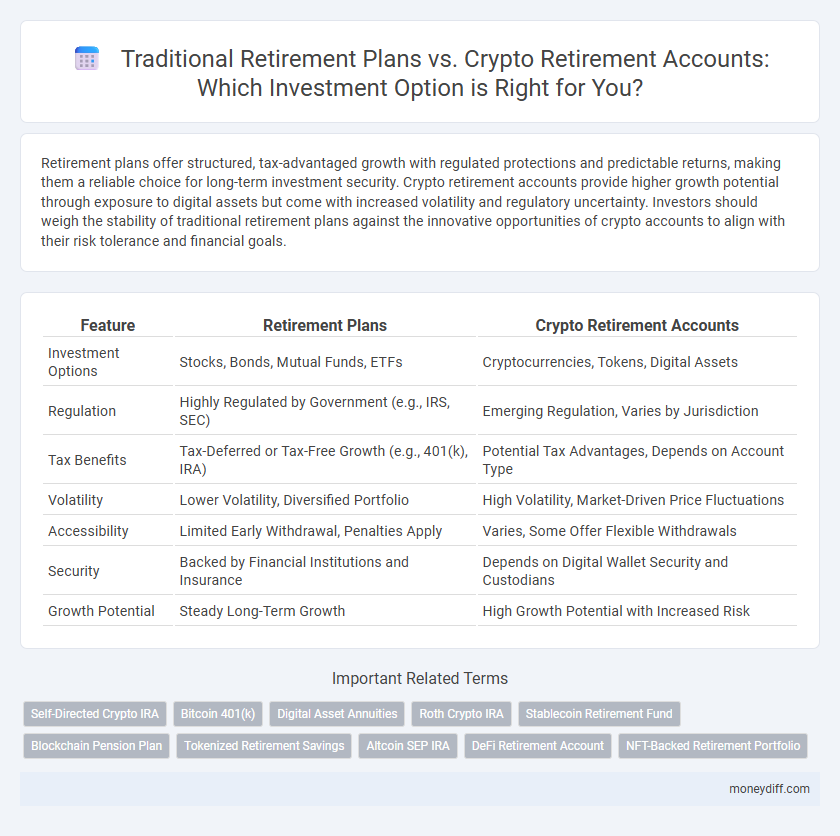

Retirement plans offer structured, tax-advantaged growth with regulated protections and predictable returns, making them a reliable choice for long-term investment security. Crypto retirement accounts provide higher growth potential through exposure to digital assets but come with increased volatility and regulatory uncertainty. Investors should weigh the stability of traditional retirement plans against the innovative opportunities of crypto accounts to align with their risk tolerance and financial goals.

Table of Comparison

| Feature | Retirement Plans | Crypto Retirement Accounts |

|---|---|---|

| Investment Options | Stocks, Bonds, Mutual Funds, ETFs | Cryptocurrencies, Tokens, Digital Assets |

| Regulation | Highly Regulated by Government (e.g., IRS, SEC) | Emerging Regulation, Varies by Jurisdiction |

| Tax Benefits | Tax-Deferred or Tax-Free Growth (e.g., 401(k), IRA) | Potential Tax Advantages, Depends on Account Type |

| Volatility | Lower Volatility, Diversified Portfolio | High Volatility, Market-Driven Price Fluctuations |

| Accessibility | Limited Early Withdrawal, Penalties Apply | Varies, Some Offer Flexible Withdrawals |

| Security | Backed by Financial Institutions and Insurance | Depends on Digital Wallet Security and Custodians |

| Growth Potential | Steady Long-Term Growth | High Growth Potential with Increased Risk |

Traditional Retirement Plans: An Overview

Traditional retirement plans, such as 401(k)s and IRAs, provide tax-advantaged growth with established regulatory frameworks ensuring investor protection and predictable income streams. These plans typically offer diversified investment options, including stocks, bonds, and mutual funds, allowing for risk management and steady compounding returns over time. Employer-sponsored plans often include matching contributions, enhancing savings potential and creating a reliable foundation for long-term financial security in retirement.

