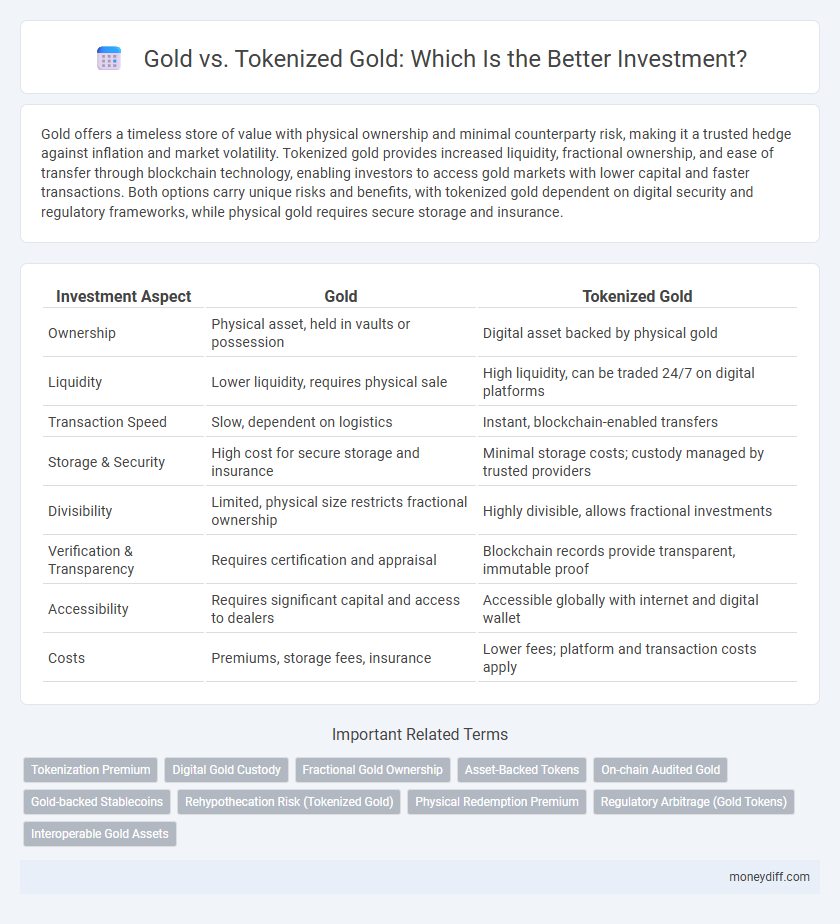

Gold offers a timeless store of value with physical ownership and minimal counterparty risk, making it a trusted hedge against inflation and market volatility. Tokenized gold provides increased liquidity, fractional ownership, and ease of transfer through blockchain technology, enabling investors to access gold markets with lower capital and faster transactions. Both options carry unique risks and benefits, with tokenized gold dependent on digital security and regulatory frameworks, while physical gold requires secure storage and insurance.

Table of Comparison

| Investment Aspect | Gold | Tokenized Gold |

|---|---|---|

| Ownership | Physical asset, held in vaults or possession | Digital asset backed by physical gold |

| Liquidity | Lower liquidity, requires physical sale | High liquidity, can be traded 24/7 on digital platforms |

| Transaction Speed | Slow, dependent on logistics | Instant, blockchain-enabled transfers |

| Storage & Security | High cost for secure storage and insurance | Minimal storage costs; custody managed by trusted providers |

| Divisibility | Limited, physical size restricts fractional ownership | Highly divisible, allows fractional investments |

| Verification & Transparency | Requires certification and appraisal | Blockchain records provide transparent, immutable proof |

| Accessibility | Requires significant capital and access to dealers | Accessible globally with internet and digital wallet |

| Costs | Premiums, storage fees, insurance | Lower fees; platform and transaction costs apply |

Understanding Gold: Traditional Investment Overview

Gold has long been regarded as a stable and tangible asset, offering investors a hedge against inflation and currency fluctuations. Traditional gold investment involves purchasing physical gold bars, coins, or jewelry, which require secure storage and insurance. The intrinsic value of gold lies in its rarity, durability, and universal demand, making it a reliable store of wealth over time.

