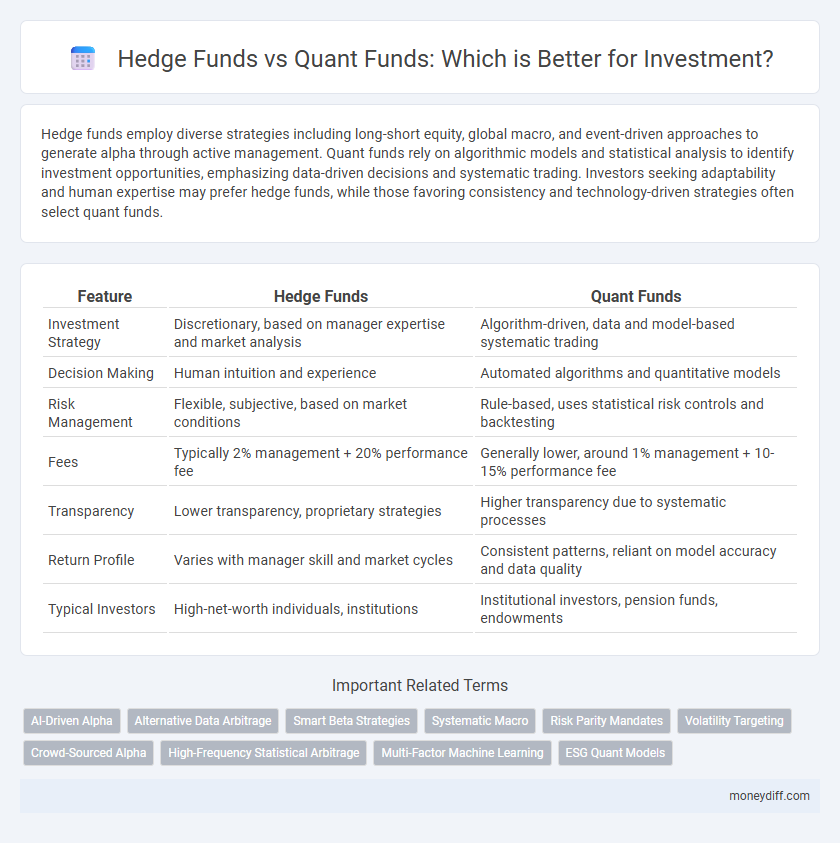

Hedge funds employ diverse strategies including long-short equity, global macro, and event-driven approaches to generate alpha through active management. Quant funds rely on algorithmic models and statistical analysis to identify investment opportunities, emphasizing data-driven decisions and systematic trading. Investors seeking adaptability and human expertise may prefer hedge funds, while those favoring consistency and technology-driven strategies often select quant funds.

Table of Comparison

| Feature | Hedge Funds | Quant Funds |

|---|---|---|

| Investment Strategy | Discretionary, based on manager expertise and market analysis | Algorithm-driven, data and model-based systematic trading |

| Decision Making | Human intuition and experience | Automated algorithms and quantitative models |

| Risk Management | Flexible, subjective, based on market conditions | Rule-based, uses statistical risk controls and backtesting |

| Fees | Typically 2% management + 20% performance fee | Generally lower, around 1% management + 10-15% performance fee |

| Transparency | Lower transparency, proprietary strategies | Higher transparency due to systematic processes |

| Return Profile | Varies with manager skill and market cycles | Consistent patterns, reliant on model accuracy and data quality |

| Typical Investors | High-net-worth individuals, institutions | Institutional investors, pension funds, endowments |

Understanding Hedge Funds: Core Concepts

Hedge funds utilize diverse strategies such as long-short equity, global macro, and event-driven approaches to achieve high returns while managing risk through active portfolio management and leverage. They often charge performance-based fees and employ sophisticated risk management techniques to protect capital against market volatility. Understanding hedge funds involves recognizing their flexibility in asset allocation, reliance on skilled managers, and their goal of generating alpha regardless of market conditions.

