Savings accounts provide a secure way to store funds with guaranteed interest but typically offer lower returns, making them less ideal for long-term wealth growth. Robo-advisor accounts use automated algorithms to manage and diversify investments, often leading to higher potential returns with lower fees compared to traditional advisors. Choosing between the two depends on risk tolerance, investment goals, and desired involvement in portfolio management.

Table of Comparison

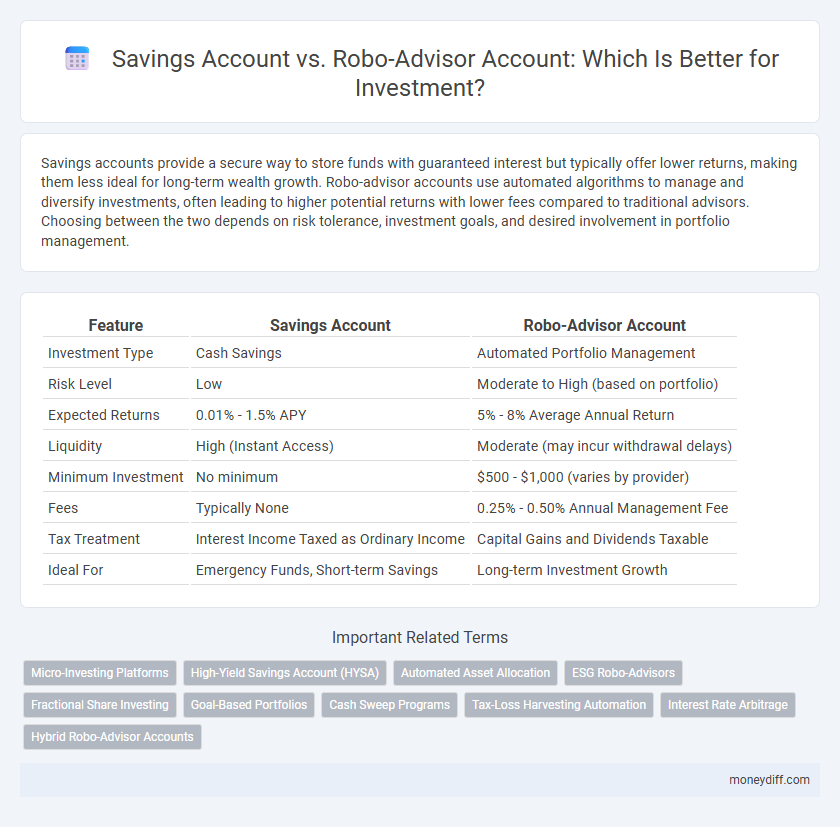

| Feature | Savings Account | Robo-Advisor Account |

|---|---|---|

| Investment Type | Cash Savings | Automated Portfolio Management |

| Risk Level | Low | Moderate to High (based on portfolio) |

| Expected Returns | 0.01% - 1.5% APY | 5% - 8% Average Annual Return |

| Liquidity | High (Instant Access) | Moderate (may incur withdrawal delays) |

| Minimum Investment | No minimum | $500 - $1,000 (varies by provider) |

| Fees | Typically None | 0.25% - 0.50% Annual Management Fee |

| Tax Treatment | Interest Income Taxed as Ordinary Income | Capital Gains and Dividends Taxable |

| Ideal For | Emergency Funds, Short-term Savings | Long-term Investment Growth |

Introduction: Comparing Savings Accounts and Robo-Advisor Accounts

Savings accounts provide low-risk, easily accessible funds with modest interest rates, making them suitable for short-term savings and emergency funds. Robo-advisor accounts offer automated, algorithm-driven investment management that diversifies portfolios across stocks, bonds, and ETFs to optimize returns based on risk tolerance and financial goals. Compared to savings accounts, robo-advisors typically deliver higher long-term growth potential, but with increased market exposure and variable returns.

