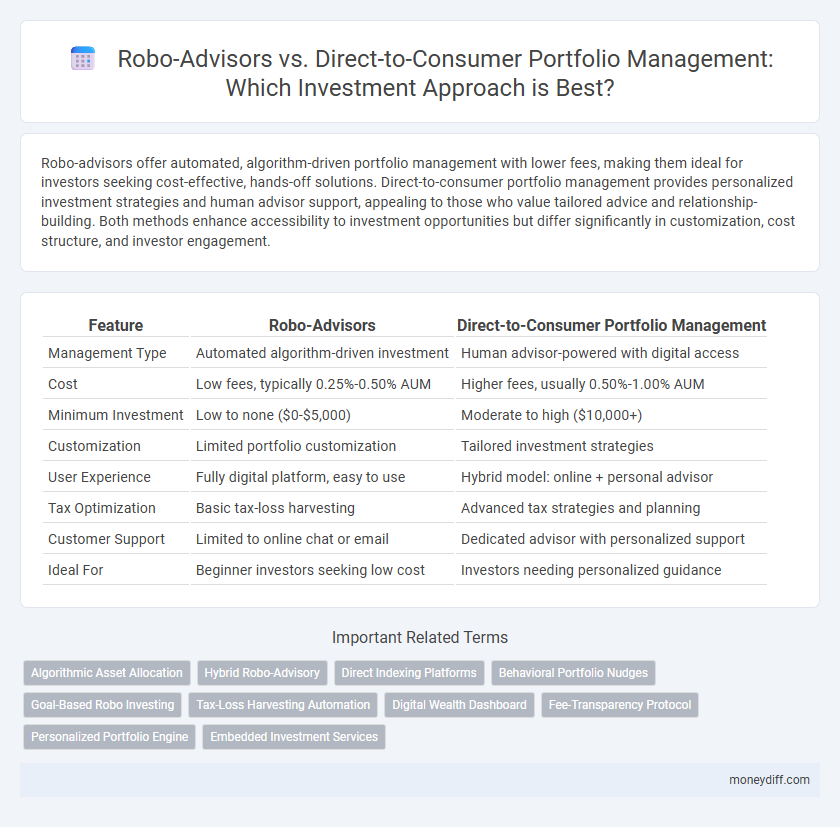

Robo-advisors offer automated, algorithm-driven portfolio management with lower fees, making them ideal for investors seeking cost-effective, hands-off solutions. Direct-to-consumer portfolio management provides personalized investment strategies and human advisor support, appealing to those who value tailored advice and relationship-building. Both methods enhance accessibility to investment opportunities but differ significantly in customization, cost structure, and investor engagement.

Table of Comparison

| Feature | Robo-Advisors | Direct-to-Consumer Portfolio Management |

|---|---|---|

| Management Type | Automated algorithm-driven investment | Human advisor-powered with digital access |

| Cost | Low fees, typically 0.25%-0.50% AUM | Higher fees, usually 0.50%-1.00% AUM |

| Minimum Investment | Low to none ($0-$5,000) | Moderate to high ($10,000+) |

| Customization | Limited portfolio customization | Tailored investment strategies |

| User Experience | Fully digital platform, easy to use | Hybrid model: online + personal advisor |

| Tax Optimization | Basic tax-loss harvesting | Advanced tax strategies and planning |

| Customer Support | Limited to online chat or email | Dedicated advisor with personalized support |

| Ideal For | Beginner investors seeking low cost | Investors needing personalized guidance |

Introduction to Robo-Advisors and Direct-to-Consumer Portfolio Management

Robo-advisors leverage advanced algorithms and AI technology to provide automated, cost-effective investment management tailored to individual risk profiles and financial goals. Direct-to-consumer portfolio management offers investors personalized, transparent access to investment strategies without traditional intermediaries, often combining human expertise with digital platforms. Both approaches prioritize accessibility and efficiency, transforming how individuals engage with wealth management services in the digital age.

