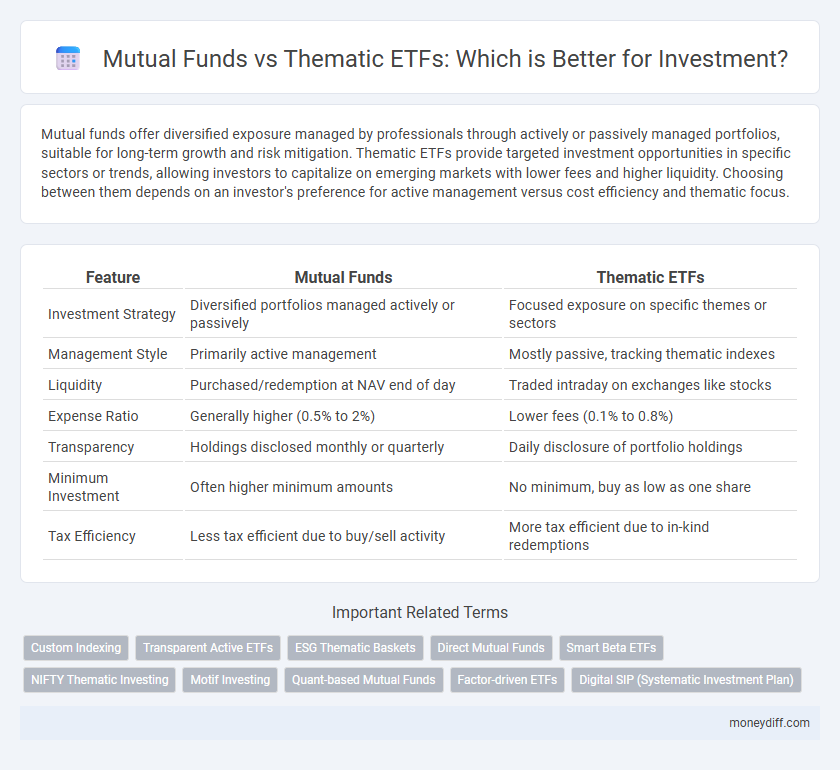

Mutual funds offer diversified exposure managed by professionals through actively or passively managed portfolios, suitable for long-term growth and risk mitigation. Thematic ETFs provide targeted investment opportunities in specific sectors or trends, allowing investors to capitalize on emerging markets with lower fees and higher liquidity. Choosing between them depends on an investor's preference for active management versus cost efficiency and thematic focus.

Table of Comparison

| Feature | Mutual Funds | Thematic ETFs |

|---|---|---|

| Investment Strategy | Diversified portfolios managed actively or passively | Focused exposure on specific themes or sectors |

| Management Style | Primarily active management | Mostly passive, tracking thematic indexes |

| Liquidity | Purchased/redemption at NAV end of day | Traded intraday on exchanges like stocks |

| Expense Ratio | Generally higher (0.5% to 2%) | Lower fees (0.1% to 0.8%) |

| Transparency | Holdings disclosed monthly or quarterly | Daily disclosure of portfolio holdings |

| Minimum Investment | Often higher minimum amounts | No minimum, buy as low as one share |

| Tax Efficiency | Less tax efficient due to buy/sell activity | More tax efficient due to in-kind redemptions |

Understanding Mutual Funds and Thematic ETFs

Mutual funds pool capital from multiple investors to invest in a diversified portfolio managed by professionals, offering broad market exposure and risk mitigation. Thematic ETFs focus on specific trends or sectors, enabling targeted investment in themes like technology, clean energy, or healthcare innovation with lower expense ratios and greater liquidity. Understanding the structural differences, management style, and cost implications helps investors align choices with their risk tolerance and financial goals.

Key Differences Between Mutual Funds and Thematic ETFs

Mutual funds pool investor money to create a diversified portfolio managed by professionals, offering broad market exposure, while thematic ETFs focus on specific sectors or trends, providing targeted investment opportunities with the flexibility of stock-like trading. Mutual funds often carry higher fees and limited intraday liquidity compared to thematic ETFs, which typically have lower expense ratios and trade throughout the day on exchanges. Investors seeking broad diversification and professional management may prefer mutual funds, whereas those aiming for sector-specific exposure and intraday trading may find thematic ETFs more suitable.

Risk Factors: Mutual Funds vs Thematic ETFs

Mutual funds generally offer diversified portfolios managed by professionals, reducing unsystematic risk through broad asset allocation. Thematic ETFs concentrate investments in specific sectors or trends, exposing investors to higher volatility and sector-specific risks. Investors must assess their risk tolerance, as thematic ETFs carry greater potential for rapid value fluctuations compared to the more stable, diversified mutual funds.

Cost Structures and Fees Comparison

Mutual funds generally charge higher expense ratios and load fees compared to thematic ETFs, which typically offer lower management fees and no sales loads. Expense ratios for mutual funds average around 0.75%-1.25%, whereas thematic ETFs often range between 0.20% and 0.60%, providing cost efficiency for investors. Trading costs and bid-ask spreads for ETFs may add to investor expenses, but the overall cost structure usually favors thematic ETFs for long-term investment savings.

Diversification Benefits: Which Is Better?

Mutual funds typically offer broader diversification by pooling a wide range of assets across various sectors, reducing risk through exposure to multiple industries and market segments. Thematic ETFs, while focused on specific trends or sectors such as technology or clean energy, provide concentrated exposure that can amplify returns but also increase volatility. Investors seeking diversified risk mitigation may prefer mutual funds, whereas those aiming for targeted growth aligned with particular themes might consider thematic ETFs.

