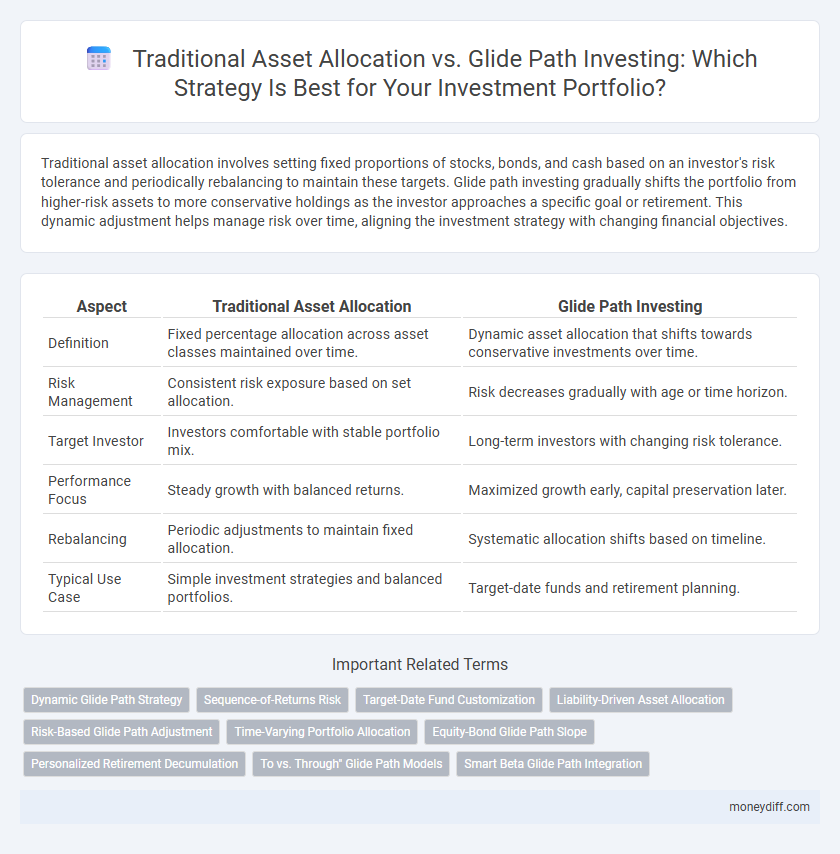

Traditional asset allocation involves setting fixed proportions of stocks, bonds, and cash based on an investor's risk tolerance and periodically rebalancing to maintain these targets. Glide path investing gradually shifts the portfolio from higher-risk assets to more conservative holdings as the investor approaches a specific goal or retirement. This dynamic adjustment helps manage risk over time, aligning the investment strategy with changing financial objectives.

Table of Comparison

| Aspect | Traditional Asset Allocation | Glide Path Investing |

|---|---|---|

| Definition | Fixed percentage allocation across asset classes maintained over time. | Dynamic asset allocation that shifts towards conservative investments over time. |

| Risk Management | Consistent risk exposure based on set allocation. | Risk decreases gradually with age or time horizon. |

| Target Investor | Investors comfortable with stable portfolio mix. | Long-term investors with changing risk tolerance. |

| Performance Focus | Steady growth with balanced returns. | Maximized growth early, capital preservation later. |

| Rebalancing | Periodic adjustments to maintain fixed allocation. | Systematic allocation shifts based on timeline. |

| Typical Use Case | Simple investment strategies and balanced portfolios. | Target-date funds and retirement planning. |

Understanding Traditional Asset Allocation

Traditional asset allocation involves dividing an investment portfolio among different asset classes such as stocks, bonds, and cash to balance risk and reward according to the investor's risk tolerance and time horizon. This strategy often relies on fixed target proportions that are periodically rebalanced to maintain the desired exposure. Understanding traditional asset allocation is crucial for investors seeking a stable, long-term approach that adjusts portfolio risk through diversification without actively adapting to changing market conditions.

What Is Glide Path Investing?

