Bonds offer a reliable fixed-income investment with varying risk levels depending on the issuer, making them suitable for conservative portfolios. Green bonds specifically finance environmentally sustainable projects, appealing to investors seeking to support climate-friendly initiatives while earning competitive returns. Choosing between traditional bonds and green bonds depends on the investor's priorities for financial gain and environmental impact.

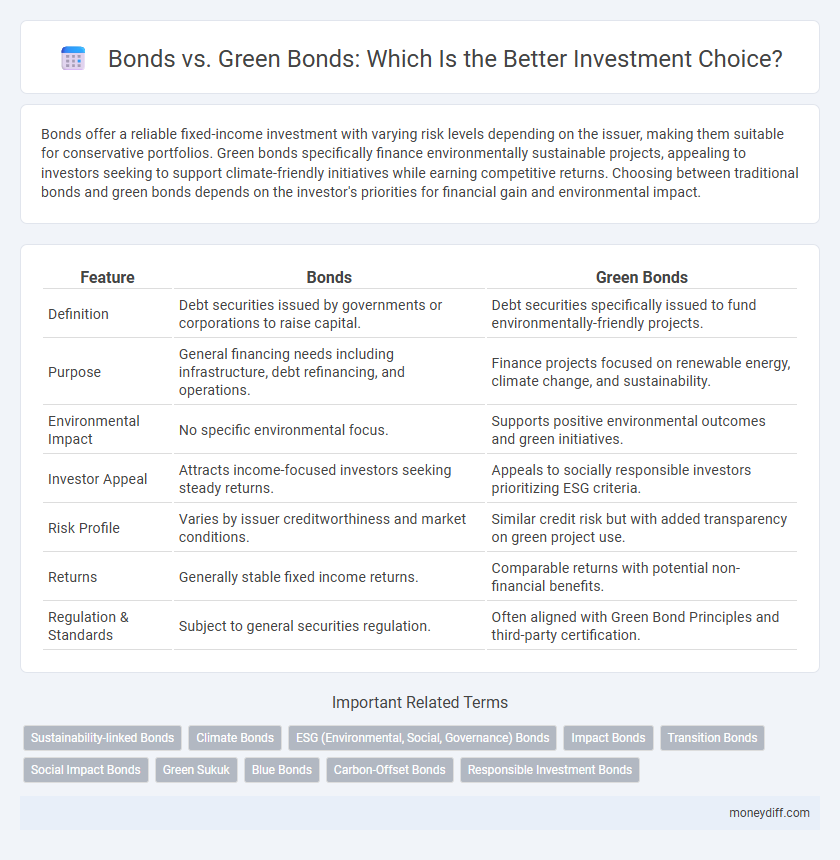

Table of Comparison

| Feature | Bonds | Green Bonds |

|---|---|---|

| Definition | Debt securities issued by governments or corporations to raise capital. | Debt securities specifically issued to fund environmentally-friendly projects. |

| Purpose | General financing needs including infrastructure, debt refinancing, and operations. | Finance projects focused on renewable energy, climate change, and sustainability. |

| Environmental Impact | No specific environmental focus. | Supports positive environmental outcomes and green initiatives. |

| Investor Appeal | Attracts income-focused investors seeking steady returns. | Appeals to socially responsible investors prioritizing ESG criteria. |

| Risk Profile | Varies by issuer creditworthiness and market conditions. | Similar credit risk but with added transparency on green project use. |

| Returns | Generally stable fixed income returns. | Comparable returns with potential non-financial benefits. |

| Regulation & Standards | Subject to general securities regulation. | Often aligned with Green Bond Principles and third-party certification. |

Introduction to Bonds and Green Bonds

Bonds are fixed-income securities that provide investors with regular interest payments and return of principal upon maturity, commonly issued by governments and corporations. Green bonds specifically finance projects with environmental benefits, such as renewable energy or pollution reduction, attracting investors interested in sustainable development. Both bonds offer stable returns, but green bonds integrate environmental impact criteria, aligning investment portfolios with ESG (Environmental, Social, and Governance) goals.