Key Differences Between Robo-Advisors and DIY Portfolio Management

Robo-advisors utilize algorithm-driven platforms to automate portfolio management, offering personalized asset allocation based on individual risk tolerance and financial goals. DIY portfolio management empowers investors with full control over asset selection and trading decisions, requiring deeper market knowledge and active monitoring. The primary difference lies in the balance between automation and manual oversight, with robo-advisors providing convenience and diversification, while DIY strategies demand hands-on engagement and expertise.

Cost Comparison: Robo-Advisors vs. Self-Directed Investing

Robo-advisors typically charge management fees ranging from 0.25% to 0.50% annually, with low or no account minimums, making them cost-effective for small to medium portfolios. Self-directed investing eliminates advisory fees but often incurs trading commissions, platform fees, and requires significant time and expertise, which can indirectly increase costs. For investors prioritizing low overhead, robo-advisors offer streamlined portfolio management at predictable expenses, while self-directed investing may reduce explicit fees but demands higher personal involvement and potential hidden costs.

User Experience and Accessibility: Which is More Investor-Friendly?

Robo-advisors offer a streamlined, algorithm-driven user experience with easy account setup and automated portfolio rebalancing, making them highly accessible for novice investors seeking low fees and minimal effort. Direct-to-consumer portfolio management platforms provide a more personalized interface, often featuring direct access to human advisors and customizable investment strategies, appealing to users who prioritize tailored financial guidance. Overall, robo-advisors tend to be more investor-friendly for those valuing simplicity and cost-efficiency, while direct platforms cater better to individuals needing comprehensive support and customization.

Portfolio Diversification Strategies: Automated vs. Self-Managed

Robo-advisors employ algorithm-driven portfolio diversification strategies that dynamically adjust asset allocation based on risk tolerance and market conditions, ensuring broad exposure across multiple asset classes with minimal human intervention. In contrast, self-managed direct-to-consumer portfolio management demands investors actively research and select individual securities, often resulting in less consistent diversification but greater control over specific investment choices. Studies indicate robo-advisors typically achieve more balanced diversification through automated rebalancing, reducing portfolio risk and enhancing long-term returns compared to self-managed approaches.

Risk Management Approaches: Algorithmic vs. Personal Oversight

Robo-advisors employ algorithmic risk management, utilizing advanced machine learning models to continuously monitor market volatility and adjust portfolios automatically for optimal asset allocation. In contrast, direct-to-consumer portfolio management relies on personal oversight, allowing financial advisors to apply qualitative judgment and tailor risk strategies based on individual client goals and behavioral factors. Algorithmic approaches offer consistent, data-driven risk mitigation, while human oversight provides flexibility to address complex, nuanced investment scenarios.

Performance Analysis: Robo-Advisors Compared to Direct Investing

Robo-advisors leverage algorithm-driven models to optimize portfolio allocation, often delivering consistent risk-adjusted returns comparable to or slightly outperforming many direct-to-consumer managed portfolios. Performance analysis reveals robo-advisors benefit from lower management fees and automated rebalancing, which can enhance net returns over time. However, direct investing offers investors personalized control and the potential for bespoke strategies that may outperform robo-advisors under active management by skilled investors.

Customization and Control: Balancing Automation with Personalization

Robo-advisors offer algorithm-driven portfolio management with limited customization, prioritizing low fees and automated rebalancing for efficiency. Direct-to-consumer portfolio management services provide greater control, enabling investors to tailor asset allocation and investment strategies according to individual risk tolerance and goals. Balancing automation and personalization involves weighing the convenience of robo-advisors against the flexibility and hands-on management available in direct portfolio solutions.

Suitability for Different Investor Profiles and Goals

Robo-advisors offer algorithm-driven portfolio management ideal for beginners and cost-conscious investors seeking automated, diversified investment solutions. Direct-to-consumer portfolio management provides personalized advice and tailored strategies suited to experienced investors with specific financial goals and tolerance for risk. Both options address unique investor profiles by balancing accessibility, customization, and cost efficiency in portfolio management.

Future Trends in Investment: Robo-Advisors or Self-Directed Solutions?

