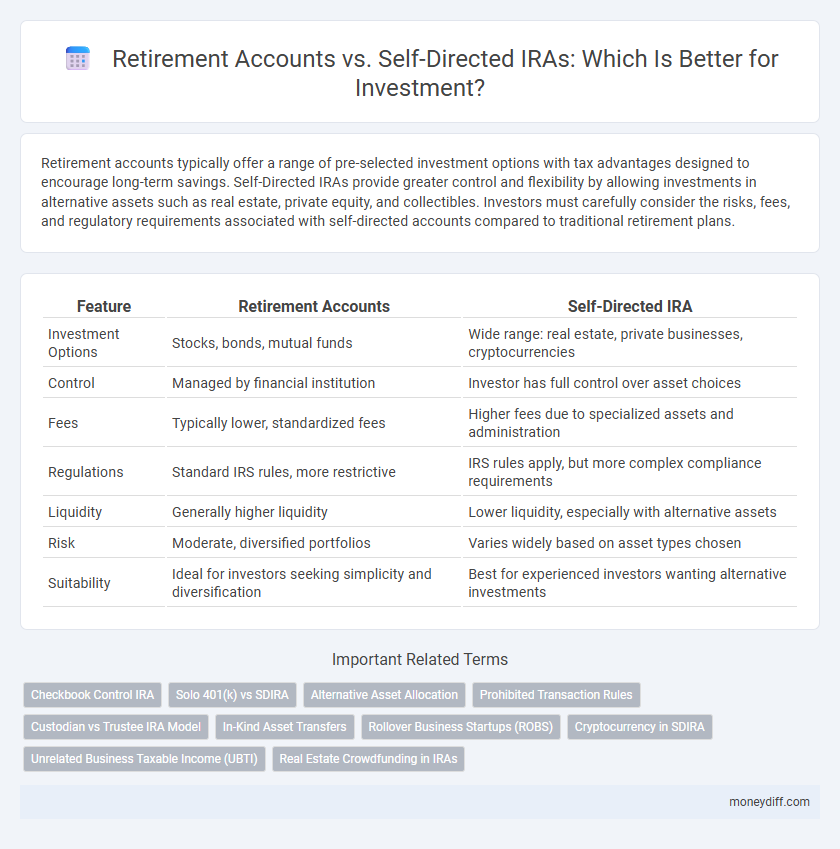

Retirement accounts typically offer a range of pre-selected investment options with tax advantages designed to encourage long-term savings. Self-Directed IRAs provide greater control and flexibility by allowing investments in alternative assets such as real estate, private equity, and collectibles. Investors must carefully consider the risks, fees, and regulatory requirements associated with self-directed accounts compared to traditional retirement plans.

Table of Comparison

| Feature | Retirement Accounts | Self-Directed IRA |

|---|---|---|

| Investment Options | Stocks, bonds, mutual funds | Wide range: real estate, private businesses, cryptocurrencies |

| Control | Managed by financial institution | Investor has full control over asset choices |

| Fees | Typically lower, standardized fees | Higher fees due to specialized assets and administration |

| Regulations | Standard IRS rules, more restrictive | IRS rules apply, but more complex compliance requirements |

| Liquidity | Generally higher liquidity | Lower liquidity, especially with alternative assets |

| Risk | Moderate, diversified portfolios | Varies widely based on asset types chosen |

| Suitability | Ideal for investors seeking simplicity and diversification | Best for experienced investors wanting alternative investments |

Understanding Retirement Accounts: Traditional vs Alternatives

Traditional retirement accounts such as 401(k)s and IRAs offer tax-deferred growth and employer-sponsored benefits but often limit investment options to stocks, bonds, and mutual funds. Self-Directed IRAs provide broader investment flexibility, allowing allocation into real estate, private equity, and precious metals, appealing to investors seeking diversification beyond conventional securities. Understanding the trade-offs between regulatory constraints, fee structures, and potential returns is crucial when choosing between traditional retirement accounts and Self-Directed IRAs.

What is a Self-Directed IRA?

