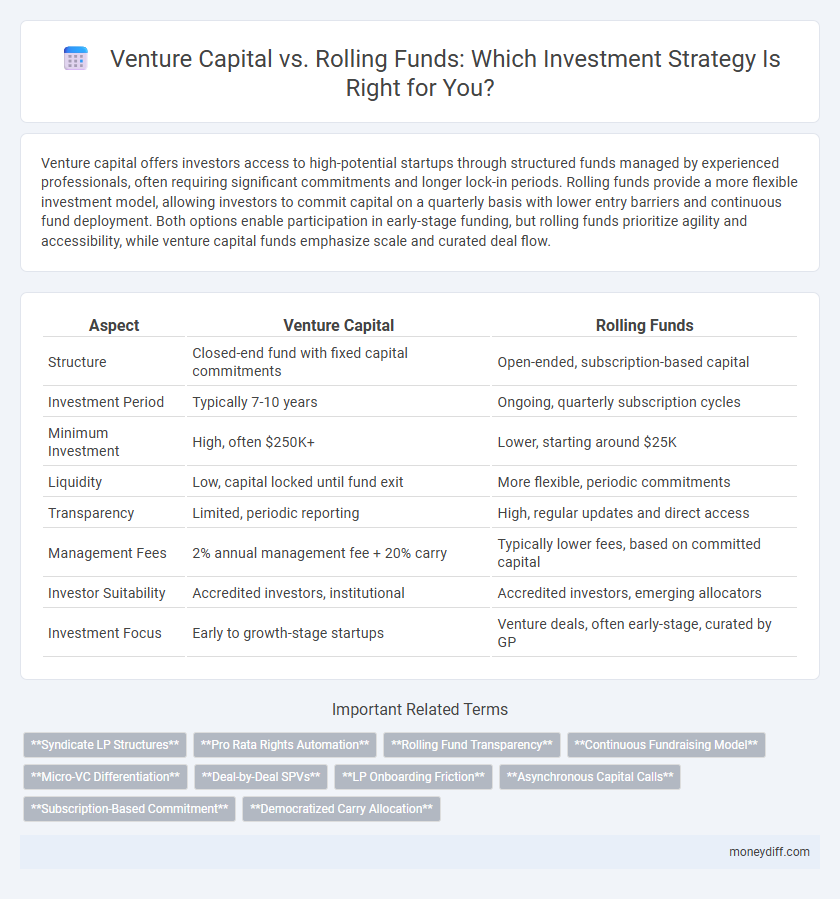

Venture capital offers investors access to high-potential startups through structured funds managed by experienced professionals, often requiring significant commitments and longer lock-in periods. Rolling funds provide a more flexible investment model, allowing investors to commit capital on a quarterly basis with lower entry barriers and continuous fund deployment. Both options enable participation in early-stage funding, but rolling funds prioritize agility and accessibility, while venture capital funds emphasize scale and curated deal flow.

Table of Comparison

| Aspect | Venture Capital | Rolling Funds |

|---|---|---|

| Structure | Closed-end fund with fixed capital commitments | Open-ended, subscription-based capital |

| Investment Period | Typically 7-10 years | Ongoing, quarterly subscription cycles |

| Minimum Investment | High, often $250K+ | Lower, starting around $25K |

| Liquidity | Low, capital locked until fund exit | More flexible, periodic commitments |

| Transparency | Limited, periodic reporting | High, regular updates and direct access |

| Management Fees | 2% annual management fee + 20% carry | Typically lower fees, based on committed capital |

| Investor Suitability | Accredited investors, institutional | Accredited investors, emerging allocators |

| Investment Focus | Early to growth-stage startups | Venture deals, often early-stage, curated by GP |

Understanding Venture Capital: Basics and Structure

Venture capital involves investment funds that manage pooled capital from limited partners to finance early-stage, high-growth startups in exchange for equity. These funds typically operate with defined lifespans, structured management fees, and carried interest, aligning incentives between general partners and investors. The traditional model contrasts with rolling funds, offering a fixed commitment and more formal governance over investment pacing and portfolio construction.