Robo-advisors leverage AI-driven algorithms to offer personalized, cost-effective portfolio management, attracting investors seeking automated, low-fee solutions. Direct-to-consumer portfolio management platforms empower users with advanced tools and real-time data for self-directed investment decisions, appealing to those prioritizing control and customization. Future investment trends indicate a hybrid model combining robo-advisor efficiency with enhanced user autonomy through integrated platforms and AI-powered insights.

Related Important Terms

Algorithmic Asset Allocation

Robo-advisors leverage advanced algorithmic asset allocation to efficiently rebalance portfolios based on real-time market data and individual risk profiles, ensuring optimized diversification and cost-effective investment management. Direct-to-consumer portfolio management often combines algorithmic strategies with personalized human oversight, enhancing customization but potentially increasing fees compared to fully automated robo-advisory services.

Hybrid Robo-Advisory

Hybrid robo-advisors combine algorithm-driven portfolio management with personalized human advice, enhancing investment strategies by balancing automation with expert insights. This approach optimizes asset allocation, risk management, and fee efficiency, appealing to investors seeking scalable yet customized financial planning solutions.

Direct Indexing Platforms

Direct indexing platforms offer personalized portfolio management by enabling investors to directly own individual securities rather than pooled funds, enhancing tax efficiency and customization compared to traditional robo-advisors. These platforms leverage advanced algorithms and big data to tailor portfolios based on unique investor preferences, reducing fees and improving after-tax returns in a scalable, transparent manner.

Behavioral Portfolio Nudges

Behavioral portfolio nudges in robo-advisors leverage algorithmic insights to subtly guide investors toward optimal decisions by automating advice based on behavioral finance principles, reducing emotional biases. In contrast, direct-to-consumer portfolio management offers personalized human interaction that can tailor nudges to individual investor psychology but may be limited by scalability and consistency.

Goal-Based Robo Investing

Goal-based robo investing leverages sophisticated algorithms to tailor portfolios aligned with individual financial objectives, providing automated adjustments to maintain optimal risk levels and asset allocation. This technology-driven approach contrasts with direct-to-consumer portfolio management by offering scalable, cost-efficient solutions that prioritize personalized goal achievement over traditional advisory methods.

Tax-Loss Harvesting Automation

Robo-advisors utilize sophisticated algorithms to automate tax-loss harvesting, enabling investors to maximize deductions and improve after-tax returns efficiently. Direct-to-consumer portfolio management platforms may offer manual or semi-automated tax-loss harvesting, often requiring greater investor involvement and potentially less optimization compared to fully automated robo-advisory systems.

Digital Wealth Dashboard

Digital wealth dashboards in robo-advisors provide automated portfolio management with real-time analytics and personalized investment insights, enhancing user engagement through intuitive interfaces. Direct-to-consumer portfolio management platforms offer greater customization and direct access to financial advisors, enabling a more tailored investment strategy with comprehensive digital reporting tools.

Fee-Transparency Protocol

Robo-advisors leverage Fee-Transparency Protocols by clearly disclosing management fees, expense ratios, and underlying costs through automated platforms, ensuring investors understand the total charges influencing returns. Direct-to-Consumer Portfolio Management often lacks standardized fee disclosures, potentially obscuring hidden costs and complicating direct comparisons, thereby affecting informed decision-making in investment strategies.

Personalized Portfolio Engine

Robo-advisors leverage sophisticated algorithms and AI-driven personalized portfolio engines to tailor investment strategies based on individual risk tolerance, financial goals, and market conditions with scalable efficiency. Direct-to-consumer portfolio management offers customization through human financial advisors but often lacks the real-time adaptability and cost-effectiveness provided by automated robo-advisor platforms.

Embedded Investment Services

Embedded investment services integrate robo-advisors directly within consumer platforms, offering seamless, automated portfolio management without requiring separate accounts or logins. This approach enhances user engagement by combining personalized algorithm-driven advice with the convenience of direct access to financial products, outperforming traditional standalone direct-to-consumer portfolio management solutions.

Robo-Advisors vs Direct-to-Consumer Portfolio Management for investment. Infographic

moneydiff.com

moneydiff.com