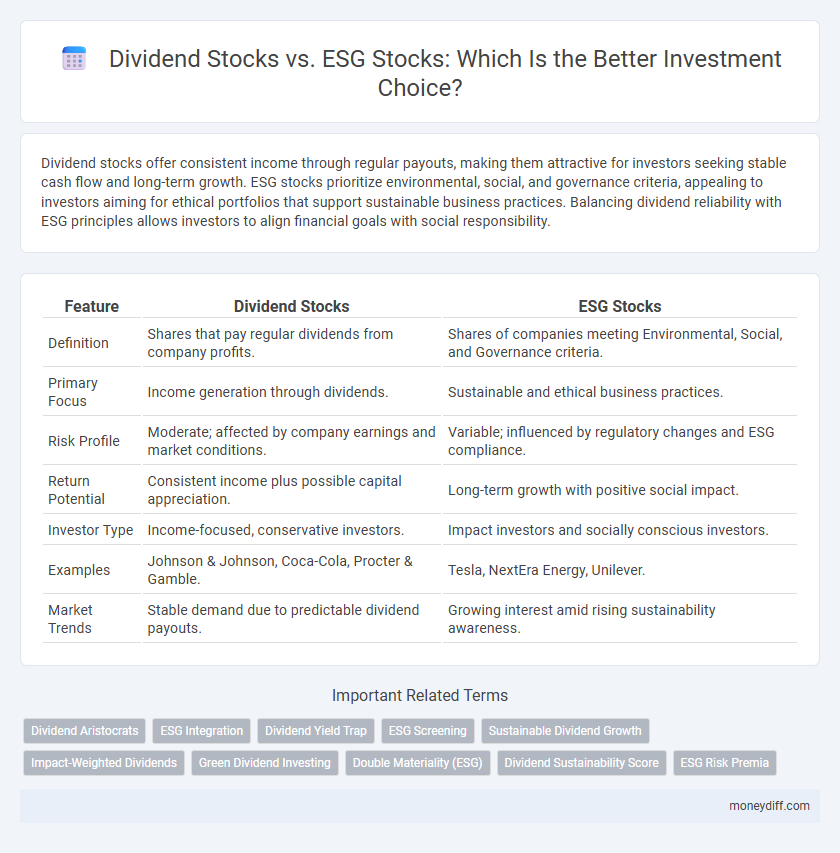

Dividend stocks offer consistent income through regular payouts, making them attractive for investors seeking stable cash flow and long-term growth. ESG stocks prioritize environmental, social, and governance criteria, appealing to investors aiming for ethical portfolios that support sustainable business practices. Balancing dividend reliability with ESG principles allows investors to align financial goals with social responsibility.

Table of Comparison

| Feature | Dividend Stocks | ESG Stocks |

|---|---|---|

| Definition | Shares that pay regular dividends from company profits. | Shares of companies meeting Environmental, Social, and Governance criteria. |

| Primary Focus | Income generation through dividends. | Sustainable and ethical business practices. |

| Risk Profile | Moderate; affected by company earnings and market conditions. | Variable; influenced by regulatory changes and ESG compliance. |

| Return Potential | Consistent income plus possible capital appreciation. | Long-term growth with positive social impact. |

| Investor Type | Income-focused, conservative investors. | Impact investors and socially conscious investors. |

| Examples | Johnson & Johnson, Coca-Cola, Procter & Gamble. | Tesla, NextEra Energy, Unilever. |

| Market Trends | Stable demand due to predictable dividend payouts. | Growing interest amid rising sustainability awareness. |

Understanding Dividend Stocks: An Overview

Dividend stocks provide investors with regular income through periodic payouts, making them attractive for those seeking cash flow and stability. These stocks typically belong to well-established companies with a track record of consistent earnings and dividend growth, offering potential for both income and capital appreciation. Understanding the reliability of dividend payments and the company's financial health is crucial when evaluating dividend stocks for long-term investment portfolios.

What Are ESG Stocks? Key Principles Explained

ESG stocks represent companies evaluated based on Environmental, Social, and Governance criteria, emphasizing sustainable and ethical business practices. Investors prioritize ESG stocks to support corporate responsibility, reduce environmental impact, and promote transparency in governance. These principles aim to balance financial returns with positive social and environmental outcomes, differentiating ESG investments from traditional dividend-paying stocks.

Dividend Stocks: Pros and Cons for Investors

Dividend stocks offer investors steady income through regular dividend payouts, providing a reliable cash flow even during market volatility. These stocks often belong to established companies with stable earnings, making them attractive for long-term portfolio stability and wealth preservation. However, dividend stocks may have limited growth potential compared to ESG stocks, and their appeal can diminish in low-interest-rate environments or during economic downturns when companies might reduce dividends.

ESG Stocks: Benefits and Drawbacks

ESG stocks prioritize environmental, social, and governance factors, appealing to investors seeking sustainable and ethical portfolios while potentially reducing long-term risks associated with regulatory changes and social pressures. The benefits of ESG stocks include alignment with global climate goals and positive brand reputation, which can enhance financial performance over time. However, drawbacks involve challenges in standardized ESG metrics, potential trade-offs in short-term returns, and the risk of greenwashing by companies overstating their sustainability efforts.

Risk and Return: Comparing Dividend vs ESG Stocks

Dividend stocks typically offer steady income with lower volatility, appealing to risk-averse investors seeking predictable returns through regular payouts. ESG stocks, while often more volatile, can provide higher long-term growth potential by aligning with sustainable and ethical business practices that may outperform traditional counterparts in evolving markets. Balancing the stability of dividends with the growth prospects of ESG investing depends on individual risk tolerance and investment horizon.

