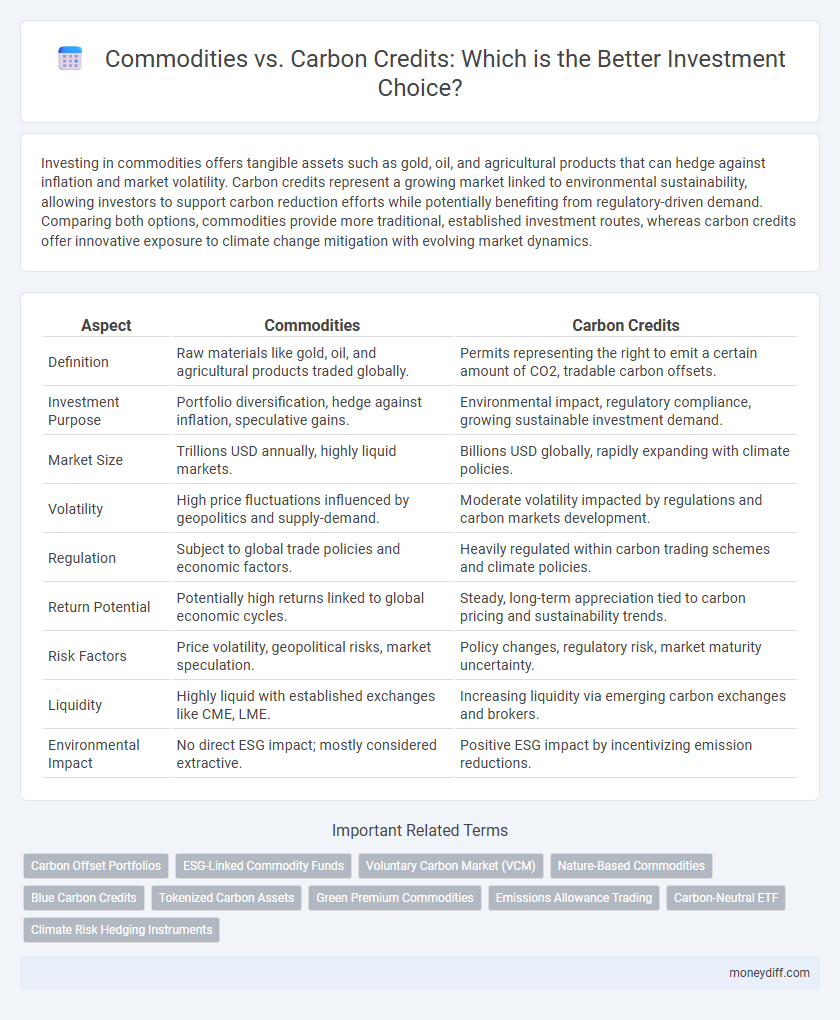

Investing in commodities offers tangible assets such as gold, oil, and agricultural products that can hedge against inflation and market volatility. Carbon credits represent a growing market linked to environmental sustainability, allowing investors to support carbon reduction efforts while potentially benefiting from regulatory-driven demand. Comparing both options, commodities provide more traditional, established investment routes, whereas carbon credits offer innovative exposure to climate change mitigation with evolving market dynamics.

Table of Comparison

| Aspect | Commodities | Carbon Credits |

|---|---|---|

| Definition | Raw materials like gold, oil, and agricultural products traded globally. | Permits representing the right to emit a certain amount of CO2, tradable carbon offsets. |

| Investment Purpose | Portfolio diversification, hedge against inflation, speculative gains. | Environmental impact, regulatory compliance, growing sustainable investment demand. |

| Market Size | Trillions USD annually, highly liquid markets. | Billions USD globally, rapidly expanding with climate policies. |

| Volatility | High price fluctuations influenced by geopolitics and supply-demand. | Moderate volatility impacted by regulations and carbon markets development. |

| Regulation | Subject to global trade policies and economic factors. | Heavily regulated within carbon trading schemes and climate policies. |

| Return Potential | Potentially high returns linked to global economic cycles. | Steady, long-term appreciation tied to carbon pricing and sustainability trends. |

| Risk Factors | Price volatility, geopolitical risks, market speculation. | Policy changes, regulatory risk, market maturity uncertainty. |

| Liquidity | Highly liquid with established exchanges like CME, LME. | Increasing liquidity via emerging carbon exchanges and brokers. |

| Environmental Impact | No direct ESG impact; mostly considered extractive. | Positive ESG impact by incentivizing emission reductions. |