Key Differences Between Bonds and Green Bonds

Bonds typically fund a wide range of governmental or corporate projects, while green bonds specifically finance environmentally sustainable initiatives such as renewable energy or pollution reduction. Green bonds often attract investors interested in ethical and socially responsible investing, offering transparency through third-party certification and impact reporting. Traditional bonds generally deliver returns based solely on credit risk and interest rate considerations, whereas green bonds combine financial returns with positive environmental impact metrics.

How Traditional Bonds Work

Traditional bonds are debt securities issued by governments or corporations to raise capital, offering fixed interest payments to investors over a specified period until maturity. Investors receive periodic coupon payments that reflect the bond's yield, making them a reliable income source with lower risk compared to stocks. These securities are traded on bond markets, with prices influenced by interest rates, credit ratings, and economic conditions.

Understanding Green Bonds: Purpose and Scope

Green bonds are fixed-income securities specifically issued to finance projects with positive environmental impacts, such as renewable energy, clean transportation, and sustainable water management. These bonds appeal to investors seeking to align their portfolios with environmental, social, and governance (ESG) criteria while earning steady returns. Understanding the scope of green bonds involves recognizing their role in fueling the global transition to a low-carbon economy and addressing climate change challenges.

Risk and Return Comparison: Bonds vs Green Bonds

Traditional bonds typically offer stable returns with moderate risk, backed by established issuers and predictable cash flows, whereas green bonds, while generally carrying comparable credit risk, may present additional risk factors related to environmental project performance and regulatory changes. Green bonds often attract investors seeking both financial returns and positive environmental impact, potentially leading to lower yield spreads due to heightened demand. The risk-return profile of green bonds can vary based on the underlying project's success, making investor due diligence and impact assessment critical for portfolio decisions.

Environmental Impact of Green Bonds

Green bonds are fixed-income securities specifically designed to fund projects with positive environmental benefits, such as renewable energy, clean transportation, and sustainable agriculture. Unlike traditional bonds, green bonds directly contribute to reducing carbon emissions and promoting eco-friendly initiatives, attracting socially responsible investors focused on environmental impact. Investment in green bonds not only offers financial returns but also supports global efforts to combat climate change and achieve sustainable development goals.

Market Trends: Growth of Green Bonds

Green bonds have experienced rapid growth in recent years, with the global issuance surpassing $500 billion in 2023, reflecting increasing investor demand for sustainable finance. Unlike traditional bonds, green bonds are specifically earmarked for projects with environmental benefits, appealing to markets prioritizing ESG criteria. Strong policy support from governments and institutions worldwide continues to drive expansion and liquidity in the green bond market.

How to Invest in Bonds and Green Bonds

To invest in bonds, investors typically purchase through brokers, mutual funds, or directly via government auctions, focusing on fixed income securities that provide regular interest payments. Green bonds are acquired similarly but specifically fund environmentally friendly projects, appealing to investors prioritizing sustainability alongside returns. Evaluating credit ratings, maturity dates, and yield curves helps optimize portfolios for both traditional and green bonds, aligning financial goals with responsible investing criteria.

Regulatory Frameworks for Bonds and Green Bonds

Regulatory frameworks for traditional bonds primarily focus on disclosure requirements, credit ratings, and investor protections governed by securities authorities such as the SEC in the United States and ESMA in Europe. Green bonds face additional regulations emphasizing environmental impact reporting, adherence to standards like the Green Bond Principles by the International Capital Market Association, and verification of sustainable use of proceeds to prevent greenwashing. These enhanced regulatory standards ensure transparency and credibility, attracting environmentally conscious investors while aligning with global sustainability goals.

Choosing the Right Option: Which Bond Suits Your Investment Goals?

