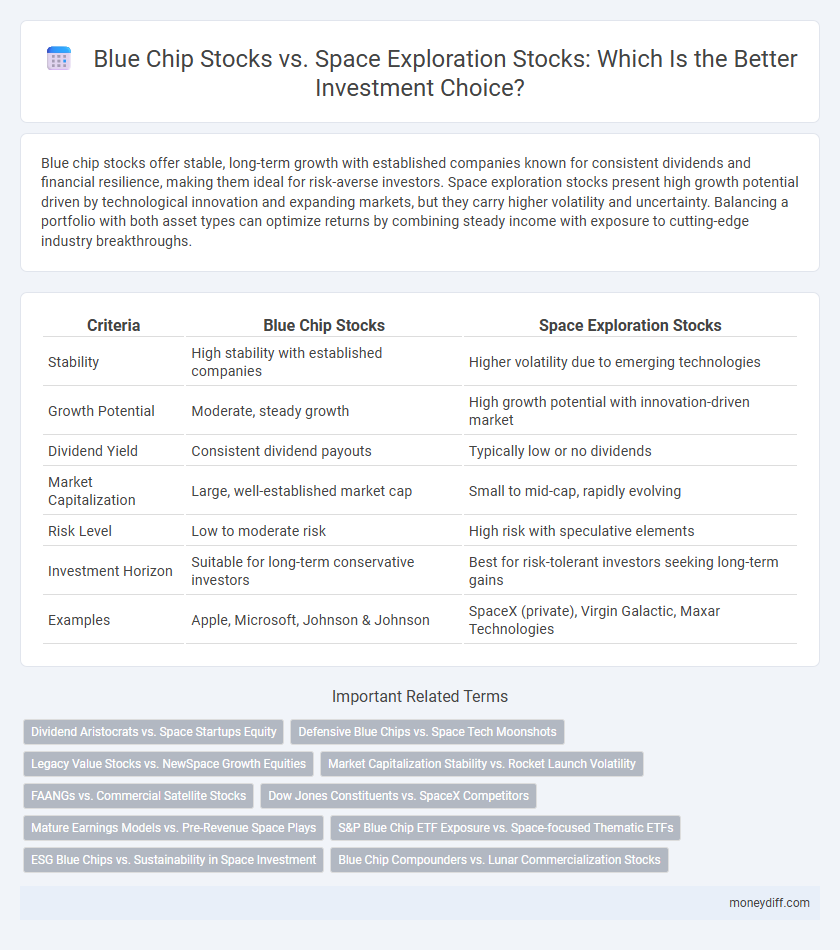

Blue chip stocks offer stable, long-term growth with established companies known for consistent dividends and financial resilience, making them ideal for risk-averse investors. Space exploration stocks present high growth potential driven by technological innovation and expanding markets, but they carry higher volatility and uncertainty. Balancing a portfolio with both asset types can optimize returns by combining steady income with exposure to cutting-edge industry breakthroughs.

Table of Comparison

| Criteria | Blue Chip Stocks | Space Exploration Stocks |

|---|---|---|

| Stability | High stability with established companies | Higher volatility due to emerging technologies |

| Growth Potential | Moderate, steady growth | High growth potential with innovation-driven market |

| Dividend Yield | Consistent dividend payouts | Typically low or no dividends |

| Market Capitalization | Large, well-established market cap | Small to mid-cap, rapidly evolving |

| Risk Level | Low to moderate risk | High risk with speculative elements |

| Investment Horizon | Suitable for long-term conservative investors | Best for risk-tolerant investors seeking long-term gains |

| Examples | Apple, Microsoft, Johnson & Johnson | SpaceX (private), Virgin Galactic, Maxar Technologies |

Understanding Blue Chip Stocks: Stability and Reliability

Blue chip stocks represent well-established companies with a history of stable earnings, strong market capitalization, and reliable dividend payments, making them a cornerstone for conservative investors. These stocks typically belong to industry leaders with proven business models and resilient performance during economic downturns. Investing in blue chip stocks offers long-term stability and lower volatility compared to emerging sectors like space exploration stocks, which carry higher risk but potentially greater returns.

