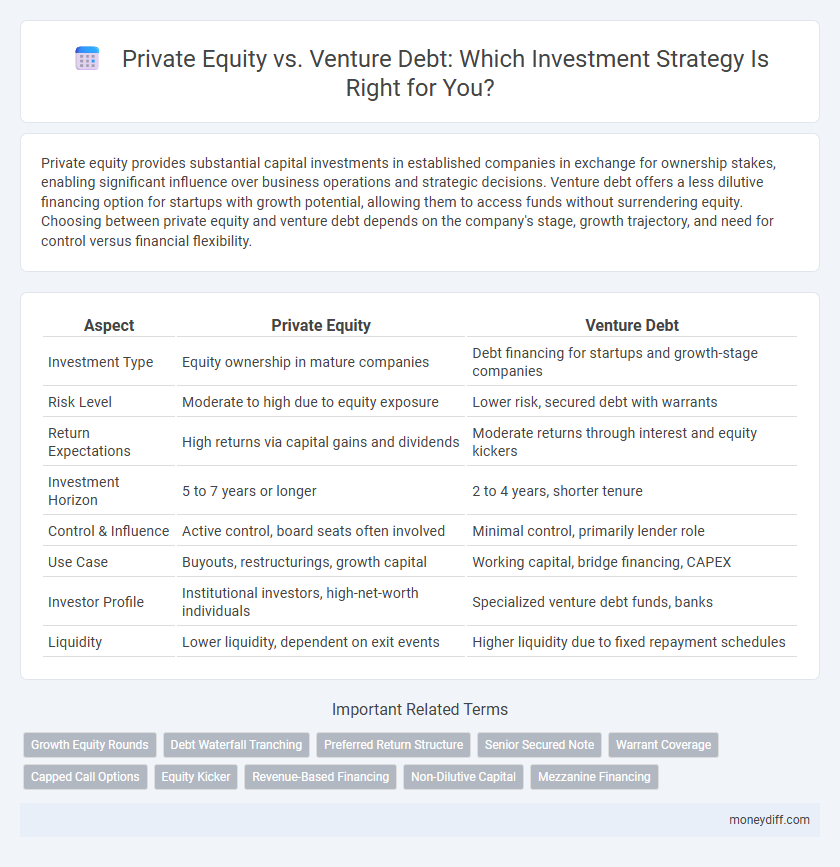

Private equity provides substantial capital investments in established companies in exchange for ownership stakes, enabling significant influence over business operations and strategic decisions. Venture debt offers a less dilutive financing option for startups with growth potential, allowing them to access funds without surrendering equity. Choosing between private equity and venture debt depends on the company's stage, growth trajectory, and need for control versus financial flexibility.

Table of Comparison

| Aspect | Private Equity | Venture Debt |

|---|---|---|

| Investment Type | Equity ownership in mature companies | Debt financing for startups and growth-stage companies |

| Risk Level | Moderate to high due to equity exposure | Lower risk, secured debt with warrants |

| Return Expectations | High returns via capital gains and dividends | Moderate returns through interest and equity kickers |

| Investment Horizon | 5 to 7 years or longer | 2 to 4 years, shorter tenure |

| Control & Influence | Active control, board seats often involved | Minimal control, primarily lender role |

| Use Case | Buyouts, restructurings, growth capital | Working capital, bridge financing, CAPEX |

| Investor Profile | Institutional investors, high-net-worth individuals | Specialized venture debt funds, banks |

| Liquidity | Lower liquidity, dependent on exit events | Higher liquidity due to fixed repayment schedules |

Understanding Private Equity and Venture Debt

Private Equity involves direct investment in companies, often acquiring significant ownership stakes to drive growth and operational improvements, targeting mature businesses with proven revenue streams. Venture Debt provides non-dilutive capital primarily to early-stage startups, complementing equity financing by offering loans that minimize ownership dilution while supporting expansion and cash flow management. Understanding these distinctions helps investors strategically balance risk, control, and return in their portfolios.

Key Differences Between Private Equity and Venture Debt

Private equity investments involve acquiring significant ownership stakes in established companies, often leading to active management roles, while venture debt provides non-dilutive capital to startups with existing venture capital backing, focused primarily on debt repayment with interest. Private equity typically requires longer investment horizons and involves high operational control, contrasting with venture debt's shorter terms and lower control but faster access to growth capital. The risk profiles differ as private equity assumes equity risk with potential for higher returns, whereas venture debt carries lower risk with predefined interest payments but limited upside.

Risk Profiles: Comparing Private Equity and Venture Debt

Private equity investments typically carry higher risk due to equity ownership in potentially volatile markets but offer substantial long-term returns through company growth and exit events. Venture debt presents a lower risk profile by providing secured loans that limit downside exposure while offering steady interest income and warrants for equity upside. Comparing risk profiles, private equity demands greater capital commitment and tolerance for illiquidity, whereas venture debt balances risk through structured repayments and protective covenants.

Expected Returns: Private Equity vs Venture Debt

Private equity typically targets higher expected returns ranging from 15% to 25% annually by acquiring significant ownership stakes in mature companies with growth potential. Venture debt offers more modest returns, generally between 8% and 12%, by providing debt financing to early-stage startups, often coupled with warrants or equity kickers. The risk profile differs as private equity involves higher exposure to market fluctuations and operational risks, while venture debt provides downside protection through secured loans and priority repayment.

Investment Time Horizons: What to Expect

Private equity investments typically involve a longer time horizon of 7 to 10 years, allowing for operational improvements and strategic growth before exit. Venture debt offers shorter investment durations, usually spanning 2 to 4 years, aligned with venture capital cycles and company milestones. Investors should anticipate extended capital commitment and liquidity timing differences when choosing between private equity and venture debt options.

