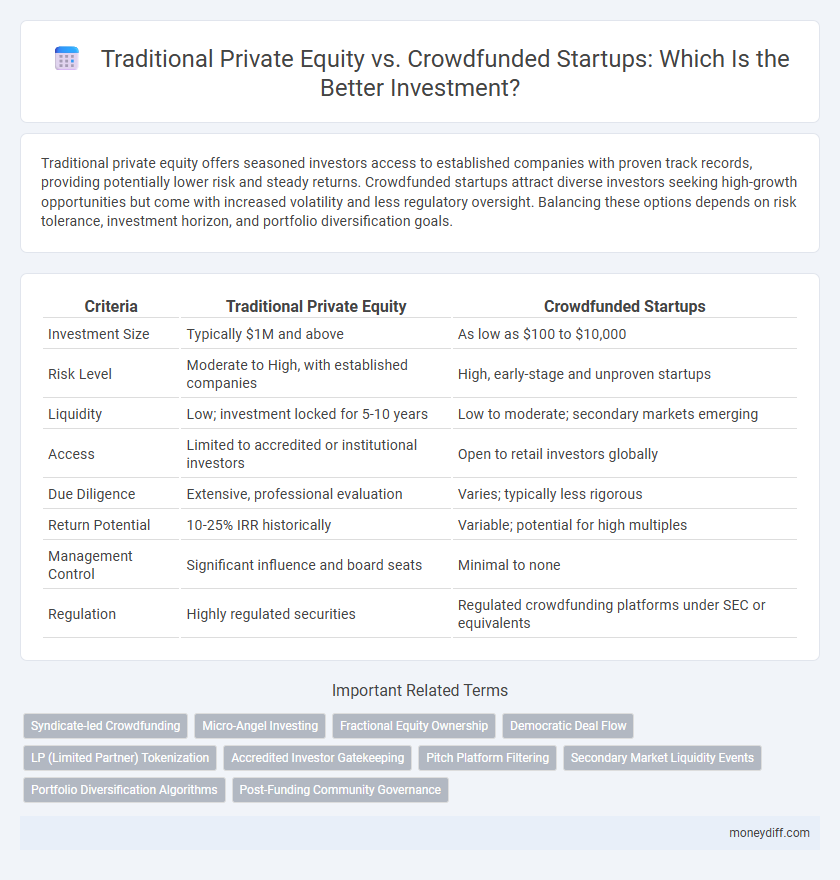

Traditional private equity offers seasoned investors access to established companies with proven track records, providing potentially lower risk and steady returns. Crowdfunded startups attract diverse investors seeking high-growth opportunities but come with increased volatility and less regulatory oversight. Balancing these options depends on risk tolerance, investment horizon, and portfolio diversification goals.

Table of Comparison

| Criteria | Traditional Private Equity | Crowdfunded Startups |

|---|---|---|

| Investment Size | Typically $1M and above | As low as $100 to $10,000 |

| Risk Level | Moderate to High, with established companies | High, early-stage and unproven startups |

| Liquidity | Low; investment locked for 5-10 years | Low to moderate; secondary markets emerging |

| Access | Limited to accredited or institutional investors | Open to retail investors globally |

| Due Diligence | Extensive, professional evaluation | Varies; typically less rigorous |

| Return Potential | 10-25% IRR historically | Variable; potential for high multiples |

| Management Control | Significant influence and board seats | Minimal to none |

| Regulation | Highly regulated securities | Regulated crowdfunding platforms under SEC or equivalents |

Understanding Traditional Private Equity Investment

Traditional private equity investment involves acquiring significant ownership stakes in established companies, typically requiring substantial capital and offering strategic guidance to drive growth and improve operations. This method provides investors with potential for high returns through active management and long-term value creation, often coupled with a rigorous due diligence process. Compared to crowdfunded startups, traditional private equity tends to focus on lower-risk, mature businesses with proven revenue streams and scalability.

The Rise of Crowdfunded Startups

Crowdfunded startups have transformed early-stage investment by democratizing capital access beyond traditional private equity's exclusive networks. This surge in crowdfunding platforms has enabled diverse investor participation, driving innovation and accelerating growth in emerging businesses. Data shows a significant increase in successful funding rounds through crowdfunding, challenging the dominance of conventional private equity models.

Key Differences Between Private Equity and Crowdfunding

Traditional private equity investments typically involve substantial capital commitments, targeting established companies with proven business models and offering significant control and influence over operations. Crowdfunded startups attract smaller investments from a large pool of individual investors, often focusing on early-stage ventures with higher risk and growth potential but limited investor control. Private equity emphasizes long-term, strategic value creation with rigorous due diligence, whereas crowdfunding leverages broad market participation and democratizes access to investment opportunities in emerging businesses.

Minimum Investment Requirements

Traditional private equity typically demands minimum investments ranging from $250,000 to several million dollars, limiting access to high-net-worth individuals and institutional investors. Crowdfunded startups offer significantly lower entry points, often allowing investments as small as $100, making early-stage opportunities accessible to a broader investor base. These contrasting minimum investment thresholds are crucial factors for investors when choosing between exclusive private equity funds and democratized crowdfunding platforms.

Risk and Return Profiles

Traditional private equity investments typically involve lower risk due to rigorous due diligence and established operational controls, offering moderate to high returns over a longer time horizon. Crowdfunded startups present higher risk profiles with greater volatility and uncertainties but also the potential for exponential returns in a shorter period if the startup succeeds. Investors must weigh the predictable, steady returns of private equity against the high-risk, high-reward nature of crowdfunded startup opportunities.