Income Generation: Dividends vs ESG Performance

Dividend stocks provide consistent income generation through regular payouts, appealing to investors seeking predictable cash flow. ESG stocks may offer lower immediate income but focus on sustainable growth and long-term value driven by strong environmental, social, and governance practices. Income-focused investors prioritize dividends, while those targeting future-oriented growth consider ESG performance as a key metric.

Long-Term Growth Potential of Dividend and ESG Stocks

Dividend stocks offer steady income through regular payouts, appealing to investors seeking consistent cash flow and reliable returns over time. ESG stocks prioritize environmental, social, and governance criteria, often driving innovation and sustainable growth that align with shifting market demands and regulatory trends. Combining dividend yields with ESG factors can enhance long-term portfolio resilience and capitalize on both income generation and ethical investment growth.

Ethical Considerations in Investment Choices

Dividend stocks often attract investors seeking steady income, but ESG stocks prioritize environmental, social, and governance criteria, reflecting a commitment to ethical investing. Evaluating ESG metrics can reveal companies with sustainable practices, reducing reputational and regulatory risks. Ethical considerations in investment choices increasingly influence portfolio performance and align with values-driven capital allocation.

Portfolio Diversification: Combining Dividend and ESG Stocks

Combining dividend stocks and ESG stocks enhances portfolio diversification by balancing steady income generation with sustainable growth potential. Dividend stocks provide predictable cash flow and financial stability, while ESG stocks offer exposure to companies committed to environmental, social, and governance practices, reducing long-term risk. This blend supports risk mitigation and aligns financial goals with ethical investing, optimizing overall portfolio resilience.

Which Is Right for You? Factors to Consider Before Investing

Dividend stocks offer consistent income through regular payouts, appealing to investors seeking stability and cash flow. ESG stocks prioritize environmental, social, and governance factors, aligning with investors' values and long-term sustainability goals. Consider your financial objectives, risk tolerance, and personal ethics before choosing between steady income from dividend stocks or the impact-driven growth potential of ESG investments.

Related Important Terms

Dividend Aristocrats

Dividend Aristocrats, known for consistent dividend growth over 25+ years, offer stable income and lower volatility, making them ideal for conservative investors prioritizing cash flow. ESG stocks prioritize environmental, social, and governance criteria, appealing to socially conscious investors but often exhibit higher growth volatility compared to Dividend Aristocrats.

ESG Integration

Dividend stocks offer steady income through regular payouts, appealing to income-focused investors, while ESG stocks prioritize environmental, social, and governance factors, attracting those seeking sustainable and ethical investment strategies. Integrating ESG criteria into portfolio selection enhances long-term risk management by considering corporate sustainability metrics alongside traditional financial performance.

Dividend Yield Trap

Dividend stocks often attract investors with high dividend yields, but these yields can signal a dividend yield trap where unsustainable payouts lead to price declines. ESG stocks prioritize environmental, social, and governance criteria, offering long-term growth potential and stability that may help avoid the risks associated with falling dividends in traditional high-yield investments.

ESG Screening

Dividend stocks prioritize consistent payouts and stable returns, appealing to income-focused investors, while ESG stocks incorporate environmental, social, and governance screening to align investments with sustainability and ethical criteria, potentially enhancing long-term risk management and societal impact. ESG screening evaluates company performance on carbon emissions, labor practices, and board diversity, offering investors a way to support responsible business practices alongside financial goals.

Sustainable Dividend Growth

Sustainable dividend growth stocks combine the reliable income of dividend stocks with the ethical focus of ESG stocks, attracting investors seeking long-term value and responsible investing. These stocks typically exhibit strong financial health, consistent dividend increases, and adherence to environmental, social, and governance criteria, making them a robust choice for sustainable wealth accumulation.

Impact-Weighted Dividends

Impact-weighted dividends provide a unique metric by integrating environmental, social, and governance (ESG) performance with traditional dividend payouts, allowing investors to assess not only financial returns but also social and environmental impact. Comparing dividend stocks and ESG stocks through impact-weighted dividends reveals how companies with strong sustainability practices can deliver competitive income while advancing positive societal outcomes.

Green Dividend Investing

Green dividend investing combines the steady income of dividend stocks with the sustainable impact of ESG stocks, targeting companies that prioritize environmental responsibility while providing consistent cash flow. This strategy appeals to investors seeking long-term growth through financially stable, eco-friendly firms that align with both profit and planetary goals.

Double Materiality (ESG)

Dividend stocks provide steady income through regular payouts, emphasizing financial returns, while ESG stocks prioritize environmental, social, and governance factors that impact both financial performance and broader societal outcomes, reflecting the principle of double materiality by addressing risks and opportunities affecting the company and stakeholders. Investors balancing dividend yields with sustainable impact increasingly consider double materiality to align profitability with long-term value creation and responsible investment.

Dividend Sustainability Score

Dividend stocks with a high Dividend Sustainability Score indicate consistent earnings, strong free cash flow, and manageable payout ratios, making them attractive for yielding reliable income over time. ESG stocks that also meet strong sustainability criteria may offer long-term growth potential, but investors prioritizing steady dividends should closely evaluate the dividend sustainability metrics to ensure durable income streams.

ESG Risk Premia

Dividend stocks offer stable income streams through regular cash payouts, appealing to income-focused investors, while ESG stocks incorporate environmental, social, and governance factors that can mitigate risks related to regulatory changes and reputational damage. ESG risk premia capture the potential for long-term outperformance by accounting for sustainability-driven risk adjustments absent in traditional dividend investment models.

Dividend Stocks vs ESG Stocks for investment. Infographic

moneydiff.com

moneydiff.com