What Are Quant Funds? An Overview

Quant funds utilize advanced mathematical models and algorithms to make investment decisions, relying heavily on data analysis and automated trading systems. These funds systematically process large datasets to identify patterns and exploit market inefficiencies, minimizing human bias in the investment process. By integrating machine learning and statistical techniques, quant funds strive for consistent alpha generation across diverse asset classes.

Key Differences Between Hedge Funds and Quant Funds

Hedge funds typically employ a wide range of strategies including long-short equity, macroeconomic trends, and arbitrage, relying heavily on human judgment and discretionary decision-making. Quant funds use algorithm-driven models and statistical techniques, processing large datasets to identify investment opportunities with minimal human intervention. The key difference lies in the reliance on systematic, data-driven approaches for quant funds versus the flexible, often subjective strategies of hedge funds.

Investment Strategies: Hedge Funds vs Quant Funds

Hedge funds typically employ discretionary investment strategies that rely on expert judgment, utilizing techniques like long/short equity, event-driven, and global macro to exploit market inefficiencies. Quant funds use algorithm-driven models based on mathematical, statistical, and machine learning techniques to identify trading opportunities and manage risk systematically. The distinction lies in hedge funds' flexible, human-driven approach versus quant funds' data-centric, automated strategy execution.

Risk Management Approaches in Both Fund Types

Hedge funds employ diverse risk management strategies, including dynamic hedging, stop-loss orders, and fundamental analysis to mitigate market volatility and preserve capital. Quant funds rely heavily on algorithmic models, statistical arbitrage, and backtested data-driven strategies to control risk by continuously optimizing portfolio allocation and minimizing drawdowns. Both fund types prioritize risk-adjusted returns, but quant funds emphasize automation and data analytics, whereas hedge funds blend quantitative tools with discretionary decision-making.

Performance Analysis: Hedge vs Quant Funds

Hedge funds traditionally rely on discretionary strategies and human judgment to generate alpha, often showing strong performance in volatile or uncertain markets. Quant funds utilize algorithmic models and large-scale data analysis to identify statistically significant investment opportunities, typically achieving consistent returns through systematic trading. Performance analysis reveals that quant funds often outperform hedge funds during stable market conditions due to their ability to exploit inefficiencies with precision and speed.

Fees and Cost Structures Compared

Hedge funds typically charge a 2% management fee plus 20% performance fees, reflecting their active management strategies and high operational costs. Quant funds often have lower fees, commonly around 1% management fees and reduced or no performance fees, due to automated, algorithm-driven investment processes. The cost structure differences directly impact net returns, making quant funds more cost-efficient for investors seeking lower expenses.

Accessibility and Minimum Investment Requirements

Hedge funds typically require high minimum investments, often exceeding $1 million, making them less accessible to retail investors. Quant funds, leveraging algorithm-driven strategies, sometimes offer lower entry thresholds and can be accessed via mutual funds or ETFs, expanding availability to a broader investor base. This difference in minimum investment requirements significantly influences investor choice, particularly for those with limited capital seeking diversified investment opportunities.

Choosing the Right Fund for Your Portfolio

Hedge funds offer diversified strategies leveraging human expertise and discretionary decision-making to adapt to market changes, while quant funds rely on algorithmic models and data-driven approaches to execute trades systematically. Selecting the right fund depends on your risk tolerance, investment goals, and preference for transparency, with hedge funds often providing more flexibility but less predictability compared to the algorithmic precision of quant funds. Evaluating historical performance, fees, and the fund manager's track record is essential to align the fund choice with your portfolio's long-term growth and risk management objectives.

Future Trends in Hedge and Quant Fund Investments

Hedge funds are increasingly integrating advanced machine learning algorithms to enhance predictive analytics, while quant funds are leveraging big data and alternative data sources to optimize trading strategies. The future trend indicates a convergence of qualitative insights and quantitative models, driving more adaptive and resilient investment approaches. Investors are expected to favor funds that demonstrate transparent risk management and real-time data processing capabilities in volatile markets.

