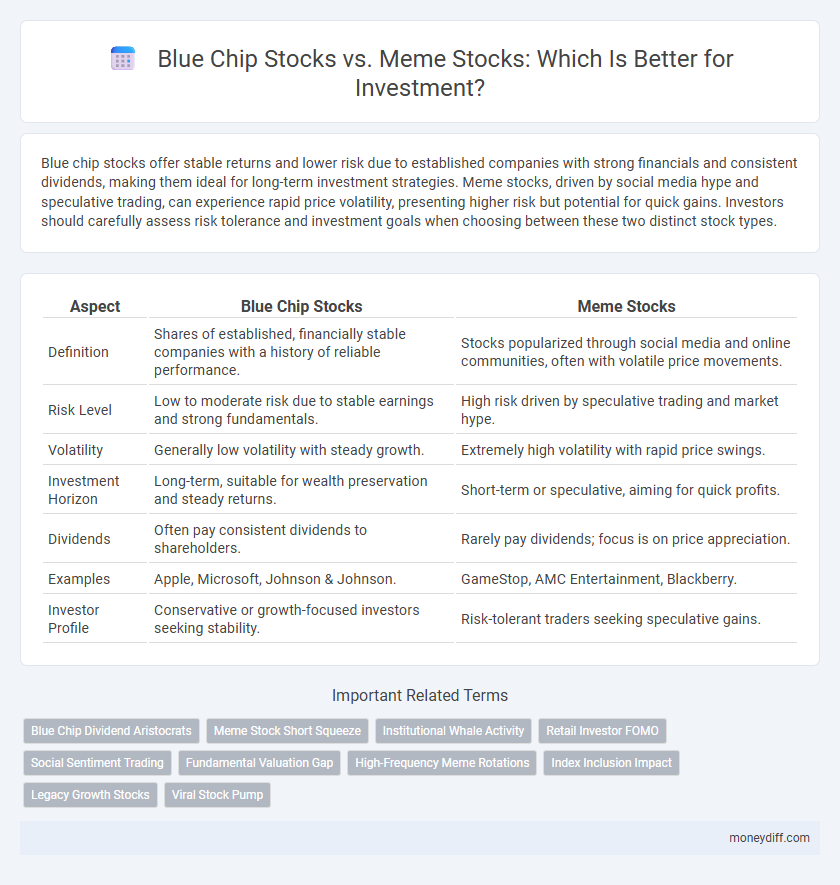

Blue chip stocks offer stable returns and lower risk due to established companies with strong financials and consistent dividends, making them ideal for long-term investment strategies. Meme stocks, driven by social media hype and speculative trading, can experience rapid price volatility, presenting higher risk but potential for quick gains. Investors should carefully assess risk tolerance and investment goals when choosing between these two distinct stock types.

Table of Comparison

| Aspect | Blue Chip Stocks | Meme Stocks |

|---|---|---|

| Definition | Shares of established, financially stable companies with a history of reliable performance. | Stocks popularized through social media and online communities, often with volatile price movements. |

| Risk Level | Low to moderate risk due to stable earnings and strong fundamentals. | High risk driven by speculative trading and market hype. |

| Volatility | Generally low volatility with steady growth. | Extremely high volatility with rapid price swings. |

| Investment Horizon | Long-term, suitable for wealth preservation and steady returns. | Short-term or speculative, aiming for quick profits. |

| Dividends | Often pay consistent dividends to shareholders. | Rarely pay dividends; focus is on price appreciation. |

| Examples | Apple, Microsoft, Johnson & Johnson. | GameStop, AMC Entertainment, Blackberry. |

| Investor Profile | Conservative or growth-focused investors seeking stability. | Risk-tolerant traders seeking speculative gains. |

Understanding Blue Chip Stocks: Definition and Characteristics

Blue chip stocks represent shares in well-established, financially stable companies with a history of reliable earnings and dividend payments, such as Apple, Microsoft, and Johnson & Johnson. These stocks typically exhibit lower volatility and are favored for long-term investment portfolios focused on steady growth and risk mitigation. Their market capitalization is usually large, reflecting strong investor confidence and resilience during economic downturns.

What Are Meme Stocks? Origins and Key Features

Meme stocks are shares of companies that gain rapid popularity and price surges primarily through social media platforms and online communities, rather than traditional financial metrics. Originating from viral trends on forums like Reddit's WallStreetBets, these stocks often exhibit high volatility and speculative trading driven by retail investors. Key features include sudden price spikes, heavy short interest, and a strong connection to internet culture and collective retail investor sentiment.

Risk Profiles: Blue Chip Stocks vs Meme Stocks

Blue chip stocks exhibit lower risk profiles due to their established market presence, strong financials, and consistent dividend payouts, appealing to conservative investors seeking long-term stability. Meme stocks possess high volatility and speculative risk driven by social media hype and retail investor sentiment, resulting in unpredictable price swings. Understanding these contrasting risk dynamics is crucial for portfolio diversification and aligning investment strategies with individual risk tolerance.

Historical Performance Comparison

Blue chip stocks demonstrate consistent long-term growth and stable dividends, reflecting established companies with strong financial health and market leadership. Meme stocks exhibit volatile price movements driven largely by social media trends and speculative trading, often resulting in sharp short-term gains followed by rapid declines. Historical performance data show blue chip stocks outperform meme stocks in risk-adjusted returns and resilience during market downturns.

Dividend Potential: Stability vs Volatility

Blue chip stocks offer reliable dividend potential with consistent payouts supported by strong financial performance and established market presence. Meme stocks, characterized by high volatility and speculative trading, rarely provide dividends and focus more on capital gains. Investors seeking steady income prioritize blue chips, while those targeting rapid growth may consider meme stocks despite dividend uncertainty.