Introduction to Rolling Funds: How They Work

Rolling funds offer a flexible investment model allowing venture capitalists to raise capital on a quarterly subscription basis, enabling continuous fundraises instead of a single, large close. Investors commit capital periodically, aligning contributions with evolving market opportunities and fund performance. This approach provides enhanced liquidity, transparency, and adaptability compared to traditional venture capital funds, appealing to both fund managers and limited partners.

Key Differences Between Venture Capital and Rolling Funds

Venture capital typically involves large, pooled funds managed by firms that invest in startups over multiple years, focusing on high-growth potential companies with structured investment cycles. Rolling funds provide continuous, subscription-based access to venture investments, enabling investors to commit capital on a quarterly basis with increased flexibility and transparency. Key differences include fund structure, investor commitment duration, and the adaptability of capital deployment.

Investment Accessibility: Who Can Participate?

Venture capital traditionally requires high-net-worth individuals or accredited investors to participate, limiting accessibility to a select group with substantial capital. Rolling funds democratize investment by allowing accredited investors to contribute smaller, recurring amounts, broadening access to venture-style investments. This model lowers entry barriers and enables a more diverse pool of investors to engage in early-stage funding opportunities.

Capital Commitment Requirements and Flexibility

Venture capital typically requires high capital commitments upfront, often involving multi-year locked-in investments that limit liquidity and flexibility for investors. Rolling funds offer a more dynamic capital commitment structure, allowing investors to contribute smaller amounts on a quarterly basis, enhancing flexibility and aligning with evolving investment preferences. This model enables quicker adjustments to capital allocation without the long-term lock-up periods characteristic of traditional venture capital.

Fundraising Processes: Traditional VC vs Rolling Funds

Traditional venture capital funds typically rely on a lengthy, cyclic fundraising process involving a fixed pool of limited partners and predefined capital commitments, often taking months or years to close. Rolling funds offer a continuous subscription model that allows investors to commit capital on a quarterly basis, enabling faster and more flexible capital deployment. This streamlined fundraising approach in rolling funds reduces administrative overhead and accelerates access to capital compared to the conventional VC model.

Potential Returns: Risk and Reward Analysis

Venture capital investments typically offer higher potential returns driven by early-stage equity stakes in high-growth startups, though they come with elevated risk due to market volatility and startup failure rates. Rolling funds provide more consistent, diversified exposure by continuously allocating capital to multiple ventures, balancing risk and reward over time. Investors seeking aggressive growth might prefer venture capital, while those aiming for steady portfolio growth often lean toward rolling funds for risk mitigation.

Operational Involvement and Investor Influence

Venture capital investments often involve high operational involvement, with investors providing strategic guidance, mentorship, and active participation in portfolio companies' decision-making processes. Rolling funds offer a more hands-off approach, allowing investors to continuously deploy capital with less day-to-day input, focusing on aggregated returns rather than direct influence. The level of investor influence in venture capital is typically greater due to structured board seats and voting rights, whereas rolling funds prioritize diversified exposure and liquidity over individual operational control.

Regulatory and Compliance Considerations

Venture capital funds are subject to stringent regulatory oversight, including registration with the Securities and Exchange Commission (SEC) and compliance with the Investment Company Act of 1940, which imposes rigorous reporting and disclosure requirements. Rolling funds offer more flexibility under regulatory frameworks, often qualifying for exemptions that streamline fundraising and investor onboarding, but they still require adherence to securities laws and anti-fraud provisions. Understanding the detailed compliance obligations and filing requirements is crucial for investors and fund managers to mitigate legal risks and ensure alignment with regulatory standards in both fund structures.

Choosing the Right Investment Approach: VC or Rolling Fund?