Understanding Commodities and Carbon Credits

Commodities are physical goods such as oil, gold, and agricultural products traded on global markets, offering tangible assets with intrinsic value influenced by supply and demand dynamics. Carbon credits represent permits that allow companies to emit a certain amount of carbon dioxide, serving as a financial tool within regulatory frameworks aimed at reducing greenhouse gas emissions. Understanding the fundamental differences between commodities and carbon credits is crucial for investors seeking diversification and exposure to sustainability-driven markets.

Market Overview: Commodities vs Carbon Credits

Commodities markets, encompassing assets like oil, gold, and agricultural products, offer high liquidity and long-established trading infrastructure with prices influenced by global supply and demand dynamics. Carbon credits, emerging within environmental finance, represent tradable certificates aimed at reducing greenhouse gas emissions, driven by regulatory policies and growing corporate sustainability commitments. The commodities market offers volatility and diverse economic exposure, whereas carbon credits present investment opportunities tied to climate change mitigation and regulatory frameworks.

Investment Potential: Profitability and Growth Trends

Commodities have demonstrated consistent profitability driven by global demand in energy, metals, and agriculture, with prices often influenced by geopolitical and economic factors, offering investors substantial growth opportunities. Carbon credits present a rapidly expanding market fueled by increasing regulatory pressures and corporate commitments to sustainability, positioning them as a high-growth asset with potential for significant returns as carbon pricing mechanisms mature. Investors seeking diversification can benefit from commodities' established liquidity and carbon credits' emerging value linked to environmental impact and policy developments.

Risk Factors in Commodities and Carbon Credits

Commodities investments face significant price volatility due to geopolitical tensions, supply chain disruptions, and fluctuating demand, leading to high market risk. Carbon credits present regulatory and policy risks, as changes in environmental legislation or carbon pricing mechanisms can drastically affect credit values. Both asset classes are exposed to liquidity risks, but carbon credits are particularly vulnerable to market immaturity and regulatory uncertainty.

Portfolio Diversification Benefits

Commodities offer tangible asset exposure that can hedge against inflation and geopolitical risks, enhancing portfolio resilience. Carbon credits provide a unique opportunity to invest in environmental sustainability while potentially benefiting from regulatory-driven demand growth. Combining commodities with carbon credits diversifies risk factors by integrating traditional market dynamics and emerging green asset classes.

Regulatory Landscape and Compliance

The regulatory landscape for commodities investment is well-established, with clear compliance requirements governed by agencies such as the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). Carbon credits face evolving regulations that vary significantly by jurisdiction, often influenced by international agreements like the Paris Agreement, creating complexity in compliance and reporting standards. Investors must navigate stringent verification protocols and transparency mandates in carbon markets, contrasting with the more standardized regulatory frameworks governing traditional commodities.

Environmental Impact and Ethical Investing

Investing in commodities often involves resource extraction that can lead to environmental degradation, whereas carbon credits promote sustainability by funding projects that reduce greenhouse gas emissions. Ethical investors increasingly favor carbon credits due to their positive impact on climate change mitigation and alignment with corporate social responsibility goals. The growing market for carbon credits reflects heightened awareness of environmental impact and the desire to support investments with measurable ecological benefits.

Liquidity and Accessibility for Investors

Commodities markets offer high liquidity with established exchanges and standardized contracts, enabling quick entry and exit for investors. Carbon credits, while increasingly accessible through emerging platforms and governmental programs, generally present lower liquidity and higher variability in market depth. Investors prioritize commodities for ease of trading, whereas carbon credits attract those seeking niche environmental impact investments with growing but less mature liquidity profiles.

Long-Term Outlook: Future Value Projections

Commodities such as gold and oil have historically demonstrated strong long-term value retention driven by supply-demand dynamics and global economic growth. Carbon credits, emerging as a critical tool for carbon offsetting, are projected to increase in value due to tightening environmental regulations and rising corporate commitments to net-zero targets. Investment prospects favor carbon credits for diversification into sustainable assets, while commodities offer stability backed by tangible resources over extended periods.