Investor Demographics: Who Chooses Blue Chips vs Meme Stocks?

Blue chip stocks attract experienced, risk-averse investors seeking stable dividends and long-term growth, often including institutional investors and retirees. Meme stocks primarily appeal to younger, tech-savvy retail investors driven by social media trends and speculative gains. Demographic distinctions reveal blue chip investors prioritize financial security, while meme stock participants embrace higher volatility and potential for rapid returns.

The Role of Social Media in Meme Stock Volatility

Social media platforms like Reddit and Twitter significantly amplify the volatility of meme stocks by driving rapid, sentiment-driven trading activity among retail investors. This phenomenon contrasts with blue chip stocks, which typically experience more stable price movements due to institutional investor confidence and fundamental financial metrics. The viral nature of social media posts can lead to extreme price fluctuations in meme stocks, increasing both risk and short-term profit potential for investors.

Portfolio Diversification: Balancing Blue Chip and Meme Stocks

In portfolio diversification, balancing blue chip stocks with meme stocks offers a strategic mix of stability and growth potential; blue chip stocks provide consistent dividends and lower volatility, while meme stocks deliver high-risk, high-reward opportunities driven by social media trends. Allocating assets between these categories can enhance risk-adjusted returns and mitigate overall portfolio risk. Effective diversification requires continuous monitoring of market sentiment and fundamental performance to optimize asset allocation.

Long-Term Growth Prospects

Blue chip stocks, representing established companies with strong financials and consistent dividend payouts, offer reliable long-term growth prospects due to their stability and market leadership. Meme stocks, driven primarily by social media hype and speculative trading, often exhibit high volatility and uncertain sustainability in value over time. Investors seeking steady portfolio growth typically prioritize blue chip stocks for their proven durability and resilience in various market conditions.

Choosing the Right Stock Type for Your Investment Goals

Blue chip stocks offer stability, consistent dividends, and proven track records, making them ideal for long-term, risk-averse investors seeking steady growth. Meme stocks, driven by social media hype and speculative interest, present high volatility and potential for rapid gains but carry significant risk. Aligning your investment goals with your risk tolerance and time horizon is crucial when choosing between blue chip and meme stocks.

Related Important Terms

Blue Chip Dividend Aristocrats

Blue Chip Dividend Aristocrats, known for their consistent dividend growth and financial stability, offer reliable long-term investment returns compared to the volatility of meme stocks driven by social media hype. These high-quality companies, often market leaders with strong balance sheets, provide steady income streams and lower investment risk.

Meme Stock Short Squeeze

Meme stock short squeezes occur when heavily shorted stocks experience a rapid price surge driven by retail investor enthusiasm on social media platforms like Reddit's WallStreetBets, creating significant volatility and potential for exponential gains within a short timeframe. Unlike blue chip stocks, which offer stable returns and strong fundamentals, meme stocks pose higher risks due to unpredictable market sentiment but can yield outsized profits during short squeeze events.

Institutional Whale Activity

Institutional whale activity significantly influences blue chip stocks, driving stability and long-term growth through large-volume investments from mutual funds, pension funds, and hedge funds. In contrast, meme stocks experience sporadic whale activity, often resulting in volatile price swings fueled by retail investor hype rather than consistent institutional support.

Retail Investor FOMO

Blue chip stocks offer retail investors stable returns and proven financial strength, reducing the fear of missing out (FOMO) driven by social media hype prevalent in meme stocks. Meme stocks, characterized by high volatility and speculative trading, often fuel retail investor FOMO but carry significant risk due to their unpredictable price swings and lack of fundamental backing.

Social Sentiment Trading

Blue chip stocks offer stable returns driven by strong fundamentals and consistent earnings, making them preferred for long-term investment strategies. Meme stocks, influenced heavily by social sentiment trading and viral online trends, present high volatility and speculative risk but can deliver rapid, short-term gains.

Fundamental Valuation Gap

Blue chip stocks exhibit a strong fundamental valuation based on consistent earnings, stable cash flow, and established market presence, making them less volatile and more reliable for long-term investment returns. Meme stocks often show significant fundamental valuation gaps, driven by social media hype and speculative buying, resulting in high volatility and greater investment risk despite short-term price surges.

High-Frequency Meme Rotations

Blue chip stocks offer stable returns and established market presence, making them a preferred choice for long-term investors focused on consistent growth. In contrast, high-frequency meme stock rotations present volatile, short-term trading opportunities driven by social media trends and retail investor speculation, requiring careful risk management.

Index Inclusion Impact

Blue chip stocks benefit from index inclusion by attracting institutional investors and passive funds, which enhances liquidity and stabilizes price performance due to predictable demand from index trackers. In contrast, meme stocks often experience volatile price swings driven by social media hype rather than fundamental inclusion criteria, resulting in unpredictable market behavior and increased investment risk.

Legacy Growth Stocks

Blue chip stocks, characterized by established companies with strong financials and consistent dividend payments, offer stable returns and lower risk, making them ideal for long-term legacy growth investors. Meme stocks, driven by social media hype and volatile trading patterns, present higher risk and unpredictable performance, making them less suitable for conservative portfolio strategies focused on sustained growth.

Viral Stock Pump

Viral stock pumps often drive meme stocks to rapid, short-term price spikes fueled by social media hype and retail investor frenzy, contrasting with blue chip stocks' steady growth supported by established financial performance and market capitalization. While meme stocks offer high volatility and speculative gains, blue chip investments provide stability, dividends, and long-term portfolio resilience in fluctuating markets.

Blue Chip Stocks vs Meme Stocks for investment. Infographic

moneydiff.com

moneydiff.com