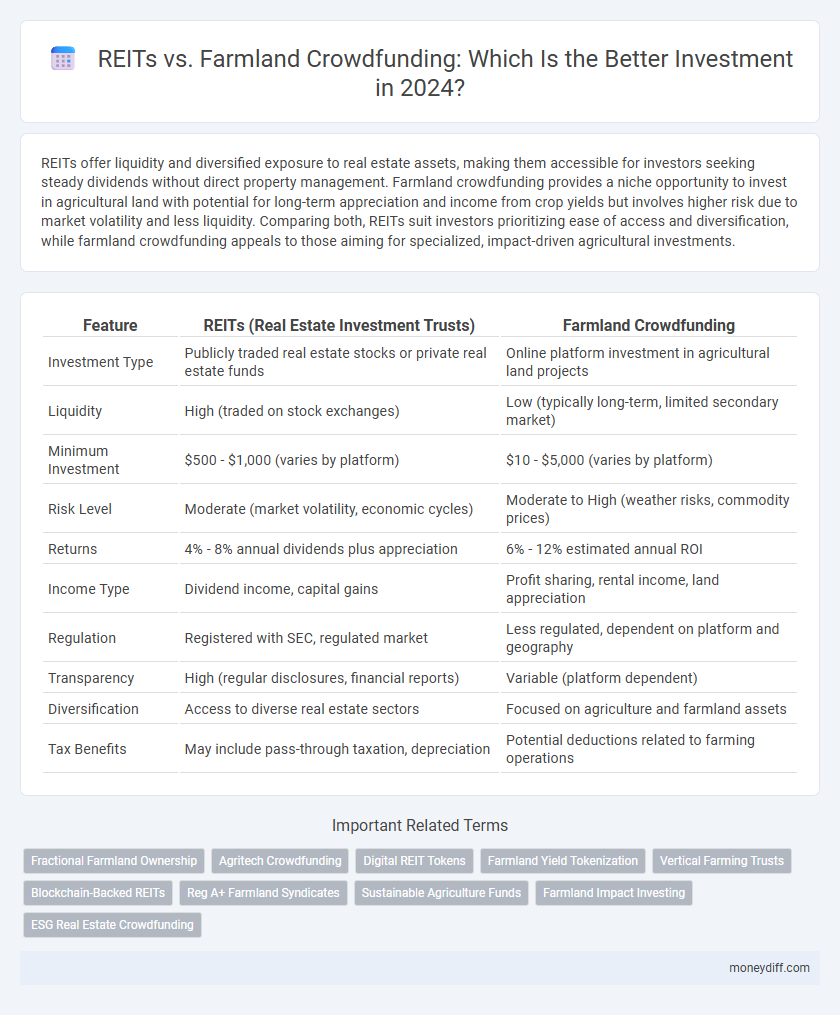

REITs offer liquidity and diversified exposure to real estate assets, making them accessible for investors seeking steady dividends without direct property management. Farmland crowdfunding provides a niche opportunity to invest in agricultural land with potential for long-term appreciation and income from crop yields but involves higher risk due to market volatility and less liquidity. Comparing both, REITs suit investors prioritizing ease of access and diversification, while farmland crowdfunding appeals to those aiming for specialized, impact-driven agricultural investments.

Table of Comparison

| Feature | REITs (Real Estate Investment Trusts) | Farmland Crowdfunding |

|---|---|---|

| Investment Type | Publicly traded real estate stocks or private real estate funds | Online platform investment in agricultural land projects |

| Liquidity | High (traded on stock exchanges) | Low (typically long-term, limited secondary market) |

| Minimum Investment | $500 - $1,000 (varies by platform) | $10 - $5,000 (varies by platform) |

| Risk Level | Moderate (market volatility, economic cycles) | Moderate to High (weather risks, commodity prices) |

| Returns | 4% - 8% annual dividends plus appreciation | 6% - 12% estimated annual ROI |

| Income Type | Dividend income, capital gains | Profit sharing, rental income, land appreciation |

| Regulation | Registered with SEC, regulated market | Less regulated, dependent on platform and geography |

| Transparency | High (regular disclosures, financial reports) | Variable (platform dependent) |

| Diversification | Access to diverse real estate sectors | Focused on agriculture and farmland assets |

| Tax Benefits | May include pass-through taxation, depreciation | Potential deductions related to farming operations |

Introduction to REITs and Farmland Crowdfunding

Real Estate Investment Trusts (REITs) offer investors a way to invest in large-scale, income-producing real estate without owning property directly, providing liquidity and diversified real estate exposure. Farmland crowdfunding platforms enable investors to pool capital to acquire agricultural land, benefiting from crop yields and land value appreciation with typically lower entry costs. Both investment options present opportunities for portfolio diversification with varying risk profiles linked to real estate market fluctuations and agricultural sector performance.