Glide path investing is a strategy that gradually adjusts the asset allocation in an investment portfolio based on the investor's age or time horizon, typically shifting from higher-risk assets like stocks to lower-risk assets such as bonds. This approach aims to reduce volatility and risk exposure as retirement or a financial goal approaches, aligning with life-cycle investing principles. Traditional asset allocation often maintains a fixed mix, while glide paths provide dynamic adjustments tailored to changing risk tolerance over time.

Key Differences Between Traditional and Glide Path Approaches

Traditional asset allocation relies on a fixed mix of equities, bonds, and cash tailored to an investor's risk tolerance, often requiring regular rebalancing to maintain target percentages. Glide path investing adjusts the portfolio allocation dynamically, gradually reducing equity exposure and increasing fixed-income holdings as the investor approaches a predetermined time horizon, such as retirement. The key difference lies in the timing and adaptability of risk management: traditional allocation remains static between rebalances, while glide path investing systematically shifts risk levels over time to align with changing financial goals.

Risk Management in Traditional Asset Allocation

Traditional Asset Allocation employs fixed percentage targets across asset classes to maintain a consistent risk profile, prioritizing diversification to mitigate market volatility. This approach regularly rebalances portfolios to realign with original risk tolerance, helping investors avoid excessive exposure to any single asset. By managing risk through stable allocation, Traditional Asset Allocation aims to protect capital while seeking steady, long-term growth.

Adaptive Risk Strategies in Glide Path Investing

Adaptive risk strategies in glide path investing dynamically adjust asset allocation based on market conditions and individual risk tolerance, contrasting with the fixed allocations typical of traditional asset allocation. This approach aims to optimize returns while mitigating downside risk by gradually shifting from equities to bonds as the investor approaches retirement. Emphasizing flexibility and responsiveness, adaptive glide paths seek to enhance portfolio resilience amid evolving financial landscapes.

Investment Time Horizon: Impact on Both Methods

Traditional asset allocation adjusts portfolio risk based on fixed percentage targets for stocks, bonds, and cash, often rebalanced periodically regardless of investment time horizon. Glide path investing dynamically reduces equity exposure as the investor approaches retirement, aligning risk reduction with the decreasing investment time horizon to preserve capital. Time horizon directly influences glide path strategies by dictating the pace of asset shifts, while traditional allocation may not fully account for changing risk tolerance over time.

Portfolio Rebalancing: Static vs Dynamic

Traditional asset allocation employs a static portfolio rebalancing approach, maintaining fixed proportions of stocks, bonds, and cash over time to preserve the desired risk level. Glide path investing uses dynamic rebalancing, gradually shifting asset weights from higher-risk equities to lower-risk bonds as the investor approaches a target date, typically retirement. This dynamic adjustment optimizes risk management by reducing exposure to market volatility and aligning investments with changing time horizons.

Suitability for Different Investor Profiles

Traditional asset allocation suits investors seeking consistent risk exposure by maintaining fixed percentages in stocks, bonds, and cash, making it ideal for those with stable investment horizons and risk tolerance. Glide path investing aligns better with lifecycle investors, shifting asset allocations from higher risk equities to lower risk bonds as retirement approaches, appealing to individuals prioritizing gradual risk reduction over time. Understanding each approach's alignment with investor goals, timelines, and risk profiles ensures optimal portfolio management tailored to individual financial needs.

Performance Comparison: Traditional Allocation vs Glide Path

Traditional asset allocation typically maintains fixed proportions of equities, bonds, and cash, providing steady risk exposure and consistent returns over time. Glide path investing gradually shifts the portfolio from higher-risk assets to safer investments as the target date approaches, aiming to reduce volatility and preserve capital near retirement. Performance comparisons reveal that glide path strategies often deliver more favorable risk-adjusted returns for target-date investors, while traditional allocation may outperform during stable market conditions due to its consistent exposure to growth assets.

Choosing the Right Approach for Your Financial Goals

Traditional asset allocation relies on a fixed mix of stocks, bonds, and cash tailored to an investor's risk tolerance and time horizon, maintaining consistent exposure across market cycles. Glide path investing gradually shifts the portfolio allocation from higher-risk equities to lower-risk fixed income as the investor approaches a target date, reducing volatility and preserving capital. Selecting the right approach depends on your financial goals, risk tolerance, and investment timeframe, ensuring alignment with retirement planning or wealth accumulation strategies.

