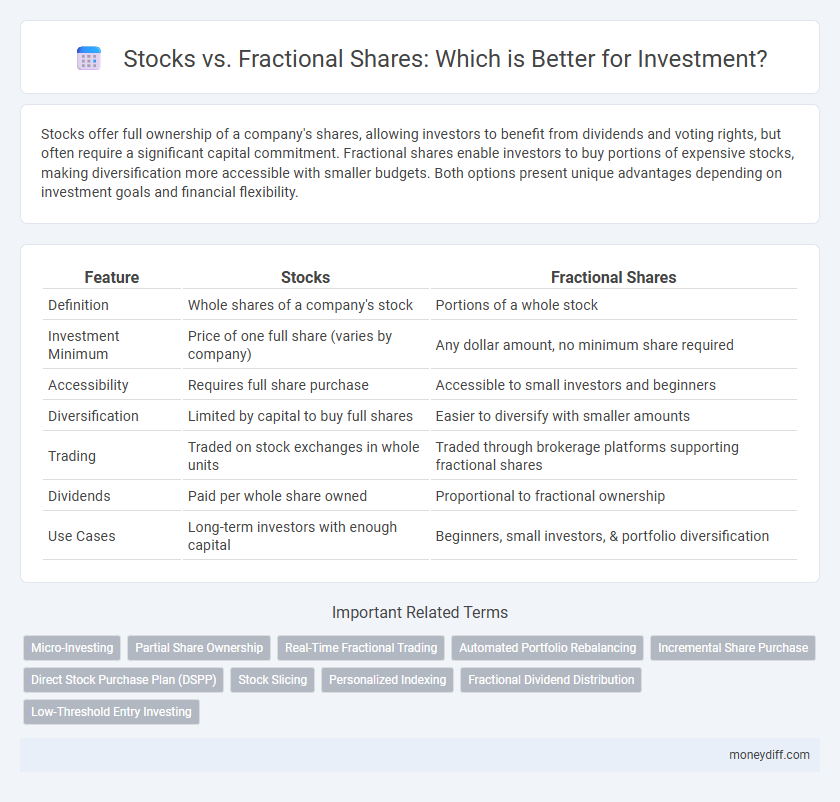

Stocks offer full ownership of a company's shares, allowing investors to benefit from dividends and voting rights, but often require a significant capital commitment. Fractional shares enable investors to buy portions of expensive stocks, making diversification more accessible with smaller budgets. Both options present unique advantages depending on investment goals and financial flexibility.

Table of Comparison

| Feature | Stocks | Fractional Shares |

|---|---|---|

| Definition | Whole shares of a company's stock | Portions of a whole stock |

| Investment Minimum | Price of one full share (varies by company) | Any dollar amount, no minimum share required |

| Accessibility | Requires full share purchase | Accessible to small investors and beginners |

| Diversification | Limited by capital to buy full shares | Easier to diversify with smaller amounts |

| Trading | Traded on stock exchanges in whole units | Traded through brokerage platforms supporting fractional shares |

| Dividends | Paid per whole share owned | Proportional to fractional ownership |

| Use Cases | Long-term investors with enough capital | Beginners, small investors, & portfolio diversification |

Understanding Stocks and Fractional Shares

Stocks represent full ownership units in a company, allowing investors to benefit from dividends and capital appreciation proportional to their share quantity. Fractional shares enable investors to purchase less than one full stock unit, making high-priced stocks more accessible and facilitating diversified portfolios with smaller capital. Understanding the distinction helps optimize investment strategies by balancing cost, risk, and ownership flexibility.

Key Differences Between Traditional Stocks and Fractional Shares

Traditional stocks require purchasing whole shares, often demanding higher initial capital, while fractional shares enable investors to buy partial ownership of expensive stocks with lower investment amounts. Fractional shares offer greater diversification opportunities and accessibility for small investors, whereas traditional stocks provide full voting rights and dividends tied to whole shares. The liquidity and pricing mechanisms differ as fractional shares are typically bought and sold through broker platforms, impacting transaction costs and availability.

Advantages of Investing in Whole Stocks

Investing in whole stocks offers full ownership, granting shareholders voting rights and eligibility for dividends, enhancing long-term wealth-building potential. Whole stocks provide clearer market liquidity and easier transferability compared to fractional shares, facilitating more straightforward trading strategies. Ownership of whole shares often aligns with traditional brokerage benefits, such as eligibility for certain stockholder perks and corporate actions.

Benefits of Fractional Shares for New Investors

Fractional shares enable new investors to access high-priced stocks without needing large capital, promoting diversification even with limited funds. They allow precise investment amounts tailored to individual budgets, enhancing flexibility and reducing financial barriers. This accessibility encourages broader market participation and helps beginners build a varied portfolio efficiently.

Accessibility: Lower Barriers with Fractional Shares

Fractional shares significantly lower the barrier to entry for individual investors by allowing the purchase of partial stock units at a fraction of the full share price, making high-value stocks more accessible. This accessibility enables diversified portfolios even with limited capital, promoting broader market participation. Traditional stock investments often require substantial upfront capital, restricting opportunities for many retail investors.

