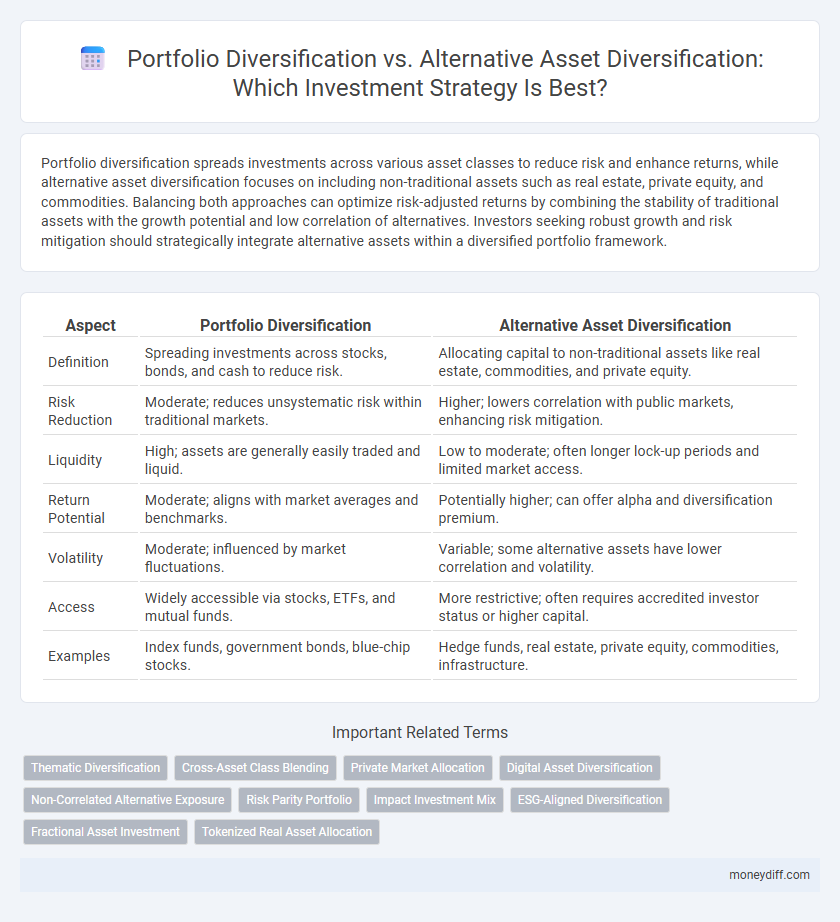

Portfolio diversification spreads investments across various asset classes to reduce risk and enhance returns, while alternative asset diversification focuses on including non-traditional assets such as real estate, private equity, and commodities. Balancing both approaches can optimize risk-adjusted returns by combining the stability of traditional assets with the growth potential and low correlation of alternatives. Investors seeking robust growth and risk mitigation should strategically integrate alternative assets within a diversified portfolio framework.

Table of Comparison

| Aspect | Portfolio Diversification | Alternative Asset Diversification |

|---|---|---|

| Definition | Spreading investments across stocks, bonds, and cash to reduce risk. | Allocating capital to non-traditional assets like real estate, commodities, and private equity. |

| Risk Reduction | Moderate; reduces unsystematic risk within traditional markets. | Higher; lowers correlation with public markets, enhancing risk mitigation. |

| Liquidity | High; assets are generally easily traded and liquid. | Low to moderate; often longer lock-up periods and limited market access. |

| Return Potential | Moderate; aligns with market averages and benchmarks. | Potentially higher; can offer alpha and diversification premium. |

| Volatility | Moderate; influenced by market fluctuations. | Variable; some alternative assets have lower correlation and volatility. |

| Access | Widely accessible via stocks, ETFs, and mutual funds. | More restrictive; often requires accredited investor status or higher capital. |

| Examples | Index funds, government bonds, blue-chip stocks. | Hedge funds, real estate, private equity, commodities, infrastructure. |

Understanding Portfolio Diversification

Portfolio diversification involves spreading investments across various asset classes such as stocks, bonds, and real estate to reduce risk and enhance returns systematically. This traditional strategy leverages the correlation differences between assets to minimize volatility and protect against market downturns. Understanding portfolio diversification is essential for investors aiming to achieve balanced growth and long-term financial stability.