Investment Strategies and Portfolio Allocation

Mutual funds offer diversified investment across various asset classes with professional management, making them suitable for broad portfolio allocation and long-term growth strategies. Thematic ETFs focus on specific sectors or trends, providing targeted exposure that can enhance portfolio diversification or capitalize on market themes. Balancing mutual funds with thematic ETFs allows investors to combine stability with growth potential through strategic asset allocation.

Historical Performance Analysis

Mutual funds have demonstrated consistent historical returns through active management, often outperforming benchmarks in volatile markets, while thematic ETFs provide targeted exposure to specific sectors or trends with lower expense ratios and higher liquidity. Data from Morningstar indicates that mutual funds tend to exhibit less tracking error compared to thematic ETFs, which can experience greater volatility due to concentrated holdings. Investors seeking diversification and risk-adjusted returns should weigh past performance metrics alongside expense ratios and portfolio transparency when choosing between mutual funds and thematic ETFs.

Liquidity and Ease of Trading

Mutual funds typically offer liquidity through end-of-day redemptions, which means investors can buy or sell shares only once per trading day at the net asset value (NAV). Thematic ETFs provide greater ease of trading with real-time market pricing, allowing investors to execute trades throughout the trading day at market prices. This intraday liquidity and flexibility make thematic ETFs more attractive for active trading strategies compared to mutual funds.

Tax Implications for Investors

Mutual funds generally distribute capital gains annually, leading to potential taxable events even if investors do not sell their shares, whereas thematic ETFs typically incur capital gains taxes only upon the investor's sale, offering more control over tax timing. Dividends from mutual funds are usually taxed as ordinary income, while thematic ETFs, especially those structured as index funds, often qualify for lower long-term capital gains tax rates. Investors should consider state-specific tax regulations and consult tax professionals to optimize investment returns through strategic selection between mutual funds and thematic ETFs.

Which Option Suits Your Investment Goals?

Mutual funds offer diversified portfolios managed by professionals, making them suitable for investors seeking broad market exposure and lower risk. Thematic ETFs provide targeted exposure to specific sectors or trends, ideal for investors aiming to capitalize on emerging market themes with higher risk tolerance. Choosing between them depends on your investment horizon, risk appetite, and desire for portfolio customization aligned with specific financial goals.

Related Important Terms

Custom Indexing

Custom indexing enhances portfolio personalization by allowing investors to tailor mutual funds and thematic ETFs to their specific risk tolerance and sector preferences. Thematic ETFs offer broad exposure to targeted trends, while mutual funds with custom indexing provide deeper customization through individual security selection within those themes.

Transparent Active ETFs

Transparent Active ETFs offer enhanced transparency and real-time pricing compared to traditional mutual funds, allowing investors to monitor underlying holdings daily and react swiftly to market changes. Unlike thematic ETFs that passively track specific sectors, Transparent Active ETFs combine active management with clear visibility, optimizing portfolio flexibility and risk management within targeted investment themes.

ESG Thematic Baskets

ESG thematic baskets within mutual funds often provide diversified exposure managed by professionals focusing on environmental, social, and governance criteria, which may offer stability and broad market representation. Thematic ETFs, conversely, deliver cost-effective, transparent, and easily tradable portfolios targeting specific ESG sectors, allowing investors to capitalize on emerging sustainability trends with enhanced liquidity.

Direct Mutual Funds

Direct mutual funds offer lower expense ratios and personalized portfolio management compared to thematic ETFs, which focus on sector-specific trends and may carry higher volatility risks. Investors seeking diversified exposure with cost efficiency and active selection prefer direct mutual funds over thematic ETFs for long-term wealth accumulation.

Smart Beta ETFs

Smart Beta ETFs leverage advanced indexing strategies to optimize risk-adjusted returns by systematically targeting factors such as value, momentum, and low volatility, offering a more tailored approach than traditional mutual funds. Compared to thematic ETFs, Smart Beta ETFs provide enhanced diversification and cost efficiency while aiming to capture persistent market anomalies that can improve portfolio performance over time.

NIFTY Thematic Investing

NIFTY Thematic ETFs provide targeted exposure to specific market themes, offering investors a cost-efficient and transparent alternative to traditional mutual funds that often involve higher management fees and less flexibility. By focusing on sectoral or thematic indices within the NIFTY framework, these ETFs enable strategic portfolio diversification aligned with evolving market trends and economic cycles.

Motif Investing

Mutual funds offer diversified portfolios managed by professionals, while Thematic ETFs focus on specific sectors or trends, providing targeted exposure with typically lower fees and higher liquidity. Motif Investing specializes in thematic ETFs that allow investors to capitalize on emerging market trends through customized basket investments, enhancing portfolio precision and adaptability.

Quant-based Mutual Funds

Quant-based mutual funds utilize advanced algorithms and data-driven strategies to optimize portfolio selection, offering diversified exposure with systematic risk management compared to thematic ETFs, which concentrate on specific market sectors or trends and may carry higher volatility. Investors seeking disciplined, data-backed investment approaches often prefer quant-based mutual funds for balanced risk-adjusted returns over the thematic, trend-focused nature of ETFs.

Factor-driven ETFs

Factor-driven ETFs focus on specific investment factors such as value, momentum, or quality, offering targeted exposure and often lower fees compared to mutual funds. While mutual funds provide broader diversification and active management, factor-driven ETFs deliver a rules-based approach that can enhance risk-adjusted returns by systematically capturing persistent market anomalies.

Digital SIP (Systematic Investment Plan)

Mutual funds offer diversified portfolios managed by professionals, while thematic ETFs provide targeted exposure to specific sectors or trends, making them ideal for investors seeking focused growth. A Digital SIP simplifies investment automation, enabling consistent contributions and portfolio rebalancing, enhancing wealth creation in both options.

Mutual Funds vs Thematic ETFs for investment. Infographic

moneydiff.com

moneydiff.com