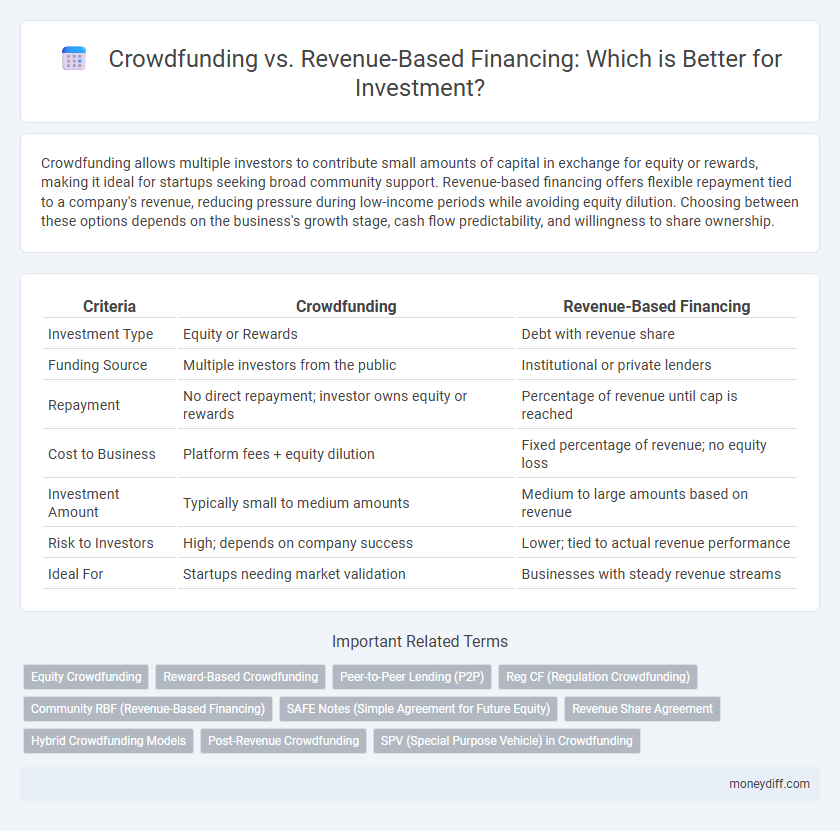

Crowdfunding allows multiple investors to contribute small amounts of capital in exchange for equity or rewards, making it ideal for startups seeking broad community support. Revenue-based financing offers flexible repayment tied to a company's revenue, reducing pressure during low-income periods while avoiding equity dilution. Choosing between these options depends on the business's growth stage, cash flow predictability, and willingness to share ownership.

Table of Comparison

| Criteria | Crowdfunding | Revenue-Based Financing |

|---|---|---|

| Investment Type | Equity or Rewards | Debt with revenue share |

| Funding Source | Multiple investors from the public | Institutional or private lenders |

| Repayment | No direct repayment; investor owns equity or rewards | Percentage of revenue until cap is reached |

| Cost to Business | Platform fees + equity dilution | Fixed percentage of revenue; no equity loss |

| Investment Amount | Typically small to medium amounts | Medium to large amounts based on revenue |

| Risk to Investors | High; depends on company success | Lower; tied to actual revenue performance |

| Ideal For | Startups needing market validation | Businesses with steady revenue streams |

Understanding Crowdfunding: Definition and Types

Crowdfunding is a method of raising capital through small contributions from a large number of people, typically via online platforms such as Kickstarter, Indiegogo, and GoFundMe. The primary types of crowdfunding include reward-based, equity-based, and donation-based models, each offering different incentives ranging from products and shares to charitable support. Understanding these variations helps investors and entrepreneurs choose the best approach for financing projects or business ventures by aligning goals with the appropriate crowdfunding structure.

What is Revenue-Based Financing?

