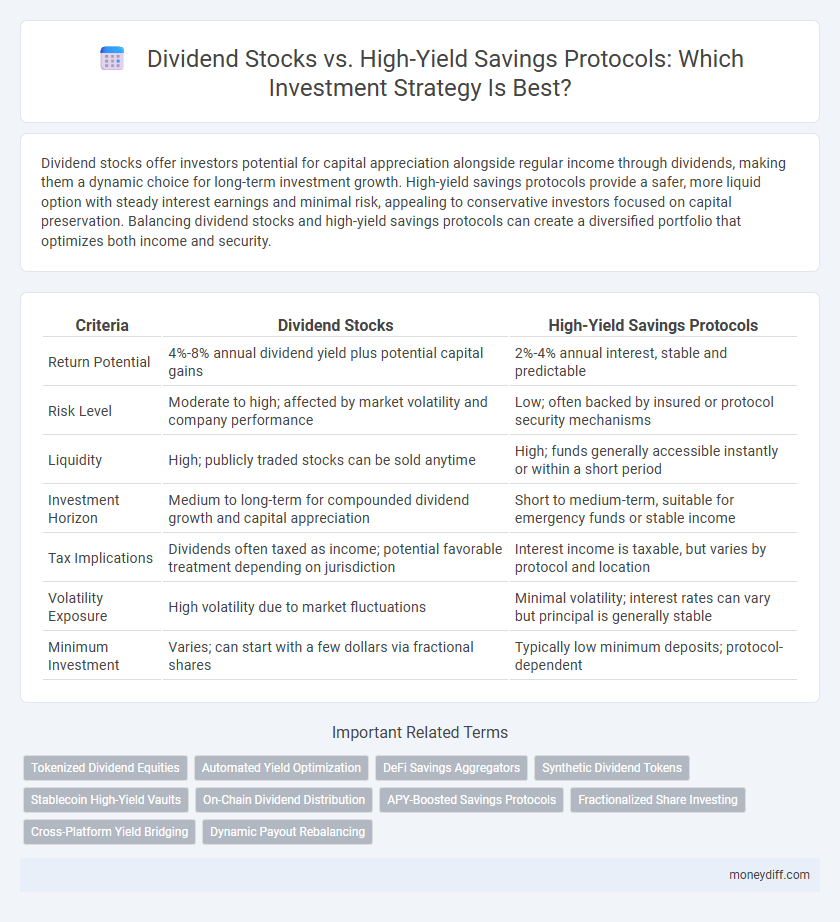

Dividend stocks offer investors potential for capital appreciation alongside regular income through dividends, making them a dynamic choice for long-term investment growth. High-yield savings protocols provide a safer, more liquid option with steady interest earnings and minimal risk, appealing to conservative investors focused on capital preservation. Balancing dividend stocks and high-yield savings protocols can create a diversified portfolio that optimizes both income and security.

Table of Comparison

| Criteria | Dividend Stocks | High-Yield Savings Protocols |

|---|---|---|

| Return Potential | 4%-8% annual dividend yield plus potential capital gains | 2%-4% annual interest, stable and predictable |

| Risk Level | Moderate to high; affected by market volatility and company performance | Low; often backed by insured or protocol security mechanisms |

| Liquidity | High; publicly traded stocks can be sold anytime | High; funds generally accessible instantly or within a short period |

| Investment Horizon | Medium to long-term for compounded dividend growth and capital appreciation | Short to medium-term, suitable for emergency funds or stable income |

| Tax Implications | Dividends often taxed as income; potential favorable treatment depending on jurisdiction | Interest income is taxable, but varies by protocol and location |

| Volatility Exposure | High volatility due to market fluctuations | Minimal volatility; interest rates can vary but principal is generally stable |

| Minimum Investment | Varies; can start with a few dollars via fractional shares | Typically low minimum deposits; protocol-dependent |

Introduction to Dividend Stocks and High-Yield Savings Protocols

Dividend stocks provide investors with regular income through company profit distributions, offering potential for capital appreciation alongside dividend payouts. High-yield savings protocols, often found in decentralized finance (DeFi), enable users to earn competitive interest rates by depositing assets into liquidity pools or staking mechanisms. Comparing these options involves analyzing risk tolerance, liquidity needs, and expected return rates in traditional versus digital finance environments.