A Self-Directed IRA is a retirement account that allows investors to hold a broader range of investment options beyond traditional stocks, bonds, and mutual funds, including real estate, private equity, and precious metals. Unlike standard IRAs managed by financial institutions, Self-Directed IRAs provide greater control and flexibility, enabling investors to diversify their portfolios according to personal investment strategies. This type of account requires adherence to IRS regulations, including prohibited transactions and disqualified persons rules, to maintain tax advantages.

Key Differences Between Standard Retirement Accounts and Self-Directed IRAs

Standard retirement accounts, such as 401(k)s and traditional IRAs, typically offer limited investment options like stocks, bonds, and mutual funds, whereas self-directed IRAs allow for a broader range of alternative investments, including real estate, private equity, and precious metals. Self-directed IRAs require more active management and due diligence by the investor to comply with IRS regulations and avoid prohibited transactions. Fees and administrative responsibilities tend to be higher in self-directed IRAs, reflecting the increased complexity and customization of investment choices compared to conventional retirement accounts.

Investment Options: Conventional vs Alternative Assets

Retirement accounts such as 401(k)s and traditional IRAs typically offer investment options limited to stocks, bonds, mutual funds, and ETFs, focusing on conventional asset classes for long-term growth and stable returns. Self-Directed IRAs provide the flexibility to invest in alternative assets like real estate, private equity, precious metals, and cryptocurrency, enabling portfolio diversification beyond standard market securities. The ability to include alternative investments can enhance risk management and potentially increase overall portfolio performance by leveraging non-correlated asset classes.

Tax Implications: Comparing Account Types

Traditional retirement accounts like 401(k)s and IRAs offer tax-deferred growth, meaning contributions reduce taxable income and taxes are paid upon withdrawal. Self-directed IRAs provide similar tax advantages but allow broader investment options, including real estate and private equity, which can impact tax reporting and potential penalties if not managed carefully. Understanding required minimum distributions (RMDs) and contribution limits is crucial to optimize tax benefits and avoid unexpected tax liabilities in both account types.

Control and Flexibility: Choosing Your Investments

Retirement accounts like 401(k)s and traditional IRAs offer limited investment options primarily focused on stocks, bonds, and mutual funds, restricting control over asset allocation. Self-Directed IRAs provide investors with greater control and flexibility, allowing them to invest in diverse assets such as real estate, private equity, and cryptocurrencies, beyond conventional securities. This expanded investment scope enables personalized portfolio strategies tailored to individual risk tolerance and financial goals.

Risk Management in Retirement Accounts

Retirement accounts typically offer built-in risk management features such as diversification requirements, regulatory oversight, and limited investment options aimed at reducing exposure to high-risk assets. Self-Directed IRAs provide greater investment flexibility but often lack the same level of automatic safeguards, placing more responsibility on the investor to manage risks effectively. Utilizing traditional retirement accounts can help mitigate portfolio volatility and protect against significant losses during market downturns through structured asset allocation and professional management.

Costs and Fees: What to Expect

Retirement accounts typically charge management fees ranging from 0.25% to 1.5% annually, while self-directed IRAs often have additional custodian fees, transaction fees, and setup costs that can increase overall expenses. Self-directed IRAs may incur fees for asset storage, annual maintenance, and administrative costs that are not usually present in traditional retirement accounts. Investors should evaluate these cost structures carefully to determine which option offers the best balance between investment flexibility and fee efficiency.

Regulatory Compliance and Custodian Roles

Retirement accounts such as 401(k)s and traditional IRAs are regulated by the IRS and require custodians to ensure compliance with contribution limits, prohibited transactions, and required minimum distributions. In contrast, Self-Directed IRAs offer broader investment options but demand more active management from the account holder to comply with IRS rules, as the custodian's role primarily involves administrative oversight rather than investment decisions. Understanding the custodian's responsibilities and strict adherence to regulatory compliance is crucial to avoiding penalties and maintaining tax-advantaged status in both account types.

Which Account Suits Your Investment Goals?

Retirement accounts like 401(k)s and traditional IRAs offer tax advantages and simplified investment options suitable for conservative investors focusing on long-term growth and employer contributions. Self-directed IRAs provide more flexibility, allowing investment in real estate, private equity, and cryptocurrencies, appealing to experienced investors seeking diversification beyond stocks and bonds. Choosing the right account depends on your risk tolerance, investment knowledge, and desire for control over asset allocation aligned with your retirement goals.

