REITs provide investors with access to diversified real estate portfolios through traditional stock markets, offering liquidity and regulatory oversight. Tokenized real estate enables fractional ownership using blockchain technology, allowing for greater transparency, lower entry barriers, and faster transactions. While REITs are established with predictable dividends, tokenized assets offer innovative opportunities for customization and global investment.

Table of Comparison

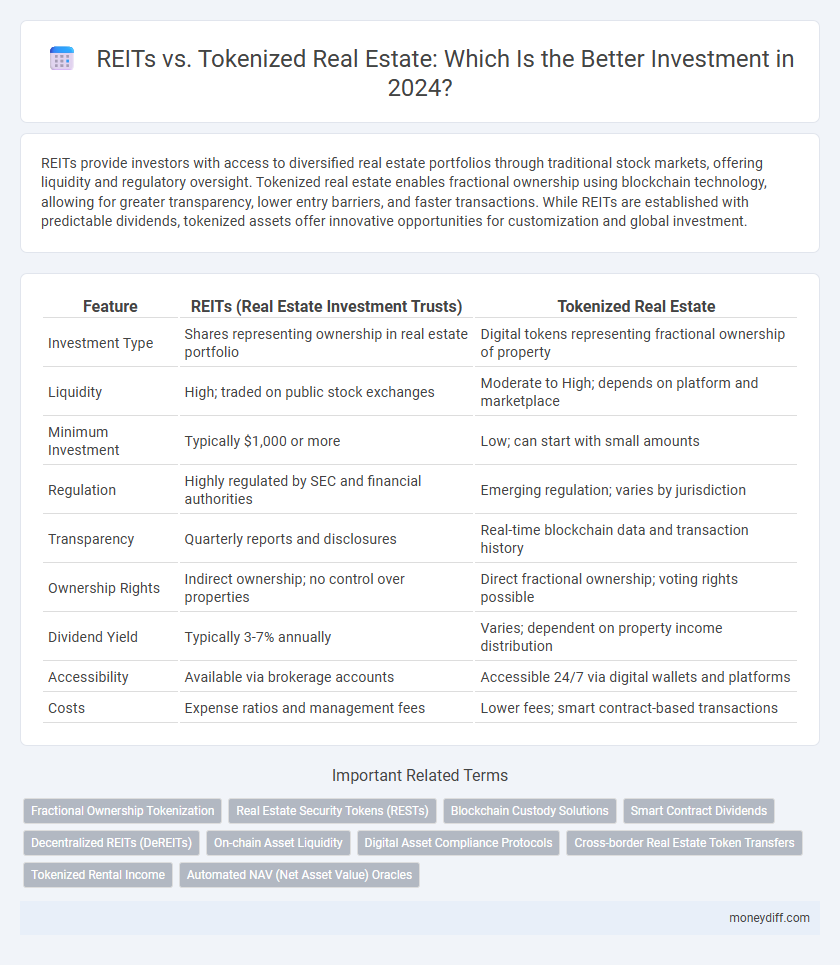

| Feature | REITs (Real Estate Investment Trusts) | Tokenized Real Estate |

|---|---|---|

| Investment Type | Shares representing ownership in real estate portfolio | Digital tokens representing fractional ownership of property |

| Liquidity | High; traded on public stock exchanges | Moderate to High; depends on platform and marketplace |

| Minimum Investment | Typically $1,000 or more | Low; can start with small amounts |

| Regulation | Highly regulated by SEC and financial authorities | Emerging regulation; varies by jurisdiction |

| Transparency | Quarterly reports and disclosures | Real-time blockchain data and transaction history |

| Ownership Rights | Indirect ownership; no control over properties | Direct fractional ownership; voting rights possible |

| Dividend Yield | Typically 3-7% annually | Varies; dependent on property income distribution |

| Accessibility | Available via brokerage accounts | Accessible 24/7 via digital wallets and platforms |

| Costs | Expense ratios and management fees | Lower fees; smart contract-based transactions |

Introduction to REITs and Tokenized Real Estate

Real Estate Investment Trusts (REITs) allow investors to buy shares in commercial real estate portfolios, providing liquidity and dividend income without direct property management. Tokenized real estate leverages blockchain technology to represent fractional ownership of properties, enabling easier access, faster transactions, and enhanced transparency. Both investment vehicles democratize real estate markets but differ in regulatory frameworks and operational structures.