Exploring Space Exploration Stocks: High-Risk, High-Reward Ventures

Space exploration stocks represent high-risk, high-reward investment opportunities driven by pioneering technologies and ambitious missions from companies like SpaceX and Blue Origin. These stocks exhibit significant volatility due to heavy R&D costs, regulatory hurdles, and long development timelines but offer potential for exponential growth tied to commercial space travel, satellite deployment, and lunar exploration initiatives. Investors seeking diversification beyond traditional blue chip stocks may consider space exploration equities for their unique growth prospects in the emerging aerospace economy.

Key Differences Between Blue Chip and Space Stocks

Blue chip stocks represent well-established companies with stable earnings, strong dividends, and lower risk, making them a reliable choice for conservative investors seeking steady growth. Space exploration stocks, often linked to emerging aerospace and technology firms, exhibit higher volatility and greater growth potential driven by advancements in space technology and government contracts. The key difference lies in risk tolerance and investment horizon, with blue chips favoring stability while space stocks offer speculative opportunities tied to innovation and market disruption.

Historical Performance: Blue Chips vs Space Exploration

Blue chip stocks have demonstrated consistent historical performance with steady dividends and resilience during market downturns, reflecting their established market presence and financial stability. Space exploration stocks, while exhibiting higher volatility and risk, have shown significant growth potential driven by technological advancements and increasing governmental and private sector investments. Evaluating historical returns, blue chips offer long-term reliability, whereas space exploration stocks provide opportunities for substantial capital appreciation in emerging markets.

Risk Factors in Blue Chip and Space Stocks

Blue chip stocks typically exhibit lower risk due to their established market presence, stable earnings, and strong dividend history, making them a safer investment during economic uncertainty. Space exploration stocks, however, involve higher volatility driven by technological uncertainties, regulatory challenges, and substantial research and development costs, posing greater risk to investors. Assessing risk tolerance is crucial when choosing between the reliability of blue chip stocks and the speculative growth potential in the space exploration sector.

Potential Returns: Comparing Long-Term Growth

Blue chip stocks offer stable, long-term growth with consistent dividends, appealing to risk-averse investors seeking reliable returns. Space exploration stocks, while volatile, present higher potential returns due to the sector's rapid innovation and expanding market opportunities. Investors prioritizing steady appreciation benefit from blue chips, whereas those targeting aggressive growth may prefer space exploration equities for their substantial upside.

Diversification Strategies Using Both Stock Types

Diversification strategies benefit from combining blue chip stocks, known for their stability and consistent dividends, with space exploration stocks, which offer high growth potential but come with greater volatility. Integrating blue chip stocks provides a solid foundation for risk management, while space exploration investments capture emerging technological advancements and market opportunities. Balancing these stock types enhances portfolio resilience and positions investors to capitalize on both steady returns and speculative gains.

Market Volatility: Safe Havens vs Speculative Frontiers

Blue chip stocks offer investors stability with consistent dividends and strong market capitalization, making them reliable safe havens during periods of market volatility. Space exploration stocks, by contrast, present higher risk and potential for significant returns due to innovation and emerging technologies, but they are subject to speculative frontiers and fluctuating investor sentiment. Market volatility influences the choice between blue chip's defensive growth and space exploration's aggressive expansion, shaping portfolio risk management strategies.

Investment Goals: Are You a Conservative or Adventurous Investor?

Conservative investors often prefer blue chip stocks for their stability, reliable dividends, and steady growth, making them ideal for long-term wealth preservation. In contrast, adventurous investors may target space exploration stocks due to their high growth potential and exposure to cutting-edge technology, despite inherent volatility and market uncertainty. Aligning investment goals with risk tolerance is crucial when choosing between the steady returns of blue chip equities and the speculative nature of space sector ventures.

Building a Balanced Portfolio: Integrating Blue Chip and Space Stocks

Building a balanced portfolio involves blending the stability of blue chip stocks, known for their consistent dividends and established market presence, with the high-growth potential of space exploration stocks driven by innovation and emerging technologies. Diversifying investments across these sectors mitigates risk while capturing gains from long-term industry advancements and market resilience. This strategic integration supports sustained portfolio growth and stability amid market fluctuations.

