Commodities provide direct exposure to physical assets such as gold, oil, and agricultural products, offering a hedge against inflation and currency fluctuations. Alternative investments, including private equity, hedge funds, and real estate, typically deliver diversification benefits and potential for higher returns due to their lower correlation with traditional markets. Choosing between commodities and alternative investments depends on an investor's risk tolerance, investment horizon, and desired portfolio balance.

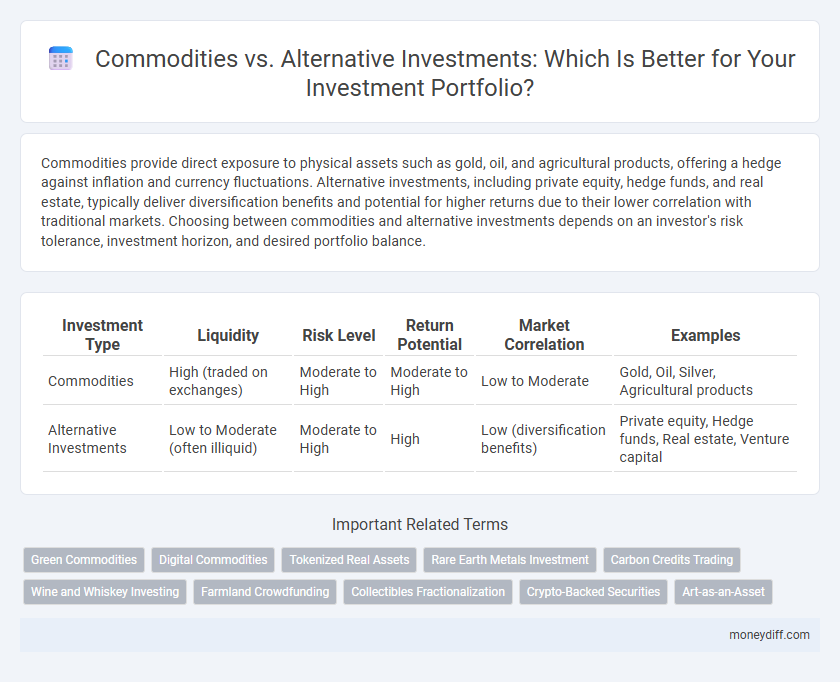

Table of Comparison

| Investment Type | Liquidity | Risk Level | Return Potential | Market Correlation | Examples |

|---|---|---|---|---|---|

| Commodities | High (traded on exchanges) | Moderate to High | Moderate to High | Low to Moderate | Gold, Oil, Silver, Agricultural products |

| Alternative Investments | Low to Moderate (often illiquid) | Moderate to High | High | Low (diversification benefits) | Private equity, Hedge funds, Real estate, Venture capital |

Commodities vs Alternative Investments: An Overview

Commodities such as gold, oil, and agricultural products offer tangible assets with intrinsic value and serve as effective hedges against inflation and market volatility. Alternative investments encompass a broad range of assets including private equity, hedge funds, real estate, and collectibles, providing portfolio diversification and potential for higher returns with varying degrees of liquidity and risk. Understanding the liquidity, risk profile, and market correlation of commodities versus alternative investments is crucial for strategic asset allocation and optimizing investment performance.

Key Characteristics of Commodities

Commodities are tangible assets like gold, oil, and agricultural products, known for their high liquidity and sensitivity to geopolitical events, inflation, and supply-demand dynamics. They provide a natural hedge against inflation and currency devaluation, making them essential for portfolio diversification. Unlike alternative investments, commodities exhibit lower correlation with traditional stocks and bonds, offering distinct risk-return profiles for investors.

Understanding Alternative Investments

Alternative investments encompass assets outside traditional stocks and bonds, including private equity, hedge funds, real estate, and commodities, offering diversification benefits and potential for higher returns. Unlike commodities, which are physical goods such as gold, oil, and agricultural products subject to market volatility and supply-demand dynamics, alternative investments provide exposure to unique risk-return profiles and often lower correlation with conventional markets. Investors seeking portfolio diversification should analyze liquidity, risk tolerance, and regulatory considerations when incorporating alternative investments.

Risk and Return Comparison

Commodities often exhibit high price volatility driven by geopolitical events and supply-demand imbalances, leading to unpredictable returns but potential for significant short-term gains. Alternative investments, such as private equity and hedge funds, typically offer diversified risk profiles with return patterns less correlated to traditional markets, providing portfolio stability. Evaluating the risk-return tradeoff, commodities present higher liquidity risk and market sensitivity, whereas alternatives may offer smoother returns but involve longer lock-up periods and less transparency.

Diversification Benefits in Portfolios

Commodities offer significant diversification benefits in investment portfolios due to their low correlation with traditional assets such as stocks and bonds, providing a hedge against inflation and market volatility. Alternative investments, including private equity, hedge funds, and real estate, complement portfolios by delivering exposure to unique risk-return profiles and enhancing overall risk-adjusted returns. Combining commodities with alternative investments increases portfolio resilience through broad asset class diversification and improved protection during market downturns.

Liquidity Differences Explained

Commodities like gold, oil, and agricultural products offer high liquidity due to active global markets and daily price fluctuations, enabling quick buying or selling with minimal price impact. Alternative investments, including real estate, private equity, and hedge funds, generally exhibit lower liquidity because of longer lock-in periods, restricted trading venues, and complex valuation processes. Understanding these liquidity differences is crucial for aligning investment choices with cash flow needs and risk tolerance.