Diversification Potential: Stocks vs Fractional Shares

Stocks provide investors the ability to purchase whole shares, often requiring significant capital, which can limit diversification in smaller portfolios. Fractional shares enable investors to buy partial ownership in high-priced stocks, facilitating broader portfolio diversification with limited funds. This flexibility allows for a more balanced investment strategy, reducing risk through exposure to multiple asset classes.

Costs and Fees: What Investors Should Know

Investing in whole stocks often involves higher upfront costs due to the full share price, whereas fractional shares allow investors to purchase a portion of expensive stocks at a lower initial investment. Brokerage fees and commissions vary but are generally more accessible with fractional shares, making them cost-effective for small investors. Understanding the fee structures, including potential custody fees and trade commissions, is crucial for minimizing expenses and maximizing investment returns.

Liquidity and Trading Flexibility

Stocks offer high liquidity with the ability to buy and sell whole shares quickly on major exchanges, enabling investors to react swiftly to market changes. Fractional shares provide trading flexibility by allowing investment in expensive stocks with smaller capital, but they may face limitations in liquidity as not all brokers support instant selling or transferring. Choosing between stocks and fractional shares depends on prioritizing immediate liquidity or flexibility in portfolio diversification with limited funds.

Building an Investment Strategy: Which Option Fits?

Stocks offer full ownership, voting rights, and dividends, making them ideal for investors seeking direct control and long-term growth in their portfolios. Fractional shares allow diversification with smaller capital, enabling investors to build a balanced strategy by accessing high-priced stocks without large upfront costs. Choosing between stocks and fractional shares depends on investment goals, risk tolerance, and the desire for portfolio flexibility or concentrated positions.

Choosing Between Stocks and Fractional Shares for Your Portfolio

Choosing between stocks and fractional shares for your portfolio depends on investment goals and capital availability. Whole stocks offer full ownership and voting rights, ideal for long-term investors seeking robust portfolio growth. Fractional shares enable diversification with limited funds, allowing access to high-priced stocks and fractional reinvestment of dividends.

Related Important Terms

Micro-Investing

Micro-investing empowers investors to buy fractional shares, allowing diverse portfolios with minimal capital, unlike traditional stocks that often require full-share purchases and higher upfront costs. This approach enhances accessibility, enabling consistent investment in high-value stocks and promoting financial inclusion.

Partial Share Ownership

Partial share ownership allows investors to purchase a fraction of a stock, enabling diversification with lower capital outlay compared to buying whole shares. Fractional shares make high-priced stocks accessible, promoting portfolio flexibility and tailored investment strategies.

Real-Time Fractional Trading

Real-time fractional trading allows investors to buy and sell partial shares instantly, offering greater flexibility and accessibility compared to traditional whole-share stock purchases. This innovation enables portfolio diversification and precise allocation of capital, making it ideal for investors seeking to optimize returns without large upfront investment.

Automated Portfolio Rebalancing

Automated portfolio rebalancing efficiently manages stocks and fractional shares by systematically adjusting asset allocations to maintain target investment goals, ensuring optimal diversification and risk management. This technology leverages fractional shares to fine-tune portfolios without the limitations of whole-share purchases, enhancing precision in adhering to strategic investment plans.

Incremental Share Purchase

Stocks represent whole shares of ownership in a company, often requiring a significant upfront investment, whereas fractional shares allow investors to purchase partial ownership in high-priced stocks, enabling incremental share purchases with smaller amounts of capital. This approach facilitates portfolio diversification and access to expensive stocks by breaking down investment barriers for retail investors.

Direct Stock Purchase Plan (DSPP)

Direct Stock Purchase Plans (DSPPs) enable investors to buy full or fractional shares directly from companies, often with reduced fees compared to traditional brokerage accounts, enhancing accessibility for smaller investments. Fractional shares purchased through DSPPs allow investors to diversify portfolios with limited capital, optimizing dollar-cost averaging in volatile markets while maintaining ownership benefits like dividends and voting rights.

Stock Slicing

Stock slicing allows investors to purchase fractional shares, enabling precise portfolio diversification and capital allocation even with limited funds. This approach overcomes the traditional barrier of buying whole shares, providing access to high-priced stocks and enhancing investment flexibility in the stock market.

Personalized Indexing

Personalized indexing leverages fractional shares to create customized portfolios that mirror an investor's unique preferences and risk tolerance, enabling precise allocation across individual stocks rather than traditional whole-share investments. This approach optimizes diversification and tax efficiency, offering greater flexibility compared to standard stock purchases.

Fractional Dividend Distribution

Fractional shares enable investors to receive proportional dividend payouts based on their exact shareholding, allowing precise income allocation even with partial stock ownership. This flexibility enhances dividend reinvestment strategies and democratizes access to high-value stocks by distributing dividends in exact fractions rather than whole shares.

Low-Threshold Entry Investing

Fractional shares allow investors to access high-value stocks with minimal capital, enabling portfolio diversification without the need for large investments. This low-threshold entry makes it easier for beginners to start investing and gradually build wealth through consistent contributions.

Stocks vs Fractional Shares for Investment. Infographic

moneydiff.com

moneydiff.com