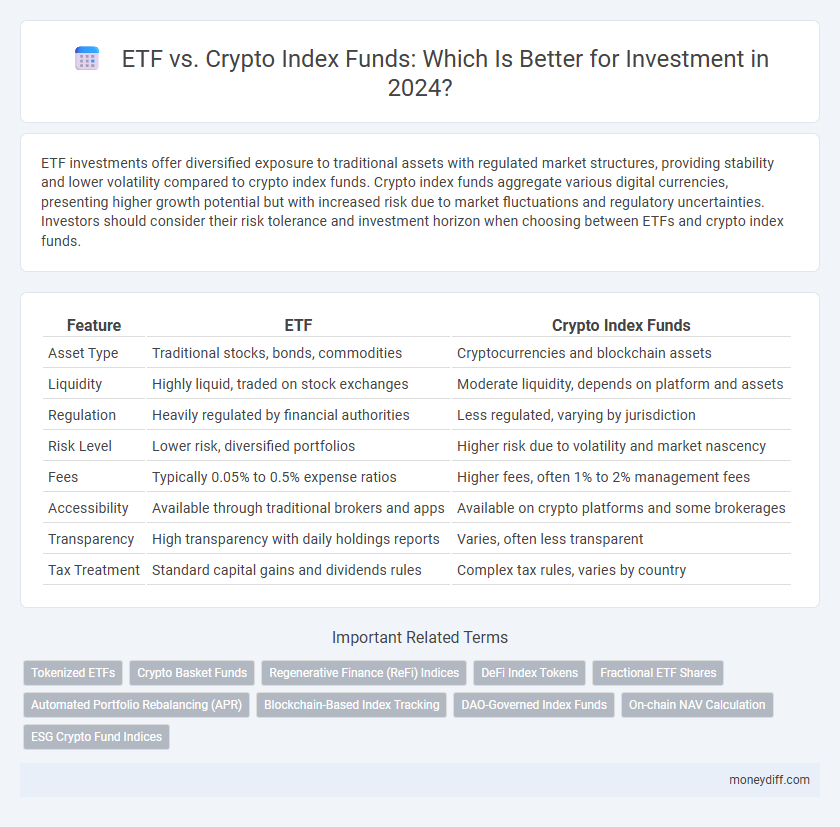

ETF investments offer diversified exposure to traditional assets with regulated market structures, providing stability and lower volatility compared to crypto index funds. Crypto index funds aggregate various digital currencies, presenting higher growth potential but with increased risk due to market fluctuations and regulatory uncertainties. Investors should consider their risk tolerance and investment horizon when choosing between ETFs and crypto index funds.

Table of Comparison

| Feature | ETF | Crypto Index Funds |

|---|---|---|

| Asset Type | Traditional stocks, bonds, commodities | Cryptocurrencies and blockchain assets |

| Liquidity | Highly liquid, traded on stock exchanges | Moderate liquidity, depends on platform and assets |

| Regulation | Heavily regulated by financial authorities | Less regulated, varying by jurisdiction |

| Risk Level | Lower risk, diversified portfolios | Higher risk due to volatility and market nascency |

| Fees | Typically 0.05% to 0.5% expense ratios | Higher fees, often 1% to 2% management fees |

| Accessibility | Available through traditional brokers and apps | Available on crypto platforms and some brokerages |

| Transparency | High transparency with daily holdings reports | Varies, often less transparent |

| Tax Treatment | Standard capital gains and dividends rules | Complex tax rules, varies by country |

Understanding ETFs and Crypto Index Funds

ETFs (Exchange-Traded Funds) offer diversified exposure to stocks, bonds, or commodities with regulated market trading and typically lower fees. Crypto index funds aggregate multiple cryptocurrencies, providing investors broader market exposure with higher volatility and less regulatory oversight. Understanding the risk profiles, liquidity, and management strategies of each fund type is essential for balancing portfolio growth and risk tolerance.

