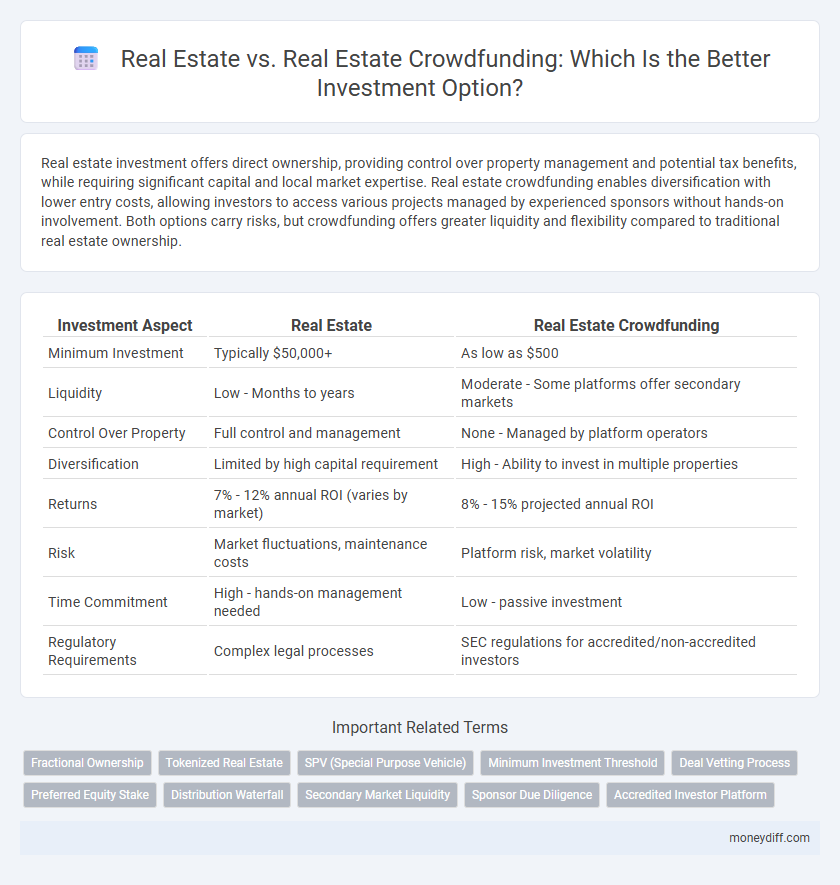

Real estate investment offers direct ownership, providing control over property management and potential tax benefits, while requiring significant capital and local market expertise. Real estate crowdfunding enables diversification with lower entry costs, allowing investors to access various projects managed by experienced sponsors without hands-on involvement. Both options carry risks, but crowdfunding offers greater liquidity and flexibility compared to traditional real estate ownership.

Table of Comparison

| Investment Aspect | Real Estate | Real Estate Crowdfunding |

|---|---|---|

| Minimum Investment | Typically $50,000+ | As low as $500 |

| Liquidity | Low - Months to years | Moderate - Some platforms offer secondary markets |

| Control Over Property | Full control and management | None - Managed by platform operators |

| Diversification | Limited by high capital requirement | High - Ability to invest in multiple properties |

| Returns | 7% - 12% annual ROI (varies by market) | 8% - 15% projected annual ROI |

| Risk | Market fluctuations, maintenance costs | Platform risk, market volatility |

| Time Commitment | High - hands-on management needed | Low - passive investment |

| Regulatory Requirements | Complex legal processes | SEC regulations for accredited/non-accredited investors |

Introduction to Real Estate and Real Estate Crowdfunding

Real estate investment involves acquiring physical properties such as residential, commercial, or industrial buildings to generate rental income or capital appreciation. Real estate crowdfunding allows investors to pool funds online to invest in real estate projects, providing access to diversified portfolios with lower capital requirements. This digital investment model offers increased liquidity and transparency compared to traditional direct property ownership.

Key Differences Between Traditional Real Estate and Crowdfunding

Traditional real estate investment requires significant capital, involves property management responsibilities, and typically offers lower liquidity compared to real estate crowdfunding. Crowdfunding platforms enable investors to pool funds for fractional ownership, providing access to diversified real estate projects with lower minimum investments and streamlined online management. Risk profiles differ as direct ownership exposes investors to market and operational risks, whereas crowdfunding risks are spread across multiple projects but depend heavily on platform reliability and regulatory frameworks.

Investment Accessibility and Entry Barriers

Real estate investing traditionally requires significant capital and often involves complex transaction processes, limiting accessibility for many individual investors. Real estate crowdfunding platforms lower entry barriers by allowing smaller investments, providing diversified portfolios with minimal initial capital. This democratization of real estate investment enables broader participation and increased liquidity compared to conventional property ownership.

Potential Returns: Comparing Profitability

Real estate investments traditionally offer stable, long-term appreciation and rental income, with average annual returns ranging from 8% to 12%, depending on location and property type. Real estate crowdfunding platforms can provide access to diversified portfolios with potentially higher short-term returns, often between 10% and 15%, by pooling capital into commercial or residential projects. However, crowdfunding investments carry higher risk and liquidity constraints compared to direct property ownership, which affects the overall profitability profile.

Risk Factors in Real Estate vs Crowdfunding

Real estate investment involves direct ownership, exposing investors to market volatility, property maintenance costs, and liquidity challenges. Real estate crowdfunding mitigates some risks by pooling funds across multiple projects, but it introduces platform risk and limited control over asset management. Both methods carry market and economic uncertainties, yet crowdfunding offers diversification with typically lower entry costs and varying degrees of transparency.