Choosing between traditional bonds and green bonds depends on your investment goals and risk tolerance. Green bonds fund environmentally sustainable projects and may appeal to investors prioritizing social responsibility alongside financial returns, whereas traditional bonds often offer a broader range of sectors and established risk profiles. Evaluating factors like project impact, yield stability, and market demand can help determine which bond aligns best with your portfolio strategy.

Related Important Terms

Sustainability-linked Bonds

Sustainability-linked bonds differ from traditional bonds by tying interest rates or principal repayments to specific environmental, social, or governance (ESG) targets, encouraging issuers to meet sustainability goals with measurable impact. These bonds provide investors with a compelling blend of financial returns and positive environmental outcomes, positioning them as a strategic choice in impact investing and corporate accountability.

Climate Bonds

Climate bonds, a subset of green bonds, specifically fund projects with positive environmental impacts, offering investors opportunities to support sustainability while earning fixed income. Traditional bonds primarily focus on financial returns without necessarily addressing environmental concerns, making climate bonds a strategic choice for investors seeking to align portfolios with climate goals.

ESG (Environmental, Social, Governance) Bonds

Green bonds, a subset of ESG bonds, specifically finance environmentally sustainable projects, offering investors targeted exposure to climate-friendly initiatives while maintaining comparable returns and credit risk to traditional bonds. ESG bonds broadly cover environmental, social, and governance criteria, attracting investors seeking to integrate ethical considerations with financial performance, appealing to a growing demand for responsible investment opportunities.

Impact Bonds

Impact bonds, a subset of green bonds, offer investors measurable positive social or environmental returns alongside financial gains, making them attractive for mission-driven portfolios. Unlike traditional bonds, these securities fund projects with verified outcomes, enhancing accountability and long-term sustainability in investment strategies.

Transition Bonds

Transition bonds finance companies shifting from high to low carbon operations, offering investors opportunities in decarbonization efforts within traditionally high-emission industries. These bonds typically provide competitive yields compared to green bonds, which fund exclusively environmentally sustainable projects, making transition bonds a strategic choice for risk-adjusted returns during energy transitions.

Social Impact Bonds

Social Impact Bonds (SIBs) prioritize funding social programs with measurable outcomes, offering investors both financial returns and positive societal impact, unlike traditional bonds which primarily focus on financial yield. Green Bonds target environmental projects but lack the targeted social performance metrics that define SIBs, making SIBs a unique vehicle for investors seeking verifiable social change alongside financial gain.

Green Sukuk

Green Sukuk offers investors a Sharia-compliant alternative to conventional bonds by financing environmentally sustainable projects, combining ethical investment principles with fixed income returns. These instruments enhance portfolio diversification while promoting renewable energy, water management, and green infrastructure initiatives in emerging markets.

Blue Bonds

Blue bonds are a specialized category of green bonds that finance marine and ocean-based projects aimed at sustainable use of ocean resources and conservation. Investors seeking environmental impact with stable returns often prefer blue bonds due to their focus on issues like ocean pollution, fisheries management, and coastal resilience, offering both ecological benefits and diversification in fixed-income portfolios.

Carbon-Offset Bonds

Carbon-offset bonds are a subset of green bonds specifically designed to finance projects that reduce or capture carbon emissions, offering investors a way to support environmental sustainability while seeking stable returns. Compared to traditional bonds, carbon-offset bonds provide a unique opportunity to align investment portfolios with global climate goals, appealing to environmentally conscious investors targeting measurable carbon impact.

Responsible Investment Bonds

Responsible investment bonds prioritize environmental and social impact alongside financial returns, with green bonds specifically funding projects that promote sustainability such as renewable energy and clean water initiatives. Investors seeking to align portfolios with ESG criteria often favor green bonds for their transparent use of proceeds and certification standards, while traditional bonds focus solely on financial performance without explicit environmental objectives.

Bonds vs Green Bonds for Investment. Infographic

moneydiff.com

moneydiff.com