Dividend investing provides steady income through regular payouts from established companies, ensuring cash flow and lower risk over time. Growth hacking focuses on aggressively scaling startups or high-growth stocks, aiming for significant capital appreciation despite higher volatility. Balancing both strategies can diversify a portfolio by combining income stability with the potential for substantial returns.

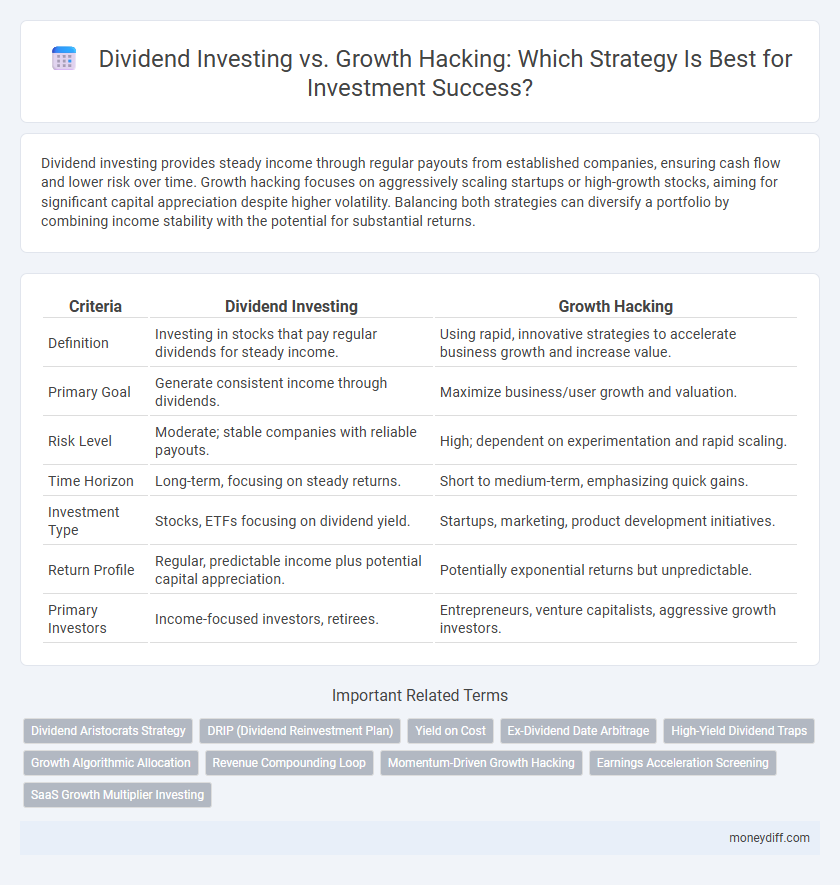

Table of Comparison

| Criteria | Dividend Investing | Growth Hacking |

|---|---|---|

| Definition | Investing in stocks that pay regular dividends for steady income. | Using rapid, innovative strategies to accelerate business growth and increase value. |

| Primary Goal | Generate consistent income through dividends. | Maximize business/user growth and valuation. |

| Risk Level | Moderate; stable companies with reliable payouts. | High; dependent on experimentation and rapid scaling. |

| Time Horizon | Long-term, focusing on steady returns. | Short to medium-term, emphasizing quick gains. |

| Investment Type | Stocks, ETFs focusing on dividend yield. | Startups, marketing, product development initiatives. |

| Return Profile | Regular, predictable income plus potential capital appreciation. | Potentially exponential returns but unpredictable. |

| Primary Investors | Income-focused investors, retirees. | Entrepreneurs, venture capitalists, aggressive growth investors. |

Introduction: Dividend Investing vs Growth Hacking

Dividend investing focuses on acquiring stocks that provide regular income through dividends, appealing to investors seeking steady cash flow and lower risk. Growth hacking in investment aims to rapidly increase portfolio value by targeting high-growth stocks or startups with significant capital appreciation potential but higher volatility. Understanding the balance between consistent dividend returns and aggressive growth strategies is essential for optimizing investment performance.

