Liabilities refer to legal responsibilities or debts a company owes, often arising from operational risks or financial obligations. Carbon offset liabilities specifically address environmental duties, representing commitments to compensate for carbon emissions by investing in projects that reduce greenhouse gases. Differentiating traditional liabilities from carbon offset liabilities is essential for businesses aiming to balance financial accountability with sustainability goals.

Table of Comparison

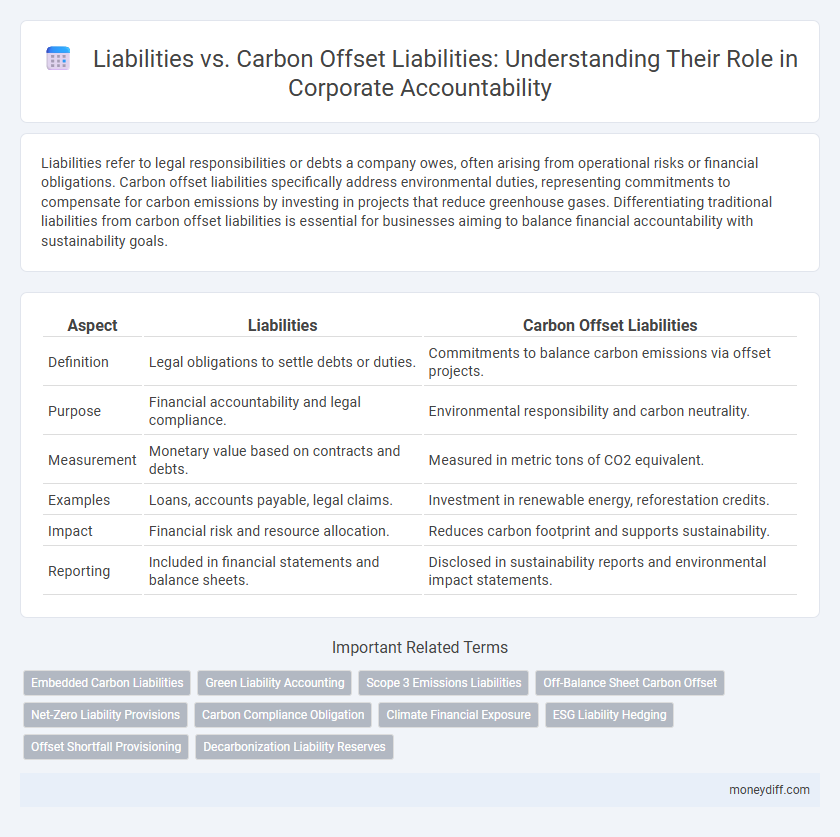

| Aspect | Liabilities | Carbon Offset Liabilities |

|---|---|---|

| Definition | Legal obligations to settle debts or duties. | Commitments to balance carbon emissions via offset projects. |

| Purpose | Financial accountability and legal compliance. | Environmental responsibility and carbon neutrality. |

| Measurement | Monetary value based on contracts and debts. | Measured in metric tons of CO2 equivalent. |

| Examples | Loans, accounts payable, legal claims. | Investment in renewable energy, reforestation credits. |

| Impact | Financial risk and resource allocation. | Reduces carbon footprint and supports sustainability. |

| Reporting | Included in financial statements and balance sheets. | Disclosed in sustainability reports and environmental impact statements. |

Understanding Financial Liabilities: A Core Overview

Financial liabilities represent obligations a company must settle, encompassing debts, loans, and accounts payable that impact its balance sheet and liquidity. Carbon offset liabilities specifically relate to commitments incurred to neutralize greenhouse gas emissions, often requiring companies to invest in environmental projects or purchase carbon credits. Understanding these liabilities is crucial for accurate financial reporting and strategic sustainability management.

