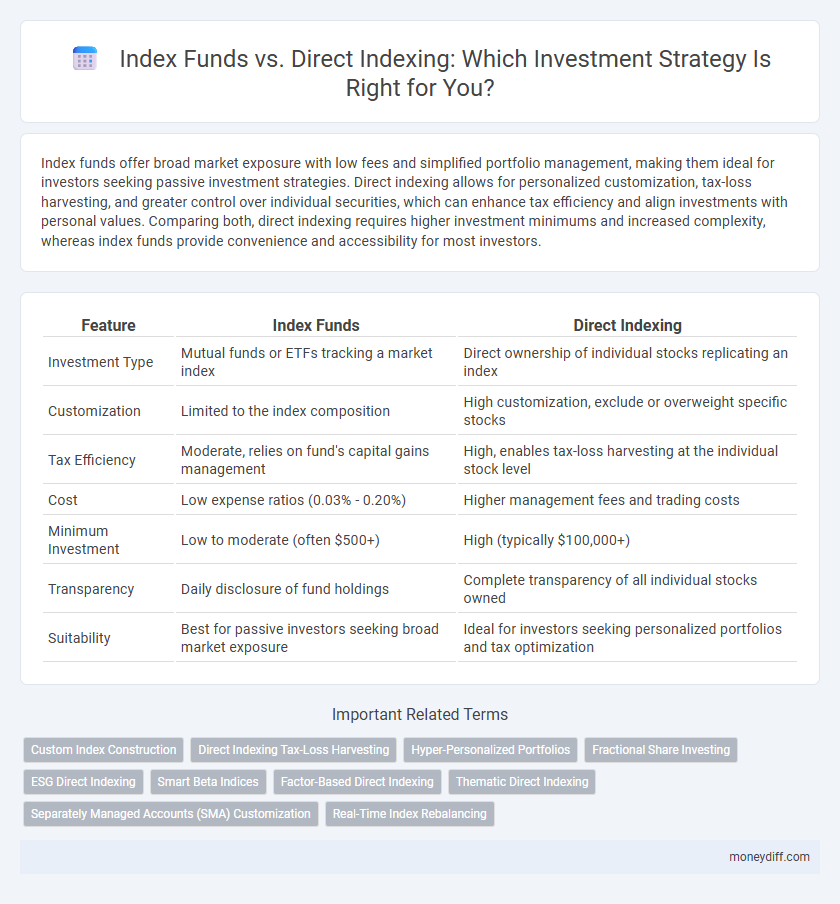

Index funds offer broad market exposure with low fees and simplified portfolio management, making them ideal for investors seeking passive investment strategies. Direct indexing allows for personalized customization, tax-loss harvesting, and greater control over individual securities, which can enhance tax efficiency and align investments with personal values. Comparing both, direct indexing requires higher investment minimums and increased complexity, whereas index funds provide convenience and accessibility for most investors.

Table of Comparison

| Feature | Index Funds | Direct Indexing |

|---|---|---|

| Investment Type | Mutual funds or ETFs tracking a market index | Direct ownership of individual stocks replicating an index |

| Customization | Limited to the index composition | High customization, exclude or overweight specific stocks |

| Tax Efficiency | Moderate, relies on fund's capital gains management | High, enables tax-loss harvesting at the individual stock level |

| Cost | Low expense ratios (0.03% - 0.20%) | Higher management fees and trading costs |

| Minimum Investment | Low to moderate (often $500+) | High (typically $100,000+) |

| Transparency | Daily disclosure of fund holdings | Complete transparency of all individual stocks owned |

| Suitability | Best for passive investors seeking broad market exposure | Ideal for investors seeking personalized portfolios and tax optimization |

Understanding Index Funds: A Comprehensive Overview

Index funds are pooled investment vehicles designed to replicate the performance of a specific market index, offering broad market exposure, low operating expenses, and diversified risk. By purchasing shares in an index fund, investors gain proportional ownership in all underlying securities, which reduces individual stock risk and minimizes the need for active management. These funds are ideal for long-term investors seeking cost-efficient, passive investment strategies aligned with general market returns.

What Is Direct Indexing? Key Concepts Explained

Direct indexing is an investment strategy that involves purchasing the individual securities within a market index rather than buying a traditional index fund. This approach allows investors to customize their portfolios for tax optimization, sector preferences, and exclusion of specific stocks, enhancing personalization compared to standard index funds. By directly owning the underlying assets, investors can harvest tax losses and align investments more closely with their financial goals and values.

Index Funds vs Direct Indexing: Core Differences

Index funds pool money to purchase a broad market index, offering simplicity and low fees through diversified exposure, while direct indexing allows investors to buy individual securities replicating the index, enabling personalized tax strategies and customization. Direct indexing provides potential for tax-loss harvesting on specific holdings, which index funds cannot offer due to their aggregated structure. The choice between the two depends on an investor's preference for cost-efficiency versus tailored portfolio management and tax optimization.

Cost Comparison: Expense Ratios and Management Fees

Index funds typically feature low expense ratios averaging around 0.03% to 0.20%, making them cost-effective for broad market exposure. Direct indexing involves higher management fees, often ranging from 0.30% to 0.50%, due to personalized portfolio customization and tax-loss harvesting benefits. Investors prioritizing minimal costs generally prefer index funds, while those seeking tailored strategies may accept higher fees associated with direct indexing.

Tax Efficiency: How Each Strategy Impacts Returns

Index funds offer broad market exposure with built-in tax efficiency through low turnover and passively managed portfolios, minimizing capital gains distributions. Direct indexing allows investors to customize portfolios by directly owning individual securities, enabling tax-loss harvesting benefits that can enhance after-tax returns more effectively than traditional index funds. The choice between the two depends on individual tax circumstances and the ability to actively manage the portfolio for tax optimization.