Understanding Crypto Retirement Accounts

Crypto retirement accounts integrate blockchain technology to offer decentralized, secure, and transparent options for long-term investment, often providing higher potential returns through digital assets like Bitcoin and Ethereum. These accounts enable tax-advantaged growth similar to traditional retirement plans but with added flexibility in asset diversification, including access to DeFi protocols and NFTs. Investors must consider regulatory uncertainties and volatility risks while evaluating crypto retirement accounts alongside conventional IRAs and 401(k)s for a balanced retirement strategy.

Risk Assessment: Traditional vs Crypto Retirement

Traditional retirement plans such as 401(k)s and IRAs offer regulatory protections and lower volatility, making them a lower-risk option for long-term retirement investment. Crypto retirement accounts provide high growth potential but come with increased risks due to market volatility, regulatory uncertainty, and cybersecurity threats. Investors must balance the stability of conventional assets against the speculative nature of cryptocurrencies when assessing portfolio risk.

Regulatory Frameworks: Compliance and Security

Retirement plans such as 401(k)s and IRAs operate under strict regulatory frameworks established by the IRS and Department of Labor, ensuring compliance with tax laws and fiduciary responsibilities for security and transparency. Crypto retirement accounts, while offering innovative decentralized investment opportunities, face evolving and less standardized regulations, introducing potential risks related to compliance and custodial security. Investors must carefully evaluate the regulatory environment and security protocols of each option to safeguard retirement assets effectively.

Diversification Strategies in Retirement Portfolios

Diversification strategies in retirement portfolios often emphasize balancing traditional retirement plans, such as 401(k)s and IRAs, with emerging options like crypto retirement accounts to optimize risk and growth potential. Traditional retirement plans provide stable, regulated investments in stocks, bonds, and mutual funds, while crypto retirement accounts offer exposure to digital assets, enhancing portfolio diversification and potential returns. Incorporating both retirement vehicles helps investors mitigate market volatility and achieve a more resilient and broadly diversified retirement portfolio.

Potential Returns: Comparing Growth Opportunities

Retirement plans such as 401(k)s and IRAs offer stable, long-term growth with tax advantages, typically yielding average annual returns between 5% and 8% based on diversified portfolios of stocks and bonds. Crypto retirement accounts, by investing in volatile digital assets like Bitcoin and Ethereum, present higher potential returns, sometimes exceeding 20% annually, but come with significantly increased risk and regulatory uncertainty. Evaluating growth opportunities requires balancing the consistent compounding of traditional retirement vehicles against the speculative nature and rapid appreciation potential of crypto investments.

Tax Implications: IRA, 401(k), and Crypto Accounts

Traditional IRAs and 401(k) plans offer tax-deferred growth, allowing contributions to lower taxable income while withdrawals in retirement are taxed as ordinary income. Roth IRAs and Roth 401(k)s provide tax-free growth and tax-free withdrawals, with contributions made from after-tax income. Crypto retirement accounts, often structured as self-directed IRAs, benefit from similar tax advantages but carry additional risks due to market volatility and regulatory uncertainty, making thorough tax planning essential for investors.

Accessibility and Liquidity: Withdrawal Options

Retirement plans typically offer limited withdrawal options with penalties for early access before age 59 1/2, focusing on long-term growth and tax advantages. Crypto retirement accounts provide greater accessibility and liquidity, allowing investors to withdraw or transfer assets more freely without traditional restrictions. This flexibility in crypto accounts supports more dynamic portfolio management and quicker response to market changes.

Future Trends in Retirement Investment Solutions

Retirement plans are evolving with increasing integration of digital assets, highlighting a shift toward crypto retirement accounts that offer decentralized investment opportunities and blockchain transparency. Future trends in retirement investment solutions emphasize greater diversification through alternative assets like cryptocurrencies, aiming to enhance portfolio growth and hedge against traditional market volatility. Regulatory advancements and improved security protocols are expected to boost adoption of crypto retirement accounts, positioning them as viable complements or alternatives to conventional retirement plans.