Defining Carbon Offset Liabilities in Modern Finance

Carbon offset liabilities represent financial obligations arising from commitments to reduce or compensate greenhouse gas emissions through verified projects, distinct from traditional liabilities that primarily account for monetary or contractual debts. These liabilities are quantified based on carbon credits or offsets obligations, reflecting an organization's environmental impact and regulatory compliance under frameworks like the Paris Agreement or carbon trading schemes. Incorporating carbon offset liabilities into financial statements ensures transparent risk management and aligns corporate accounting practices with sustainability goals and global climate targets.

Key Differences Between Traditional and Carbon Offset Liabilities

Traditional liabilities represent financial obligations that a company must settle through cash, services, or assets, typically recorded on the balance sheet and impacting creditworthiness. Carbon offset liabilities, however, arise from environmental commitments to compensate for carbon emissions by investing in offset projects, often involving future performance obligations rather than immediate financial cash outflows. The key difference lies in their nature: traditional liabilities are concrete monetary debts, while carbon offset liabilities are contingent and linked to sustainability goals, reflecting evolving regulatory and market-driven environmental responsibilities.

The Impact of Carbon Regulations on Corporate Liabilities

Carbon regulations increasingly redefine corporate liabilities by imposing stricter requirements for carbon emissions reporting and reduction commitments, elevating the financial risks of non-compliance. Carbon offset liabilities emerge as contingent liabilities that companies must account for, representing obligations to offset carbon emissions through verified projects, thus influencing balance sheet transparency and investor risk assessment. This evolving regulatory landscape compels corporations to integrate carbon offset liabilities into their overall liability management strategies to mitigate potential legal and reputational risks.

How Carbon Offset Liabilities Affect Balance Sheets

Carbon offset liabilities represent obligations companies recognize for future carbon credits or emissions reductions, impacting balance sheets by increasing long-term liabilities. These offsets can create contingent liabilities that reflect potential regulatory costs or carbon pricing risks, altering financial statements' risk profiles. Proper accounting for carbon offset liabilities ensures accurate asset valuation and compliance with evolving environmental reporting standards.

Reporting and Accounting for Carbon Offset Liabilities

Liabilities represent an entity's financial obligations, while carbon offset liabilities specifically pertain to commitments made to compensate for carbon emissions through offset projects. Accurate reporting and accounting for carbon offset liabilities require recognizing these obligations as contingent liabilities or provisions, ensuring transparency in environmental impact and regulatory compliance. Proper measurement involves quantifying the volume of carbon offsets needed, aligning with international standards like the Greenhouse Gas Protocol for consistent financial disclosure.

Risk Management Strategies: Financial vs Carbon Offset Liabilities

Financial liabilities involve obligations requiring monetary payments, directly impacting a company's balance sheet and cash flow, necessitating robust risk management strategies like reserve funds and insurance. Carbon offset liabilities represent environmental commitments to counterbalance carbon emissions, requiring strategic investments in sustainable projects and adherence to regulatory frameworks to mitigate reputational and compliance risks. Effective risk management integrates financial controls with proactive carbon offset planning to balance fiscal responsibilities and environmental accountability.

Regulatory Compliance: Navigating Liability and Carbon Obligations

Understanding the distinction between traditional liabilities and carbon offset liabilities is crucial for regulatory compliance in environmental law. Traditional liabilities encompass financial obligations arising from general business operations, whereas carbon offset liabilities specifically address commitments to reduce or neutralize carbon emissions under climate regulations. Navigating these liabilities requires companies to integrate carbon accounting frameworks and comply with evolving emission standards to avoid penalties and ensure sustainable business practices.

Integrating Carbon Offset Liabilities into Financial Planning

Integrating carbon offset liabilities into financial planning requires accurately quantifying future environmental obligations alongside traditional liabilities such as loans and accounts payable. Companies must incorporate projected carbon credit costs and regulatory requirements into balance sheets and cash flow forecasts to ensure comprehensive risk management. This approach enhances transparency and aligns financial strategies with sustainability goals, mitigating the risks associated with carbon offset liabilities.

