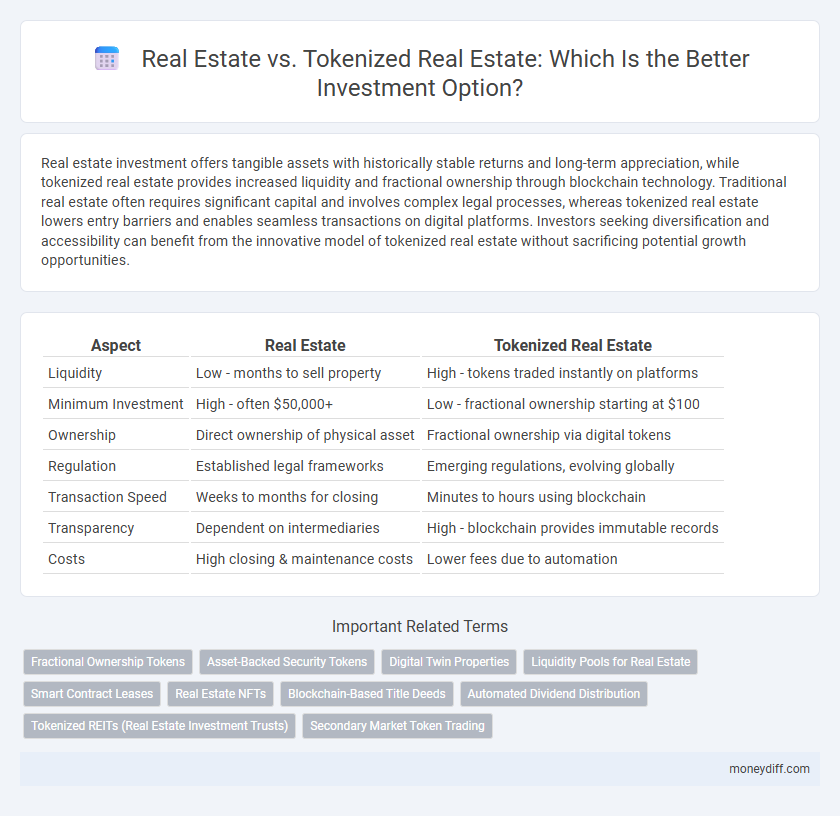

Real estate investment offers tangible assets with historically stable returns and long-term appreciation, while tokenized real estate provides increased liquidity and fractional ownership through blockchain technology. Traditional real estate often requires significant capital and involves complex legal processes, whereas tokenized real estate lowers entry barriers and enables seamless transactions on digital platforms. Investors seeking diversification and accessibility can benefit from the innovative model of tokenized real estate without sacrificing potential growth opportunities.

Table of Comparison

| Aspect | Real Estate | Tokenized Real Estate |

|---|---|---|

| Liquidity | Low - months to sell property | High - tokens traded instantly on platforms |

| Minimum Investment | High - often $50,000+ | Low - fractional ownership starting at $100 |

| Ownership | Direct ownership of physical asset | Fractional ownership via digital tokens |

| Regulation | Established legal frameworks | Emerging regulations, evolving globally |

| Transaction Speed | Weeks to months for closing | Minutes to hours using blockchain |

| Transparency | Dependent on intermediaries | High - blockchain provides immutable records |

| Costs | High closing & maintenance costs | Lower fees due to automation |

Understanding Traditional Real Estate Investment

Traditional real estate investment involves purchasing physical properties such as residential, commercial, or industrial assets, offering tangible ownership and potential rental income. This approach requires significant capital, due diligence, and ongoing management, with market liquidity often limited due to lengthy sales processes. Investors benefit from property appreciation and tax advantages but face risks like market volatility, maintenance costs, and regulatory changes affecting asset value.

What Is Tokenized Real Estate?

Tokenized real estate represents ownership of property through digital tokens on a blockchain, enabling fractional investment and increased liquidity compared to traditional real estate. This innovative approach democratizes access to high-value assets by allowing investors to buy and trade smaller shares with greater transparency and lower transaction costs. Blockchain technology secures transactions and ownership records, minimizing fraud and speeding up settlement times in the real estate market.

Key Differences Between Real Estate and Tokenized Real Estate

Real estate investments involve direct ownership of physical property, requiring substantial capital, maintenance, and regulatory compliance, whereas tokenized real estate allows fractional ownership through blockchain-based digital tokens, enhancing liquidity and accessibility. Traditional real estate transactions are often time-consuming and involve intermediaries such as brokers and legal professionals, while tokenized assets enable faster, decentralized trading on digital platforms. Risk profiles differ as physical properties are subject to market volatility and physical deterioration, whereas tokenized real estate depends on digital security and regulatory frameworks governing cryptocurrencies and digital assets.

Accessibility and Minimum Investment Requirements

Real estate investments typically require substantial capital, limiting accessibility for many individual investors due to high minimum investment thresholds. Tokenized real estate lowers entry barriers by enabling fractional ownership through blockchain technology, allowing investors to participate with significantly smaller amounts. This increased liquidity and reduced minimum investment requirement democratize access to real estate markets, attracting a broader investor base.

Liquidity: Selling Real Estate vs Selling Tokens

Traditional real estate investments often face liquidity challenges due to lengthy transaction processes, legal complexities, and market fluctuations, making property sales time-consuming and costly. Tokenized real estate enables fractional ownership and quicker transactions through blockchain technology, significantly enhancing liquidity by allowing investors to buy and sell tokens on digital marketplaces with lower fees and faster settlement times. This increased liquidity appeals to investors seeking flexible investment options and the ability to efficiently adjust their portfolios in response to market conditions.

