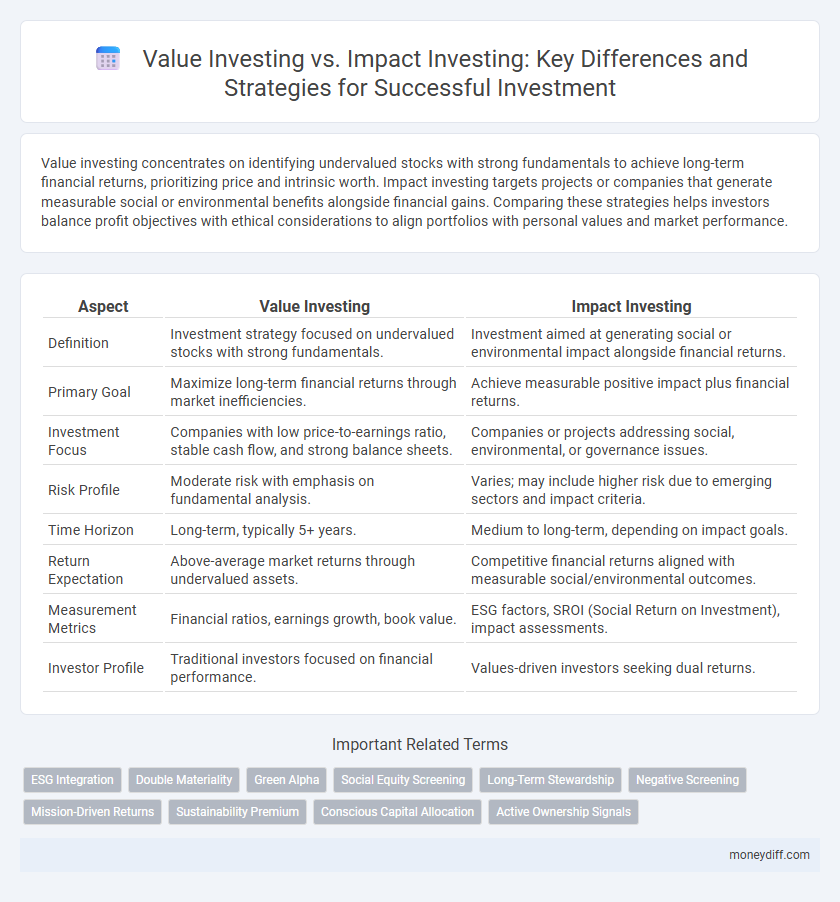

Value investing concentrates on identifying undervalued stocks with strong fundamentals to achieve long-term financial returns, prioritizing price and intrinsic worth. Impact investing targets projects or companies that generate measurable social or environmental benefits alongside financial gains. Comparing these strategies helps investors balance profit objectives with ethical considerations to align portfolios with personal values and market performance.

Table of Comparison

| Aspect | Value Investing | Impact Investing |

|---|---|---|

| Definition | Investment strategy focused on undervalued stocks with strong fundamentals. | Investment aimed at generating social or environmental impact alongside financial returns. |

| Primary Goal | Maximize long-term financial returns through market inefficiencies. | Achieve measurable positive impact plus financial returns. |

| Investment Focus | Companies with low price-to-earnings ratio, stable cash flow, and strong balance sheets. | Companies or projects addressing social, environmental, or governance issues. |

| Risk Profile | Moderate risk with emphasis on fundamental analysis. | Varies; may include higher risk due to emerging sectors and impact criteria. |

| Time Horizon | Long-term, typically 5+ years. | Medium to long-term, depending on impact goals. |

| Return Expectation | Above-average market returns through undervalued assets. | Competitive financial returns aligned with measurable social/environmental outcomes. |

| Measurement Metrics | Financial ratios, earnings growth, book value. | ESG factors, SROI (Social Return on Investment), impact assessments. |

| Investor Profile | Traditional investors focused on financial performance. | Values-driven investors seeking dual returns. |

Understanding Value Investing: Fundamentals and Strategies

Value investing centers on identifying undervalued stocks with strong fundamentals such as low price-to-earnings ratios, solid earnings growth, and robust cash flow. Key strategies include thorough financial analysis, margin of safety, and long-term holding to capitalize on intrinsic value appreciation. This approach contrasts with impact investing, which prioritizes social and environmental returns alongside financial gains.