Customization and Personalization in Investment Portfolios

Index funds offer broad market exposure through pre-built portfolios with limited customization, making them ideal for investors seeking simplicity and low costs. Direct indexing enables personalized portfolio construction by replicating an index at the individual stock level, allowing investors to exclude specific sectors, incorporate ESG criteria, or optimize tax strategies. This customization in direct indexing provides enhanced control over asset allocation and risk management tailored to individual investment goals.

Accessibility and Minimum Investment Requirements

Index funds offer broad-market exposure with low minimum investment requirements, often starting as low as $100, making them highly accessible to beginner investors. Direct indexing requires higher minimum investments, typically $25,000 or more, as it involves purchasing individual securities to replicate an index. The higher initial capital limits direct indexing accessibility but allows for greater customization and tax-loss harvesting opportunities.

Portfolio Diversification: Advantages and Drawbacks

Index funds provide broad market exposure through a single investment, ensuring diversification with minimal effort and lower management costs. Direct indexing offers personalized portfolio construction, allowing investors to tailor diversification based on tax-loss harvesting and specific sector preferences but requires higher capital and active management. While index funds limit customization, direct indexing can induce complexity and potential concentration risks if not carefully managed.

Performance Analysis: Historical Returns Compared

Index funds typically offer broad market exposure with lower costs and consistently strong historical returns, averaging around 7-10% annually over the past decade. Direct indexing allows investors to customize portfolios at a granular level, potentially enhancing tax efficiency and capturing specific tax-loss harvesting opportunities that can improve net returns by 0.5-1%. Performance comparisons reveal that while index funds excel in simplicity and cost-effectiveness, direct indexing may outperform in after-tax returns, especially for high-net-worth investors seeking personalized strategies.

Choosing the Right Fit: Index Funds or Direct Indexing

Index funds offer broad market exposure with lower costs and simplicity, making them ideal for investors seeking passive, diversified portfolios. Direct indexing enables tailored tax-loss harvesting and customization by directly owning underlying securities, suitable for investors aiming for personalized strategies and enhanced tax efficiency. The decision depends on balancing cost sensitivity, customization needs, and tax management goals to find the optimal investment fit.

Related Important Terms

Custom Index Construction

Custom index construction in direct indexing allows investors to tailor portfolios by selecting individual securities that reflect personal values, tax considerations, and specific risk tolerances, unlike traditional index funds that replicate a fixed basket of securities. This customization enhances tax efficiency and diversification, providing greater control over investment exposure and potential for improved after-tax returns.

Direct Indexing Tax-Loss Harvesting

Direct indexing offers enhanced tax-loss harvesting opportunities by allowing investors to sell individual securities at a loss within a customized portfolio, thereby offsetting gains and reducing taxable income more effectively than traditional index funds. This strategy can lead to improved after-tax returns through targeted tax management and personalized asset selection.

Hyper-Personalized Portfolios

Index funds offer broad market exposure with lower fees by pooling assets into a single diversified portfolio, while direct indexing enables hyper-personalized portfolios by allowing investors to own individual securities, tailor tax strategies, and avoid unwanted holdings. This customization enhances tax efficiency and aligns investments with specific values or financial goals, making direct indexing a powerful tool for personalized wealth management.

Fractional Share Investing

Fractional share investing enables precise allocation in both index funds and direct indexing, allowing investors to buy portions of shares regardless of price, enhancing diversification and capital efficiency. Direct indexing leverages fractional shares to replicate an index's performance with personalized tax management and customization advantages over traditional index funds.

ESG Direct Indexing

ESG direct indexing allows investors to customize portfolios with specific environmental, social, and governance criteria while replicating index performance, offering higher personalization and potential tax benefits compared to traditional index funds. This approach enhances investment alignment with ethical values and can improve diversification by targeting ESG-compliant companies within individual securities rather than pooled assets.

Smart Beta Indices

Smart Beta indices combine the benefits of traditional index funds with strategic factor weighting, offering enhanced risk-adjusted returns compared to direct indexing, which allows tailored portfolio customization but requires higher capital and complexity. Investors seeking cost-efficient exposure with systematic factor tilts often prefer Smart Beta index funds over direct indexing, which is favored for tax-loss harvesting and personalized holdings.

Factor-Based Direct Indexing

Factor-based direct indexing enables investors to customize portfolios by targeting specific investment factors such as value, momentum, or low volatility, offering greater control and tax efficiency compared to traditional index funds. This strategy enhances risk management and performance potential by allowing precise exposure adjustments, which are typically unavailable in broad-based index fund investments.

Thematic Direct Indexing

Thematic direct indexing allows investors to create customized portfolios aligned with specific themes, such as clean energy or technology innovation, offering greater flexibility and precision than traditional index funds. This approach provides enhanced tax efficiency and the ability to exclude unwanted companies, optimizing returns while adhering to individual values and market trends.

Separately Managed Accounts (SMA) Customization

Separately Managed Accounts (SMA) offer enhanced customization in direct indexing by allowing investors to tailor portfolios based on individual preferences, tax considerations, and ESG criteria compared to the standardized composition of index funds. This customization provides greater control over asset selection, tax-loss harvesting opportunities, and risk management, making SMAs a preferred choice for personalized investment strategies.

Real-Time Index Rebalancing

Real-time index rebalancing in direct indexing allows investors to adjust their portfolios instantly based on market fluctuations, optimizing tax efficiency and personalized exposure compared to traditional index funds that rebalance periodically. This dynamic approach enhances portfolio precision and responsiveness, aligning investments closely with individual financial goals and market conditions.

Index Funds vs Direct Indexing for Investment. Infographic

moneydiff.com

moneydiff.com