How Savings Accounts Work as Investment Tools

Savings accounts serve as low-risk investment tools by providing a fixed interest rate on deposits, typically insured by the FDIC up to $250,000, ensuring principal protection. They offer high liquidity, allowing investors immediate access to funds without penalty, but generally yield lower returns compared to other investment options. Savings accounts are ideal for conservative investors prioritizing capital preservation and emergency fund accumulation over aggressive growth.

Understanding Robo-Advisor Accounts for Investing

Robo-advisor accounts leverage sophisticated algorithms to create diversified investment portfolios tailored to individual risk tolerance and financial goals, offering automated asset allocation and rebalancing. These platforms typically charge lower fees compared to traditional financial advisors while providing access to a wide range of ETFs and index funds. Unlike savings accounts that offer low, fixed interest rates with minimal growth potential, robo-advisor investments have the potential for higher returns through strategic exposure to stock and bond markets.

Safety and Risk: Savings Accounts vs. Robo-Advisors

Savings accounts offer guaranteed principal protection insured by the FDIC up to $250,000, making them the safest option with virtually no risk of loss. Robo-advisor accounts, while not insured, provide diversified portfolios tailored to risk tolerance, balancing the potential for higher returns with market volatility. Investors prioritizing capital preservation should consider savings accounts, whereas those willing to accept moderate risk for growth may prefer robo-advisor investments.

Potential Returns: Interest Rates vs. Investment Growth

Savings accounts typically offer lower interest rates, around 0.01% to 1.5% annually, resulting in modest, predictable returns with minimal risk. Robo-advisor accounts invest in diversified portfolios with potential annual returns ranging from 5% to 8%, reflecting market growth but with higher volatility. The choice between the two depends on an investor's risk tolerance and desire for growth versus capital preservation.

Liquidity and Accessibility of Funds

Savings accounts offer high liquidity with immediate access to funds via ATMs, online transfers, or withdrawals, making them ideal for emergency cash needs. Robo-advisor accounts, while generally allowing easy transfers and withdrawals, may involve processing times or market-dependent restrictions, affecting immediate accessibility. Investors seeking both liquidity and investment growth must balance the quick access of savings accounts against the potentially higher returns but variable liquidity of robo-advisor platforms.

Fees and Minimum Balance Requirements

Savings accounts typically offer low or no fees but often require minimal or no minimum balance, making them accessible yet yielding lower returns. Robo-advisor accounts usually carry management fees ranging from 0.25% to 0.50% annually and enforce minimum balance requirements starting around $500 to $5,000, depending on the platform. Investors must weigh the higher cost and minimums against potential automated portfolio diversification and growth offered by robo-advisors.

Suitability for Different Financial Goals

Savings accounts offer low-risk, highly liquid options ideal for short-term goals such as emergency funds or upcoming expenses. Robo-advisor accounts provide diversified, algorithm-driven portfolios suited for long-term growth, making them more appropriate for retirement planning or wealth accumulation. Choosing between the two depends on individual risk tolerance and financial objectives.

Tax Implications: What Investors Need to Know

Savings accounts typically offer lower interest rates but provide straightforward tax treatment where earned interest is taxed as ordinary income. Robo-advisor accounts may generate dividends, capital gains, and interest, each with distinct tax implications, including potential for tax-loss harvesting to minimize taxable events. Investors should evaluate the impact of taxes on net returns by considering account types, investment strategies, and possible tax advantages like tax-deferred or tax-exempt growth.

Choosing the Right Option for Your Investment Strategy

Savings accounts provide low-risk, highly liquid options with minimal returns, ideal for emergency funds or short-term goals. Robo-advisor accounts offer diversified portfolios managed by algorithms, balancing risk and growth potential for long-term investment strategies. Selecting between these depends on your financial goals, risk tolerance, and desired investment horizon to optimize your wealth-building approach.