Revenue-Based Financing (RBF) is an investment model where businesses receive capital in exchange for a fixed percentage of their future gross revenues until a predetermined repayment amount is reached. Unlike equity crowdfunding, RBF does not require giving up ownership or control, making it an attractive option for founders seeking flexible repayment tied directly to sales performance. This financing method aligns investor returns with business growth, reducing risk during periods of fluctuating revenue.

Key Differences Between Crowdfunding and Revenue-Based Financing

Crowdfunding involves raising capital from a large pool of individual investors, typically in exchange for equity or rewards, while revenue-based financing provides funds from investors repaid through a percentage of the company's future revenues. Crowdfunding offers access to a broad audience and can serve as a marketing tool, whereas revenue-based financing aligns investor returns with actual business performance without diluting ownership. Key differences include funding source diversity, repayment structures, and impact on equity, making each option suitable for different investment strategies and business needs.

Pros and Cons of Crowdfunding for Investors

Crowdfunding offers investors the advantage of diversified, low-entry investments in innovative startups, enhancing portfolio variety and potential high returns from early-stage ventures. However, crowdfunding carries risks such as limited liquidity, minimal regulatory oversight, and a higher chance of project failure, which can lead to complete loss of invested capital. Investors should weigh these factors against their risk tolerance and the potential for community engagement and direct support to entrepreneurs.

Advantages and Risks of Revenue-Based Financing

Revenue-Based Financing offers startups flexible repayment tied to actual revenue, reducing the pressure of fixed debt obligations and preserving equity for founders. Investors benefit from potential high returns linked directly to company performance, but the model carries risks such as fluctuating revenue affecting repayment schedules and the potential for prolonged financing duration if growth slows. This approach is advantageous for businesses with steady, predictable income streams but may pose challenges in volatile markets or industries with irregular cash flow.

Investor Eligibility and Participation Requirements

Crowdfunding typically allows a broad range of investors, including non-accredited individuals, enabling widespread participation with minimal financial thresholds. Revenue-based financing restricts investors often to accredited individuals or entities, requiring a higher minimum investment and a focus on consistent startup revenue streams. Both methods demand due diligence, but crowdfunding emphasizes inclusivity while revenue-based financing prioritizes investor qualification and ongoing revenue sharing.

Expected Returns: Crowdfunding vs Revenue-Based Financing

Expected returns in crowdfunding typically vary widely depending on project success and investor stake, often offering equity shares or rewards, while revenue-based financing provides more predictable returns tied directly to a fixed percentage of revenue until a predetermined cap is reached. Crowdfunding investors may face higher risk due to project failure or delayed returns, whereas revenue-based financing reduces risk by aligning returns with the company's cash flow performance. Understanding the trade-offs between variable equity upside in crowdfunding and steady income streams in revenue-based financing is crucial for investment decision-making.

Risk Mitigation Strategies for Both Models

Crowdfunding allows investors to diversify risk across multiple projects by pooling small contributions, reducing individual exposure, while revenue-based financing ties repayments directly to company earnings, aligning investor returns with business performance and mitigating default risk. Structured agreements and transparent financial reporting are key risk mitigation strategies in revenue-based financing, ensuring investors monitor cash flow before returns are disbursed. Both models benefit from thorough due diligence and diversification to minimize potential losses and enhance investment security.

Suitability for Different Business Types

Crowdfunding is ideal for startups and consumer-focused businesses seeking early-stage capital and market validation through a broad investor base. Revenue-based financing suits established companies with consistent cash flow looking to raise growth capital without diluting equity or taking on debt. Choosing between these options depends on the business's stage, revenue predictability, and willingness to share ownership or repay through revenue streams.

Making the Right Choice: Factors to Consider Before Investing

Assessing crowdfunding and revenue-based financing involves evaluating risk tolerance, expected returns, and control over investment. Crowdfunding offers diversification with potential high returns but often lacks guaranteed income, while revenue-based financing provides steady repayments tied to company revenue without equity dilution. Investors must consider business stage, cash flow predictability, and exit strategy to make an informed decision aligning with financial goals.

