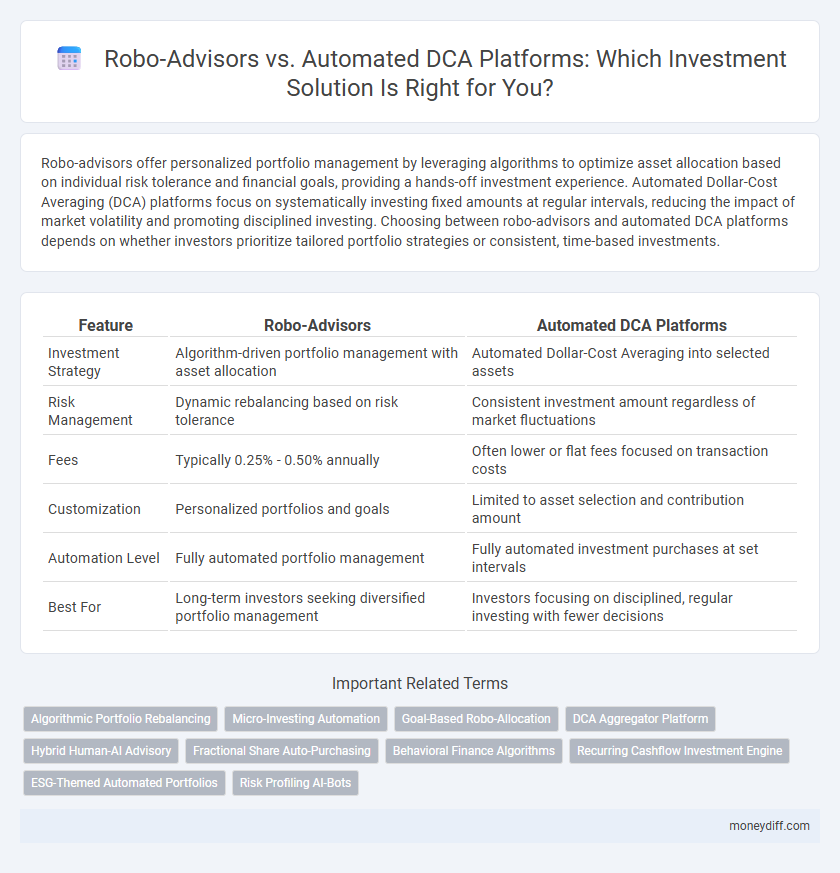

Robo-advisors offer personalized portfolio management by leveraging algorithms to optimize asset allocation based on individual risk tolerance and financial goals, providing a hands-off investment experience. Automated Dollar-Cost Averaging (DCA) platforms focus on systematically investing fixed amounts at regular intervals, reducing the impact of market volatility and promoting disciplined investing. Choosing between robo-advisors and automated DCA platforms depends on whether investors prioritize tailored portfolio strategies or consistent, time-based investments.

Table of Comparison

| Feature | Robo-Advisors | Automated DCA Platforms |

|---|---|---|

| Investment Strategy | Algorithm-driven portfolio management with asset allocation | Automated Dollar-Cost Averaging into selected assets |

| Risk Management | Dynamic rebalancing based on risk tolerance | Consistent investment amount regardless of market fluctuations |

| Fees | Typically 0.25% - 0.50% annually | Often lower or flat fees focused on transaction costs |

| Customization | Personalized portfolios and goals | Limited to asset selection and contribution amount |

| Automation Level | Fully automated portfolio management | Fully automated investment purchases at set intervals |

| Best For | Long-term investors seeking diversified portfolio management | Investors focusing on disciplined, regular investing with fewer decisions |

Introduction to Robo-Advisors and Automated DCA Platforms

Robo-advisors are digital platforms that leverage algorithms and AI to provide automated, personalized investment management and portfolio rebalancing based on an investor's risk profile and goals. Automated Dollar-Cost Averaging (DCA) platforms systematically invest fixed amounts at regular intervals, reducing the impact of market volatility and removing emotional bias from investment decisions. Both technologies aim to simplify investing, with robo-advisors offering holistic portfolio management while automated DCA platforms focus on disciplined, schedule-based investing.