Diversification Opportunities in Both Investment Types

Real estate investment traditionally offers portfolio diversification through physical asset classes like residential, commercial, and industrial properties, reducing risk exposure. Tokenized real estate enables fractional ownership, allowing investors to diversify across multiple properties and geographic locations with lower capital requirements. This digital approach enhances liquidity and access, broadening investment opportunities beyond conventional market limitations.

Regulatory and Compliance Considerations

Real estate investments typically require adherence to established zoning laws, property rights, and local government regulations, ensuring physical asset security but involving complex legal procedures. Tokenized real estate involves securities regulations compliance such as Know Your Customer (KYC), Anti-Money Laundering (AML) policies, and adherence to the SEC and blockchain-specific laws, offering increased liquidity and fractional ownership. Navigating these regulatory frameworks is essential for mitigating risks and ensuring investor protection in both traditional and tokenized real estate markets.

Risks and Security Factors

Real estate investment traditionally involves risks such as market volatility, liquidity constraints, and high entry costs, with security tied to physical property regulations and title clarity. Tokenized real estate introduces risks including cybersecurity threats, smart contract vulnerabilities, and regulatory uncertainties, although it offers enhanced liquidity and fractional ownership security through blockchain technology. Investors should weigh the tangible asset protection of traditional real estate against the innovative security protocols and potential systemic risks inherent in tokenized digital assets.

Potential Returns and Passive Income Streams

Traditional real estate investments often provide steady rental income and long-term appreciation, creating reliable passive income streams with relatively stable returns. Tokenized real estate offers increased liquidity and fractional ownership opportunities, enabling investors to diversify portfolios with lower capital while potentially accessing higher-yield projects and faster transactions. Both options carry unique risks and rewards, but tokenized assets may enhance potential returns through blockchain-enabled transparency and global market access.

Choosing the Right Investment: Factors to Consider

When choosing between traditional real estate and tokenized real estate for investment, consider factors such as liquidity, transparency, and accessibility. Tokenized real estate offers fractional ownership and easier transactions through blockchain technology, while traditional real estate provides tangible assets with potential for long-term appreciation. Evaluate your investment horizon, risk tolerance, and regulatory environment before making a decision.

Related Important Terms

Fractional Ownership Tokens

Fractional ownership tokens in tokenized real estate enable investors to buy smaller, tradable shares of properties, increasing liquidity and lowering entry barriers compared to traditional real estate investment. These blockchain-based tokens provide transparent ownership records and facilitate faster transactions, enhancing accessibility and diversification opportunities in real estate portfolios.

Asset-Backed Security Tokens

Asset-backed security tokens in tokenized real estate provide fractional ownership, increased liquidity, and transparent blockchain-based transactions, outperforming traditional real estate's limited accessibility and higher entry barriers. These digital tokens facilitate seamless global trading and enhanced portfolio diversification, making them a compelling alternative for modern investors seeking efficient real estate exposure.

Digital Twin Properties

Traditional real estate investment offers tangible asset ownership, while tokenized real estate leverages blockchain technology to provide fractional ownership and enhanced liquidity through digital twin properties that mirror physical assets with real-time data and transparent transactions. Digital twin properties enable investors to analyze precise property conditions, market trends, and transaction history, optimizing portfolio management and decision-making in tokenized real estate markets.

Liquidity Pools for Real Estate

Real estate liquidity pools enable fractional ownership and faster trading of property-backed tokens, significantly enhancing market liquidity compared to traditional real estate investments, which often involve lengthy transactions and illiquid assets. Tokenized real estate platforms leverage blockchain technology to provide transparent, decentralized liquidity pools, allowing investors to buy, sell, or trade shares in properties with lower entry barriers and improved portfolio diversification.

Smart Contract Leases

Smart contract leases in tokenized real estate streamline rental agreements by automating payments and enforcing terms through blockchain technology, reducing administrative costs and increasing transparency. Traditional real estate leases often involve manual processes and intermediaries, resulting in higher transaction fees and slower dispute resolutions.

Real Estate NFTs

Real estate NFTs offer fractional ownership and increased liquidity compared to traditional real estate investments, enabling investors to buy, sell, or trade digital property stakes on blockchain platforms. This tokenized approach reduces entry barriers, enhances transparency with immutable records, and accelerates transaction times compared to conventional real estate asset acquisition and management.

Blockchain-Based Title Deeds

Blockchain-based title deeds enhance transparency and security in tokenized real estate investments by providing immutable proof of ownership and reducing fraud risks. Traditional real estate relies on centralized records that can be cumbersome and prone to errors, while tokenized assets enable fractional ownership and increased liquidity through smart contracts on the blockchain.

Automated Dividend Distribution

Automated dividend distribution in tokenized real estate enhances investment efficiency by enabling instant, transparent payouts directly to investors' digital wallets, reducing administrative costs and delays common in traditional real estate. This technology leverages blockchain smart contracts to ensure accuracy and security, providing a seamless, real-time income stream compared to conventional real estate investment models.

Tokenized REITs (Real Estate Investment Trusts)

Tokenized REITs leverage blockchain technology to offer fractional ownership, increased liquidity, and lower entry barriers compared to traditional real estate investments. These digital assets enable real-time trading on secondary markets, enhancing accessibility and transparency for investors seeking diversified portfolios in commercial and residential properties.

Secondary Market Token Trading

Secondary market token trading offers increased liquidity and accessibility compared to traditional real estate investments, enabling investors to buy and sell fractional property tokens rapidly without the need for lengthy transaction processes. This digital approach enhances market transparency and reduces entry barriers, allowing diversification and efficient portfolio management through real-time price discovery on blockchain platforms.

Real Estate vs Tokenized Real Estate for Investment. Infographic

moneydiff.com

moneydiff.com