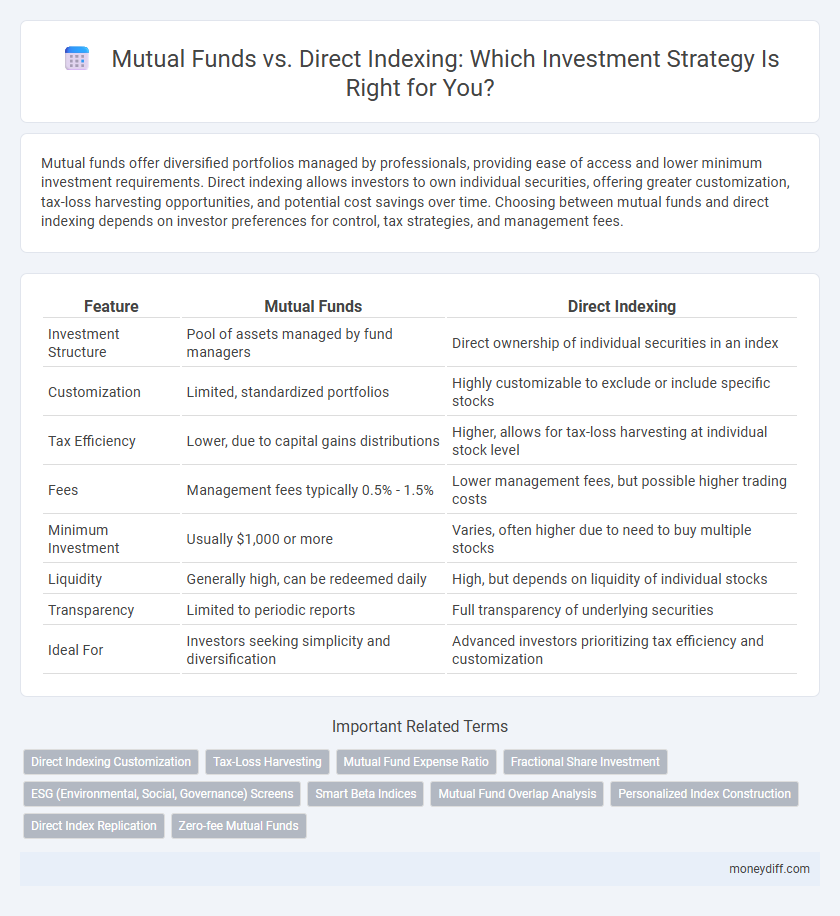

Mutual funds offer diversified portfolios managed by professionals, providing ease of access and lower minimum investment requirements. Direct indexing allows investors to own individual securities, offering greater customization, tax-loss harvesting opportunities, and potential cost savings over time. Choosing between mutual funds and direct indexing depends on investor preferences for control, tax strategies, and management fees.

Table of Comparison

| Feature | Mutual Funds | Direct Indexing |

|---|---|---|

| Investment Structure | Pool of assets managed by fund managers | Direct ownership of individual securities in an index |

| Customization | Limited, standardized portfolios | Highly customizable to exclude or include specific stocks |

| Tax Efficiency | Lower, due to capital gains distributions | Higher, allows for tax-loss harvesting at individual stock level |

| Fees | Management fees typically 0.5% - 1.5% | Lower management fees, but possible higher trading costs |

| Minimum Investment | Usually $1,000 or more | Varies, often higher due to need to buy multiple stocks |

| Liquidity | Generally high, can be redeemed daily | High, but depends on liquidity of individual stocks |

| Transparency | Limited to periodic reports | Full transparency of underlying securities |

| Ideal For | Investors seeking simplicity and diversification | Advanced investors prioritizing tax efficiency and customization |

Understanding Mutual Funds: A Comprehensive Overview

Mutual funds pool capital from multiple investors to invest in diversified portfolios of stocks, bonds, or other securities, managed by professional fund managers aiming to achieve specific investment objectives. They offer liquidity, diversification, and ease of access with varying expense ratios reflecting management and operational costs. Understanding key metrics such as net asset value (NAV), expense ratio, and fund performance history helps investors evaluate mutual funds for informed decision-making.