How REITs Operate: A Traditional Approach

REITs, or Real Estate Investment Trusts, operate by pooling capital from multiple investors to acquire and manage income-generating properties, distributing at least 90% of taxable income as dividends. These trusts offer liquidity through public stock exchanges, enabling investors to buy and sell shares with relative ease compared to direct real estate ownership. Regulatory oversight and established market frameworks provide stability and transparency, making REITs a traditional yet reliable avenue for real estate investment.

Understanding Tokenized Real Estate: The Digital Disruptor

Tokenized real estate leverages blockchain technology to offer fractional ownership, enhancing liquidity and accessibility compared to traditional REITs. This digital disruptor enables investors to trade property shares seamlessly on digital platforms, reducing barriers such as high entry costs and lengthy transactions. By integrating smart contracts, tokenized assets provide transparent governance and real-time settlement, distinguishing them from conventional real estate investment vehicles.

Key Differences Between REITs and Tokenized Real Estate

REITs are traditional investment vehicles that pool investor capital to own and manage income-generating real estate, offering liquidity through public exchanges and regulatory oversight. Tokenized real estate leverages blockchain technology to enable fractional ownership, providing increased liquidity, transparency, and accessibility with lower investment minimums. Key differences include regulatory frameworks, liquidity mechanisms, transaction speeds, and the level of investor control over individual assets.

Liquidity Comparison: REITs vs Tokenized Real Estate

REITs offer higher liquidity as they are traded on major stock exchanges, allowing investors to buy or sell shares quickly with established market prices. Tokenized real estate, while gaining traction, typically operates on blockchain platforms with varying liquidity depending on the marketplace and regulatory environment. The decentralized nature of tokenized assets can enable fractional ownership but often faces challenges in achieving the consistent liquidity levels found in traditional REIT markets.

Accessibility and Entry Barriers for Investors

REITs offer broad accessibility with low minimum investment thresholds, enabling individual investors to enter the real estate market without significant capital. Tokenized real estate leverages blockchain technology to further reduce entry barriers by allowing fractional ownership and 24/7 trading on digital platforms. This increased accessibility empowers a wider range of investors to participate in real estate investment with enhanced liquidity and transparency.

Regulatory Frameworks and Compliance Issues

REITs operate within established regulatory frameworks such as the Securities Act of 1933 and the Investment Company Act of 1940, ensuring investor protection and standardized compliance requirements. Tokenized real estate investments face evolving regulatory landscapes, with jurisdictions varying in their treatment of digital securities and challenges related to Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance. The clear, tested regulatory oversight of REITs contrasts with the nascent and often fragmented compliance protocols governing tokenized assets, affecting transparency and legal certainty for investors.

Potential Returns and Risk Factors

REITs offer stable income through dividends and exposure to diversified property portfolios but are subject to market volatility and regulatory risks. Tokenized real estate provides higher liquidity, fractional ownership, and potentially greater capital appreciation, yet faces challenges such as limited regulation, platform security risks, and market adoption uncertainty. Investors should weigh the predictable cash flow and regulatory oversight of REITs against the innovative, but nascent, nature and speculative potential of tokenized real estate investments.

Tax Implications for Investors

REITs offer investors favorable tax treatment with dividends typically taxed as ordinary income, while tokenized real estate investments may involve complex tax reporting due to their classification as digital assets. Investors in tokenized real estate face potential capital gains taxes upon sale and must navigate regulations that vary by jurisdiction, impacting tax efficiency. Understanding the tax implications specific to each vehicle is crucial to optimizing after-tax returns and compliance.