Core Differences: Robo-Advisors vs Automated DCA

Robo-advisors utilize algorithm-driven portfolio management to tailor investments based on individual risk tolerance, goals, and time horizon, often including tax optimization and rebalancing features. Automated Dollar-Cost Averaging (DCA) platforms focus on consistent investment amounts at regular intervals, minimizing market timing risk without personalized asset allocation or portfolio management. While robo-advisors offer comprehensive financial planning and adaptive strategies, automated DCA platforms emphasize disciplined, simplistic investing through scheduled contributions.

Investment Strategies and Portfolio Diversification

Robo-advisors utilize advanced algorithms to create and manage diversified portfolios tailored to individual risk profiles, offering strategic asset allocation and periodic rebalancing to optimize long-term returns. Automated Dollar-Cost Averaging (DCA) platforms emphasize disciplined investing by regularly purchasing assets regardless of market fluctuations, reducing timing risk but often with less emphasis on dynamic portfolio diversification. Combining robo-advisor strategies with automated DCA can enhance investment outcomes by merging personalized diversification with systematic entry points into the market.

Cost Comparison: Fees and Charges Breakdown

Robo-advisors typically charge management fees ranging from 0.25% to 0.50% annually, with some platforms adding fund expense ratios averaging 0.10% to 0.20%. Automated dollar-cost averaging (DCA) platforms often have lower or no management fees but may impose per-transaction charges between $1 and $5, depending on the number of trades. Investors should evaluate total cost impact based on trading frequency and account balance to determine which option offers better cost efficiency over time.

User Experience and Platform Accessibility

Robo-advisors offer personalized investment strategies with intuitive interfaces, making them accessible to both novice and experienced investors seeking tailored portfolio management. Automated DCA platforms streamline recurring investments through simple setups, prioritizing ease of use for cost-averaging strategies without requiring extensive financial knowledge. Both platforms enhance user experience by providing mobile apps, real-time tracking, and seamless fund transfers, but robo-advisors typically incorporate comprehensive financial planning tools alongside investment automation.

Risk Management Approaches

Robo-advisors utilize algorithm-driven portfolio diversification and periodic rebalancing to optimize risk-adjusted returns tailored to individual risk profiles, employing Modern Portfolio Theory for strategic asset allocation. Automated Dollar-Cost Averaging (DCA) platforms emphasize risk mitigation by systematically spreading investment purchases over time, reducing market timing risk and smoothing entry prices during volatile conditions. Combining robo-advisory algorithms with automated DCA schedules can enhance risk control by blending dynamic asset allocation with disciplined, incremental investing.

Customization and Control Over Investments

Robo-advisors offer tailored portfolio recommendations based on risk tolerance and financial goals but often limit customization options to predefined asset allocations. Automated DCA (Dollar-Cost Averaging) platforms provide granular control over investment timing and amounts, allowing investors to specify exact schedules and contribution values. Investors seeking precise control over individual transactions may prefer DCA platforms, while those prioritizing algorithm-driven portfolio management might opt for robo-advisors.

Performance Tracking and Reporting Features

Robo-advisors offer comprehensive performance tracking and reporting features that include detailed portfolio analytics, tax-loss harvesting reports, and personalized investment insights, enhancing investors' ability to monitor growth and make informed decisions. Automated DCA platforms focus primarily on simplifying systematic investment through dollar-cost averaging but typically provide more basic performance summaries and less granular reporting tools. Investors seeking sophisticated data visualization and real-time performance metrics may prefer robo-advisors for their advanced analytical capabilities and user-friendly dashboards.

Suitability for Different Investor Profiles

Robo-advisors provide tailored portfolio management using algorithms suited for investors seeking diversified, low-maintenance investment strategies with risk tolerance assessments. Automated Dollar-Cost Averaging (DCA) platforms appeal to disciplined investors prioritizing consistent investment amounts over time to mitigate market volatility. Risk-averse beginners often prefer robo-advisors, while self-directed investors with steady cash flow benefit from automated DCA for gradual wealth accumulation.

Choosing the Right Solution for Your Financial Goals

Robo-advisors offer tailored portfolio management using algorithms and human oversight, ideal for investors seeking automated diversification and rebalancing aligned with their risk profile. Automated Dollar-Cost Averaging (DCA) platforms prioritize consistent, scheduled investments to mitigate market volatility, suitable for disciplined savers aiming to build wealth steadily over time. Evaluating factors such as desired customization, risk tolerance, investment horizon, and fee structures is crucial in selecting the optimal solution that supports long-term financial objectives.