What Is Direct Indexing? Key Concepts Explained

Direct indexing allows investors to replicate a market index by purchasing individual securities within the index rather than buying a mutual fund or ETF. This strategy offers tax-loss harvesting opportunities and customization based on personal values or risk tolerance, which traditional mutual funds cannot provide. By owning the underlying assets directly, investors gain greater control over portfolio composition and potential cost efficiency.

Core Differences: Mutual Funds versus Direct Indexing

Mutual funds pool investors' money to buy a diversified portfolio managed by professionals, offering simplicity and broad market exposure with built-in diversification and lower transaction costs. Direct indexing allows investors to purchase individual securities to replicate a specific index, providing greater customization, tax-loss harvesting opportunities, and potential for personalized portfolio management. The core difference lies in mutual funds' collective investment structure versus direct indexing's tailored ownership of individual stocks aligned with an index.

Costs and Fees Comparison: Which is More Affordable?

Mutual funds often charge expense ratios averaging between 0.5% and 1.5%, which can erode long-term returns, while direct indexing typically incurs lower management fees and trading costs due to its customized, passive approach. Investors in direct indexing may face higher initial account minimums and potential tax-loss harvesting service fees, but overall benefit from more precise tax management and reduced hidden costs. When comparing affordability, direct indexing tends to be more cost-effective for investors seeking personalized portfolios and tax efficiency, whereas mutual funds suit those preferring ease of access and lower upfront investment.

Tax Efficiency: Mutual Funds vs Direct Indexing

Direct indexing offers enhanced tax efficiency by allowing investors to harvest tax losses at the individual security level, reducing capital gains taxes more effectively than mutual funds. Mutual funds typically distribute capital gains to shareholders annually, which can trigger unexpected tax liabilities even without selling shares. By owning a customized basket of stocks directly, investors can strategically manage tax events and improve after-tax returns compared to traditional mutual fund investments.

Portfolio Customization and Flexibility

Direct indexing offers superior portfolio customization and flexibility compared to mutual funds by allowing investors to select individual securities aligning with their specific financial goals, risk tolerance, and ethical preferences. Unlike mutual funds, which pool assets and follow a fixed investment strategy, direct indexing enables real-time adjustments and tax-loss harvesting tailored to the investor's unique portfolio needs. This personalized approach enhances control over asset allocation and potential tax efficiency, making direct indexing a preferred option for investors seeking bespoke investment solutions.

Performance Potential: Historical Returns and Volatility

Mutual funds offer diversified exposure managed by professionals, typically resulting in steady historical returns with moderate volatility. Direct indexing allows investors to replicate index performance by owning individual securities, potentially enhancing returns through tax-loss harvesting while exposing portfolios to greater volatility. Studies indicate that direct indexing can outperform mutual funds in minimizing taxes and tailoring risk, but requires active management and a higher cost threshold.

Accessibility and Minimum Investment Requirements

Mutual funds often offer greater accessibility with lower minimum investment requirements, sometimes as low as $500, making them suitable for new investors. Direct indexing typically requires higher minimum investments, often ranging from $10,000 to $25,000, limiting accessibility for smaller portfolios. This gap in entry thresholds significantly influences the choice between diversified mutual funds and tailored direct index portfolios.

Risk Management Strategies: Mutual Funds vs Direct Indexing

Mutual funds provide risk management through professional portfolio diversification and active asset allocation, reducing exposure to individual security volatility. Direct indexing allows investors to customize holdings, enabling tax-loss harvesting and precise risk control by excluding specific companies or sectors. Both strategies offer unique approaches to mitigating investment risk, with mutual funds emphasizing expert management and direct indexing focusing on tailored portfolio adjustments.

