Gold remains a timeless investment asset known for its intrinsic value and physical security, while digital gold offers greater liquidity and ease of transaction through online platforms. Investors seeking diversification benefit from combining both, leveraging gold's stability and digital gold's accessibility. Market volatility and evolving technology continue to shape the dynamics between traditional gold and digital gold investments.

Table of Comparison

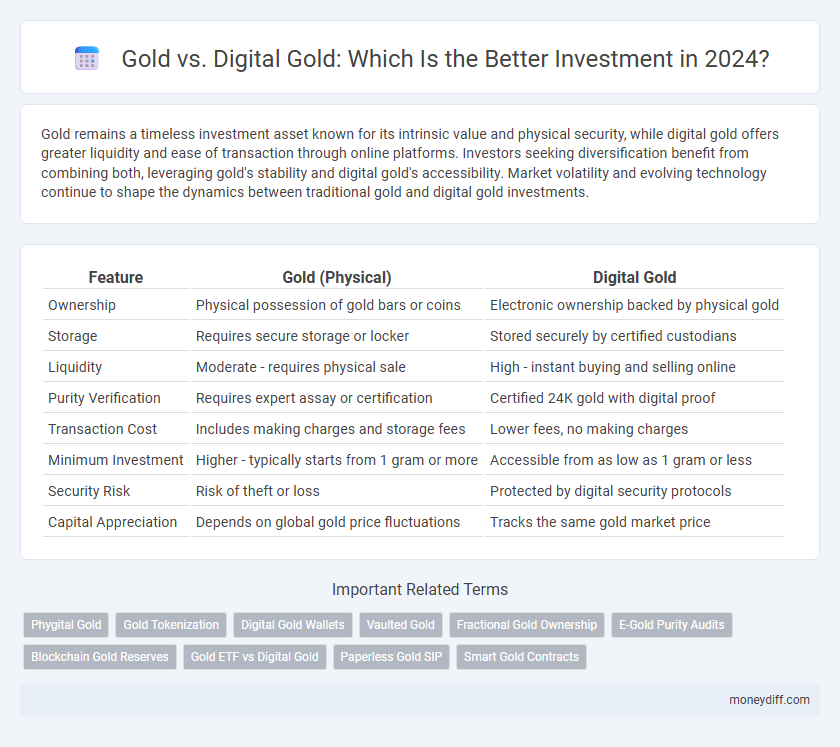

| Feature | Gold (Physical) | Digital Gold |

|---|---|---|

| Ownership | Physical possession of gold bars or coins | Electronic ownership backed by physical gold |

| Storage | Requires secure storage or locker | Stored securely by certified custodians |

| Liquidity | Moderate - requires physical sale | High - instant buying and selling online |

| Purity Verification | Requires expert assay or certification | Certified 24K gold with digital proof |

| Transaction Cost | Includes making charges and storage fees | Lower fees, no making charges |

| Minimum Investment | Higher - typically starts from 1 gram or more | Accessible from as low as 1 gram or less |

| Security Risk | Risk of theft or loss | Protected by digital security protocols |

| Capital Appreciation | Depends on global gold price fluctuations | Tracks the same gold market price |

Understanding Gold vs Digital Gold: An Overview

Gold investment offers tangible asset ownership with intrinsic value, while digital gold provides a convenient, secure way to buy and sell gold electronically without physical storage concerns. Physical gold requires storage and insurance costs, whereas digital gold platforms ensure real-time price updates and liquidity, making it easier for small investors to enter the market. Both forms correlate closely with global gold prices, but digital gold enhances accessibility and transaction efficiency through technology-driven solutions.

Key Differences Between Physical Gold and Digital Gold

Physical gold offers tangible ownership, requiring secure storage and incurring higher transaction costs, whereas digital gold provides ease of access through online platforms with lower entry barriers and minimal storage concerns. Unlike physical gold, digital gold investments can be bought in fractional quantities, enabling more flexible investment strategies. However, digital gold depends on the credibility of the platform and digital security, while physical gold maintains intrinsic value independent of digital systems.

Investment Security: How Safe is Your Gold?

Physical gold offers a high level of investment security due to its tangible nature and historical stability as a store of value, providing protection against inflation and economic downturns. Digital gold, while convenient and easily accessible, depends on third-party platforms and cybersecurity measures, introducing risks such as hacking and platform insolvency. Investors seeking secure gold investments should weigh the physical possession benefits against the digital ease, considering storage, insurance, and counterparty risks.

Liquidity and Ease of Transaction: Physical vs Digital Gold

Physical gold often involves higher transaction costs and longer settlement times due to storage, verification, and security measures, impacting overall liquidity. Digital gold platforms offer immediate buying and selling with minimal fees, enhancing ease of transaction and better liquidity for investors. Investors can quickly convert digital gold assets into cash, providing more flexibility compared to the physical gold market.

Storage and Insurance: Cost Factors Compared

Physical gold requires secure, insured storage solutions such as vaults or safety deposit boxes, which often entail substantial annual fees and insurance premiums based on the asset's value. Digital gold, stored electronically on platforms, eliminates physical storage costs and transfers insurance responsibilities to the provider, typically reflected in lower overall fees and increased liquidity. Investors must evaluate these ongoing cost factors against personal risk tolerance and convenience preferences to determine the optimal investment choice.

