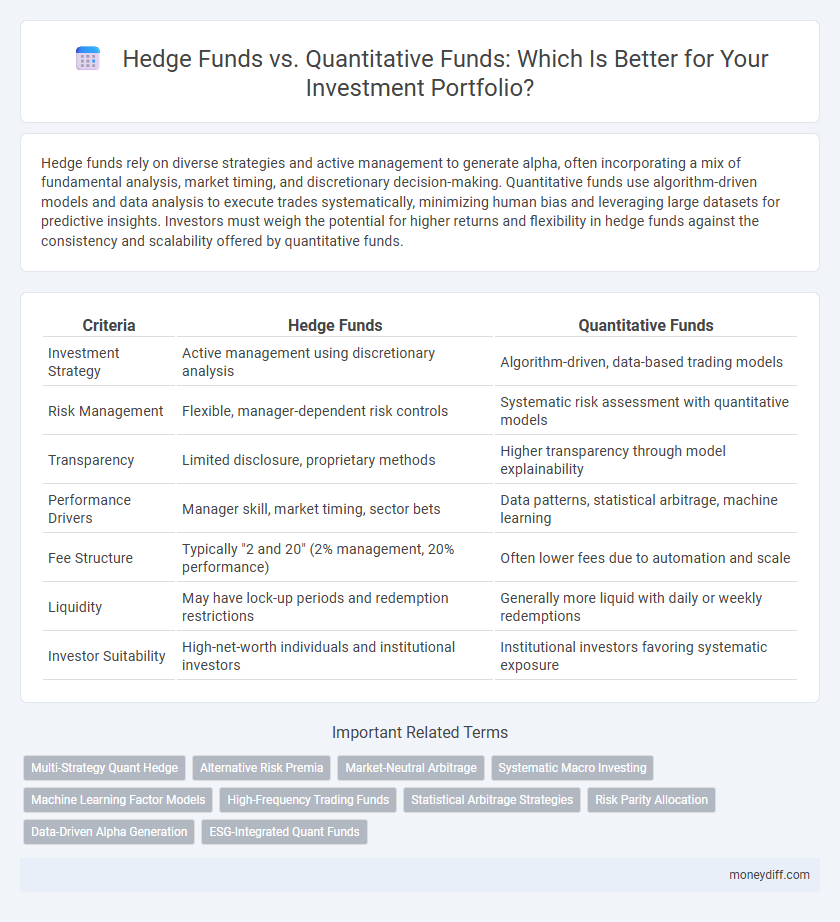

Hedge funds rely on diverse strategies and active management to generate alpha, often incorporating a mix of fundamental analysis, market timing, and discretionary decision-making. Quantitative funds use algorithm-driven models and data analysis to execute trades systematically, minimizing human bias and leveraging large datasets for predictive insights. Investors must weigh the potential for higher returns and flexibility in hedge funds against the consistency and scalability offered by quantitative funds.

Table of Comparison

| Criteria | Hedge Funds | Quantitative Funds |

|---|---|---|

| Investment Strategy | Active management using discretionary analysis | Algorithm-driven, data-based trading models |

| Risk Management | Flexible, manager-dependent risk controls | Systematic risk assessment with quantitative models |

| Transparency | Limited disclosure, proprietary methods | Higher transparency through model explainability |

| Performance Drivers | Manager skill, market timing, sector bets | Data patterns, statistical arbitrage, machine learning |

| Fee Structure | Typically "2 and 20" (2% management, 20% performance) | Often lower fees due to automation and scale |

| Liquidity | May have lock-up periods and redemption restrictions | Generally more liquid with daily or weekly redemptions |

| Investor Suitability | High-net-worth individuals and institutional investors | Institutional investors favoring systematic exposure |

Introduction to Hedge Funds and Quantitative Funds

Hedge funds are alternative investment vehicles that employ diverse strategies, including long-short equity, arbitrage, and macroeconomic trends, aiming for absolute returns regardless of market conditions. Quantitative funds utilize advanced mathematical models, algorithms, and big data analysis to identify trading opportunities and manage risks with high precision and automation. Both fund types cater to sophisticated investors seeking diversified portfolio strategies, but differ fundamentally in approach: hedge funds emphasize discretionary decision-making, while quantitative funds rely on systematic, data-driven processes.

