Hedge funds offer diversified investment strategies with professional management and regulatory oversight, providing stability and long-term growth potential. Crypto hedge funds specifically target digital assets, offering higher volatility and potential for substantial returns but carry increased risk due to market unpredictability and regulatory uncertainties. Investors should balance risk tolerance and investment goals when choosing between traditional hedge funds and crypto hedge funds.

Table of Comparison

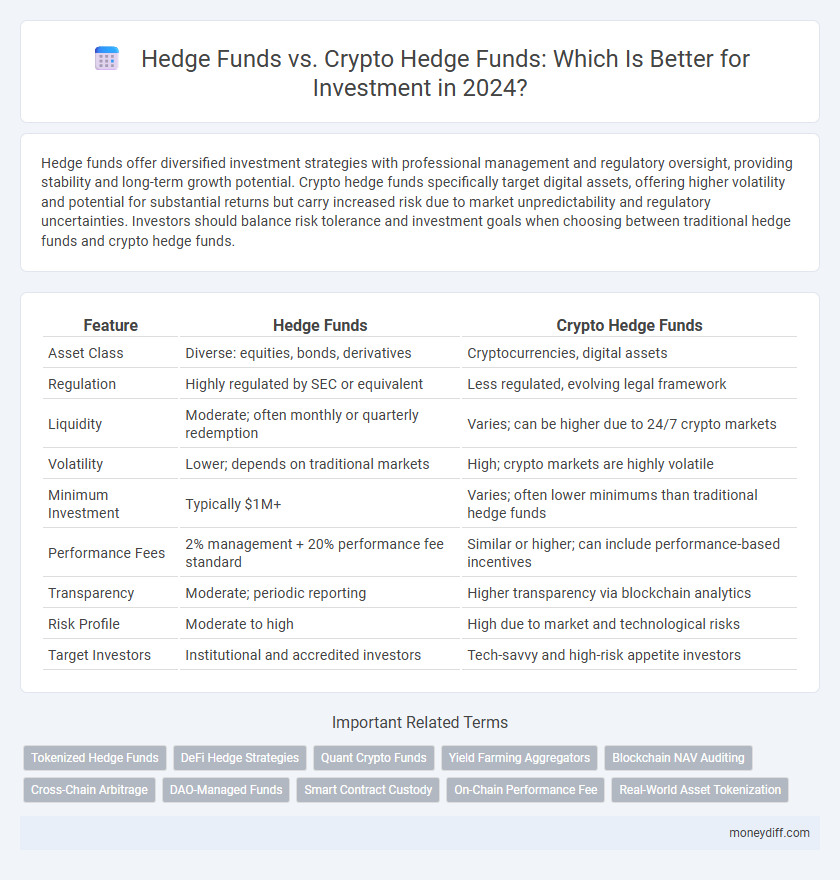

| Feature | Hedge Funds | Crypto Hedge Funds |

|---|---|---|

| Asset Class | Diverse: equities, bonds, derivatives | Cryptocurrencies, digital assets |

| Regulation | Highly regulated by SEC or equivalent | Less regulated, evolving legal framework |

| Liquidity | Moderate; often monthly or quarterly redemption | Varies; can be higher due to 24/7 crypto markets |

| Volatility | Lower; depends on traditional markets | High; crypto markets are highly volatile |

| Minimum Investment | Typically $1M+ | Varies; often lower minimums than traditional hedge funds |

| Performance Fees | 2% management + 20% performance fee standard | Similar or higher; can include performance-based incentives |

| Transparency | Moderate; periodic reporting | Higher transparency via blockchain analytics |

| Risk Profile | Moderate to high | High due to market and technological risks |

| Target Investors | Institutional and accredited investors | Tech-savvy and high-risk appetite investors |

Understanding Traditional Hedge Funds

Traditional hedge funds employ diverse strategies such as long-short equity, arbitrage, and macroeconomic bets to generate returns while managing risk through professional portfolio management and regulatory oversight. They typically invest in regulated financial instruments including stocks, bonds, and derivatives, focusing on capital preservation and steady growth. These funds require high minimum investments and cater primarily to accredited investors seeking diversified exposure with established risk controls.

What Are Crypto Hedge Funds?