Choosing the Right Approach: Key Factors for Investors

Evaluating risk tolerance, investment goals, and cost efficiency is crucial when choosing between mutual funds and direct indexing. Mutual funds offer diversification and professional management with relatively lower initial capital requirements, while direct indexing provides tax efficiency and customization by owning individual securities. Investors should also consider their willingness to engage in portfolio management and the potential tax benefits when selecting the optimal investment strategy.

Related Important Terms

Direct Indexing Customization

Direct Indexing offers unparalleled customization by allowing investors to tailor their portfolios to specific tax strategies, environmental, social, and governance (ESG) preferences, and individual stock selections, unlike Mutual Funds which follow a fixed index composition. This customization enhances tax efficiency and aligns investments closely with personal values and financial goals, providing a more personalized investment vehicle.

Tax-Loss Harvesting

Mutual funds offer limited tax-loss harvesting opportunities due to their pooled structure and infrequent trading, whereas direct indexing allows investors to customize portfolios and strategically harvest losses across individual securities, enhancing tax efficiency. Individual stock selection in direct indexing provides greater control over capital gains timing, making it a more effective tool for minimizing tax liabilities compared to mutual fund investments.

Mutual Fund Expense Ratio

Mutual funds typically charge an expense ratio ranging from 0.5% to 2%, which covers management fees and operating costs, reducing overall investor returns compared to direct indexing. Direct indexing often incurs lower ongoing fees by directly owning underlying securities, allowing for more tax-efficient and cost-effective portfolio customization.

Fractional Share Investment

Fractional share investment in mutual funds allows investors to diversify with smaller amounts by purchasing units of pooled assets, while direct indexing enables customized portfolios by buying fractional shares of individual securities to replicate an index. Direct indexing offers tax-loss harvesting benefits and personalized exposure, whereas mutual funds provide professional management and simplified diversification without the need for managing individual stock components.

ESG (Environmental, Social, Governance) Screens

Mutual funds with ESG screens offer diversified portfolios managed by professionals integrating environmental, social, and governance criteria, whereas direct indexing provides investors with granular control to customize ESG factors by directly owning stocks aligned with their values. Direct indexing allows for tax-loss harvesting and precise ESG alignment, potentially enhancing impact and returns compared to traditional mutual fund ESG investments.

Smart Beta Indices

Smart Beta indices offer an alternative to mutual funds by using a rules-based approach to weight stocks, enhancing risk-adjusted returns through factor exposure such as value, momentum, or low volatility. Direct indexing enables investors to replicate these Smart Beta strategies with greater tax efficiency and customization compared to traditional mutual funds, optimizing portfolio performance and cost-effectiveness.

Mutual Fund Overlap Analysis

Mutual fund overlap analysis identifies common holdings across multiple funds to assess diversification and reduce redundant investments, enhancing portfolio efficiency. Unlike direct indexing where investors tailor portfolios with precise stock selections, mutual fund overlap can lead to unintended concentration, impacting risk-adjusted returns and overall investment strategy.

Personalized Index Construction

Direct indexing offers personalized index construction by enabling investors to tailor portfolios based on individual preferences, tax strategies, and financial goals, unlike mutual funds which provide standardized, pre-built portfolios managed by fund managers. This customization enhances tax efficiency and aligns investments more closely with personal values and risk tolerances.

Direct Index Replication

Direct index replication offers investors precise exposure to target indices by purchasing individual securities in exact proportions, enhancing customization and potential tax efficiency compared to mutual funds. Unlike mutual funds that pool assets and use active or passive management, direct indexing enables direct ownership and tailored portfolio construction aligned with specific investment goals.

Zero-fee Mutual Funds

Zero-fee mutual funds offer investors cost-effective exposure to diversified assets without management fees, making them attractive for long-term portfolio growth. Direct indexing allows personalized index replication with tax-loss harvesting benefits, but typically involves higher costs compared to zero-fee mutual funds.

Mutual Funds vs Direct Indexing for investment Infographic

moneydiff.com

moneydiff.com