Understanding Dividend Investing Fundamentals

Dividend investing centers on acquiring shares of companies that consistently distribute a portion of their earnings as dividends, providing investors with regular income and potential for capital appreciation. Understanding key metrics such as dividend yield, payout ratio, and dividend growth rate is essential to evaluate the sustainability and profitability of dividend payments. This strategy emphasizes long-term wealth accumulation through reinvestment of dividends and compounding returns, contrasting with growth hacking that focuses on rapid capital gains from high-growth stocks.

What is Growth Hacking in Investment?

Growth hacking in investment refers to employing innovative, data-driven strategies aimed at rapidly increasing a company's market value and revenue streams. Investors focused on growth hacking prioritize startups or businesses with high scalability potential, emphasizing aggressive marketing, customer acquisition, and product development tactics to maximize returns. This approach contrasts with dividend investing, which focuses on stable income through regular payouts rather than exponential business expansion.

Risk Profiles: Dividend Strategies vs Growth Tactics

Dividend investing typically offers lower risk profiles by providing steady income through regular payouts, appealing to conservative investors seeking capital preservation. Growth hacking strategies, however, involve higher risk due to market volatility and reliance on rapid capital appreciation, attracting investors with greater risk tolerance aiming for significant long-term gains. Understanding these differing risk profiles is essential for aligning investment choices with individual financial goals and risk appetite.

Long-Term Wealth: Compound Growth vs Dividend Reinvestment

Dividend investing leverages dividend reinvestment to harness compound growth, enabling steady accumulation of wealth through regular income streams and compounded returns. Growth hacking in investment targets rapid capital appreciation by identifying high-growth stocks with potential for significant price increases, often sacrificing immediate income for long-term gains. Prioritizing dividend reinvestment supports sustained wealth creation with lower volatility, while growth-focused strategies require higher risk tolerance to capitalize on exponential value expansion over time.

Income Stability: Regular Payouts vs Capital Gains

Dividend investing provides income stability through consistent, regular payouts from established companies, appealing to investors seeking predictable cash flow. Growth hacking strategies emphasize capital gains by targeting high-potential startups or rapidly scaling businesses, often resulting in variable short-term returns but significant long-term appreciation. Balancing dividend income with growth opportunities can optimize portfolio diversification and risk management for steady wealth accumulation.

Portfolio Diversification: Balancing Dividends and Growth

Balancing dividend investing and growth hacking strategies enhances portfolio diversification by combining steady income streams with high capital appreciation potential. Dividend stocks provide reliable cash flow and reduce volatility, while growth investments target significant expansion in emerging sectors. A well-diversified portfolio integrates both to optimize risk-adjusted returns and long-term wealth accumulation.

Tax Implications of Dividends vs Growth Investments

Dividend investing often results in immediate tax liabilities since dividends are typically taxed as ordinary income or qualified dividends, depending on the investor's tax bracket. Growth investments defer taxes until capital gains are realized, allowing for potential tax advantages through long-term appreciation and tax loss harvesting. Understanding the tax treatment of dividends versus growth gains is crucial for optimizing after-tax returns in an investment portfolio.

Suitability: Which Investment Style Fits Your Goals?

Dividend investing suits investors seeking steady income and lower risk through regular payouts from established companies, making it ideal for conservative portfolios or retirement planning. Growth hacking focuses on aggressive capital appreciation by targeting high-growth stocks or startups, appealing to investors with higher risk tolerance and longer time horizons. Choosing the right investment style depends on personal financial goals, risk appetite, and investment timeline for optimal portfolio alignment.

Conclusion: Choosing the Right Path for Financial Growth

Dividend investing offers steady income through regular payouts, appealing to risk-averse investors seeking reliable cash flow and long-term wealth preservation. Growth hacking focuses on identifying high-potential assets that promise substantial capital appreciation, ideal for investors willing to accept higher volatility for accelerated portfolio expansion. Selecting the right investment strategy depends on individual financial goals, risk tolerance, and time horizon, ensuring alignment with one's path to sustainable financial growth.