Choosing the Right Retirement Strategy for You

Evaluating Retirement Plans against Crypto Retirement Accounts involves assessing factors such as risk tolerance, tax implications, and long-term growth potential. Traditional retirement plans offer proven stability and regulatory protections, while crypto retirement accounts provide high growth opportunities with increased volatility. Selecting the right retirement strategy requires balancing individual financial goals with an understanding of market dynamics and emerging asset classes.

Related Important Terms

Self-Directed Crypto IRA

Self-Directed Crypto IRAs offer investors the ability to diversify retirement portfolios by including cryptocurrencies, providing higher growth potential compared to traditional retirement plans like 401(k)s or IRAs that mainly invest in stocks and bonds. These accounts enable tax advantages similar to conventional plans while allowing direct control over digital assets, appealing to investors seeking exposure to the volatile yet rewarding crypto market.

Bitcoin 401(k)

Bitcoin 401(k) offers a unique opportunity to diversify traditional retirement portfolios by integrating cryptocurrency, potentially enhancing long-term growth through exposure to Bitcoin's high volatility and historic appreciation trends. Traditional retirement plans use conventional assets like stocks and bonds, while Bitcoin 401(k) accounts leverage blockchain technology to provide tax-advantaged gains, liquidity, and decentralized asset management.

Digital Asset Annuities

Digital asset annuities in crypto retirement accounts offer enhanced liquidity and potential for higher returns compared to traditional retirement plans, leveraging blockchain technology for secure, transparent transactions. This innovative investment vehicle allows retirees to diversify portfolios with digital assets while maintaining steady income streams aligned with evolving market dynamics.

Roth Crypto IRA

Roth Crypto IRAs combine tax-free growth benefits of Roth retirement accounts with the high-growth potential of cryptocurrency investments, offering an innovative alternative to traditional retirement plans like 401(k)s and conventional Roth IRAs. Investors prioritize Roth Crypto IRAs for their ability to diversify portfolios through assets like Bitcoin and Ethereum while securing future tax advantages and flexible withdrawal options.

Stablecoin Retirement Fund

A Stablecoin Retirement Fund offers a low-volatility alternative to traditional retirement plans by leveraging blockchain technology for transparent, secure, and stable asset growth. Unlike conventional IRAs or 401(k)s, crypto retirement accounts with stablecoins reduce exposure to market fluctuations while potentially providing higher liquidity and faster transaction settlement times.

Blockchain Pension Plan

Blockchain Pension Plans leverage decentralized ledger technology to enhance transparency, security, and real-time tracking of retirement funds compared to traditional retirement plans. These crypto retirement accounts enable diversification through digital assets, potentially increasing returns while maintaining regulatory compliance and reducing intermediary fees.

Tokenized Retirement Savings

Tokenized retirement savings in crypto retirement accounts offer enhanced liquidity and potential for higher returns compared to traditional retirement plans, leveraging blockchain technology to provide transparent, secure, and easily transferable digital assets. These accounts enable diversification beyond conventional stocks and bonds, with tokenized assets facilitating fractional ownership and real-time portfolio adjustments tailored to an investor's retirement goals.

Altcoin SEP IRA

Altcoin SEP IRAs combine traditional retirement plan benefits, such as tax advantages and employer contributions, with the growth potential of altcoin investments, offering a diversified approach compared to conventional retirement accounts. Investors seeking higher returns through cryptocurrency exposure should consider the regulatory framework and volatility risks inherent in Altcoin SEP IRAs before allocating retirement funds.

DeFi Retirement Account

DeFi retirement accounts leverage blockchain technology to offer decentralized finance solutions, providing increased transparency, reduced fees, and higher liquidity compared to traditional retirement plans. These crypto retirement accounts enable investors to access diversified digital assets and automated yield strategies, potentially enhancing long-term growth and retirement security.

NFT-Backed Retirement Portfolio

NFT-backed retirement portfolios offer a unique alternative to traditional retirement plans by combining the potential high returns of cryptocurrency with digital asset ownership, providing diversification and inflation hedging. These crypto retirement accounts leverage blockchain technology for enhanced transparency and liquidity, attracting investors seeking innovative, long-term growth strategies beyond conventional stocks and bonds.

Retirement Plans vs Crypto Retirement Accounts for investment. Infographic

moneydiff.com

moneydiff.com