REITs offer traditional real estate investment opportunities with physical properties and often provide regular dividends, making them attractive for income-focused investors. eREITs operate online with lower minimum investments and increased liquidity, appealing to a broader range of individual investors seeking accessibility and flexibility. Comparing REITs and eREITs involves balancing factors like risk, returns, fees, and investment horizon to determine which vehicle aligns best with financial goals.

Table of Comparison

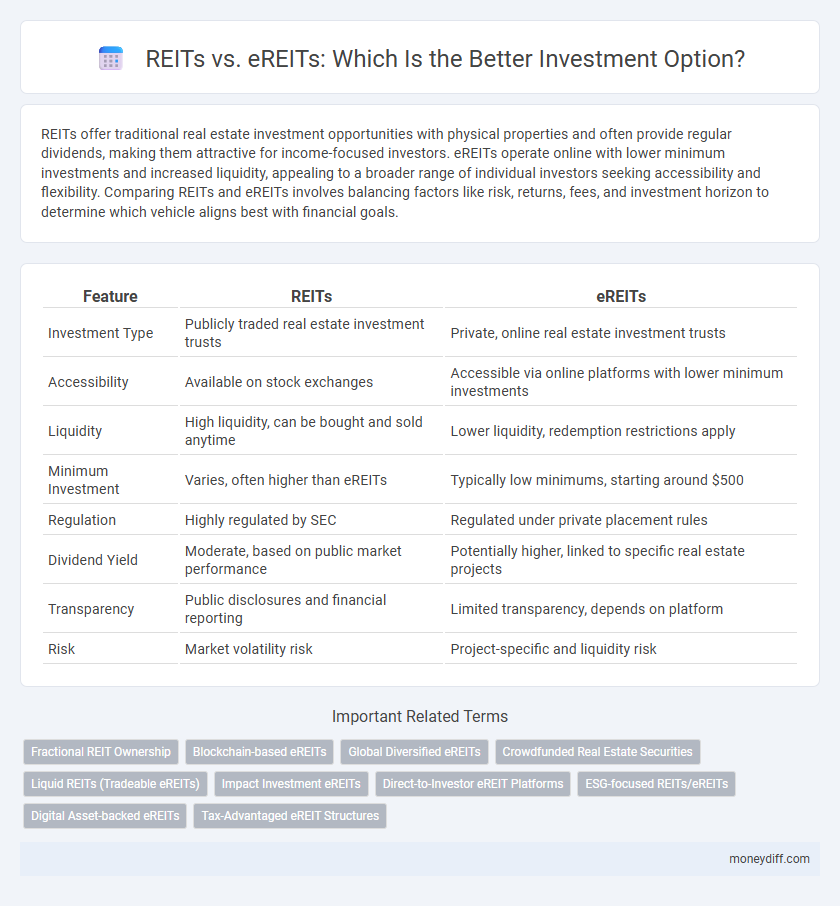

| Feature | REITs | eREITs |

|---|---|---|

| Investment Type | Publicly traded real estate investment trusts | Private, online real estate investment trusts |

| Accessibility | Available on stock exchanges | Accessible via online platforms with lower minimum investments |

| Liquidity | High liquidity, can be bought and sold anytime | Lower liquidity, redemption restrictions apply |

| Minimum Investment | Varies, often higher than eREITs | Typically low minimums, starting around $500 |

| Regulation | Highly regulated by SEC | Regulated under private placement rules |

| Dividend Yield | Moderate, based on public market performance | Potentially higher, linked to specific real estate projects |

| Transparency | Public disclosures and financial reporting | Limited transparency, depends on platform |

| Risk | Market volatility risk | Project-specific and liquidity risk |

Understanding REITs: Traditional Real Estate Investment Trusts

Traditional Real Estate Investment Trusts (REITs) allow investors to pool capital to invest in diversified, income-generating real estate portfolios, including commercial properties, residential complexes, and industrial spaces. These trusts are publicly traded on major stock exchanges, providing liquidity and regulatory transparency while delivering regular dividend income from rental earnings. Understanding the structure and market behavior of traditional REITs is essential for investors seeking stable cash flow and long-term property appreciation within the real estate sector.