Choosing the right investment approach between venture capital (VC) and rolling funds depends on factors like capital commitment, investment flexibility, and reporting structure. Venture capital typically requires larger, fixed commitments and targets high-growth startups through traditional fund cycles, while rolling funds offer continuous fundraising, enabling investors to deploy capital in smaller increments with more frequent deployment opportunities. Understanding these differences helps investors align their risk tolerance, liquidity needs, and investment horizons for optimal portfolio diversification.

Related Important Terms

Syndicate LP Structures

Venture capital syndicate LP structures pool capital from limited partners into a single investment vehicle managed by experienced general partners, providing diversified exposure to high-growth startups with professional oversight. Rolling funds, operating on a subscription basis, offer continuous capital deployment with flexible entry points, enabling LPs to participate in venture investments without long-term commitments or capital calls.

Pro Rata Rights Automation

Venture capital typically involves negotiated pro rata rights manually managed through legal agreements, whereas rolling funds leverage automated pro rata rights to streamline follow-on investments and maintain ownership percentages efficiently. This automation reduces administrative overhead and ensures timely capital deployment, enhancing scalability for investors continuously participating in multiple funding rounds.

Rolling Fund Transparency

Rolling funds offer investors enhanced transparency through quarterly updates and public reporting of portfolio performance, enabling real-time insights into fund allocations and returns. This contrasts with traditional venture capital funds, where information is often restricted until the fund's lifecycle milestones, limiting investor visibility.

Continuous Fundraising Model

Venture capital typically involves raising fixed funds with set closing periods, whereas rolling funds utilize a continuous fundraising model allowing investors to subscribe quarterly, providing consistent capital flow and increased flexibility. This model enhances agility in deployment strategies and aligns investor commitments with ongoing market opportunities, distinguishing rolling funds in dynamic investment environments.

Micro-VC Differentiation

Micro-VCs in venture capital typically manage smaller funds with focused investment strategies and deeper founder engagement, offering tailored support and higher operational involvement compared to rolling funds that continuously raise capital and often provide more scalable but less personalized investment approaches. This differentiation highlights micro-VCs' ability to build strong niche networks and deliver hands-on guidance, whereas rolling funds prioritize flexible fundraising and diversified deal flow across multiple investment cycles.

Deal-by-Deal SPVs

Deal-by-deal SPVs in venture capital enable investors to evaluate and commit capital to individual startup opportunities, offering granular control and risk management. Rolling funds differ by providing continuous capital deployment across multiple deals, but lack the targeted specificity and investor autonomy inherent in deal-by-deal SPVs.

LP Onboarding Friction

Venture Capital firms often face significant LP onboarding friction due to extensive due diligence processes, lengthy legal negotiations, and high minimum commitments that can delay capital deployment. Rolling Funds streamline LP onboarding by enabling quarterly commitments with simplified subscription documents, reducing barriers and accelerating investment cycles for limited partners.

Asynchronous Capital Calls

Rolling funds provide asynchronous capital calls, allowing investors to commit capital on a recurring basis rather than a single upfront lump sum, enhancing flexibility and liquidity management. Venture capital funds typically require synchronous capital calls, where investors fund committed capital in allocated tranches following the investment schedule.

Subscription-Based Commitment

Venture capital typically involves a fixed capital commitment where investors contribute a predetermined amount over the fund's life, often leading to illiquidity and longer lock-up periods. Rolling funds offer a subscription-based commitment model allowing investors to commit capital on a quarterly basis, providing greater flexibility and ongoing access to new deals without long-term obligations.

Democratized Carry Allocation

Venture capital typically allocates carry to a limited group of general partners, whereas rolling funds offer a democratized carry allocation model that enables a broader range of investors to participate in profit sharing. This structure enhances alignment of interests and fosters greater transparency and inclusivity in venture investing.

Venture Capital vs Rolling Funds for investment. Infographic

moneydiff.com

moneydiff.com