Related Important Terms

Checkbook Control IRA

Checkbook Control IRAs provide investors direct access to manage retirement funds, allowing for quicker investment decisions compared to traditional retirement accounts that require custodian approval. This structure enhances flexibility and control, enabling diversified investments such as real estate, private equity, and startups within a single self-directed retirement account.

Solo 401(k) vs SDIRA

A Solo 401(k) offers higher contribution limits up to $66,000 in 2024 and allows both employee deferrals and employer profit-sharing, providing greater tax advantages and flexibility compared to a Self-Directed IRA (SDIRA), which has lower annual contribution limits of $7,000 for those under 50. While SDIRAs enable a broader range of alternative investments such as real estate and private equity, Solo 401(k)s often include loan options and simpler administrative requirements, making them ideal for self-employed individuals seeking maximum retirement savings and investment control.

Alternative Asset Allocation

Retirement accounts like Traditional and Roth IRAs provide tax advantages and diversified portfolios but often limit alternative asset allocation to stocks, bonds, and mutual funds. Self-Directed IRAs expand investment options to include real estate, private equity, precious metals, and cryptocurrencies, enabling broader diversification and potential for higher returns within a retirement strategy.

Prohibited Transaction Rules

Retirement accounts must strictly adhere to prohibited transaction rules that prevent self-dealing and conflicts of interest, safeguarding the investor's tax advantages and account integrity. Self-Directed IRAs offer broader investment options but require careful compliance with IRS regulations to avoid prohibited transactions such as buying property for personal use or engaging in transactions with disqualified persons.

Custodian vs Trustee IRA Model

Retirement accounts typically use a custodian IRA model where a financial institution holds and manages assets, ensuring compliance with IRS regulations and simplifying administrative duties. The self-directed IRA employs a trustee model, granting investors greater control and flexibility over diverse alternative investments, while the trustee remains responsible for asset custody and regulatory oversight.

In-Kind Asset Transfers

In-kind asset transfers allow investors to move assets such as stocks, bonds, or mutual funds from a traditional retirement account to a self-directed IRA without triggering taxable events, preserving investment value. This process enhances portfolio diversification and control within a self-directed IRA, enabling access to alternative investments like real estate or private equity.

Rollover Business Startups (ROBS)

Rollover Business Startups (ROBS) enable investors to use funds from traditional retirement accounts like 401(k)s or IRAs to finance new business ventures without incurring early withdrawal penalties, offering a strategic advantage over typical Retirement Accounts that limit investment choices. Self-Directed IRAs expand investment flexibility by allowing control over diverse asset classes, but ROBS specifically facilitate direct business funding through qualified employer plans, blending retirement savings with entrepreneurial opportunity.

Cryptocurrency in SDIRA

Retirement accounts such as 401(k)s and traditional IRAs generally offer limited exposure to cryptocurrency, while Self-Directed IRAs (SDIRAs) enable investors to directly hold digital assets like Bitcoin and Ethereum, providing greater control and diversification in their portfolios. SDIRAs require compliance with IRS rules on prohibited transactions and custodial management, making them essential for investors seeking tax-advantaged cryptocurrency investments within a retirement framework.

Unrelated Business Taxable Income (UBTI)

Retirement accounts such as traditional IRAs typically have limited exposure to Unrelated Business Taxable Income (UBTI), whereas Self-Directed IRAs, which allow investments in alternative assets like real estate or private equity, are more susceptible to generating UBTI. Understanding UBTI's tax implications is critical for investors using Self-Directed IRAs to avoid unexpected tax liabilities and preserve tax-deferred growth.

Real Estate Crowdfunding in IRAs

Retirement accounts like Traditional and Roth IRAs offer tax advantages but often limit real estate crowdfunding investments to select platforms, whereas Self-Directed IRAs provide broader access to diverse real estate crowdfunding opportunities, enabling direct investment in commercial and residential projects for retirement growth. Utilizing a Self-Directed IRA for real estate crowdfunding enhances portfolio diversification and potential returns through partial ownership in vetted real estate assets, while maintaining tax-deferred or tax-free growth depending on the account type.

Retirement Accounts vs Self-Directed IRA for investment. Infographic

moneydiff.com

moneydiff.com