Exploring Alternative Asset Diversification

Exploring alternative asset diversification enhances portfolio resilience by incorporating investments such as real estate, private equity, hedge funds, and commodities, which often exhibit low correlation with traditional stocks and bonds. These assets can reduce overall portfolio volatility and improve risk-adjusted returns by providing exposure to unique market dynamics and economic cycles. Institutional investors increasingly allocate 20-30% of their portfolios to alternative assets to achieve better diversification and potential alpha generation.

Key Differences Between Portfolio and Alternative Diversification

Portfolio diversification primarily involves spreading investments across various traditional asset classes like stocks, bonds, and mutual funds to reduce risk and enhance returns. Alternative asset diversification focuses on including non-traditional investments such as private equity, real estate, hedge funds, or commodities to provide uncorrelated returns and further risk mitigation. Key differences lie in liquidity, risk profile, and correlation to market performance, with alternative assets often offering higher potential returns but greater complexity and less market transparency compared to conventional portfolio diversification.

Core Benefits of Traditional Asset Diversification

Traditional asset diversification primarily reduces investment risk by spreading capital across stocks, bonds, and cash equivalents, thereby minimizing exposure to market volatility. It enhances portfolio stability and liquidity, ensuring more predictable returns and easier asset allocation adjustments. This approach leverages established market instruments with transparent pricing, providing a solid foundation for long-term wealth preservation and growth.

The Role of Alternative Assets in Modern Portfolios

Alternative assets such as private equity, real estate, and hedge funds play a crucial role in modern portfolios by enhancing diversification beyond traditional stocks and bonds. Incorporating alternative investments can reduce overall portfolio volatility and improve risk-adjusted returns due to their low correlation with conventional asset classes. Investors seeking to optimize performance and protect against market downturns increasingly allocate a portion of their portfolios to alternative assets for more robust diversification.

Risk Management: Traditional vs Alternative Diversification

Portfolio diversification traditionally involves spreading investments across various asset classes such as stocks, bonds, and real estate to reduce unsystematic risk and enhance overall stability. Alternative asset diversification includes non-traditional investments like private equity, hedge funds, commodities, and real assets, offering potential for higher returns and lower correlation with public markets, thus improving risk-adjusted performance. Integrating alternative assets can mitigate portfolio volatility more effectively than relying solely on conventional diversification strategies.

Performance Comparison: Conventional vs Alternative Strategies

Portfolio diversification across traditional stocks and bonds aims to reduce risk through asset allocation but often faces limitations in capturing alpha during market volatility. Alternative asset diversification, including real estate, private equity, and hedge funds, tends to offer enhanced returns and lower correlation to conventional markets, improving overall portfolio resilience. Performance comparisons reveal that integrating alternative strategies can boost risk-adjusted returns and reduce drawdowns compared to solely conventional diversification approaches.

Integration Strategies for Diverse Asset Classes

Integrating portfolio diversification with alternative asset diversification enhances risk-adjusted returns by combining traditional equities and bonds with assets like real estate, private equity, and commodities. Strategic allocation models leverage correlations and volatility patterns among diverse asset classes to optimize overall portfolio resilience and growth potential. Employing multi-asset integration strategies ensures balanced exposure, effective risk mitigation, and improved capital preservation in dynamic market environments.

Common Pitfalls in Diversifying Investments

Over-diversification can dilute portfolio returns and increase management complexity, often leading to suboptimal investment outcomes. Investors may mistakenly assume alternative assets like real estate, private equity, or commodities inherently reduce risk without fully considering liquidity constraints and valuation challenges. Failure to conduct thorough due diligence and maintain strategic alignment between traditional and alternative asset classes exposes portfolios to unintended correlations and potential losses.