Choosing the Right Option for Your Investment Strategy

Commodities offer tangible assets like gold and oil that provide portfolio diversification and inflation hedging, while carbon credits represent intangible assets tied to environmental impact and regulatory frameworks. Evaluating risk tolerance, market volatility, and long-term sustainability goals is essential when deciding between commodity investments and carbon credit portfolios. Incorporating carbon credits aligns with ESG criteria and emerging green economy trends, whereas commodities deliver traditional value through global demand dynamics.

Related Important Terms

Carbon Offset Portfolios

Carbon offset portfolios offer investors a sustainable alternative to traditional commodities by generating verified environmental benefits through projects that reduce greenhouse gas emissions, potentially enhancing long-term value amid escalating regulatory and consumer demand for decarbonization. These portfolios diversify investment risk while aligning capital with global climate goals, providing measurable carbon reduction impacts that commodities alone cannot deliver.

ESG-Linked Commodity Funds

ESG-linked commodity funds integrate environmental, social, and governance criteria to provide sustainable investment opportunities by combining exposure to traditional commodities with carbon credits. These funds aim to mitigate climate risks and enhance portfolio diversification while promoting responsible resource management and supporting global decarbonization goals.

Voluntary Carbon Market (VCM)

Investing in commodities offers tangible assets with established market liquidity, while carbon credits in the Voluntary Carbon Market (VCM) present growth potential tied to global sustainability trends and regulatory pressures. The VCM's increasing demand for verified emission reductions makes carbon credits a strategic investment for environmentally conscious portfolios seeking long-term value in climate action initiatives.

Nature-Based Commodities

Nature-based commodities, such as timber, agricultural products, and bioenergy, offer tangible assets with intrinsic value and established markets that provide liquidity and price transparency. Carbon credits serve as regulatory or voluntary compliance instruments tied to verified emissions reductions, presenting opportunities for impact-driven investment but with higher market complexity and price volatility.

Blue Carbon Credits

Investing in blue carbon credits offers a unique opportunity to support coastal ecosystem restoration while generating returns linked to carbon sequestration in mangroves, seagrasses, and salt marshes, unlike traditional commodities which are subject to market volatility and supply constraints. Blue carbon credit markets are expanding rapidly due to increased regulatory support and corporate commitments to net-zero emissions, making them a promising alternative to conventional commodity investments.

Tokenized Carbon Assets

Tokenized carbon assets offer a transparent and efficient alternative to traditional commodities by enabling fractional ownership and real-time trading on blockchain platforms, enhancing liquidity and accessibility for investors. These digital carbon credits not only support environmental sustainability but also provide a diversified portfolio option with potential for long-term value appreciation amid growing regulatory demand for carbon offsetting.

Green Premium Commodities

Green premium commodities, such as sustainably sourced metals and agricultural products, offer investors the potential for long-term value appreciation driven by the global transition to low-carbon economies. Carbon credits represent a growing market incentivizing emissions reductions, but green premium commodities provide tangible assets with embedded environmental benefits and increasing demand from eco-conscious industries.

Emissions Allowance Trading

Emissions allowance trading in carbon credits offers investors a dynamic market driven by regulatory frameworks and global climate policies, providing opportunities for diversification and impact investment. Commodities, while traditionally valued for tangible assets like gold or oil, carry price volatility linked to supply-demand fluctuations, contrasting with the regulatory influence and environmental benefits embedded in carbon credit markets.

Carbon-Neutral ETF

Carbon-Neutral ETFs increasingly attract investors by focusing on carbon credits that offset emissions, providing both environmental impact and financial returns compared to traditional commodity investments like oil or metals. These ETFs enable portfolio diversification while supporting global sustainability goals through regulated carbon markets and verified carbon offset projects.

Climate Risk Hedging Instruments

Commodities offer tangible assets with price volatility linked to supply-demand dynamics, while carbon credits represent regulatory-driven instruments designed to offset carbon emissions and support decarbonization goals. Carbon credits provide targeted climate risk hedging by enabling investors to mitigate exposure to transition risks in carbon-intensive sectors through a market mechanism aligned with global climate policies.

Commodities vs Carbon Credits for investment. Infographic

moneydiff.com

moneydiff.com