Regulatory Framework: Physical Gold vs Digital Gold

Physical gold is regulated by established frameworks involving customs duties, hallmarking standards, and secure storage requirements enforced by government authorities. Digital gold operates under emerging regulatory guidelines focused on platform licensing, transparent audits, and investor protection measures within the fintech and commodity markets. Investors must evaluate compliance standards, custodial guarantees, and legal recourse options unique to each asset type for informed decision-making.

Accessibility and Convenience for Investors

Gold offers traditional investors a tangible asset with established market liquidity but often involves higher storage and security costs. Digital gold provides enhanced accessibility through online platforms, enabling instant purchases and sales without physical handling. Investors benefit from the convenience of fractional ownership and real-time tracking, making digital gold an attractive option for those seeking flexibility and ease of transaction.

Tax Implications on Gold and Digital Gold Investments

Investing in physical gold often involves capital gains tax upon sale and potential wealth tax depending on jurisdiction, with valuation conducted through official purities and market rates. Digital gold investments, typically held through online platforms, may benefit from streamlined tax reporting and lower transaction costs, but are subject to digital asset tax regulations, which vary widely by country. Both forms require careful consideration of tax treatment on gains, holding periods, and potential socio-economic tax incentives to optimize net returns.

Risks and Challenges: What Investors Should Know

Investing in physical gold involves risks like storage theft, insurance costs, and market liquidity constraints, whereas digital gold carries cybersecurity threats, counterparty risks, and regulatory uncertainties. Physical gold's price volatility may be less influenced by digital platform failures compared to digital gold, which depends heavily on the integrity of online transaction systems. Understanding the contrasting risk profiles is crucial for investors seeking to balance traditional asset security against modern technological vulnerabilities.

Future Outlook: The Evolution of Gold Investment

Gold investment continues to evolve with digital gold platforms offering increased accessibility, fractional ownership, and ease of transaction compared to traditional physical gold. Digital gold leverages blockchain technology to provide enhanced transparency, security, and instantaneous settlement, appealing to tech-savvy investors seeking diversification. Market trends indicate growing institutional interest and regulatory frameworks supporting digital gold, suggesting a robust future compared to the conventional gold market dominated by physical assets and bullion trading.

Related Important Terms

Phygital Gold

Phygital gold combines the tangible security of physical gold with the convenience and liquidity of digital gold, allowing investors to own verified, allocated gold stored in secure vaults while trading seamlessly on digital platforms. This hybrid investment offers enhanced transparency, ease of transaction, and reduced risks compared to traditional physical gold, making it an attractive option for modern portfolios seeking asset diversification.

Gold Tokenization

Gold tokenization transforms physical gold into digital tokens on blockchain, enabling fractional ownership, enhanced liquidity, and easier transferability compared to traditional gold investments. This innovation combines gold's intrinsic value with the speed and accessibility of digital assets, attracting modern investors seeking both security and convenience.

Digital Gold Wallets

Digital gold wallets provide a secure and convenient way to invest in gold without physical storage concerns, allowing instant liquidity and fractional ownership through blockchain technology. Unlike traditional gold, digital gold offers enhanced transparency, lower transaction costs, and easy accessibility via smartphone apps, making it an efficient tool for modern portfolio diversification.

Vaulted Gold

Vaulted gold offers physical ownership and secure storage, providing investors with tangible asset protection compared to digital gold, which represents ownership via digital tokens without direct possession. Vaulted gold's audited reserves and insured vaults enhance trust and transparency, appealing to investors seeking long-term wealth preservation amid market volatility.

Fractional Gold Ownership

Fractional gold ownership in digital gold investment platforms allows investors to buy, sell, and hold precise ounces or grams, offering greater liquidity and flexibility compared to traditional physical gold. Digital gold provides real-time market pricing and secure storage without the need for physical handling, making it an efficient option for diversified investment portfolios seeking tangible asset exposure.

E-Gold Purity Audits

Gold investments maintain value through verified purity standards, with E-Gold purity audits using blockchain technology to ensure transparent, tamper-proof authentication. Digital gold platforms that incorporate rigorous purity audits provide investors with secure, real-time verification of asset authenticity, enhancing trust and liquidity in the investment process.

Blockchain Gold Reserves

Blockchain gold reserves provide transparent verification and secure ownership tracking, making digital gold an attractive alternative to traditional physical gold investment. Unlike physical gold, digital gold backed by blockchain technology allows for fractional ownership, instant transactions, and reduced storage costs, enhancing liquidity and accessibility for investors.

Gold ETF vs Digital Gold

Gold ETFs offer regulated, low-cost exposure to physical gold with easy liquidity on stock exchanges, making them a preferred choice for investors seeking transparency and convenience. Digital gold platforms allow fractional ownership with instant transactions and storage benefits, yet they often lack the regulatory oversight and security guarantees provided by Gold ETFs.

Paperless Gold SIP

Paperless Gold SIP offers a seamless, secure way to invest in gold without physical storage hassles, providing liquidity and transparency through digital platforms. Unlike traditional gold, digital gold SIPs enable fractional investments, real-time price tracking, and easy redemption, making them a flexible and cost-effective option for modern investors.

Smart Gold Contracts

Smart Gold Contracts blend blockchain technology with traditional gold investment, offering enhanced security, transparency, and instant ownership transfer compared to physical gold holdings. Digital gold backed by these smart contracts enables fractional investments, real-time liquidity, and reduced storage risks, making it a competitive alternative to conventional gold in modern portfolios.

Gold vs Digital Gold for investment Infographic

moneydiff.com

moneydiff.com