Related Important Terms

Micro-Investing Platforms

Micro-investing platforms leverage robo-advisor technology to provide automated portfolio management with low minimum investments, offering higher growth potential compared to traditional savings accounts. These digital tools use algorithms to diversify assets and rebalance portfolios, enabling investors to maximize returns while minimizing risks in small-scale investment scenarios.

High-Yield Savings Account (HYSA)

High-Yield Savings Accounts (HYSA) offer secure, FDIC-insured interest rates typically around 4.5% to 5%, providing liquidity and low risk compared to Robo-Advisor accounts, which invest in diversified portfolios with potential for higher long-term returns but come with market volatility and fees averaging 0.25% to 0.50%. HYSA is ideal for conservative investors prioritizing capital preservation and easy access to funds, while Robo-Advisors suit those seeking automated portfolio management with algorithm-driven asset allocation tailored to risk tolerance.

Automated Asset Allocation

Robo-advisor accounts use automated asset allocation algorithms that dynamically adjust portfolios based on risk tolerance and market conditions, offering personalized investment strategies beyond the static interest rates of savings accounts. This automation enhances diversification and potential returns while maintaining low fees, making robo-advisors a more efficient option for growth-oriented investors compared to traditional savings accounts.

ESG Robo-Advisors

ESG Robo-Advisors integrate environmental, social, and governance criteria into automated portfolio management, offering tailored sustainable investment options that typically yield higher long-term returns compared to traditional savings accounts. These robo-advisor platforms use advanced algorithms to optimize investments aligned with investors' ethical values while minimizing risk through diversified asset allocation.

Fractional Share Investing

Fractional share investing allows individuals to purchase portions of shares through robo-advisor accounts, providing diversified exposure with lower capital requirements compared to traditional savings accounts which offer limited growth potential and fixed interest rates. Robo-advisors leverage algorithms to optimize portfolio allocation and reinvest dividends automatically, enhancing compound growth beyond the nominal returns typical of savings accounts.

Goal-Based Portfolios

Savings accounts provide low-risk, low-return options primarily for emergency funds, while robo-advisor accounts offer goal-based portfolios that automatically adjust asset allocations to meet specific investment objectives and time horizons. Goal-based portfolios leverage algorithms and diversification strategies to optimize returns and manage risk tailored to individual financial goals.

Cash Sweep Programs

Cash Sweep Programs in Robo-Advisor Accounts automatically transfer uninvested cash into high-yield savings vehicles or money market funds, maximizing idle funds' returns compared to traditional Savings Accounts. These programs enhance liquidity and optimize interest accrual, providing a seamless integration of safety and growth within automated investment platforms.

Tax-Loss Harvesting Automation

Robo-advisor accounts offer automated tax-loss harvesting that systematically identifies and sells securities at a loss to offset capital gains, enhancing after-tax returns compared to traditional savings accounts, which provide minimal tax-advantaged growth. This automation leverages algorithms to optimize portfolio tax efficiency without requiring active management, making robo-advisors a superior investment vehicle for maximizing tax benefits over time.

Interest Rate Arbitrage

Savings accounts typically offer lower interest rates compared to robo-advisor accounts, which leverage diversified portfolios and algorithm-driven strategies to potentially generate higher returns. Investors can exploit interest rate arbitrage by shifting funds from low-yield savings accounts to robo-advisor platforms, optimizing growth while managing risk through automated rebalancing.

Hybrid Robo-Advisor Accounts

Hybrid robo-advisor accounts combine the low fees and automated portfolio management of robo-advisors with the personalized advice and human oversight typical of traditional financial advisors, optimizing investment growth beyond standard savings accounts. These accounts typically offer diversified asset allocation strategies and tax-efficient investment options, providing a balanced approach to risk and return compared to the low-yield but highly liquid savings accounts.

Savings Account vs Robo-Advisor Accounts for investment. Infographic

moneydiff.com

moneydiff.com