Building a Balanced Investment Approach for Long-Term Growth

Portfolio diversification spreads investments across traditional asset classes like stocks, bonds, and real estate to reduce risk and enhance long-term returns. Alternative asset diversification incorporates assets such as private equity, hedge funds, commodities, and real assets to further mitigate volatility and improve portfolio resilience. Combining both strategies creates a balanced investment approach that leverages market opportunities while protecting against systemic shocks, fostering sustainable growth over time.

Related Important Terms

Thematic Diversification

Thematic diversification in portfolio management enhances risk mitigation by allocating assets across varied investment themes such as technology, healthcare, and sustainability, capturing sector-specific growth trends. Alternative asset diversification further broadens exposure by integrating non-traditional investments like real estate, commodities, and private equity, which often exhibit low correlation with public markets and strengthen overall portfolio resilience.

Cross-Asset Class Blending

Cross-asset class blending enhances investment resilience by integrating portfolio diversification across traditional stocks and bonds with alternative asset diversification, such as real estate, private equity, and commodities, reducing overall risk and improving return potential. This strategy leverages varying correlation patterns and market cycles, optimizing capital allocation and achieving more stable, long-term growth in volatile markets.

Private Market Allocation

Portfolio diversification traditionally balances risks across stocks, bonds, and cash, while alternative asset diversification emphasizes private market allocations such as private equity, real estate, and infrastructure to enhance return potential and reduce correlation with public markets. Incorporating private market investments can offer investors access to unique growth opportunities and long-term value creation that may not be captured through conventional portfolio strategies.

Digital Asset Diversification

Digital asset diversification enhances traditional portfolio diversification by incorporating cryptocurrencies, tokens, and blockchain-based assets that offer unique risk-return profiles and low correlation to conventional financial instruments. This approach mitigates volatility and improves potential growth by spreading investments across various digital asset classes such as DeFi tokens, NFTs, and stablecoins, complementing traditional assets like stocks and bonds.

Non-Correlated Alternative Exposure

Portfolio diversification traditionally aims to reduce risk by spreading investments across various asset classes such as stocks and bonds, whereas alternative asset diversification focuses on incorporating non-correlated alternatives like hedge funds, private equity, real estate, and commodities, which provide exposure to distinct market dynamics. This non-correlated alternative exposure enhances risk-adjusted returns by mitigating the impact of market volatility and economic cycles typically affecting traditional portfolios.

Risk Parity Portfolio

Risk parity portfolio strategy emphasizes balancing risk contributions across diversified asset classes, enhancing stability by allocating capital based on volatility rather than nominal weights. Incorporating alternative asset diversification, such as real estate, private equity, and commodities, alongside traditional portfolios, reduces correlation risks and improves risk-adjusted returns.

Impact Investment Mix

Portfolio diversification reduces risk by spreading investments across multiple asset classes, while alternative asset diversification in impact investing enhances social and environmental returns alongside financial gains. Combining traditional portfolios with impact-focused alternatives like green bonds and social enterprises optimizes the investment mix for sustainable growth and resilience.

ESG-Aligned Diversification

ESG-aligned portfolio diversification integrates environmental, social, and governance criteria across traditional asset classes to mitigate risks and enhance long-term returns, while alternative asset diversification includes impact investments like renewable energy projects and social bonds that directly support sustainable development goals. Combining these strategies fosters resilience against market volatility and aligns capital allocation with ethical, sustainable outcomes.

Fractional Asset Investment

Fractional asset investment enhances portfolio diversification by enabling investors to allocate capital across a variety of traditional and alternative assets, such as real estate, private equity, and cryptocurrency, without large capital commitments. This fractional approach reduces risk concentration while providing access to non-correlated alternative asset classes that can improve overall portfolio performance and resilience.

Tokenized Real Asset Allocation

Tokenized real asset allocation enhances portfolio diversification by providing fractional ownership in tangible assets like real estate and commodities, reducing correlation with traditional equities and bonds. This alternative asset diversification improves liquidity and access to global markets, optimizing risk-adjusted returns in investment portfolios.

Portfolio Diversification vs Alternative Asset Diversification for Investment Infographic

moneydiff.com

moneydiff.com