Key Differences Between REITs and Farmland Crowdfunding

REITs offer liquidity through publicly traded shares while farmland crowdfunding involves direct ownership with less liquidity but potential for higher control over assets. REITs typically invest in diversified portfolios of income-generating properties, whereas farmland crowdfunding focuses solely on agricultural real estate. Risk profiles differ as REITs are impacted by real estate market fluctuations, while farmland crowdfunding depends heavily on agricultural yields and commodity prices.

Investment Accessibility and Minimum Requirements

REITs offer high investment accessibility with relatively low minimum requirements, often allowing investors to participate with amounts as small as $500 to $1,000. Farmland crowdfunding platforms typically require higher minimum investments, ranging from $5,000 to $10,000, creating a more exclusive entry point. Both options provide opportunities for diversification, but REITs are generally more accessible to retail investors seeking lower barriers to entry.

Potential Returns: What Investors Can Expect

REITs typically offer consistent dividend yields ranging from 4% to 8%, driven by income-generating commercial properties, while farmland crowdfunding can provide higher annualized returns of 10% to 15%, fueled by crop yields and land appreciation. Investors in farmland crowdfunding may benefit from tax advantages and asset appreciation linked to agricultural productivity, though these returns carry risks related to weather and commodity prices. REITs provide more liquidity and diversification, making them suitable for those seeking stable income, whereas farmland crowdfunding appeals to investors aiming for higher long-term growth in the agriculture sector.

Risk Factors: Volatility and Stability

REITs exhibit higher volatility due to their sensitivity to stock market fluctuations and economic cycles, posing greater risk for investors seeking stable returns. Farmland crowdfunding offers comparatively lower volatility by providing steady cash flows through agricultural leases and commodity price insulation. Investors prioritizing income stability and long-term asset appreciation often favor farmland crowdfunding over the more market-reactive REITs.

Liquidity: Selling Your Investment

REITs offer high liquidity by allowing investors to buy and sell shares quickly on public exchanges, facilitating timely access to capital. Farmland crowdfunding investments are generally less liquid, as selling stakes often depends on platform-specific secondary markets or fixed holding periods. Investors prioritizing ease of exit and immediate cash conversion typically favor REITs over farmland crowdfunding options.

Income Streams and Dividend Potential

REITs typically offer more consistent income streams through regular dividend payouts derived from rental income across diversified real estate portfolios. Farmland crowdfunding investments generate income through agricultural lease payments and potential crop yield profits, which may be less predictable but can offer inflation-hedged returns. Dividend potential is generally higher and more stable with REITs due to regulatory requirements to distribute a significant portion of taxable income, whereas farmland crowdfunding income varies with commodity prices and weather-dependent crop performance.

Tax Implications for Investors

REITs offer investors the advantage of pass-through income, often taxed at ordinary income rates, with potential for depreciation deductions to offset gains. Farmland crowdfunding investments may provide favorable tax treatment through long-term capital gains and opportunities for deduction of expenses like property management costs. Understanding the tax implications of both options is crucial for maximizing after-tax returns and aligning with individual financial goals.

Diversification Benefits in Your Portfolio

REITs offer diversification through exposure to commercial real estate sectors like retail, office, and industrial properties, providing steady income with moderate liquidity. Farmland crowdfunding adds unique diversification by incorporating agricultural assets correlated less with traditional markets and offering potential inflation hedging due to rising farmland values. Combining REITs with farmland investments enhances portfolio resilience by balancing income stability and growth potential across different real asset classes.