Related Important Terms

Dividend Aristocrats Strategy

Dividend Aristocrats strategy emphasizes investing in companies with a consistent history of increasing dividends for at least 25 years, providing stable income and lower volatility compared to aggressive growth hacking approaches. This method prioritizes reliable cash flow and long-term wealth accumulation over rapid expansion, appealing to risk-averse investors seeking sustainable returns.

DRIP (Dividend Reinvestment Plan)

Dividend Reinvestment Plans (DRIPs) enable investors to automatically reinvest dividends to purchase additional shares, harnessing compounding returns and promoting steady portfolio growth with lower transaction costs. Compared to growth hacking strategies focused on rapid capital gains, DRIPs emphasize long-term wealth accumulation through disciplined, dividend-focused investing.

Yield on Cost

Dividend investing prioritizes generating steady income through high-yielding stocks, enhancing Yield on Cost by reinvesting dividends to maximize long-term returns. Growth hacking focuses on aggressive capital appreciation, which may delay income but can significantly increase portfolio value and potential future Yield on Cost through stock price appreciation.

Ex-Dividend Date Arbitrage

Dividend investing leverages the ex-dividend date arbitrage strategy by capturing stock price movements around the ex-dividend date to optimize returns, focusing on dividend yield and timing. Growth hacking in investment emphasizes rapid capital appreciation through high-growth stocks, often bypassing dividend considerations for accelerated valuation increases.

High-Yield Dividend Traps

High-yield dividend traps often lure investors with attractive payouts but conceal deteriorating fundamentals, making dividend investing riskier compared to growth hacking strategies focusing on scalable business models and innovation-driven capital appreciation. Prioritizing growth hacking enables investors to capture exponential value creation in disruptive sectors, whereas high-yield dividend traps may erode portfolio returns through unsustainable dividends and declining stock prices.

Growth Algorithmic Allocation

Growth Algorithmic Allocation leverages data-driven strategies and machine learning models to optimize portfolio growth by dynamically adjusting asset weights based on market signals and risk factors. This approach contrasts with dividend investing by prioritizing capital appreciation and adaptive rebalancing over steady income streams from dividend-paying stocks.

Revenue Compounding Loop

Dividend investing leverages steady payouts to create a revenue compounding loop by reinvesting dividends for exponential portfolio growth, while growth hacking focuses on aggressive performance strategies to amplify returns rapidly but with higher risk. Prioritizing dividend reinvestment harnesses consistent cash flow for sustained long-term compounding, contrasting with growth hacking's emphasis on short-term scalability and market disruption.

Momentum-Driven Growth Hacking

Dividend investing emphasizes steady income streams from established companies with regular payouts, offering lower risk and predictable returns, while momentum-driven growth hacking targets rapid capital appreciation by exploiting market trends and behavioral finance strategies to capture short-term price surges in emerging sectors. Investors prioritizing momentum-driven growth hacking often leverage technical analysis, social media sentiment, and algorithmic trading to identify and act on volatile stock movements, aiming for accelerated portfolio growth despite higher risk exposure.

Earnings Acceleration Screening

Dividend investing prioritizes stable income streams through consistent dividend-paying stocks, emphasizing companies with strong cash flow and a history of dividend growth. Growth hacking in investment focuses on earnings acceleration screening to identify stocks with rapid revenue and earnings expansion, targeting firms that reinvest profits for aggressive growth potential.

SaaS Growth Multiplier Investing

Dividend investing offers steady cash flow through regular payouts, appealing to investors seeking reliable income streams in SaaS companies with strong, consistent earnings. Growth hacking for SaaS emphasizes aggressive user acquisition and scaling strategies, aiming for exponential revenue growth and higher valuation multiples, which can lead to superior long-term capital appreciation.

Dividend Investing vs Growth Hacking for investment. Infographic

moneydiff.com

moneydiff.com