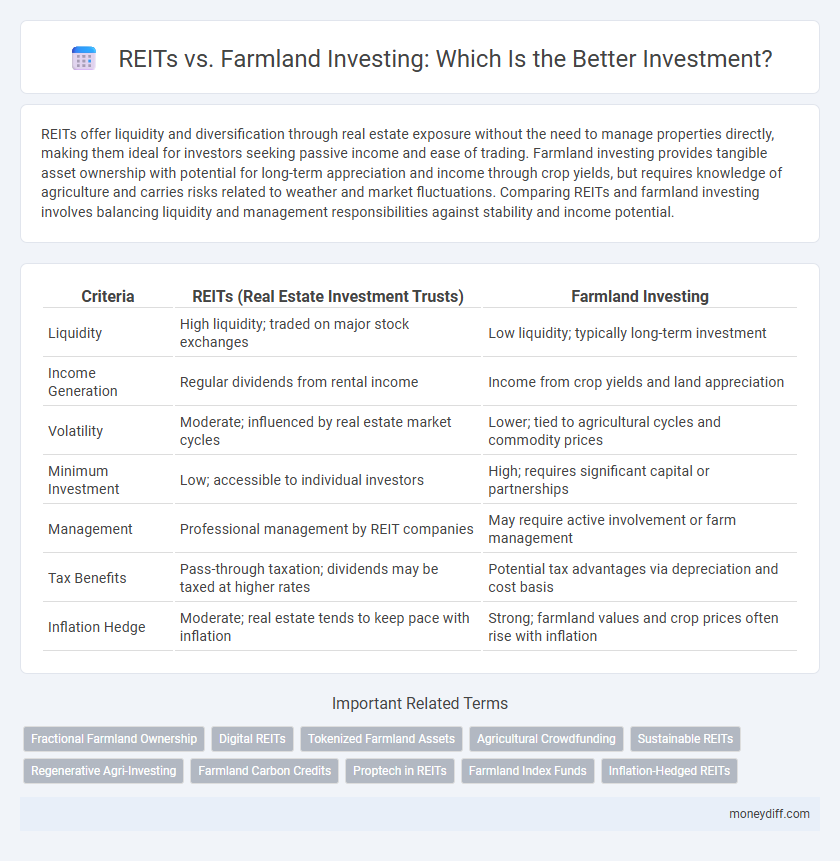

REITs offer liquidity and diversification through real estate exposure without the need to manage properties directly, making them ideal for investors seeking passive income and ease of trading. Farmland investing provides tangible asset ownership with potential for long-term appreciation and income through crop yields, but requires knowledge of agriculture and carries risks related to weather and market fluctuations. Comparing REITs and farmland investing involves balancing liquidity and management responsibilities against stability and income potential.

Table of Comparison

| Criteria | REITs (Real Estate Investment Trusts) | Farmland Investing |

|---|---|---|

| Liquidity | High liquidity; traded on major stock exchanges | Low liquidity; typically long-term investment |

| Income Generation | Regular dividends from rental income | Income from crop yields and land appreciation |

| Volatility | Moderate; influenced by real estate market cycles | Lower; tied to agricultural cycles and commodity prices |

| Minimum Investment | Low; accessible to individual investors | High; requires significant capital or partnerships |

| Management | Professional management by REIT companies | May require active involvement or farm management |

| Tax Benefits | Pass-through taxation; dividends may be taxed at higher rates | Potential tax advantages via depreciation and cost basis |

| Inflation Hedge | Moderate; real estate tends to keep pace with inflation | Strong; farmland values and crop prices often rise with inflation |

Understanding REITs: An Overview

Real Estate Investment Trusts (REITs) allow investors to gain exposure to diversified real estate portfolios without directly owning properties, offering liquidity similar to stocks. REITs generate income primarily through rental yields and capital appreciation, and they are legally required to distribute at least 90% of taxable income as dividends. Compared to farmland investing, REITs provide greater market accessibility and less management responsibility, making them a more passive investment option.

Exploring Farmland Investing

Farmland investing offers tangible asset appreciation, consistent income through crop yields, and diversification benefits that are less correlated with stock market volatility compared to REITs. Farmland provides inflation hedge advantages due to rising land values and increasing agricultural commodity prices. Investors benefit from potential tax incentives and long-term capital growth driven by global food demand and sustainable agriculture trends.

Historical Performance Comparison

REITs have historically delivered average annual returns of around 8-12% over the past two decades, driven by consistent rental income and property appreciation. Farmland investing, meanwhile, has shown competitive returns averaging 9-11% annually, benefiting from crop yield improvements and rising land values. Both asset classes exhibit low correlation to traditional equities, offering diversification but with differing risk profiles and liquidity constraints.

Income Generation Potential

REITs typically offer higher liquidity and consistent dividend income derived from diversified commercial real estate holdings, making them attractive for steady income generation. Farmland investing provides potential for income through crop yields and land lease payments, with income stability tied closely to agricultural commodity prices and weather conditions. Investors seeking predictable cash flow might prefer REITs, while those willing to accept variability for inflation protection and asset appreciation may consider farmland.

Risk Factors in REITs and Farmland

REITs expose investors to market volatility, interest rate fluctuations, and sector-specific risks such as property devaluation or tenant defaults, impacting income stability. Farmland investing carries risks related to weather conditions, crop yields, regulatory changes, and commodity price fluctuations, affecting asset productivity and returns. Both asset classes require careful risk assessment, but farmland offers diversification benefits and inflation hedging compared to REITs' sensitivity to economic cycles and real estate market dynamics.