Impact Investing: Definition and Core Principles

Impact investing focuses on generating measurable social and environmental benefits alongside financial returns by directing capital to projects and companies that prioritize sustainability, social justice, and ethical governance. Core principles include intentionality, where investments aim to create positive impact; measurement and management, ensuring transparent tracking of outcomes; and additionality, meaning investments drive change that would not occur otherwise. This approach contrasts with traditional value investing, which primarily emphasizes financial metrics and undervalued assets without necessarily prioritizing societal impact.

Key Differences Between Value and Impact Investing

Value investing prioritizes identifying undervalued stocks based on fundamental analysis, targeting long-term capital appreciation through financial metrics like price-to-earnings ratios and book value. Impact investing emphasizes generating measurable social or environmental benefits alongside financial returns, often focusing on sectors such as renewable energy, sustainable agriculture, or affordable housing. The key difference lies in value investing's focus on intrinsic financial value, whereas impact investing integrates intentional positive impact as a core investment criterion.

Historical Performance: Value Investing vs Impact Investing

Value investing, historically rooted in the principles of Benjamin Graham and popularized by Warren Buffett, has demonstrated consistent long-term outperformance by targeting undervalued stocks with strong fundamentals. Impact investing, while relatively newer, emphasizes social and environmental returns alongside financial gains, and recent studies show competitive, though more variable, historical performance compared to traditional value strategies. Empirical data from Morningstar and MSCI indicate that value investing typically offers stable alpha generation, whereas impact investing attracts investors prioritizing ethical outcomes with moderately lower volatility.

Risk Factors in Value and Impact Investing

Value investing carries risks related to market volatility and company-specific issues such as poor financial health or management errors, which can lead to undervaluation traps. Impact investing involves risks tied to measuring social or environmental outcomes, regulatory changes, and the potential trade-off between financial returns and positive impact. Both strategies require rigorous due diligence to balance risk exposure with investment goals.

Evaluating Companies: Financial Metrics vs Social Impact Metrics

Value investing prioritizes analyzing financial metrics such as price-to-earnings ratio, dividend yield, and earnings growth to identify undervalued companies with strong fundamentals. Impact investing evaluates social impact metrics, including environmental sustainability, community development, and social governance, alongside financial returns to achieve positive societal outcomes. Investors balance these approaches by weighing tangible financial performance against measurable social contributions to optimize portfolio impact and profitability.

The Role of ESG Criteria in Impact Investing

ESG criteria play a pivotal role in impact investing by guiding investment decisions toward companies that prioritize environmental sustainability, social responsibility, and strong governance practices. Unlike value investing, which emphasizes financial metrics such as price-to-earnings ratios and intrinsic value, impact investing evaluates both financial returns and positive societal outcomes. Integrating ESG factors enables impact investors to identify opportunities that generate measurable social and environmental benefits alongside competitive financial performance.

Building a Diversified Portfolio: Value vs Impact Approaches

Building a diversified portfolio involves balancing value investing strategies, which focus on undervalued stocks with strong fundamentals and long-term growth potential, against impact investing approaches that prioritize social and environmental returns alongside financial gains. Value investing typically seeks companies with solid earnings, low price-to-earnings ratios, and resilient business models, whereas impact investing targets ventures that generate measurable positive outcomes in areas like sustainability, community development, and corporate responsibility. Incorporating both strategies can optimize risk-adjusted returns while aligning investments with ethical and performance goals.

Who Should Choose Value Investing or Impact Investing?

Investors prioritizing long-term financial returns through undervalued stocks typically choose value investing, while those seeking to align portfolios with ethical, social, or environmental goals often prefer impact investing. Value investors focus on fundamental analysis and market inefficiencies to maximize wealth, whereas impact investors measure success by both financial performance and positive societal impact. Individuals aiming for diversified risk with potential social benefits may integrate both strategies to balance profit and purpose in their investment approach.