Related Important Terms

Dividend Aristocrats vs. Space Startups Equity

Dividend Aristocrats offer consistent, high-yield returns through established blue chip stocks with decades of dividend growth, making them ideal for risk-averse investors seeking stable income. Space startups equity presents high-growth potential but comes with significant volatility and speculative risk, appealing to investors prioritizing innovation and long-term capital appreciation.

Defensive Blue Chips vs. Space Tech Moonshots

Defensive blue chip stocks such as Johnson & Johnson and Procter & Gamble offer stable dividends and resilience during economic downturns, making them ideal for risk-averse investors seeking consistent returns. In contrast, space exploration stocks like Virgin Galactic and Rocket Lab present high-growth potential with substantial volatility, appealing to investors willing to embrace speculative, long-term gains linked to breakthroughs in satellite technology and space tourism.

Legacy Value Stocks vs. NewSpace Growth Equities

Blue chip stocks represent legacy value with established companies offering consistent dividends and stable growth, appealing to risk-averse investors seeking long-term reliability. NewSpace growth equities, tied to the emerging space exploration sector, present high volatility but potentially exponential returns driven by innovative technology and expanding market opportunities.

Market Capitalization Stability vs. Rocket Launch Volatility

Blue chip stocks offer high market capitalization stability, providing investors with consistent returns and lower risk due to established business models and steady cash flows. Space exploration stocks exhibit significant volatility driven by high R&D costs, unpredictable launch outcomes, and evolving regulatory environments, presenting potential for high rewards but increased investment risk.

FAANGs vs. Commercial Satellite Stocks

FAANG stocks, representing established technology giants like Facebook, Apple, Amazon, Netflix, and Google, offer stable growth and strong dividends appealing to conservative investors seeking steady returns. In contrast, commercial satellite stocks, including companies like Maxar Technologies and Spire Global, present higher risk with potential exponential gains driven by the expanding space economy and increased demand for satellite-based services.

Dow Jones Constituents vs. SpaceX Competitors

Dow Jones constituents like Apple, Microsoft, and Johnson & Johnson offer stable dividends and long-term growth, appealing to conservative investors focused on established market performance. In contrast, SpaceX competitors such as Blue Origin and Virgin Galactic present higher volatility and speculative potential driven by advancements in commercial space travel and aerospace innovation.

Mature Earnings Models vs. Pre-Revenue Space Plays

Blue chip stocks offer stable returns with mature earnings models grounded in established market performance and consistent dividends, making them attractive for risk-averse investors seeking predictability. In contrast, space exploration stocks typically represent pre-revenue ventures with high growth potential but increased volatility and uncertain financial outcomes, appealing to investors with higher risk tolerance aiming for long-term gains.

S&P Blue Chip ETF Exposure vs. Space-focused Thematic ETFs

S&P Blue Chip ETFs offer diversified exposure to large-cap, financially stable companies with consistent dividends, making them a reliable choice for conservative investors. Space-focused thematic ETFs, while more volatile, target high-growth segments within aerospace and satellite technology, appealing to investors seeking speculative returns in the emerging space economy.

ESG Blue Chips vs. Sustainability in Space Investment

ESG blue chip stocks offer established companies with strong environmental, social, and governance practices, ensuring stable returns and long-term sustainability in traditional markets. In contrast, space exploration stocks emphasize innovative sustainability efforts such as resource utilization in orbit and low-impact launch technologies, presenting high-growth potential with pioneering environmental strategies.

Blue Chip Compounders vs. Lunar Commercialization Stocks

Blue chip compounders offer steady growth and consistent dividends through established companies with proven track records, making them ideal for risk-averse investors seeking long-term wealth accumulation. In contrast, lunar commercialization stocks present high-growth potential tied to the emerging space economy but come with considerable volatility and speculative risks due to uncertain regulatory environments and technological challenges.

Blue Chip Stocks vs Space Exploration Stocks for investment. Infographic

moneydiff.com

moneydiff.com