Which Is Right for You: Choosing Between REITs and Tokenized Real Estate

REITs offer liquidity and diversification through traditional stock exchanges, making them suitable for investors seeking regulated, passive real estate exposure. Tokenized real estate provides fractional ownership on blockchain platforms with lower entry barriers, enhanced transparency, and potential for global access. Assess your risk tolerance, investment horizon, and comfort with digital assets to determine which aligns best with your financial goals.

Related Important Terms

Fractional Ownership Tokenization

Fractional ownership through tokenized real estate enables investors to buy and trade digital shares of property assets with increased liquidity and lower entry costs compared to traditional REITs, which often have higher fees and less transparency. Tokenization leverages blockchain technology to provide real-time verification, reduced transaction times, and a global investor base, enhancing portfolio diversification and accessibility in real estate investment.

Real Estate Security Tokens (RESTs)

Real Estate Security Tokens (RESTs) offer fractional ownership, increased liquidity, and transparent blockchain-based transactions compared to traditional REITs, which often suffer from limited trading hours and regulatory constraints. RESTs enable investors to access global real estate markets with lower entry barriers and real-time settlement, revolutionizing portfolio diversification and risk management strategies.

Blockchain Custody Solutions

REITs traditionally rely on centralized custody methods involving banks and trust companies, whereas tokenized real estate leverages blockchain custody solutions that enhance security and transparency through decentralized ledger technology. Blockchain custody enables real-time asset tracking and seamless cross-border transactions, reducing counterparty risk and operational inefficiencies common in conventional REIT investments.

Smart Contract Dividends

REITs offer traditional dividend payouts regulated by statutory frameworks, while tokenized real estate leverages smart contracts to automate and expedite dividend distributions directly to investors' digital wallets. Smart contract dividends enhance transparency and reduce intermediaries, enabling real-time, programmable payouts that align with blockchain technology advantages in investment efficiency.

Decentralized REITs (DeREITs)

Decentralized REITs (DeREITs) leverage blockchain technology to provide fractional ownership in real estate assets, enhancing transparency, liquidity, and accessibility compared to traditional REITs. By eliminating intermediaries and enabling smart contracts, DeREITs offer investors real-time dividend distribution and lower entry barriers, transforming real estate investment with increased efficiency and reduced costs.

On-chain Asset Liquidity

REITs offer traditional real estate investment with limited liquidity, often requiring days to weeks for asset liquidation, while tokenized real estate leverages blockchain technology to enable near-instant on-chain asset liquidity and fractional ownership transfers. This enhanced liquidity in tokenized assets can attract investors seeking faster, more flexible entry and exit opportunities in the real estate market.

Digital Asset Compliance Protocols

REITs operate under traditional regulatory frameworks governed by securities laws, ensuring compliance through established financial audits and reporting standards, whereas tokenized real estate leverages blockchain technology with smart contracts that enforce Digital Asset Compliance Protocols such as KYC, AML, and regulatory token standards like ERC-1400. This digital compliance infrastructure enhances transparency, automated regulatory adherence, and fractional ownership accessibility compared to conventional REIT structures.

Cross-border Real Estate Token Transfers

Cross-border real estate token transfers enable seamless, transparent investment in global properties by leveraging blockchain technology, reducing traditional barriers such as regulatory complexities and transaction costs that often hinder REITs. Tokenized real estate offers fractional ownership with enhanced liquidity and faster settlement, outperforming conventional REIT structures in international market accessibility.

Tokenized Rental Income

Tokenized real estate offers investors direct fractional ownership of rental income streams through blockchain technology, enabling transparent, real-time revenue distribution and increased liquidity compared to traditional REITs. This decentralized model reduces intermediaries and enhances accessibility, allowing investors to participate in rental markets globally with lower entry barriers and faster transaction settlements.

Automated NAV (Net Asset Value) Oracles

Automated NAV Oracles in tokenized real estate offer real-time, transparent asset valuation compared to traditional REITs that rely on periodic manual appraisals, enhancing liquidity and investor confidence. This technology leverages blockchain to provide continuous, accurate net asset value updates, enabling more efficient portfolio management and faster decision-making in digital real estate investments.

REITs vs Tokenized Real Estate for investment. Infographic

moneydiff.com

moneydiff.com