Key Differences Between ETFs and Crypto Index Funds

ETFs provide diversified exposure to traditional asset classes like stocks and bonds, regulated by financial authorities, and often feature lower volatility compared to Crypto Index Funds, which track a basket of cryptocurrencies within a highly volatile and less regulated market. ETFs offer greater liquidity and transparency with established market infrastructure, while Crypto Index Funds provide targeted access to emerging blockchain assets and decentralized finance projects. Investors must weigh the stability and regulatory protections of ETFs against the high growth potential and risk inherent in Crypto Index Funds.

Historical Performance: ETFs vs Crypto Index Funds

ETFs have demonstrated consistent historical performance with lower volatility due to diversified asset allocation across traditional markets, often yielding average annual returns between 7-10% over the past decade. Crypto index funds, while showing explosive growth with annual returns sometimes exceeding 100% during bullish cycles, exhibit significantly higher volatility and risk, often influenced by market sentiment and regulatory developments. Investors seeking stability and long-term growth typically favor ETFs, whereas those willing to accept higher risk for potential outsized returns may consider crypto index funds as a complement to traditional investment portfolios.

Risk Factors: Assessing Investment Volatility

ETF investments typically exhibit lower volatility due to diversified portfolios regulated by established financial entities, offering more predictable risk profiles. Crypto index funds, however, face higher risk from market fluctuations, regulatory uncertainties, and technological vulnerabilities, resulting in significant price swings. Investors must evaluate their risk tolerance carefully, considering the inherent instability and potential for rapid asset appreciation or loss in cryptocurrency markets.

Liquidity and Accessibility in ETFs vs Crypto Index Funds

ETFs offer high liquidity with shares traded on major stock exchanges, allowing investors to buy and sell assets instantly during market hours. Crypto index funds face lower liquidity due to limited trading platforms and less established markets, which can lead to price slippage and longer transaction times. Accessibility differs as ETFs require traditional brokerage accounts, while crypto index funds are accessible 24/7 through various digital wallets and decentralized exchanges, appealing to investors seeking around-the-clock trading.

Diversification Benefits: Traditional vs Crypto Portfolio

Exchange-Traded Funds (ETFs) provide broad diversification across established sectors, reducing risk through exposure to multiple asset classes such as stocks, bonds, and commodities. Crypto index funds offer diversification within the digital asset space by holding a range of cryptocurrencies, which can enhance portfolio volatility management but remain correlated to market-specific risks. Combining traditional ETFs with crypto index funds can optimize diversification benefits by balancing stable, regulated investments with high-growth, high-risk digital assets.

Fees and Costs: Comparing Investment Expenses

ETFs generally offer lower expense ratios, typically ranging from 0.03% to 0.50%, while Crypto Index Funds often charge higher fees between 0.50% and 2% due to custody and security complexities. Transaction costs for ETFs are usually minimal, benefiting from established market infrastructure, whereas Crypto Index Funds may incur higher trading and blockchain network fees. Investors should carefully consider these cost differences, as higher expenses in Crypto Index Funds can significantly impact long-term returns compared to the more cost-efficient ETF options.

Regulatory Environment: ETFs and Crypto Index Funds

Exchange-Traded Funds (ETFs) operate within well-established regulatory frameworks enforced by organizations like the SEC, offering investors greater transparency and legal protections. Crypto index funds face evolving regulatory scrutiny, varying significantly by jurisdiction, with some countries imposing strict compliance requirements while others maintain lax oversight. This regulatory disparity affects fund stability, investor confidence, and potential market accessibility in each investment type.

Suitability for Different Investor Profiles

ETF investments offer diversification and lower volatility, making them suitable for risk-averse investors seeking stable long-term growth. Crypto index funds appeal to more aggressive, tech-savvy investors willing to accept higher volatility for potential outsized returns in the emerging digital asset market. Understanding risk tolerance, investment horizon, and knowledge of each asset class helps determine which option aligns best with an individual's financial goals.