Understanding Dividend Stocks: How They Work

Dividend stocks represent shares in companies that distribute a portion of their earnings to shareholders, typically on a quarterly basis, providing a steady income stream. These stocks are often issued by well-established firms with consistent profitability, making them attractive for long-term investment focused on income generation. Understanding dividend yield, payout ratio, and the company's financial health is crucial for evaluating the potential return and risk of dividend stock investments.

High-Yield Savings Protocols Explained

High-yield savings protocols offer investors a secure way to earn compounded interest with minimal risk, leveraging decentralized finance (DeFi) platforms that provide higher interest rates than traditional savings accounts. These protocols use automated smart contracts to allocate funds efficiently, optimizing yield through lending, staking, or liquidity mining across blockchain networks. Compared to dividend stocks, high-yield savings protocols provide more liquidity and lower volatility, making them a popular choice for risk-averse investors seeking steady returns.

Risk and Return Comparison: Dividend Stocks vs Savings Protocols

Dividend stocks typically offer higher potential returns through capital appreciation and regular dividend payouts but come with increased market volatility and company-specific risks. High-yield savings protocols provide lower, more stable returns backed by interest rates or algorithmic yield strategies, minimizing principal risk but limiting growth potential. Investors should weigh the trade-off between dividend stocks' fluctuating income and capital risk against the predictable but modest returns of savings protocols.

Liquidity and Accessibility in Both Investment Options

Dividend stocks offer moderate liquidity with shares typically tradable on stock exchanges during market hours, allowing investors relatively quick access to funds. High-yield savings protocols provide superior liquidity and accessibility as funds can often be withdrawn anytime without penalties, supported by digital platforms enabling instant transfers. Investors prioritizing immediate access and ease of transactions may prefer high-yield savings protocols, while those willing to tolerate market hours for potential capital gains might favor dividend stocks.

Income Generation: Predictability and Growth Potential

Dividend stocks offer consistent income with the potential for dividend growth driven by company earnings and market performance, providing investors with both predictability and capital appreciation. High-yield savings protocols deliver stable, fixed interest rates that ensure predictable income streams, but typically lack the growth potential associated with equities. Evaluating income generation requires balancing the stability of savings protocols against the dynamic, potentially higher returns from dividend stock investments.

Tax Implications: Dividends vs Savings Interest

Dividend stocks often generate qualified dividends taxed at favorable capital gains rates, which can be lower than ordinary income tax rates applied to interest earnings from high-yield savings protocols. Savings interest is typically taxed as ordinary income, increasing the tax burden for investors in higher tax brackets compared to dividend income. Understanding these tax implications is crucial for optimizing after-tax returns in dividend stocks versus interest from savings accounts.

Long-Term Wealth Building Strategies

Dividend stocks offer potential for capital appreciation and a steady income stream through regular dividend payments, making them a powerful tool for long-term wealth accumulation. High-yield savings protocols provide stable, low-risk returns with higher interest rates than traditional savings accounts, enhancing liquidity and capital preservation. Combining dividend stock investments with high-yield savings strategies diversifies risk and balances growth potential and financial security in a long-term portfolio.

Suitability for Different Investor Profiles

Dividend stocks offer potential for capital appreciation and steady income, appealing to investors seeking long-term growth with moderate risk tolerance. High-yield savings protocols provide lower but stable returns, ideal for conservative investors prioritizing liquidity and capital preservation. The choice depends on risk appetite, investment horizon, and income needs, with dividend stocks favored by growth-oriented investors and high-yield savings suited for income-focused savers.