Liquidity and Exit Strategies

Real estate investments typically offer lower liquidity due to lengthy transaction processes and extended holding periods, while real estate crowdfunding platforms provide enhanced liquidity through shorter investment horizons and structured exit opportunities. Crowdfunding enables investors to access secondary markets or predetermined buyback programs, facilitating more flexible exit strategies compared to traditional real estate transactions. Understanding the liquidity differences and exit mechanisms is crucial for aligning investment choices with financial goals and risk tolerance.

Diversification Opportunities in Each Approach

Real estate investment offers direct ownership of physical properties, providing tangible asset control and potential for steady rental income, while real estate crowdfunding allows investors to diversify across multiple projects with lower capital requirements, reducing risk exposure. Crowdfunding platforms enable access to geographically and asset-type varied portfolios, enhancing diversification beyond single-property investments. Direct real estate requires significant capital and can concentrate risk in one location or property type, whereas crowdfunding spreads capital across various developments and markets.

Legal and Regulatory Considerations

Real estate investment requires navigating complex legal frameworks including property rights, zoning laws, and landlord-tenant regulations, which vary significantly by jurisdiction. Real estate crowdfunding platforms operate under securities regulations such as the JOBS Act in the U.S., mandating compliance with SEC rules to protect investors and ensure transparency. Understanding these regulatory environments is crucial for mitigating risks and ensuring lawful participation in either traditional real estate or crowdfunding investments.

Fees and Costs: What Investors Need to Know

Real estate investment typically involves property management fees, maintenance costs, and transaction expenses, which can significantly impact overall returns. Real estate crowdfunding platforms often charge lower entry fees and annual management fees but may include platform fees and profit-sharing arrangements that affect net gains. Investors should carefully compare these fees to align costs with their investment goals and expected liquidity.

Which Option Suits Your Investment Goals?

Real estate investment requires assessing liquidity, risk tolerance, and capital commitment, with traditional real estate offering direct ownership and potential for long-term appreciation but demanding significant upfront costs and management efforts. Real estate crowdfunding allows investors to diversify portfolios with lower entry costs, passive income streams, and reduced management responsibilities, making it suitable for those seeking flexibility and smaller investment amounts. Aligning your investment goals with the desired level of control, time horizon, and financial resources determines whether traditional real estate or real estate crowdfunding better fits your strategy.

Related Important Terms

Fractional Ownership

Real estate crowdfunding enables fractional ownership by allowing investors to buy smaller shares of high-value properties, increasing accessibility compared to traditional real estate investing that typically requires substantial capital and full ownership responsibility. This model diversifies investment portfolios with lower entry costs, reduced risk, and potential for passive income from rental returns or property appreciation.

Tokenized Real Estate

Tokenized Real Estate offers fractional ownership of properties through blockchain technology, providing increased liquidity and accessibility compared to traditional real estate investments. This digital approach enables investors to diversify portfolios with lower capital requirements while benefiting from transparent transactions and reduced entry barriers inherent in real estate crowdfunding platforms.

SPV (Special Purpose Vehicle)

Investing in real estate through an SPV (Special Purpose Vehicle) allows for direct ownership and more control over properties, offering potential tax benefits and asset protection. Real estate crowdfunding SPVs pool multiple investors' funds into a single legal entity, enabling access to diverse projects and reducing individual risk while maintaining a structured investment vehicle.

Minimum Investment Threshold

Real estate investment typically requires a substantial minimum investment, often ranging from $50,000 to $100,000 or more, limiting access to wealthy investors. In contrast, real estate crowdfunding platforms lower the minimum investment threshold to as little as $500 to $5,000, enabling broader participation and portfolio diversification for individual investors.

Deal Vetting Process

Real estate investment relies heavily on thorough deal vetting involving property inspections, market analysis, and financial due diligence to maximize returns and minimize risks. In contrast, real estate crowdfunding platforms streamline this vetting process by leveraging expert teams and advanced algorithms to evaluate multiple projects, offering investors curated opportunities with reduced individual research efforts.

Preferred Equity Stake

Preferred equity stake in real estate investment offers priority returns and downside protection compared to traditional equity, making it a less risky option. Real estate crowdfunding platforms provide access to preferred equity stakes with lower capital requirements and liquidity advantages, appealing to investors seeking diversified portfolios without direct property management.

Distribution Waterfall

Real estate investment typically follows a hierarchical distribution waterfall where returns are prioritized to repay initial capital, preferred returns, and then profit splits between investors and sponsors, ensuring transparent allocation. Real estate crowdfunding platforms implement similar distribution waterfalls but often provide more accessible entry points for smaller investors while maintaining aligned interests through structured return tiers.

Secondary Market Liquidity

Real estate investments typically lack secondary market liquidity, requiring longer holding periods and limited exit options, whereas real estate crowdfunding platforms often provide access to secondary markets, enabling investors to buy and sell shares more easily and improve portfolio flexibility. Enhanced liquidity through crowdfunding secondary markets reduces capital lock-up and accelerates potential returns compared to traditional property ownership.

Sponsor Due Diligence

Sponsor due diligence in real estate investment involves a thorough evaluation of the developer's track record, financial stability, and project execution capabilities, ensuring risk mitigation and alignment with investor goals. Real estate crowdfunding platforms enhance transparency by rigorously vetting sponsors, providing detailed background checks and performance histories to protect investors and optimize portfolio outcomes.

Accredited Investor Platform

Real estate crowdfunding platforms tailored for accredited investors offer diversified portfolios with lower entry thresholds compared to direct real estate investments that require substantial capital and management expertise. These platforms leverage technology to provide access to exclusive commercial and residential projects, enhancing liquidity and transparency while mitigating traditional real estate market risks.

Real Estate vs Real Estate Crowdfunding for investment Infographic

moneydiff.com

moneydiff.com