Related Important Terms

Algorithmic Portfolio Rebalancing

Robo-advisors leverage algorithmic portfolio rebalancing to maintain optimal asset allocation by automatically adjusting investments based on market fluctuations and risk tolerance, enhancing long-term portfolio performance. Automated DCA platforms primarily focus on systematic investments through dollar-cost averaging, but often lack the dynamic rebalancing capabilities that robo-advisors use to optimize returns and risk management.

Micro-Investing Automation

Robo-advisors utilize algorithm-driven portfolio management tailored to individual risk profiles, offering automated rebalancing and tax-loss harvesting, whereas automated Dollar-Cost Averaging (DCA) platforms specialize in consistent, scheduled micro-investments that mitigate market volatility impact. Micro-investing automation leverages fractional shares and low fees, enabling investors to build diversified portfolios incrementally with minimal effort and enhanced accessibility.

Goal-Based Robo-Allocation

Goal-based robo-allocation in robo-advisors optimizes portfolio construction by dynamically adjusting asset allocation to align with investor-specific financial milestones, leveraging algorithms that consider risk tolerance and investment horizon. Automated DCA platforms focus primarily on systematic contributions to reduce market timing risk but typically lack the personalized, goal-driven rebalancing features that enhance portfolio performance and goal achievement in robo-advisors.

DCA Aggregator Platform

DCA aggregator platforms streamline automated dollar-cost averaging by consolidating investments across multiple assets and accounts, optimizing portfolio diversification and reducing market timing risks. By leveraging algorithm-driven schedules and real-time market data, these platforms enhance investment discipline and cost efficiency compared to traditional robo-advisors.

Hybrid Human-AI Advisory

Hybrid Human-AI advisory platforms combine the personalized expertise of financial advisors with the efficiency of robo-advisors, enhancing investment strategies through advanced algorithms and tailored human insights. This approach offers dynamic portfolio management and automated dollar-cost averaging (DCA) that adapts to market conditions while addressing individual risk tolerance and financial goals.

Fractional Share Auto-Purchasing

Robo-advisors offer personalized portfolio management using algorithms, while automated DCA platforms emphasize disciplined investing through fractional share auto-purchasing, enabling investors to buy partial shares regularly regardless of price fluctuations. Fractional share auto-purchasing enhances diversification and dollar-cost averaging by allowing smaller investments to accumulate into well-balanced portfolios efficiently.

Behavioral Finance Algorithms

Robo-advisors leverage behavioral finance algorithms to customize investment portfolios by analyzing client biases, risk tolerance, and financial goals, enhancing decision-making efficiency. Automated DCA platforms systematically invest fixed amounts regularly, minimizing emotional bias and market-timing errors, aligning with behavioral finance principles to promote disciplined investment habits.

Recurring Cashflow Investment Engine

Robo-advisors offer personalized portfolio management using advanced algorithms, optimizing asset allocation based on investor risk profiles and goals, while automated DCA platforms focus on systematic, recurring cashflow investment to mitigate market volatility through consistent buying. The recurring cashflow investment engine in automated DCA platforms ensures disciplined investing by allocating fixed amounts at regular intervals, promoting long-term wealth accumulation with reduced emotional decision-making risk.

ESG-Themed Automated Portfolios

Robo-advisors offering ESG-themed automated portfolios leverage advanced algorithms to optimize diversified investments in sustainable assets, aligning with investors' environmental and social values while ensuring risk-adjusted returns. Automated DCA platforms systematically invest fixed amounts into ESG funds over time, reducing market timing risks and fostering disciplined contributions aligned with long-term sustainable growth goals.

Risk Profiling AI-Bots

Robo-advisors leverage advanced AI-powered risk profiling algorithms to tailor investment portfolios according to individual risk tolerance, ensuring optimized asset allocation and personalized financial strategies. Automated DCA platforms use AI bots mainly to execute scheduled investments, lacking sophisticated risk assessment capabilities, which may lead to less customized risk management compared to robo-advisor solutions.

Robo-Advisors vs Automated DCA Platforms for investment. Infographic

moneydiff.com

moneydiff.com