Final Thoughts: Choosing the Right Investment Path

Dividend stocks offer potential capital appreciation and a steady income stream through regular payouts, appealing to investors seeking long-term growth and market exposure. High-yield savings protocols provide lower risk and liquidity with predictable interest earnings, fitting those prioritizing capital preservation and quick access to funds. Selecting the optimal investment path depends on individual risk tolerance, income needs, and financial goals, balancing growth opportunities against security and flexibility.

Related Important Terms

Tokenized Dividend Equities

Tokenized dividend equities offer investors fractional ownership in dividend-paying companies, combining blockchain efficiency with consistent income streams traditionally found in dividend stocks. These digital assets provide enhanced liquidity and accessibility compared to high-yield savings protocols, making them a compelling choice for diversified investment portfolios seeking both growth and cash flow.

Automated Yield Optimization

Automated yield optimization leverages algorithm-driven strategies to dynamically allocate investments between dividend stocks and high-yield savings protocols, maximizing returns based on market conditions and interest rate fluctuations. This approach enhances portfolio efficiency by continuously balancing the steady income from dividend stocks with the liquidity and competitive interest rates offered by high-yield savings accounts.

DeFi Savings Aggregators

DeFi savings aggregators offer higher yields than traditional high-yield savings accounts by leveraging decentralized finance protocols that optimize returns through automated yield farming and liquidity mining. Dividend stocks provide steady income through company payouts but lack the compounding and dynamic yield potential enabled by DeFi platforms, making aggregators a compelling option for crypto-savvy investors seeking superior passive income.

Synthetic Dividend Tokens

Synthetic Dividend Tokens offer a unique investment advantage by mimicking traditional dividend stocks while providing enhanced liquidity and programmable payout schedules through blockchain technology. Compared to high-yield savings protocols, these tokens deliver consistent passive income with lower volatility and potential for capital appreciation within decentralized finance ecosystems.

Stablecoin High-Yield Vaults

Dividend stocks offer steady income through regular payouts tied to company profits, appealing to investors seeking equity growth combined with passive earnings, whereas Stablecoin High-Yield Vaults provide decentralized finance protocols that deliver significantly higher annual percentage yields by leveraging blockchain liquidity pools and smart contracts. These vaults minimize volatility exposure compared to traditional dividend stocks and often include automated reinvestment strategies to compound returns efficiently in the stablecoin ecosystem.

On-Chain Dividend Distribution

On-chain dividend distribution leverages blockchain technology to provide transparent, automated, and real-time payouts, enhancing the efficiency of dividend stocks compared to traditional systems. High-yield savings protocols offer decentralized finance (DeFi) mechanisms that generate interest through smart contracts, but they lack the equity stake and profit-sharing benefits inherent in dividend stock investments.

APY-Boosted Savings Protocols

APY-boosted savings protocols offer competitive returns often exceeding traditional dividend stocks by leveraging decentralized finance mechanisms that compound interest frequently. These protocols provide enhanced liquidity and lower risk compared to the volatility commonly associated with dividend stock markets.

Fractionalized Share Investing

Fractionalized share investing enables investors to purchase portions of high-dividend stocks, maximizing portfolio diversification and enabling consistent income streams without large capital outlays. Compared to high-yield savings protocols, this approach offers potential capital appreciation alongside dividend income, balancing growth and stability in investment strategies.

Cross-Platform Yield Bridging

Dividend stocks offer steady income through quarterly payouts and potential capital appreciation, benefiting from long-term market growth and tax advantages. Cross-platform yield bridging enhances investment strategies by enabling seamless transfer of returns between dividend stocks and high-yield savings protocols, optimizing liquidity and maximizing overall yield.

Dynamic Payout Rebalancing

Dividend stocks offer dynamic payout rebalancing by adjusting dividend yields based on company earnings and market conditions, providing potential for income growth and capital appreciation. High-yield savings protocols, however, feature algorithm-driven interest rate adjustments that rebalance payouts to maintain competitive yields with lower risk and higher liquidity.

Dividend Stocks vs High-Yield Savings Protocols for investment. Infographic

moneydiff.com

moneydiff.com