The Future of Liabilities: Financial Trends and Carbon Offset Obligations

Future liability trends show a shift toward integrating traditional financial obligations with carbon offset liabilities as companies face stricter environmental regulations and increased investor scrutiny on sustainability metrics. Financial liabilities will increasingly reflect the cost of carbon emissions through mandatory carbon offset obligations, influencing balance sheets and risk assessments. This evolution demands enhanced accounting frameworks to accurately measure and report both financial debts and environmental responsibilities.

Related Important Terms

Embedded Carbon Liabilities

Embedded carbon liabilities represent the carbon emissions embedded in goods and services throughout their lifecycle, differentiating from traditional financial liabilities which cover monetary obligations. Unlike general liabilities, carbon offset liabilities specifically address the obligation to neutralize or mitigate these embedded emissions through verified carbon credits or environmental projects.

Green Liability Accounting

Green Liability Accounting distinguishes traditional financial liabilities from carbon offset liabilities by quantifying environmental obligations related to greenhouse gas emissions. Carbon offset liabilities represent measurable commitments to reduce or neutralize emissions, integrating sustainability into corporate financial responsibility frameworks.

Scope 3 Emissions Liabilities

Liabilities related to Scope 3 emissions encompass indirect greenhouse gas emissions across a company's value chain, posing significant financial and reputational risks if not properly managed. Carbon offset liabilities arise when organizations commit to offsetting these emissions through verified projects, creating potential obligations that must be accounted for in sustainability reporting and financial disclosures.

Off-Balance Sheet Carbon Offset

Off-balance sheet carbon offset liabilities refer to environmental obligations not recorded on a company's financial statements, contrasting traditional liabilities that appear as recognized debts or obligations. These off-balance sheet items pose hidden financial risks by representing future carbon credit purchases or emission reductions commitments that may impact a company's addressable liabilities once regulatory or market conditions mandate their disclosure.

Net-Zero Liability Provisions

Liabilities represent financial obligations a company owes, while Carbon Offset Liabilities specifically pertain to commitments made to compensate for greenhouse gas emissions through offsets. Net-Zero Liability Provisions integrate these carbon-related obligations into overall financial reporting, ensuring transparency and accountability for achieving corporate emission reduction targets.

Carbon Compliance Obligation

Liabilities represent financial obligations arising from past transactions, whereas Carbon Offset Liabilities specifically pertain to obligations to compensate for carbon emissions under regulatory frameworks, reflecting a Carbon Compliance Obligation. This obligation mandates entities to either reduce emissions or purchase verified carbon credits to meet emission reduction targets and avoid penalties.

Climate Financial Exposure

Liabilities encompass legal and financial obligations, while carbon offset liabilities specifically refer to the commitments companies make to counterbalance their greenhouse gas emissions through carbon credits or projects. Climate financial exposure arises when these offset liabilities become uncertain or devalued, potentially impacting reported financial health and increasing regulatory and market risks.

ESG Liability Hedging

Liabilities represent financial obligations a company owes, whereas carbon offset liabilities specifically pertain to environmental responsibilities tied to carbon emissions reduction commitments. ESG liability hedging involves strategic financial instruments and risk management practices designed to mitigate potential losses arising from environmental, social, and governance-related liabilities, ensuring compliance and sustainable performance.

Offset Shortfall Provisioning

Liabilities in financial statements represent present obligations arising from past events, while Carbon Offset Liabilities specifically refer to the recognized obligations for emissions that have not been fully offset. Offset Shortfall Provisioning involves setting aside reserves to cover potential deficits when the actual carbon offset credits fall short of the mandated environmental targets or regulatory requirements.

Decarbonization Liability Reserves

Decarbonization liability reserves specifically account for future costs associated with reducing carbon emissions, distinguishing them from general liabilities that represent broader financial obligations. These reserves provide companies with a strategic buffer to meet regulatory requirements and invest in carbon offset projects, ensuring long-term environmental compliance and sustainability goals.

Liabilities vs Carbon Offset Liabilities for liability. Infographic

moneydiff.com

moneydiff.com