Related Important Terms

AI-Driven Alpha

Hedge funds leverage diverse strategies including discretionary management and alternative assets, while quant funds utilize algorithmic trading powered by AI models to identify alpha-generating patterns in vast datasets. AI-driven alpha in quant funds enables high-frequency decision-making, precise risk management, and systematic adaptation to market changes, often outperforming traditional hedge fund methods.

Alternative Data Arbitrage

Hedge funds leveraging alternative data arbitrage capitalize on insights from non-traditional datasets such as satellite imagery, social media trends, and credit card transactions to identify market inefficiencies. Quant funds deploy advanced algorithms and machine learning models to process vast alternative data streams, enabling rapid, data-driven investment decisions that exploit subtle arbitrage opportunities.

Smart Beta Strategies

Smart Beta strategies combine factor-based investing with systematic approaches, making them integral to both Hedge Funds and Quant Funds for enhanced risk-adjusted returns. Hedge Funds leverage Smart Beta to exploit market inefficiencies through discretionary insights, while Quant Funds apply algorithmic models to systematically capture factor premiums like value, momentum, and low volatility.

Systematic Macro

Systematic Macro hedge funds employ advanced quantitative models to analyze macroeconomic data and market trends, enabling data-driven decisions across global asset classes. These quant funds leverage algorithmic strategies to exploit inefficiencies and manage risks dynamically, offering higher transparency and scalability compared to traditional discretionary macro hedge funds.

Risk Parity Mandates

Hedge funds and quant funds differ significantly in executing risk parity mandates; hedge funds rely on discretionary strategies integrating qualitative insights, whereas quant funds utilize algorithmic models and data-driven approaches to balance asset class risks systematically. Risk parity portfolios managed by quant funds often achieve more consistent volatility targeting and diversification through advanced factor analysis, reducing drawdowns compared to hedge funds' dynamic but sometimes less transparent risk management.

Volatility Targeting

Hedge funds utilize volatility targeting to adjust leverage and exposure, aiming to stabilize returns during market turbulence by dynamically managing risk levels. Quant funds deploy algorithmic models that optimize volatility targeting by analyzing large datasets and market signals to predict and adjust for changing market volatilities in real-time.

Crowd-Sourced Alpha

Hedge funds leverage diverse strategies including crowd-sourced alpha to enhance portfolio returns through human insights and discretionary management, whereas quant funds rely on algorithmic models and big data analytics to systematically exploit market inefficiencies. Crowd-sourced alpha integrates collective intelligence from a broad investor base, improving decision-making in hedge funds by combining qualitative insights with data-driven approaches typical of quant funds.

High-Frequency Statistical Arbitrage

Hedge funds employing high-frequency statistical arbitrage utilize rapid algorithmic trading to exploit minute market inefficiencies, often relying on advanced quantitative models and real-time data analysis. Quant funds specializing in this strategy focus on large-scale data processing and machine learning to optimize trade execution and minimize risk, offering enhanced precision in the volatile, short-term trading environment.

Multi-Factor Machine Learning

Hedge funds traditionally rely on discretionary management and qualitative insights, while quant funds leverage multi-factor machine learning models to analyze vast datasets, identify complex patterns, and optimize portfolio construction with higher predictive accuracy. Multi-factor machine learning enhances risk-adjusted returns by dynamically adapting to market inefficiencies and incorporating variables such as momentum, value, and volatility in real-time.

ESG Quant Models

Hedge funds traditionally employ discretionary strategies with ESG factors integrated qualitatively, while quant funds leverage advanced ESG quant models that systematically analyze vast datasets to identify sustainable investment opportunities. These ESG quant models enhance risk-adjusted returns by applying machine learning algorithms to environmental, social, and governance data, enabling precise, data-driven portfolio construction aligned with responsible investing principles.

Hedge Funds vs Quant Funds for Investment Infographic

moneydiff.com

moneydiff.com