to traditional loans due to multiple overlapping payment obligations that can lead to unexpected debt accumulation. Unlike structured traditional loans with fixed repayment schedules, BNPL stacking often lacks comprehensive credit checks, resulting in higher default rates and escalating financial liabilities for both consumers and lenders.

Credit Line Utilization Ratio

Traditional loans impact liability by increasing debt balance and affecting credit line utilization ratio through fixed monthly payments, while Buy Now Pay Later (BNPL) services often bypass traditional credit lines, resulting in minimal immediate impact on the credit utilization ratio but may accumulate as short-term liabilities if unpaid. Effective management of these liabilities requires monitoring how each option influences overall credit utilization and long-term debt obligations.

Soft Credit Pull Approval

Traditional loans typically involve a hard credit pull that can temporarily lower credit scores, increasing borrower liability risk during approval. Buy Now Pay Later services often use soft credit pulls, minimizing impact on credit scores and reducing immediate liability concerns for consumers.

Revolving Credit Impact

Traditional loans typically have fixed repayment schedules that reduce liability predictably over time, whereas Buy Now Pay Later (BNPL) options often function as revolving credit, potentially increasing short-term liability due to ongoing unpaid balances and deferred payments. Revolving credit in BNPL can lead to fluctuating liability amounts on credit reports, impacting debt-to-income ratios and overall credit utilization differently than traditional installment loans.

Deferred Interest Trap

Traditional loans typically involve fixed payment schedules with clear interest accrual, minimizing the risk of unexpected financial liability. Buy Now Pay Later (BNPL) plans often feature deferred interest traps where unpaid balances can suddenly accumulate high-interest charges, significantly increasing the borrower's liability if payments are missed or delayed.

Split Payment Schemes

Traditional loans create long-term liabilities with fixed repayment schedules and interest rates, impacting credit scores and overall debt burden. Buy Now Pay Later (BNPL) splits payments into smaller, interest-free installments, reducing immediate liability but potentially increasing short-term financial strain if multiple BNPL schemes overlap.

Nonbank Lender Liability

Nonbank lenders offering Buy Now Pay Later (BNPL) services often face less stringent regulatory liability compared to traditional loan providers, leading to increased risk exposure and potential consumer protection issues. Traditional loans typically carry defined liability frameworks requiring thorough credit assessments and transparent disclosure, minimizing lender risk and borrower default rates.

Regulatory Arbitrage (BNPL vs Traditional Loan)

Buy Now Pay Later (BNPL) services often operate under lighter regulatory frameworks compared to traditional loans, creating regulatory arbitrage that may reduce consumer protections and increase liability risks for providers. Traditional loans face strict oversight including interest rate caps and disclosure requirements, whereas BNPL schemes exploit regulatory gaps, potentially escalating financial liability due to unclear responsibility for credit risk and consumer defaults.

Traditional Loan vs Buy Now Pay Later for liability. Infographic

moneydiff.com

moneydiff.com