What Are eREITs? An Introduction to Digital Real Estate Investing

eREITs, or electronic Real Estate Investment Trusts, represent a digital evolution of traditional REITs, allowing investors to buy shares in real estate portfolios through online platforms. These digital securities offer increased liquidity, lower minimum investments, and streamlined access compared to conventional REITs, making real estate investment more accessible to a broader audience. Powered by blockchain technology, eREITs provide transparent ownership records, faster transactions, and reduced fees while maintaining exposure to diversified real estate assets.

Key Differences Between REITs and eREITs

REITs are publicly traded real estate investment trusts offering liquidity and transparency on major stock exchanges, while eREITs are non-traded, online-only real estate funds with lower liquidity but often lower minimum investments. Traditional REITs provide dividends from diversified commercial property portfolios, whereas eREITs may focus on specific property types or markets with potentially higher yield but increased risk. Investors should evaluate factors like liquidity, minimum investment requirements, market exposure, and fee structures when comparing REITs and eREITs.

Accessibility and Investment Minimums: REITs vs eREITs

REITs typically require higher minimum investments, often starting at $1,000 or more, limiting accessibility for smaller investors. eREITs offer lower minimums, sometimes as low as $500, enabling broader participation through online platforms. This increased accessibility allows individuals to diversify portfolios with real estate exposure without large capital commitments.

Liquidity Comparison: Are eREITs More Liquid Than Traditional REITs?

eREITs typically offer higher liquidity compared to traditional REITs due to their online platform accessibility and shorter redemption periods, allowing investors to buy and sell shares more quickly. Traditional REITs often trade on public exchanges, providing daily liquidity but can be subject to market volatility and longer settlement times. The enhanced liquidity of eREITs makes them attractive for investors seeking faster access to funds without the need for public market exposure.

Diversification Opportunities in REITs and eREITs

REITs and eREITs both offer diversification opportunities by allowing investors to access real estate portfolios across various sectors such as residential, commercial, and industrial properties. Traditional REITs often involve higher entry costs and liquidity constraints, while eREITs provide lower minimum investments and greater liquidity through online platforms, expanding access to a broader range of investors. Diversification through REITs and eREITs helps reduce portfolio risk by spreading investments across multiple geographic locations and property types.

Fees and Cost Structures: Evaluating Investment Expenses

REITs typically involve higher fees due to management expenses and brokerage commissions, often ranging from 1% to 2.5% annually. eREITs offer lower cost structures by leveraging digital platforms and minimizing administrative overhead, with fees sometimes below 1%. Evaluating these expenses is crucial, as lower fees in eREITs can enhance net returns while traditional REITs may provide broader market access.

Performance and Returns: Historical Data and Projections

REITs have historically delivered steady income streams with average annual returns ranging from 8% to 12%, driven by stable property income and capital appreciation in commercial real estate markets. eREITs, leveraging online platforms, provide increased liquidity and lower minimum investments, often matching traditional REIT performance while appealing to tech-savvy investors. Projections indicate eREITs may experience accelerated growth due to digital accessibility and growing investor demand, but traditional REITs remain a robust choice backed by decades of consistent market data.

Regulatory Considerations: Compliance and Investor Protections

REITs are subject to strict SEC regulations, ensuring comprehensive investor protections and transparent compliance requirements. eREITs, while also regulated by the SEC, often operate under different frameworks that may involve fewer disclosure obligations and varying levels of liquidity protections. Investors must evaluate the regulatory environment of each to align with their risk tolerance and compliance expectations in real estate investment.