Related Important Terms

Equity Crowdfunding

Equity crowdfunding allows investors to obtain ownership stakes in startups, providing potential for long-term capital gains and influence on company decisions, unlike revenue-based financing which offers fixed returns linked to company revenue without equity dilution. Startups utilizing equity crowdfunding can access a broad investor base, accelerating capital inflow while aligning investor interests with business growth and increasing market visibility.

Reward-Based Crowdfunding

Reward-based crowdfunding allows investors to receive non-monetary rewards such as products or services in exchange for their financial contributions, fostering customer loyalty and market validation without diluting equity. Unlike revenue-based financing, this model does not require repayment from future revenue, reducing financial risk for founders while leveraging community support to accelerate product development.

Peer-to-Peer Lending (P2P)

Peer-to-peer (P2P) lending in crowdfunding enables investors to directly fund businesses in exchange for future revenue shares, offering a flexible alternative to traditional equity or debt financing. Revenue-based financing through P2P platforms structures repayments as a percentage of the company's revenue, aligning investor returns with business performance and mitigating fixed repayment risks.

Reg CF (Regulation Crowdfunding)

Regulation Crowdfunding (Reg CF) enables investors to fund startups through equity stakes, offering potential ownership and long-term returns, while revenue-based financing provides capital through flexible repayments tied to a percentage of company revenue without relinquishing equity. Crowdfunding under Reg CF democratizes investment access with SEC oversight and limits individual investments, whereas revenue-based financing appeals to businesses seeking non-dilutive funding with predictable repayment structures based on sales performance.

Community RBF (Revenue-Based Financing)

Community Revenue-Based Financing (RBF) offers investors a flexible alternative to traditional crowdfunding by linking returns directly to a company's revenue performance, creating aligned interests between entrepreneurs and backers. Unlike equity crowdfunding, Community RBF avoids ownership dilution and provides predictable cash flow through agreed-upon revenue share percentages, making it an attractive option for startups seeking sustainable growth capital.

SAFE Notes (Simple Agreement for Future Equity)

SAFE Notes offer investors equity in startups without immediate valuation, making them more flexible than traditional crowdfunding where investors often receive rewards or pre-sales rather than equity. Revenue-Based Financing allows founders to repay investors through a percentage of future revenues, but SAFE Notes provide potential for higher returns through equity conversion upon funding events, appealing to both startups and investors looking for future ownership stakes.

Revenue Share Agreement

Revenue Share Agreements (RSAs) offer investors a fixed percentage of future revenues until a predetermined amount is repaid, providing flexible returns aligned with the business's cash flow. Unlike crowdfunding, which pools many small investors often without repayment guarantees, RSAs ensure investors a direct stake in company performance without equity dilution.

Hybrid Crowdfunding Models

Hybrid crowdfunding models blend equity crowdfunding and revenue-based financing, offering investors a share of future revenues along with potential equity stakes, optimizing return on investment and risk distribution. These models leverage the scalability of crowdfunding platforms while providing startups with flexible capital that aligns repayment with business performance.

Post-Revenue Crowdfunding

Post-revenue crowdfunding enables businesses with proven sales to attract a broad investor base by offering equity stakes, contrasting with revenue-based financing where investors receive a percentage of future revenues without equity dilution. This method provides scalability through community engagement while maintaining financial flexibility, making it ideal for companies seeking to leverage customer loyalty alongside capital growth.

SPV (Special Purpose Vehicle) in Crowdfunding

Crowdfunding using Special Purpose Vehicles (SPVs) streamlines investor participation by pooling funds into a separate legal entity, enhancing risk management and simplifying compliance compared to direct investment models like revenue-based financing. SPVs in crowdfunding offer structured equity ownership and improved transparency, making them a preferred option for startups seeking scalable capital while protecting individual investors.

Crowdfunding vs Revenue-Based Financing for investment. Infographic

moneydiff.com

moneydiff.com