Control and Influence Over Portfolio Companies

Private equity investors typically acquire majority stakes, granting significant control and influence over portfolio companies' strategic decisions and operations. Venture debt providers offer capital with limited ownership, resulting in minimal control but preserving founders' equity and decision-making power. The choice between private equity and venture debt hinges on the investor's desire for control versus the company's preference for maintaining operational autonomy.

Suitability for Different Investor Types

Private equity suits investors seeking control and longer-term capital appreciation through established companies, offering direct operational influence and potential high returns with moderate risk. Venture debt appeals to risk-tolerant investors looking for faster liquidity and lower dilution, typically supporting early-stage startups with debt instruments linked to equity upside. Institutional investors prefer private equity for stable growth, while venture debt attracts those aiming for portfolio diversification in high-growth sectors with manageable risk exposure.

Exit Strategies and Liquidity Options

Private equity investments typically offer exit opportunities through buyouts, secondary sales, or initial public offerings (IPOs), providing substantial liquidity but often requiring longer holding periods. Venture debt offers faster liquidity options via scheduled repayments and warrants, enabling investors to realize returns without waiting for traditional exit events. Exit strategies in private equity prioritize controlling stakes and substantial influence, while venture debt focuses on debt servicing and potential upside from equity kickers.

Industry Sectors and Investment Trends

Private equity investments predominantly target mature industry sectors such as healthcare, manufacturing, and consumer goods, emphasizing long-term value creation and operational improvements. Venture debt, on the other hand, is often favored in high-growth sectors like technology, biotechnology, and fintech, providing scalable capital solutions to startups with established venture capital backing. Recent investment trends indicate a rise in venture debt utilization within SaaS and clean energy industries, reflecting a strategic shift toward less dilutive financing alternatives amid evolving market dynamics.

Choosing the Right Strategy: Private Equity or Venture Debt

Choosing the right investment strategy between private equity and venture debt depends on a company's growth stage, capital needs, and risk tolerance. Private equity provides substantial funding through equity stakes, often suitable for mature businesses seeking expansion or restructuring, while venture debt offers debt financing with less dilution for early-stage startups aiming to extend runway without sacrificing ownership. Evaluating factors such as control preferences, repayment abilities, and long-term goals ensures alignment with the most strategic and capital-efficient option.

Related Important Terms

Growth Equity Rounds

Private equity typically targets mature companies with established cash flows in growth equity rounds, offering large capital injections to scale operations and drive expansion. In contrast, venture debt provides growth-stage startups with non-dilutive financing, allowing them to extend runways and accelerate growth without significant equity dilution.

Debt Waterfall Tranching

Private equity investments often involve equity stakes with higher risk tolerance, while venture debt provides structured debt financing accompanied by a strict debt waterfall tranching hierarchy, ensuring prioritized repayments and reduced investor risk. Debt Waterfall Tranching allocates cash flows sequentially from senior to junior tranches, protecting senior debt holders by minimizing default exposure in venture debt deals.

Preferred Return Structure

Private Equity typically offers a preferred return structure known as a "hurdle rate," ensuring limited partners receive a minimum annual return, commonly around 8%, before general partners share in profits. Venture Debt usually lacks a preferred return but combines interest payments with warrants, providing downside protection and potential equity upside without diluting ownership as much as equity-based investments.

Senior Secured Note

Senior Secured Notes in venture debt provide investors with a higher priority claim on company assets compared to equity holders, reducing risk while offering consistent interest returns. Private equity investments typically involve ownership stakes with higher potential returns but greater exposure to market volatility and lower claim priority in liquidation events.

Warrant Coverage

Warrant coverage in private equity provides investors with the right to purchase equity at a predetermined price, enhancing potential returns by allowing equity participation alongside debt investment. In venture debt, warrant coverage serves as a critical incentive, offering lenders equity upside to compensate for higher credit risk while preserving founders' equity dilution compared to traditional equity financing.

Capped Call Options

Capped call options in private equity offer investors a defined upside limit while protecting against downside risk, contrasting with venture debt that provides companies non-dilutive capital but typically lacks structured equity upside. Private equity investors leverage capped calls to optimize returns within predetermined thresholds, whereas venture debt focuses on steady interest income without equity participation.

Equity Kicker

Private equity investments typically involve significant ownership stakes with an equity kicker that enhances returns through preferential shares or warrants, aligning investor incentives with company growth. Venture debt often includes warrants as an equity kicker, providing lenders potential upside without diluting founders' control as much as traditional equity financing.

Revenue-Based Financing

Revenue-based financing offers a flexible alternative to private equity and venture debt by providing capital in exchange for a percentage of ongoing gross revenues, allowing startups to avoid equity dilution and fixed debt repayments. This model aligns investor returns with company performance, making it particularly attractive for businesses with predictable revenue streams seeking non-dilutive growth capital.

Non-Dilutive Capital

Private equity investment often involves equity dilution as investors receive ownership stakes, whereas venture debt provides non-dilutive capital, allowing companies to raise funds without sacrificing equity or control. Leveraging venture debt can preserve founder ownership and maintain valuation while supporting growth, making it a strategic tool for startups seeking capital efficiency.

Mezzanine Financing

Mezzanine financing serves as a hybrid investment tool positioned between equity and debt, offering higher returns than traditional debt with subordinated risk in private equity deals. This form of capital often complements venture debt by providing growth-stage companies with flexible funding options that balance ownership dilution and debt servicing pressures.

Private Equity vs Venture Debt for investment. Infographic

moneydiff.com

moneydiff.com