Crypto hedge funds are investment vehicles that pool capital to invest primarily in cryptocurrencies and blockchain-related assets, leveraging strategies such as arbitrage, market making, and algorithmic trading to generate returns. Unlike traditional hedge funds, crypto hedge funds operate in a highly volatile and rapidly evolving market, offering exposure to digital assets like Bitcoin, Ethereum, and other altcoins. These funds appeal to investors seeking diversification beyond conventional financial instruments, combining the potential for high returns with increased risk due to market fluctuations and regulatory uncertainty.

Key Differences Between Hedge Funds and Crypto Hedge Funds

Hedge funds typically invest in traditional assets such as equities, bonds, and derivatives, utilizing diversified strategies to mitigate risk and achieve steady returns, while crypto hedge funds focus exclusively on digital assets like cryptocurrencies and blockchain technology-based tokens, often embracing higher volatility for amplified gains. Regulatory oversight on hedge funds is more established and stringent, whereas crypto hedge funds operate in a relatively nascent and evolving regulatory environment, influencing risk profiles and investor protections. Liquidity varies significantly, with hedge funds offering more predictable redemption schedules compared to crypto hedge funds, where market liquidity and asset volatility can impact investors' ability to exit positions swiftly.

Risk Profiles: Hedge Funds vs Crypto Hedge Funds

Hedge funds typically exhibit lower risk profiles due to diversified portfolios across traditional assets like equities, bonds, and commodities, often employing risk management strategies to mitigate volatility. Crypto hedge funds face higher risk levels driven by the inherent volatility of cryptocurrencies, regulatory uncertainty, and limited historical data, increasing exposure to market swings and liquidity challenges. Investors in crypto hedge funds must assess tolerance for amplified price fluctuations and potential technological risks compared to more stable hedge fund investments.

Potential Returns: Which Offers Better Growth?

Hedge funds traditionally deliver steady, risk-adjusted returns by leveraging diversified assets and advanced strategies, often targeting annualized returns between 7-12%. Crypto hedge funds, while highly volatile, present opportunities for exponential growth with annual returns sometimes exceeding 50%, driven by the rapid innovation and market inefficiencies in the cryptocurrency space. Investors prioritizing aggressive growth may favor crypto hedge funds, but those seeking consistency and capital preservation typically prefer traditional hedge funds.

Regulatory Landscape Comparison

Hedge funds operate under well-established regulatory frameworks such as the Investment Advisers Act of 1940 and the Dodd-Frank Act, ensuring investor protections and transparent reporting requirements. Crypto hedge funds face evolving and often uncertain regulatory environments, with jurisdictions imposing varying degrees of oversight, including compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. The regulatory disparity affects risk management, investor confidence, and operational stability within traditional hedge funds versus crypto hedge funds.

Fees and Cost Structures

Hedge funds typically charge a 2% management fee and 20% performance fee, reflecting traditional cost structures in investment management. Crypto hedge funds may offer lower management fees closer to 1%, but their performance fees can vary widely due to market volatility and regulatory uncertainty. Investors should assess the total cost of ownership, including potential hidden expenses like custody, transaction fees, and tax implications when comparing these two types of hedge funds.

Accessibility for Individual Investors

Traditional hedge funds often require high minimum investments and are limited to accredited investors, restricting accessibility for most individuals. Crypto hedge funds tend to offer lower entry barriers and more flexible investment options, enabling broader participation from retail investors. However, the regulatory environment for crypto hedge funds remains less established, impacting transparency and risk assessment for individual investors.

Diversification Strategies in Each Fund Type

Hedge funds primarily employ diversification strategies by allocating assets across stocks, bonds, commodities, and derivatives to reduce risk while targeting consistent returns. Crypto hedge funds emphasize diversification within digital assets, investing in a mix of cryptocurrencies, blockchain startups, and tokenized assets to capitalize on the volatile market. Both fund types utilize portfolio diversification to enhance risk-adjusted performance, but crypto hedge funds face unique challenges due to the emerging nature and high volatility of crypto markets.

Future Trends: The Evolution of Hedge Funds and Crypto Hedge Funds

Hedge funds are increasingly integrating blockchain technology and digital assets, signaling a shift towards hybrid investment models that blend traditional strategies with cryptocurrency exposure. Crypto hedge funds are evolving with enhanced regulatory compliance and sophisticated risk management tools, attracting institutional investors seeking high-growth opportunities in the digital finance ecosystem. The future landscape of investments will likely feature convergence between hedge funds and crypto-focused funds, driven by advancements in decentralized finance (DeFi) and algorithmic trading techniques.