Access to Investment Opportunities

Traditional private equity offers access to established companies with proven track records, typically requiring substantial capital and strict accreditation criteria. Crowdfunded startups enable a broader range of investors to participate early in high-growth potential ventures with lower minimum investments. This democratization of access allows individual investors to diversify portfolios beyond conventional markets while assuming higher risk profiles.

Liquidity and Exit Strategies

Traditional private equity investments typically offer lower liquidity due to long lock-up periods and reliance on exit events like IPOs or acquisitions, which can take several years. Crowdfunded startups, on the other hand, provide more flexible exit opportunities through secondary markets or buybacks but often face higher volatility and less predictable returns. Investors must weigh these liquidity constraints and exit options carefully to align with their investment horizon and risk tolerance.

Due Diligence and Transparency

Traditional private equity investments undergo extensive due diligence processes involving thorough financial audits, management evaluations, and market analysis to minimize risks and ensure transparency. Crowdfunded startups offer less rigorous due diligence, often relying on self-reported data and limited third-party verification, which can increase investment risk due to lower transparency. Investors seeking higher accountability typically prefer private equity for its structured oversight and comprehensive disclosure standards.

Regulatory Considerations

Traditional private equity investments operate under stringent regulatory frameworks, including SEC registration and accredited investor requirements, ensuring investor protection through rigorous due diligence and financial disclosures. Crowdfunded startups benefit from more lenient regulations under the JOBS Act, allowing non-accredited investors to participate but often involve less regulatory oversight, increasing potential risk. Understanding these regulatory differences is crucial for investors to assess compliance obligations, transparency levels, and legal protections in private equity versus crowdfunding opportunities.

Choosing the Right Investment Path

Traditional private equity investments offer access to established companies with proven financial track records, providing lower risk but often requiring substantial capital commitments and longer holding periods. Crowdfunded startups present opportunities for higher returns by investing in early-stage ventures with innovative ideas, though they carry increased risk and less liquidity. Investors should assess their risk tolerance, capital availability, and desired involvement level to determine the most suitable investment path.

Related Important Terms

Syndicate-led Crowdfunding

Syndicate-led crowdfunding offers investors access to diversified startup portfolios with lower minimum commitments compared to traditional private equity, which typically requires substantial capital and longer lock-up periods. This model leverages experienced lead investors to curate deals and provide due diligence, enhancing transparency and risk management for individual contributors.

Micro-Angel Investing

Micro-angel investing in traditional private equity typically involves substantial capital commitments and access to established networks, offering higher control and potential returns with increased risk. Crowdfunded startups lower investment barriers by enabling smaller contributions from diverse investors, fostering portfolio diversification and early-stage innovation exposure without extensive due diligence requirements.

Fractional Equity Ownership

Traditional private equity offers investors substantial fractional equity ownership, typically securing significant control and higher potential returns through large capital commitments in established companies. Crowdfunded startups provide fractional equity ownership with lower financial barriers, enabling diverse investors to partake in early-stage ventures but usually involve higher risk and diluted ownership stakes.

Democratic Deal Flow

Traditional private equity typically limits deal flow to high-net-worth individuals and institutional investors, creating barriers to entry and less democratic access to exclusive investment opportunities. Crowdfunded startups democratize deal flow by enabling a broader range of investors to participate in early-stage funding rounds, increasing market liquidity and diversifying investment portfolios.

LP (Limited Partner) Tokenization

Limited Partner (LP) tokenization in traditional private equity enhances liquidity and transparency by enabling fractional ownership and faster secondary market transactions, revolutionizing capital access for investors. In crowdfunded startups, LP tokenization democratizes investment opportunities but often lacks the regulatory rigor and established returns associated with conventional private equity funds.

Accredited Investor Gatekeeping

Traditional private equity investment enforces strict accredited investor gatekeeping, limiting participation to high-net-worth individuals and institutional investors to mitigate risk. Crowdfunded startups lower barriers, allowing non-accredited investors access to early-stage opportunities, but introduce higher volatility and regulatory complexity.

Pitch Platform Filtering

Traditional private equity employs rigorous pitch platform filtering, using extensive due diligence and experienced fund managers to select high-potential startups, ensuring lower risk and substantial growth potential. Crowdfunded startups rely on public pitch platforms with minimal filtering, allowing broader access but increasing exposure to higher investment risks and variable project quality.

Secondary Market Liquidity Events

Traditional private equity investments typically offer fewer opportunities for secondary market liquidity events due to longer holding periods and limited access to buyers, whereas crowdfunded startups often provide earlier exit options through digital platforms facilitating secondary sales. Enhanced liquidity in crowdfunded startups allows investors to diversify risk and realize returns more quickly compared to the often illiquid nature of traditional private equity holdings.

Portfolio Diversification Algorithms

Portfolio diversification algorithms in traditional private equity leverage deep financial analysis and historical performance data to optimize asset allocation, minimizing risk through controlled exposure to large, established firms. Crowdfunded startups benefit from machine learning models that assess real-time market trends and startup viability, allowing dynamic diversification across smaller, high-growth potential ventures to balance risk and reward effectively.

Post-Funding Community Governance

Traditional private equity firms exercise centralized post-funding community governance through board control and strategic decision-making, ensuring alignment with investor interests and regulatory compliance. In contrast, crowdfunded startups often implement decentralized governance models, leveraging community voting mechanisms and stakeholder engagement to influence company direction and accountability.

Traditional Private Equity vs Crowdfunded Startups for investment. Infographic

moneydiff.com

moneydiff.com