Choosing the Right Option: REITs or eREITs for Your Portfolio

REITs offer traditional real estate investment benefits with liquidity through public markets, while eREITs provide fractional ownership via online platforms, often requiring lower minimum investments. Evaluating factors such as risk tolerance, investment horizon, and desired income streams helps determine the best fit for portfolio diversification. Comparing historical returns, regulatory frameworks, and management fees is essential in choosing between REITs and eREITs for optimizing real estate exposure.

Related Important Terms

Fractional REIT Ownership

Fractional REIT ownership allows investors to purchase smaller, more affordable shares of real estate investment trusts, enhancing diversification and liquidity compared to traditional REITs. eREITs operate entirely online, offering streamlined access to institutional-grade real estate assets with lower minimum investments and transparent fee structures.

Blockchain-based eREITs

Blockchain-based eREITs offer enhanced transparency and liquidity compared to traditional REITs by utilizing decentralized ledgers to streamline transactions and reduce intermediaries. Smart contracts embedded in eREITs ensure automated compliance and faster distributions, making them an innovative alternative for investors seeking real estate exposure with lower entry barriers and improved operational efficiency.

Global Diversified eREITs

Global diversified eREITs offer investors exposure to a wide range of real estate assets across multiple countries, reducing risk through geographic and sector diversification compared to traditional REITs that often focus on specific regions or property types. These digital investment platforms provide enhanced liquidity, lower entry barriers, and efficient portfolio management, making global eREITs a compelling choice for investors seeking diversified real estate exposure with ease of access.

Crowdfunded Real Estate Securities

Crowdfunded real estate securities such as eREITs offer investors low minimum investments and increased liquidity compared to traditional REITs, which typically require larger capital commitments and are traded on public exchanges. eREITs leverage online platforms to provide diversified access to commercial real estate assets, enabling fractional ownership and streamlined investment processes for retail investors.

Liquid REITs (Tradeable eREITs)

Liquid REITs, also known as tradeable eREITs, offer enhanced liquidity compared to traditional REITs by allowing investors to buy and sell shares on secondary markets, providing faster access to capital. These digital investment vehicles leverage blockchain technology to improve transparency, reduce transaction costs, and enable fractional ownership, making real estate investment more accessible and flexible.

Impact Investment eREITs

Impact Investment eREITs offer a unique opportunity to invest in real estate with a focus on social and environmental outcomes, combining financial returns with positive community impact. These digital platforms expand access and transparency compared to traditional REITs, enabling investors to support sustainable development projects while diversifying their portfolios.

Direct-to-Investor eREIT Platforms

Direct-to-investor eREIT platforms offer enhanced accessibility and lower entry barriers compared to traditional REITs, enabling individual investors to directly participate in real estate portfolios with reduced fees and increased transparency. These digital platforms leverage technology to streamline investment processes, provide real-time data analytics, and allow fractional ownership, making real estate investment more democratic and liquid.

ESG-focused REITs/eREITs

ESG-focused REITs prioritize environmentally sustainable and socially responsible real estate assets, offering investors exposure to green buildings and community-centric properties with potential for stable, long-term returns. eREITs enhance accessibility and liquidity by leveraging digital platforms, enabling smaller investments in ESG-compliant real estate portfolios while maintaining alignment with sustainability criteria and corporate governance standards.

Digital Asset-backed eREITs

Digital asset-backed eREITs combine the traditional benefits of Real Estate Investment Trusts (REITs) with blockchain technology, offering enhanced liquidity, transparency, and fractional ownership opportunities. These digital eREITs often provide faster transaction settlements and global accessibility compared to conventional REITs, making them an attractive option for investors seeking exposure to real estate through innovative financial instruments.

Tax-Advantaged eREIT Structures

eREITs leverage tax-advantaged structures such as pass-through taxation under the IRS's real estate investment trust guidelines, allowing investors to avoid double taxation common in traditional REITs. This efficient tax design enhances after-tax returns by reducing taxable income at the entity level, making eREITs particularly attractive for high-net-worth individuals seeking to maximize investment yield.

REITs vs eREITs for Investment Infographic

moneydiff.com

moneydiff.com