Market Volatility: Commodities vs Alternatives

Commodities often exhibit higher market volatility due to sensitivity to geopolitical events, weather conditions, and supply-demand imbalances, leading to rapid price fluctuations. Alternative investments such as private equity, hedge funds, and real estate typically demonstrate lower volatility, offering more stable, long-term returns through diversification and less direct exposure to public market swings. Investors seeking to mitigate risk during turbulent market phases may benefit from balancing commodity exposure with alternatives that provide smoother performance cycles.

Accessibility and Entry Barriers

Commodities typically require substantial capital and specialized knowledge, resulting in higher entry barriers compared to many alternative investments like private equity or real estate. Alternative investments often offer greater accessibility through lower minimum investments and diversified vehicle options such as crowdfunding platforms or REITs. Understanding these distinctions helps investors align their portfolio strategies with their risk tolerance and investment goals.

Performance Trends and Historical Data

Commodities have historically exhibited strong performance during inflationary periods, with assets like gold and oil often acting as hedges against currency devaluation and market volatility. Alternative investments, including private equity and hedge funds, typically offer diversification benefits and potential for higher risk-adjusted returns by accessing non-correlated assets with longer investment horizons. Historical data shows commodities can provide quick liquidity and immediate market exposure, whereas alternative investments often require extended lock-in periods but can outperform traditional assets during economic recoveries and low-interest-rate environments.

Choosing the Best Investment for Your Goals

Commodities provide tangible assets like gold and oil, offering inflation hedging and portfolio diversification benefits critical for risk-averse investors. Alternative investments, including private equity, hedge funds, and real estate, deliver potentially higher returns with less correlation to traditional markets, aligning well with long-term growth objectives. Selecting the best investment depends on your risk tolerance, liquidity needs, and time horizon to optimize returns while managing market volatility effectively.

Related Important Terms

Green Commodities

Green commodities, such as renewable energy resources and sustainable agricultural products, offer a promising alternative investment class with potential for high returns and positive environmental impact. Unlike traditional commodities, green commodities align with ESG criteria, attracting investors seeking to diversify portfolios while supporting the transition to a low-carbon economy.

Digital Commodities

Digital commodities such as cryptocurrencies and tokenized assets offer investors enhanced liquidity and transparency compared to traditional commodities like gold or oil, while providing diversification benefits distinct from conventional alternative investments like private equity or hedge funds. The blockchain technology underpinning digital commodities facilitates secure, decentralized trading and real-time tracking, positioning them as innovative tools for portfolio optimization and risk management.

Tokenized Real Assets

Tokenized real assets offer unparalleled liquidity and fractional ownership compared to traditional commodities, enabling investors to access diverse alternative investments on blockchain platforms. By leveraging digital tokenization, investors can seamlessly trade physical assets like real estate, art, and infrastructure, reducing entry barriers and enhancing portfolio diversification beyond conventional commodity markets.

Rare Earth Metals Investment

Rare earth metals investment offers significant growth potential due to their critical role in advanced technologies and renewable energy sectors, contrasting with traditional commodities that often face price volatility and supply risks. Alternative investments like rare earth metals provide portfolio diversification and hedge against inflation, leveraging increasing global demand for sustainable and high-tech materials.

Carbon Credits Trading

Carbon credits trading within alternative investments offers a dynamic avenue for diversifying portfolios while supporting environmental sustainability, contrasting with traditional commodities like oil or gold that primarily respond to market supply and demand fluctuations. This emerging market benefits from increasing regulatory support and corporate commitments to carbon neutrality, driving potential long-term returns and risk mitigation in investment strategies focused on climate impact.

Wine and Whiskey Investing

Wine and whiskey investing offers unique portfolio diversification compared to traditional commodities like gold or oil, benefiting from increasing global demand and limited supply dynamics. These alternative investments provide potential for high returns due to provenance, age, and brand rarity, appealing to collectors and investors seeking non-correlated assets.

Farmland Crowdfunding

Farmland crowdfunding offers investors accessible exposure to agricultural assets, combining the stability of commodities with the diversified returns typical of alternative investments. This method leverages collective capital to acquire and manage farmland, providing potential income through crop yields and land appreciation, often with lower volatility compared to traditional commodities trading.

Collectibles Fractionalization

Collectibles fractionalization enables investors to acquire partial ownership in high-value assets such as rare coins, art, and vintage cars, offering liquidity and diversification beyond traditional commodities like gold and oil. This innovative investment approach reduces entry barriers while leveraging blockchain technology to ensure transparency and secure transactions in alternative investment markets.

Crypto-Backed Securities

Crypto-backed securities offer a unique blend of traditional commodity investment stability with the innovative potential of blockchain technology, providing investors exposure to digital asset markets while mitigating volatility through underlying physical asset collateralization. These hybrid instruments enhance portfolio diversification by combining the liquidity and transparency of alternative investments with the intrinsic value of commodities, appealing to investors seeking risk-adjusted returns in a rapidly evolving financial landscape.

Art-as-an-Asset

Art-as-an-asset offers a unique diversification opportunity within alternative investments by providing non-correlated returns compared to commodities like gold or oil. Its intrinsic cultural value and long-term appreciation potential make art a compelling choice for investors seeking to enhance portfolio resilience and hedge against market volatility.

Commodities vs Alternative Investments for Investment. Infographic

moneydiff.com

moneydiff.com