Future Outlook: Growth Potential and Trends

ETF investments display steady growth driven by regulatory clarity, diversified portfolios, and institutional adoption, making them a reliable choice for long-term wealth accumulation. Crypto index funds offer high growth potential fueled by blockchain innovation, increasing market capitalization, and expanding DeFi applications, although they carry higher volatility and regulatory uncertainty. Emerging trends indicate hybrid financial products that combine ETF stability with crypto asset exposure could become a dominant force in the next decade's investment landscape.

Related Important Terms

Tokenized ETFs

Tokenized ETFs combine the regulatory transparency and diversified exposure of traditional ETFs with blockchain's efficiency, providing seamless, fractional ownership and 24/7 trading opportunities. Compared to crypto index funds, tokenized ETFs offer enhanced liquidity, reduced counterparty risk, and easier portfolio management through programmable smart contracts on decentralized platforms.

Crypto Basket Funds

Crypto basket funds offer diversified exposure to multiple cryptocurrencies within a single investment vehicle, reducing volatility risks compared to individual crypto assets. Unlike traditional ETFs, these funds leverage blockchain technology for transparency and often provide easier access to the crypto market through regulated exchanges.

Regenerative Finance (ReFi) Indices

ETF investments in Regenerative Finance (ReFi) indices offer diversified exposure with regulated transparency and lower volatility compared to crypto index funds, which provide higher growth potential but with increased risk and less regulatory oversight. ReFi-focused ETFs enable investors to support sustainable projects through established financial markets, while crypto index funds deliver decentralized access to emerging green blockchain initiatives.

DeFi Index Tokens

DeFi index tokens represent a strategic subset of crypto index funds that provide diversified exposure to decentralized finance projects, often outperforming traditional ETFs through higher growth potential and liquidity on blockchain platforms. Their algorithm-driven rebalancing and transparent smart contract structures offer investors enhanced risk management and real-time asset tracking compared to conventional ETF models.

Fractional ETF Shares

Fractional ETF shares enable investors to buy smaller portions of expensive ETFs, increasing accessibility and diversification compared to crypto index funds that often require whole unit purchases and involve higher volatility. While crypto index funds offer exposure to multiple digital assets, fractional ETFs provide regulated market stability and broad asset allocation, making them a practical choice for balanced investment portfolios.

Automated Portfolio Rebalancing (APR)

Automated Portfolio Rebalancing (APR) in ETFs ensures consistent asset allocation by periodically adjusting holdings to maintain target risk levels, enhancing portfolio stability. Crypto index funds with APR leverage blockchain technology for real-time rebalancing, offering increased transparency and reduced manual intervention compared to traditional ETFs.

Blockchain-Based Index Tracking

Blockchain-based index tracking through crypto index funds offers diversified exposure to multiple cryptocurrencies by mirroring a basket of digital assets, while ETFs provide regulated investment options with traditional market indices but limited direct blockchain asset integration. Crypto index funds leverage blockchain transparency and real-time asset rebalancing, enhancing liquidity and security compared to conventional ETF structures.

DAO-Governed Index Funds

DAO-governed index funds offer decentralized management and transparent decision-making processes, distinguishing them from traditional ETFs by leveraging blockchain technology for enhanced security and community-driven governance. These crypto index funds provide diversified exposure to digital assets while enabling token holders to participate directly in fund operations, aligning investment strategies with decentralized finance (DeFi) principles.

On-chain NAV Calculation

ETF net asset value (NAV) calculation relies on end-of-day market prices, offering transparency but limited intraday updates, while crypto index funds utilize on-chain data to compute real-time NAV, enhancing accuracy and responsiveness. On-chain NAV enables investors to track precise asset valuations across decentralized finance (DeFi) protocols, minimizing discrepancies caused by market volatility and providing continuous portfolio insights.

ESG Crypto Fund Indices

ESG crypto fund indices integrate environmental, social, and governance criteria into diversified portfolios of cryptocurrencies, offering investors aligned with sustainable values a targeted exposure distinct from traditional ETFs. These indices provide enhanced transparency and accountability in the rapidly evolving crypto market, addressing ethical concerns often overlooked by conventional financial instruments.

ETF vs Crypto Index Funds for investment. Infographic

moneydiff.com

moneydiff.com