Choosing the Right Option: REITs vs. Farmland Crowdfunding

REITs offer liquidity and diversification through publicly traded real estate assets, making them suitable for investors seeking stable income with lower entry barriers. Farmland crowdfunding provides direct exposure to agricultural land investments, often yielding higher returns but with increased risks and less liquidity. Assessing factors like investment horizon, risk tolerance, and desired asset control is essential when choosing between REITs and farmland crowdfunding platforms.

Related Important Terms

Fractional Farmland Ownership

Fractional farmland ownership through crowdfunding platforms offers investors direct exposure to agricultural assets, providing diversification and potential inflation hedging compared to REITs, which mainly invest in commercial real estate and may carry higher management fees and market volatility. This investment model allows smaller capital commitments with tangible asset backing, appealing to investors seeking more control and transparency in the agricultural sector.

Agritech Crowdfunding

Agritech crowdfunding platforms offer investors direct access to high-growth agricultural technology projects, providing more targeted exposure compared to traditional REITs, which typically focus on diversified real estate portfolios including farmland but with less operational involvement. Investing in agritech crowdfunding enhances portfolio diversification by supporting innovative sustainable farming solutions, yielding potential high returns aligned with the global rise in smart agriculture and food security demands.

Digital REIT Tokens

Digital REIT tokens offer fractional ownership in diversified real estate portfolios with enhanced liquidity and transparency compared to traditional REITs, making them accessible to a broader range of investors. Farmland crowdfunding provides direct investment in agricultural land but may involve higher operational risks and lower liquidity, positioning digital REIT tokens as a more flexible and scalable option for real estate investment.

Farmland Yield Tokenization

Farmland yield tokenization leverages blockchain technology to fractionalize ownership, offering increased liquidity and accessibility compared to traditional REITs, which often require larger capital and longer lock-in periods. By enabling direct investment in agricultural assets, farmland tokenization provides transparent yield generation linked to crop production and land appreciation, diversifying portfolios with real-world, inflation-resistant assets.

Vertical Farming Trusts

Vertical Farming Trusts within REITs offer investors diversified exposure to innovative urban agriculture with stable income potential, while farmland crowdfunding provides direct ownership stakes in agricultural land but with higher liquidity risk and operational variability. Investing in Vertical Farming Trusts leverages technological advancements in controlled environment agriculture, aligning with sustainable investment trends and long-term asset appreciation.

Blockchain-Backed REITs

Blockchain-backed REITs offer enhanced transparency, security, and liquidity through tokenization, enabling fractional ownership and real-time trading unlike traditional farmland crowdfunding. These decentralized platforms reduce intermediaries and lower entry barriers, making institutional-grade real estate investments accessible to a broader range of investors.

Reg A+ Farmland Syndicates

Reg A+ farmland syndicates offer direct equity stakes in agricultural assets with transparent valuations and regulatory oversight, providing investors access to high-growth farmland investments traditionally dominated by institutional players. Unlike REITs, which pool capital into diversified real estate portfolios with liquidity on public exchanges, Reg A+ farmland crowdfunding enables fractional ownership in specific farmland projects, aligning investor returns closely with actual farm yields and commodity cycles.

Sustainable Agriculture Funds

Sustainable agriculture funds within REITs offer diversified exposure to environmentally responsible farming operations with steady income through lease agreements and property appreciation. Farmland crowdfunding platforms provide direct investment opportunities in specific sustainable agriculture projects, enabling investors to support regenerative farming practices while benefiting from potential crop yield profits and land value growth.

Farmland Impact Investing

Farmland crowdfunding offers investors direct exposure to agricultural land, promoting sustainable farming practices and generating steady passive income through crop yields and land appreciation. Unlike REITs, farmland impact investing emphasizes environmental stewardship and social benefits, making it a compelling choice for those seeking long-term, responsible investment opportunities.

ESG Real Estate Crowdfunding

ESG real estate crowdfunding platforms offering REITs provide diversified, environmentally responsible investment options with transparent governance and steady income streams, while farmland crowdfunding emphasizes sustainable agriculture, carbon sequestration, and community impact, appealing to investors prioritizing environmental and social governance in land-based assets. Investors seeking balance between liquidity, ESG criteria, and tangible asset exposure often compare REITs' regulated market presence against farmland crowdfunding's niche focus on regenerative farming practices and local ecosystem benefits.

REITs vs Farmland Crowdfunding for investment. Infographic

moneydiff.com

moneydiff.com