Key Differences Between Hedge Funds and Quantitative Funds

Hedge funds employ diverse strategies, including long-short equity, arbitrage, and macroeconomic bets, relying heavily on manager discretion and qualitative analysis, whereas quantitative funds utilize algorithmic models and statistical techniques to make investment decisions based on large datasets. Hedge funds often target absolute returns with flexible investment mandates and may involve higher fees and less transparency, while quantitative funds emphasize systematic, data-driven approaches that aim to reduce human bias and improve replication of performance. Risk management in hedge funds is typically subjective, contrasting with the rule-based, automated risk controls embedded in quantitative strategies.

Investment Strategies: Traditional vs Algorithmic Approaches

Hedge funds typically rely on traditional investment strategies, including fundamental analysis and discretionary decision-making by portfolio managers. Quantitative funds leverage algorithmic approaches, utilizing complex mathematical models, big data, and machine learning to identify investment opportunities and manage risk. The algorithmic precision of quantitative funds often enables faster adaptation to market changes compared to the more subjective methods employed by hedge funds.

Risk Management Techniques in Hedge and Quantitative Funds

Hedge funds employ dynamic risk management techniques such as stop-loss orders, portfolio diversification, and leverage adjustments to mitigate market volatility and protect investor capital. Quantitative funds utilize algorithm-driven models and real-time data analysis to identify risk exposures, optimize asset allocation, and implement automated hedging strategies. Both fund types focus on minimizing drawdowns, but quantitative funds leverage advanced statistical methods and machine learning to enhance risk prediction and adaptive response.

Performance Comparison: Returns and Volatility

Hedge funds and quantitative funds differ significantly in performance metrics, with hedge funds often yielding higher absolute returns due to active management and discretionary strategies. Quantitative funds typically exhibit lower volatility by leveraging algorithm-driven models that adapt to market conditions rapidly, enhancing risk-adjusted returns. Historical data shows quantitative funds outperform hedge funds during volatile market periods, driven by systematic risk controls and data-driven decision-making.

Fee Structures and Costs Analysis

Hedge funds typically charge a 2% management fee and a 20% performance fee, whereas quantitative funds often have lower fees, averaging around 1% management and 10% performance fees due to their algorithm-driven strategies. The higher costs in hedge funds reflect active management and discretionary decision-making, while quantitative funds emphasize cost efficiency through automated trading models. Investors should weigh the impact of these fee structures on net returns, considering that lower fees in quantitative funds can enhance long-term portfolio growth.

Transparency and Regulatory Considerations

Hedge funds often operate with less transparency, employing complex strategies that can obscure risk and performance details from investors, whereas quantitative funds emphasize data-driven models offering clearer algorithmic insights and systematic trading processes. Regulatory considerations differentiate these funds, with hedge funds subject to looser regulations under exemptions like the Investment Company Act, while quantitative funds, especially those structured as mutual funds or ETFs, face stricter oversight to protect retail investors. Transparency in quantitative funds enhances regulatory compliance and investor confidence, whereas hedge funds' opacity can lead to higher due diligence requirements and regulatory scrutiny.

Accessibility: Minimum Investment and Investor Eligibility

Hedge funds typically require high minimum investments, often starting at $1 million or more, and impose strict eligibility criteria, limiting access to accredited or institutional investors. Quantitative funds generally offer lower entry points, sometimes as accessible as $10,000, and accommodate a broader range of investors by utilizing algorithm-driven strategies. This accessibility difference significantly impacts individual investors' ability to diversify portfolios and participate in alternative investment opportunities.

Role of Technology and Data in Quantitative Investing

Quantitative funds leverage advanced algorithms, machine learning, and big data analytics to identify investment opportunities and manage risk, enabling systematic and data-driven decision-making. Hedge funds may employ technology but often rely more on discretionary strategies and human judgment to navigate markets. The integration of real-time data and sophisticated computational models in quantitative investing enhances precision, scalability, and the ability to adapt to evolving market conditions.