What is Tokenized Gold? A Modern Approach

Tokenized gold represents ownership of physical gold through digital tokens secured on a blockchain, allowing investors to buy, sell, and trade gold assets efficiently and transparently. Unlike traditional gold investment, tokenized gold offers fractional ownership, instant liquidity, and reduced transaction costs, making it accessible to a broader range of investors. This innovative approach combines the value stability of gold with the convenience and security of blockchain technology.

Liquidity Comparison: Physical Gold vs Tokenized Gold

Physical gold offers limited liquidity due to the need for secure storage, authentication, and physical delivery, which can delay transactions. Tokenized gold provides enhanced liquidity by enabling instant trading on digital platforms, reducing transaction times and lowering entry barriers for investors. This increased liquidity makes tokenized gold a more flexible and accessible investment option compared to traditional physical gold.

Security and Ownership: Safeguarding Your Assets

Gold offers tangible security through physical ownership, providing investors with direct control over their assets and protection against digital vulnerabilities. Tokenized gold combines the benefits of blockchain technology, such as transparency and ease of transfer, while ensuring ownership is verifiable and secured via smart contracts. Investors seeking both asset security and efficient liquidity may find tokenized gold a compelling alternative to traditional physical gold holdings.

Accessibility: How Easy is it to Invest?

Tokenized gold offers greater accessibility for investors by enabling fractional ownership and reducing the minimum investment amount compared to traditional physical gold, which often requires significant upfront capital and secure storage. Digital platforms facilitate seamless, instant purchasing and selling of tokenized gold, eliminating the logistical challenges associated with handling physical bullion. This ease of access broadens participation, allowing both retail and institutional investors to diversify portfolios with minimal barriers.

Cost Analysis: Fees, Storage, and Transaction Costs

Tokenized gold investment generally involves lower storage fees and eliminates the need for physical vaulting, reducing overall holding costs compared to traditional gold. Transaction costs for tokenized gold are often minimized through blockchain efficiency and fractional ownership, enabling smaller minimum investments and faster trades. Conventional gold incurs higher expenses from physical security, insurance, and dealer premiums, which can significantly impact net returns over time.

Flexibility in Trading: Gold vs Tokenized Gold

Tokenized gold offers enhanced flexibility in trading by enabling fractional ownership and 24/7 market access on digital platforms, unlike traditional physical gold which requires secure storage and is typically traded during limited market hours. The ability to quickly buy or sell small units of tokenized gold increases liquidity and reduces transaction costs, making it more adaptable to real-time market conditions. Traditional gold investments, while stable, lack the instantaneous transferability and programmable features provided by blockchain technology in tokenized gold.

Regulatory Considerations and Compliance

Gold investment is traditionally regulated under strict commodities laws, requiring compliance with anti-money laundering (AML) and know-your-customer (KYC) policies. Tokenized gold, as a digital asset, falls under emerging frameworks encompassing securities regulations, blockchain-specific compliance mandates, and cross-border trading laws. Investors must evaluate jurisdiction-specific regulatory clarity and custodial security standards to mitigate legal risks in both physical and tokenized gold markets.

Diversification: Portfolio Impact and Risk Mitigation

Gold offers time-tested stability and acts as a hedge against inflation, making it a reliable asset for portfolio diversification and risk mitigation. Tokenized gold enables fractional ownership, enhancing liquidity and accessibility while maintaining exposure to gold's intrinsic value. Integrating both physical gold and tokenized gold can optimize portfolio diversification by balancing traditional safety with digital innovation.