Future Trends in Value and Impact Investing

Future trends in value investing emphasize integrating environmental, social, and governance (ESG) metrics with traditional financial analysis to identify undervalued stocks poised for long-term growth. Impact investing focuses increasingly on measurable social and environmental outcomes alongside financial returns, driven by rising investor demand for sustainability and accountability. Advances in data analytics and artificial intelligence are expected to enhance decision-making in both strategies, enabling more precise assessment of risk, impact, and value creation.

Related Important Terms

ESG Integration

Value investing emphasizes selecting stocks based on fundamental financial metrics like low price-to-earnings ratios and strong balance sheets, whereas impact investing integrates Environmental, Social, and Governance (ESG) factors to generate positive societal outcomes alongside financial returns. ESG integration in impact investing involves systematically incorporating environmental sustainability, social responsibility, and governance quality into investment analysis, enhancing risk management and long-term value creation beyond traditional financial indicators.

Double Materiality

Value investing prioritizes financial returns by analyzing intrinsic company value, while impact investing integrates Environmental, Social, and Governance (ESG) criteria to generate positive societal outcomes alongside profits; the principle of double materiality emphasizes that investors must assess both financial risks and the broader environmental and social impacts of their investments to achieve sustainable long-term performance. Understanding double materiality enables investors to align portfolios with global sustainability goals without compromising value creation.

Green Alpha

Green Alpha specializes in impact investing by targeting companies with sustainable practices and strong environmental, social, and governance (ESG) metrics, prioritizing long-term ecological benefits alongside financial returns. Unlike traditional value investing, which focuses primarily on undervalued assets based on financial ratios, Green Alpha integrates rigorous sustainability criteria to drive both positive environmental impact and competitive investment performance.

Social Equity Screening

Value investing focuses on identifying undervalued assets with strong financial fundamentals, while impact investing incorporates social equity screening to prioritize investments that generate positive social outcomes alongside financial returns. Social equity screening evaluates companies based on criteria such as diversity, inclusion, and community impact to align portfolios with ethical and societal goals.

Long-Term Stewardship

Value investing emphasizes long-term stewardship by selecting undervalued assets with strong fundamentals to generate sustainable returns over time. Impact investing integrates environmental, social, and governance (ESG) criteria to achieve measurable positive outcomes alongside financial growth, fostering responsible long-term asset management.

Negative Screening

Value investing emphasizes selecting undervalued stocks based on fundamental analysis, often overlooking ethical concerns, while impact investing prioritizes positive social and environmental outcomes by incorporating negative screening to exclude companies involved in harmful industries like tobacco, fossil fuels, or weapons. Negative screening enhances portfolio alignment with sustainability goals, reducing exposure to reputational and regulatory risks without necessarily sacrificing financial returns.

Mission-Driven Returns

Mission-driven returns in value investing prioritize long-term financial performance by identifying undervalued assets with strong fundamentals, while impact investing seeks measurable social and environmental outcomes alongside competitive returns. Both strategies align investor goals with purposeful capital allocation but differ in balancing financial metrics versus tangible societal impact.

Sustainability Premium

Value investing focuses on identifying undervalued assets with strong financial fundamentals, while impact investing prioritizes measurable social and environmental benefits alongside financial returns. The sustainability premium reflects the growing market preference for companies with robust ESG practices, potentially enhancing long-term value and attracting impact-driven investors seeking both profit and purpose.

Conscious Capital Allocation

Value investing emphasizes selecting undervalued stocks with strong fundamentals to generate long-term financial returns, while impact investing targets companies and projects that deliver measurable social and environmental benefits alongside financial gains. Conscious capital allocation integrates both strategies by prioritizing investments that balance robust economic performance with positive societal impact, aligning investor values with sustainable growth.

Active Ownership Signals

Active ownership in value investing emphasizes rigorous financial analysis and strategic voting to enhance shareholder value, whereas impact investing leverages active engagement to drive environmental, social, and governance (ESG) improvements alongside financial returns. Both approaches signal commitment through proxy voting, shareholder resolutions, and direct dialogue with management, but value investors prioritize long-term economic fundamentals while impact investors focus on measurable social and environmental outcomes.

Value Investing vs Impact Investing for investment. Infographic

moneydiff.com

moneydiff.com