Related Important Terms

Tokenized Hedge Funds

Tokenized hedge funds offer enhanced liquidity, transparency, and accessibility compared to traditional hedge funds by leveraging blockchain technology to fractionalize ownership through digital tokens. These funds attract a broader investor base, reduce entry barriers, and enable real-time tracking of asset performance, positioning them as a disruptive innovation within the hedge fund investment landscape.

DeFi Hedge Strategies

Hedge funds traditionally utilize diversified portfolios and sophisticated risk management to generate consistent returns, while crypto hedge funds, particularly those employing DeFi hedge strategies, capitalize on decentralized finance protocols to leverage yield farming, liquidity mining, and automated market making. DeFi hedge strategies exploit smart contract automation and token arbitrage across decentralized exchanges, offering enhanced liquidity and increased transparency compared to conventional hedge fund models.

Quant Crypto Funds

Quant crypto hedge funds leverage algorithmic trading and advanced data analytics to capitalize on volatile cryptocurrency markets, offering higher risk-adjusted returns compared to traditional hedge funds. Their ability to process vast amounts of real-time market data and execute high-frequency trades provides investors with diversified exposure and enhanced alpha generation in the evolving digital asset space.

Yield Farming Aggregators

Hedge funds traditionally manage diversified portfolios with established regulatory frameworks, whereas crypto hedge funds emphasize digital asset strategies, including yield farming aggregators that optimize returns through automated DeFi protocol investments. Yield farming aggregators enhance crypto hedge fund performance by pooling liquidity, minimizing gas fees, and dynamically reallocating capital across high-yield DeFi platforms for maximum yield optimization.

Blockchain NAV Auditing

Hedge funds utilizing traditional investment strategies contrast with crypto hedge funds, which specifically leverage blockchain technology for enhanced transparency through real-time NAV auditing. Blockchain NAV auditing enables immutable, automated tracking of asset valuations, reducing errors and increasing investor confidence by providing verifiable, on-chain records of fund performance.

Cross-Chain Arbitrage

Hedge funds specializing in cross-chain arbitrage leverage advanced algorithms to exploit price discrepancies across multiple blockchain networks, delivering potentially higher returns with diversified risk exposure compared to traditional hedge funds. Crypto hedge funds enhance liquidity and efficiency in decentralized markets by capitalizing on the rapid transaction speeds and lower fees inherent in blockchain technology.

DAO-Managed Funds

DAO-managed funds represent a revolutionary shift in investment structures, leveraging decentralized autonomous organizations to enhance transparency and reduce management fees compared to traditional hedge funds and crypto hedge funds. These funds enable investors to participate in collective decision-making through smart contracts on blockchain platforms, increasing governance efficiency and potentially improving returns by minimizing human biases and operational overhead.

Smart Contract Custody

Hedge funds typically rely on traditional custodial services for asset security, whereas crypto hedge funds utilize smart contract custody solutions that enhance transparency, reduce counterparty risk, and enable automated, programmable asset management. Smart contract custody in crypto hedge funds leverages blockchain technology to provide decentralized control and real-time auditing, offering investors heightened security and efficiency compared to conventional hedge fund custody models.

On-Chain Performance Fee

Hedge funds typically charge performance fees based on traditional asset returns, whereas crypto hedge funds leverage on-chain data to transparently calculate performance fees, enhancing trust and accuracy. On-chain performance fees allow investors to verify transactions and portfolio adjustments in real-time, potentially reducing disputes and increasing accountability in crypto hedge fund investments.

Real-World Asset Tokenization

Hedge funds traditionally manage diversified portfolios in equities, bonds, and derivatives, while crypto hedge funds leverage blockchain technology to facilitate real-world asset tokenization, enabling fractional ownership, enhanced liquidity, and 24/7 market access. Real-world asset tokenization in crypto hedge funds unlocks new investment opportunities by transforming physical assets like real estate and commodities into digital tokens, driving transparency and reducing settlement times compared to conventional hedge fund assets.

Hedge Funds vs Crypto Hedge Funds for investment. Infographic

moneydiff.com

moneydiff.com