Choosing the Right Fund: Factors for Investors to Consider

Investors should evaluate hedge funds and quantitative funds based on factors such as risk tolerance, investment horizon, and desired level of transparency in trading strategies. Hedge funds often rely on active management and discretionary decision-making, while quantitative funds use algorithm-driven models for systematic investment approaches. Assessing fee structures, historical performance, and alignment with individual financial goals is essential in choosing the optimal fund type.

Related Important Terms

Multi-Strategy Quant Hedge

Multi-strategy quant hedge funds leverage advanced algorithms and diverse trading models to optimize risk-adjusted returns across various asset classes, outperforming traditional hedge funds by implementing systematic, data-driven strategies. Their integration of machine learning and real-time data analytics enables dynamic allocation and enhanced alpha generation, making them a preferred choice for sophisticated investors seeking diversification and consistent performance.

Alternative Risk Premia

Hedge funds traditionally leverage discretionary strategies aiming to exploit market inefficiencies, while quantitative funds utilize algorithmic models to systematically capture alternative risk premia such as momentum, value, and carry across diversified asset classes. Alternative risk premia strategies employed by quantitative funds offer scalable, transparent, and cost-effective access to diversified sources of return, often providing lower correlation to traditional hedge fund approaches.

Market-Neutral Arbitrage

Market-neutral arbitrage strategies in hedge funds leverage human expertise to exploit pricing inefficiencies while managing risk through diversified asset exposure. Quantitative funds utilize advanced algorithms and statistical models to systematically identify and execute arbitrage opportunities, offering scalability and reduced emotional bias in investment decisions.

Systematic Macro Investing

Systematic Macro Investing leverages algorithm-driven strategies to analyze global economic indicators and execute trades across multiple asset classes, offering a data-driven approach distinct from traditional hedge funds that rely on discretionary decision-making. Quantitative funds in this space utilize advanced models to identify macroeconomic trends and optimize portfolio allocation, enhancing risk-adjusted returns compared to conventional hedge fund strategies.

Machine Learning Factor Models

Hedge funds leveraging machine learning factor models utilize advanced algorithms and vast data sets to identify complex patterns and optimize asset allocation, enhancing predictive accuracy and risk management. Quantitative funds specializing in these models employ systematic, data-driven strategies to exploit market inefficiencies with greater consistency and scalability compared to traditional hedge fund approaches.

High-Frequency Trading Funds

High-frequency trading funds leverage advanced algorithms and high-speed data processing to execute thousands of trades per second, generating profits from minute price discrepancies in liquid markets. Hedge funds employing high-frequency trading strategies combine quantitative models with discretionary oversight to enhance risk management and exploit short-term market inefficiencies.

Statistical Arbitrage Strategies

Hedge funds utilizing statistical arbitrage strategies leverage complex algorithms and high-frequency trading to exploit short-term market inefficiencies, often combining fundamental analysis with quantitative models. Quantitative funds primarily depend on mathematical and statistical techniques to identify pricing anomalies systematically, enabling faster execution and risk diversification in statistical arbitrage compared to traditional hedge funds.

Risk Parity Allocation

Hedge funds typically employ discretionary strategies with flexible risk parity allocation adjusting exposure across asset classes based on market trends, while quantitative funds rely on algorithm-driven models to maintain systematic risk parity, optimizing portfolio diversification and volatility control. Risk parity allocation in quantitative funds often results in more stable risk-adjusted returns by balancing equity, bond, and commodity risks through data-driven optimization techniques.

Data-Driven Alpha Generation

Hedge funds leverage diverse strategies including fundamental analysis and discretionary decision-making to generate alpha, while quantitative funds utilize algorithmic models and large datasets to identify statistical patterns and execute trades systematically. Data-driven alpha generation in quantitative funds relies on advanced machine learning, big data analytics, and real-time market data to optimize investment performance and risk management.

ESG-Integrated Quant Funds

ESG-integrated quantitative funds leverage algorithmic models to systematically incorporate environmental, social, and governance criteria into their investment decisions, offering a disciplined approach that enhances transparency and risk management compared to traditional hedge funds. These quant funds utilize big data analytics and machine learning to identify sustainable investment opportunities while aligning with ESG mandates, delivering performance benefits alongside measurable social impact.

Hedge Funds vs Quantitative Funds for investment. Infographic

moneydiff.com

moneydiff.com