Related Important Terms

Dynamic Glide Path Strategy

Dynamic Glide Path strategy adjusts asset allocation based on market conditions and individual risk tolerance, enhancing potential returns while managing downside risk more effectively than traditional static asset allocation. This approach dynamically shifts investments from equities to safer assets like bonds as retirement nears, optimizing growth and capital preservation through tailored risk exposure.

Sequence-of-Returns Risk

Traditional asset allocation relies on maintaining a fixed portfolio mix, potentially exposing investors to significant sequence-of-returns risk during market downturns early in retirement. Glide path investing gradually reduces exposure to volatile assets over time, effectively mitigating sequence-of-returns risk by adjusting allocation based on the investor's time horizon and withdrawal needs.

Target-Date Fund Customization

Traditional asset allocation maintains fixed percentages of stocks, bonds, and cash, offering stability but limited flexibility for individual risk tolerance. Glide path investing customizes the target-date fund by gradually shifting asset allocation toward conservative investments as the target retirement date approaches, optimizing growth potential and risk reduction tailored to the investor's timeline.

Liability-Driven Asset Allocation

Liability-Driven Asset Allocation (LDLA) prioritizes aligning investment portfolios with future liabilities, reducing risk by focusing on cash flow matching and duration targeting, contrasting with Traditional Asset Allocation's static risk-return balance. Glide Path Investing adjusts asset allocations dynamically as investors age, but LDLA offers more precise management of liabilities, making it ideal for pension funds and insurance companies seeking to secure long-term obligations.

Risk-Based Glide Path Adjustment

Risk-based glide path adjustment tailors asset allocation by dynamically reducing equity exposure as an investor approaches retirement, minimizing downside risk while preserving growth potential; this contrasts with traditional asset allocation, which relies on fixed target allocations regardless of changing risk tolerance or market conditions. Incorporating risk metrics into glide path strategies enhances portfolio resilience and aligns investments more closely with evolving investor needs over time.

Time-Varying Portfolio Allocation

Traditional asset allocation maintains a fixed mix of stocks, bonds, and cash based on an investor's risk tolerance, while glide path investing dynamically adjusts the proportion of these assets over time to reduce risk as the investment horizon shortens. Time-varying portfolio allocation in glide path strategies optimizes returns by increasing equity exposure during early investment phases and progressively shifting toward conservative fixed-income assets approaching retirement.

Equity-Bond Glide Path Slope

Equity-bond glide path investing adjusts the asset allocation by gradually shifting exposure from equities to bonds as the investor approaches a target date, optimizing risk reduction through a smoother slope in the glide path. Traditional asset allocation often maintains static or less dynamic equity-bond ratios, which may increase volatility and reduce adaptability to changing market conditions over time.

Personalized Retirement Decumulation

Traditional asset allocation relies on fixed investment proportions tailored to investors' risk tolerance and time horizon, while glide path investing gradually adjusts asset mixes based on age or proximity to retirement. Personalized retirement decumulation strategies leverage glide paths to optimize withdrawal rates and reduce sequence of returns risk, enhancing long-term portfolio sustainability.

To vs. Through" Glide Path Models

Traditional asset allocation typically involves maintaining fixed investment proportions To a target allocation based on risk tolerance, while Glide Path investing gradually shifts asset allocation Through different stages of an investor's life to reduce risk and optimize returns over time. To Glide Path models adjust allocations abruptly at predetermined points, whereas Through Glide Path models provide a continuous, dynamic adjustment aligned with evolving financial goals and market conditions.

Smart Beta Glide Path Integration

Smart Beta Glide Path Integration combines the disciplined risk-adjusted approach of traditional asset allocation with dynamic factor-based strategies, optimizing portfolio returns by gradually shifting investment exposure from high-volatility equities to lower-risk fixed income assets as the target date approaches. This integration enhances diversification and risk management by systematically adjusting factor exposures, such as value, momentum, and quality, to align with evolving investor goals and market conditions.

Traditional Asset Allocation vs Glide Path Investing for investment. Infographic

moneydiff.com

moneydiff.com