Liquidity and Accessibility

REITs offer significantly higher liquidity compared to farmland investing, as shares can be bought and sold quickly on public markets, enabling easy entry and exit for investors. Farmland investments tend to have lower accessibility due to higher capital requirements and longer holding periods, making it challenging for average investors to participate. The ease of trading REITs enhances portfolio flexibility, while farmland requires a more hands-on approach and patience for illiquid asset appreciation.

Diversification Benefits

REITs provide investors with exposure to diversified property portfolios including commercial, residential, and industrial assets, enhancing liquidity and reducing risk through professional management. Farmland investing offers diversification by adding an asset class less correlated with traditional financial markets, benefiting from agricultural commodity cycles and inflation hedging. Combining REITs and farmland in a portfolio increases overall diversification, balancing market volatility with stable, income-generating real assets.

Tax Implications

REITs offer favorable tax treatment with dividends usually taxed as ordinary income, but they allow for deductions like depreciation that can reduce taxable income. Farmland investing benefits from lower capital gains tax rates when land is held long-term, and potential property tax benefits vary by jurisdiction. Understanding state-specific tax rules and passive income classifications is crucial for optimizing returns in both investment types.

Upfront Costs and Capital Requirements

REITs typically require lower upfront costs and allow investors to enter the market with smaller capital due to fractional ownership and liquidity, while farmland investing demands significant initial capital for land acquisition and maintenance. Farmland investments involve additional expenses such as property taxes, equipment, and operational costs, leading to higher capital requirements. REITs offer a more accessible entry point for investors seeking exposure to real estate without intensive capital commitments.

Long-Term Growth Prospects

REITs offer liquidity and diversified exposure to commercial real estate, with historically steady income and moderate long-term appreciation. Farmland investing provides inflation hedge benefits through tangible asset ownership and potential for capital growth linked to rising food demand and land scarcity. Both asset classes demonstrate unique growth drivers, but farmland often yields higher resilience during economic downturns, supporting sustained wealth accumulation over decades.

Related Important Terms

Fractional Farmland Ownership

Fractional farmland ownership offers direct exposure to agricultural assets with potential for stable cash flow and capital appreciation, contrasting with REITs that provide more liquid, diversified real estate portfolios but may be subject to market volatility. Investors seeking tangible asset control and inflation hedging often prefer fractional farmland for its lower correlation to traditional markets and long-term land value growth.

Digital REITs

Digital REITs offer investors liquid access to diversified real estate portfolios with lower entry costs and real-time trading capabilities, contrasting with farmland investing which typically requires substantial capital and entails longer holding periods due to illiquidity and operational risks. The integration of blockchain technology in Digital REITs enhances transparency, reduces administrative overhead, and provides fractional ownership opportunities, making them a more flexible and accessible option compared to traditional farmland investments.

Tokenized Farmland Assets

Tokenized farmland assets offer a unique investment opportunity combining the liquidity of Real Estate Investment Trusts (REITs) with the tangible value and inflation hedge of agricultural land, enabling fractional ownership and blockchain-based transparency. Unlike traditional REITs, tokenized farmland investments provide direct exposure to farmland appreciation and crop yield profits, enhancing portfolio diversification with lower volatility compared to typical real estate markets.

Agricultural Crowdfunding

Agricultural crowdfunding platforms provide investors with access to diverse farmland investments, offering fractional ownership and the potential for steady income through crop yields and land appreciation, unlike REITs which typically focus on commercial real estate with different risk and return profiles. Farmland investing via crowdfunding enables direct exposure to agricultural assets, benefiting from sustainable land management and food demand growth, making it a distinct alternative to traditional REIT investments.

Sustainable REITs

Sustainable REITs prioritize eco-friendly property management and energy-efficient infrastructure, offering investors exposure to real estate with long-term environmental benefits and potential for stable income streams. Farmland investing provides tangible asset growth through crop production and land appreciation but may involve higher operational risks and lower liquidity compared to the transparent market and dividend structures of sustainable REITs.

Regenerative Agri-Investing

Regenerative agriculture-focused REITs offer scalable, professionally managed access to sustainable farmland assets, emphasizing soil health and carbon sequestration for long-term value growth. Direct farmland investing in regenerative practices provides hands-on control and participation in ecological restoration, potentially delivering both environmental impact and stable income through crop yields and land appreciation.

Farmland Carbon Credits

Farmland investing offers unique opportunities through Farmland Carbon Credits, which generate revenue by capturing and sequestering atmospheric carbon in soil, providing investors with both ecological benefits and long-term income. Unlike REITs that primarily focus on rental income and property appreciation, farmland investments capitalize on sustainable agricultural practices and carbon markets, aligning with growing demand for environmentally responsible assets.

Proptech in REITs

REITs incorporating PropTech leverage advanced data analytics and automation to optimize asset management and enhance returns, offering greater liquidity and diversification compared to traditional farmland investing, which relies on physical asset appreciation and agricultural yields. The integration of PropTech in REITs enables real-time market insights and efficient portfolio management, making them a more scalable and technology-driven option for investors seeking exposure to real estate.

Farmland Index Funds

Farmland index funds offer diversified exposure to agricultural real estate, providing investors with inflation protection and steady income through crop yields and land appreciation. Compared to REITs, farmland funds typically experience lower volatility and benefit from the increasing global demand for food and sustainable land management practices.

Inflation-Hedged REITs

Inflation-hedged REITs, particularly those focused on commercial and industrial properties, provide consistent dividend yields and capital appreciation by adjusting rents based on inflation indices, making them a resilient choice against rising inflation compared to farmland investing, which can face climate risks and operational variability. While farmland offers tangible asset benefits and potential crop yield growth, inflation-hedged REITs outperform in liquidity, diversification, and stability during inflationary periods.

REITs vs Farmland Investing for investment. Infographic

moneydiff.com

moneydiff.com