Future Outlook: Trends in Gold and Tokenized Gold Investments

Gold investment remains a trusted hedge against inflation and market volatility, with growing interest in tokenized gold offering enhanced liquidity and accessibility through blockchain technology. Tokenized gold platforms leverage smart contracts to enable fractional ownership, lower transaction costs, and facilitate seamless global trading, attracting tech-savvy and younger investors. Future trends indicate expanding regulatory clarity and integration of tokenized gold within decentralized finance (DeFi) ecosystems, potentially revolutionizing traditional gold investment frameworks.

Related Important Terms

Tokenization Premium

Tokenized gold offers a unique investment advantage through the tokenization premium, enabling fractional ownership, enhanced liquidity, and seamless global transferability compared to traditional physical gold. This premium reflects the added value of blockchain authenticity, instant settlement, and reduced storage costs, making tokenized gold a more efficient and accessible asset class for modern investors.

Digital Gold Custody

Digital gold custody offers enhanced security and transparency compared to physical gold storage, utilizing blockchain technology to provide real-time ownership verification and reduced risk of theft or fraud. Tokenized gold enables fractional ownership and seamless digital transfers, making it a more accessible and liquid investment option than traditional gold holdings.

Fractional Gold Ownership

Tokenized gold enables fractional gold ownership by digitizing physical gold into blockchain-based tokens, allowing investors to buy and sell small, precise amounts without the need for full physical possession. This form of investment provides enhanced liquidity, reduced entry barriers, and transparent provenance compared to traditional gold, which often requires larger capital and faces storage and authentication challenges.

Asset-Backed Tokens

Gold offers a traditional, tangible investment with intrinsic value and historical stability, while tokenized gold leverages blockchain technology to provide fractional ownership, enhanced liquidity, and easier transferability. Asset-backed tokens representing gold combine the security of physical gold with the efficiency of digital assets, enabling investors to diversify portfolios with transparent, verifiable holdings.

On-chain Audited Gold

On-chain audited gold ensures transparent, verifiable ownership by recording gold-backed assets directly on the blockchain, reducing the risks associated with traditional physical gold investments. Tokenized gold with on-chain audits provides enhanced liquidity and instant transferability while maintaining secure proof of asset backing through immutable blockchain records.

Gold-backed Stablecoins

Gold-backed stablecoins combine the stability of traditional gold investments with the liquidity and ease of blockchain technology, enabling instant transactions and fractional ownership. These tokenized assets provide a transparent, secure, and accessible alternative to physical gold, appealing to investors seeking diversification and reduced custody risks in the digital economy.

Rehypothecation Risk (Tokenized Gold)

Tokenized gold investment carries rehypothecation risk, where digital assets can be rehypothecated by custodians or platforms, potentially leading to loss or reduced access during financial distress. In contrast, physical gold investment eliminates rehypothecation risk by providing direct ownership without reliance on intermediaries or digital frameworks.

Physical Redemption Premium

Investing in tokenized gold often incurs a physical redemption premium, reflecting the costs and logistics of converting digital tokens into actual bullion, which can impact overall returns compared to owning physical gold directly. Physical gold eliminates redemption fees and offers tangible asset security, though tokenized gold provides enhanced liquidity and easier fractional ownership.

Regulatory Arbitrage (Gold Tokens)

Tokenized gold offers investors access to fractional ownership and enhanced liquidity while navigating regulatory arbitrage by operating under blockchain-friendly jurisdictions, contrasting with traditional gold investments subject to stringent physical asset regulations; this regulatory flexibility can streamline compliance and reduce custodial overhead. Despite volatility in crypto regulations, gold tokens leverage decentralized frameworks to enable borderless trading and real-time settlement, optimizing investment efficiency compared to conventional gold's regulatory constraints.

Interoperable Gold Assets

Interoperable gold assets enable seamless transfer and trading across blockchain platforms, enhancing liquidity and accessibility compared to traditional gold investments. Tokenized gold provides fractional ownership with lower barriers, while physical gold offers intrinsic value and long-term stability, making a hybrid approach optimal for diversified portfolios.

Gold vs Tokenized Gold for investment. Infographic

moneydiff.com

moneydiff.com