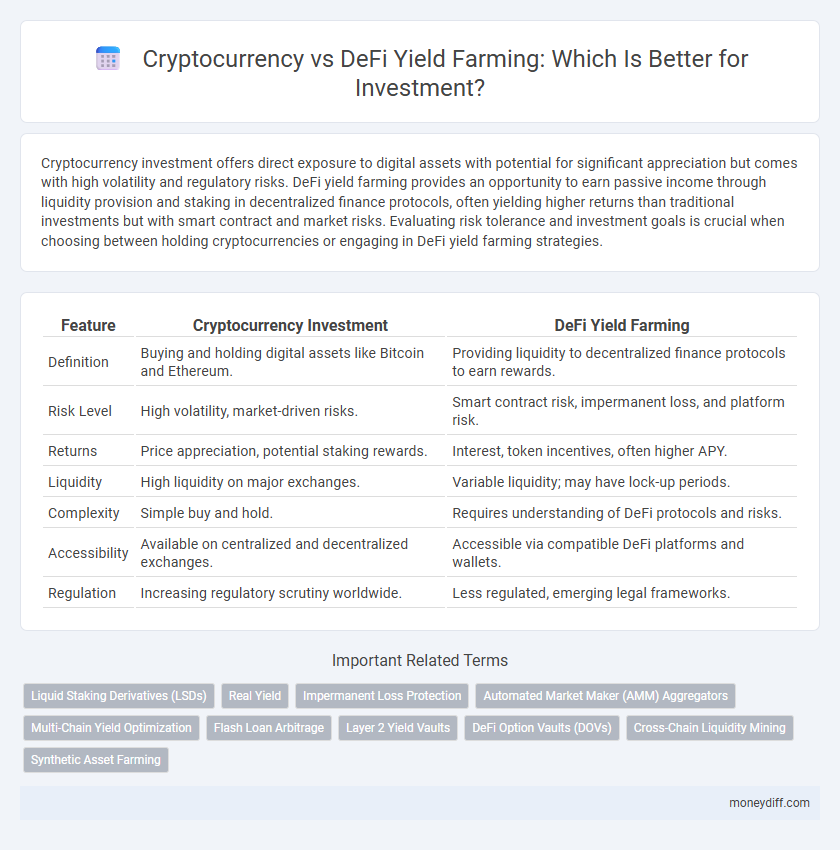

Cryptocurrency investment offers direct exposure to digital assets with potential for significant appreciation but comes with high volatility and regulatory risks. DeFi yield farming provides an opportunity to earn passive income through liquidity provision and staking in decentralized finance protocols, often yielding higher returns than traditional investments but with smart contract and market risks. Evaluating risk tolerance and investment goals is crucial when choosing between holding cryptocurrencies or engaging in DeFi yield farming strategies.

Table of Comparison

| Feature | Cryptocurrency Investment | DeFi Yield Farming |

|---|---|---|

| Definition | Buying and holding digital assets like Bitcoin and Ethereum. | Providing liquidity to decentralized finance protocols to earn rewards. |

| Risk Level | High volatility, market-driven risks. | Smart contract risk, impermanent loss, and platform risk. |

| Returns | Price appreciation, potential staking rewards. | Interest, token incentives, often higher APY. |

| Liquidity | High liquidity on major exchanges. | Variable liquidity; may have lock-up periods. |

| Complexity | Simple buy and hold. | Requires understanding of DeFi protocols and risks. |

| Accessibility | Available on centralized and decentralized exchanges. | Accessible via compatible DeFi platforms and wallets. |

| Regulation | Increasing regulatory scrutiny worldwide. | Less regulated, emerging legal frameworks. |

Understanding Cryptocurrency Investment Basics

Cryptocurrency investment involves purchasing digital assets like Bitcoin or Ethereum, relying on price appreciation and market trends for returns. DeFi Yield Farming focuses on lending or staking crypto within decentralized finance platforms to earn interest or rewards, often with higher risks and variable yields. Understanding the volatility, security protocols, and liquidity risks in both strategies is crucial for effective portfolio management and maximizing returns in the digital asset ecosystem.

What is DeFi Yield Farming?

DeFi yield farming involves lending or staking cryptocurrency assets in decentralized finance protocols to earn rewards or interest, leveraging smart contracts on blockchain platforms like Ethereum. Unlike traditional cryptocurrency investments that rely on asset appreciation, yield farming generates passive income through liquidity provision and reward tokens. This approach offers high potential returns but comes with risks such as smart contract vulnerabilities and market volatility.

Risk and Reward: Cryptocurrency vs. DeFi Yield Farming

Cryptocurrency investment offers high volatility with potential for substantial gains but carries significant market and regulatory risks. DeFi yield farming presents opportunities for attractive returns through liquidity provision and staking, yet exposes investors to smart contract vulnerabilities and impermanent loss. Balancing the high risk-high reward profile of both requires thorough risk assessment and diversification strategies tailored to individual investor risk tolerance.

How to Start Investing in Cryptocurrencies

To start investing in cryptocurrencies, choose a reputable exchange platform such as Coinbase, Binance, or Kraken, and create a verified account. Secure your investment by transferring assets to a private wallet, preferably a hardware wallet like Ledger or Trezor, to minimize hacking risks. Research and analyze market trends, focusing on coins with strong fundamentals and potential for growth before committing capital.

Exploring Top DeFi Yield Farming Platforms

Top DeFi yield farming platforms like Aave, Compound, and Yearn.finance offer investors lucrative opportunities by providing high APYs through decentralized lending and liquidity pools. These platforms enable users to earn interest or tokens by staking cryptocurrencies, leveraging smart contracts for secure and transparent transactions. Compared to traditional cryptocurrency investments, DeFi yield farming can generate superior passive income but comes with higher smart contract risks and market volatility.

Security Concerns: Protecting Your Crypto Assets

Cryptocurrency investment faces significant security risks such as hacking, phishing, and wallet vulnerabilities, necessitating the use of hardware wallets and multi-factor authentication to safeguard assets. DeFi yield farming introduces smart contract risks and impermanent loss, requiring thorough audits of protocols and diversification across trusted platforms to minimize exposure. Prioritizing robust security practices and ongoing risk assessment is crucial to protect crypto assets in both traditional cryptocurrency holdings and DeFi yield farming.

Liquidity, Volatility, and Market Factors

Cryptocurrency investments offer high liquidity on major exchanges but are subject to significant volatility due to market speculation and macroeconomic factors. DeFi yield farming provides potentially higher returns by leveraging liquidity pools, yet it involves smart contract risks and lower liquidity compared to centralized platforms. Market factors such as regulatory changes and network congestion critically impact both investment vehicles, influencing yield sustainability and capital accessibility.

Passive Income Potential: Crypto vs. Yield Farming

Cryptocurrency investments offer passive income through staking and holding assets that appreciate over time, while DeFi yield farming provides opportunities to earn higher returns by lending or providing liquidity on decentralized platforms, often with increased risk exposure. Yield farming can generate substantial short-term gains through rewards like governance tokens and interest, but requires active management and understanding of smart contract vulnerabilities. Comparing passive income potential, crypto staking tends to be more stable and long-term, whereas DeFi yield farming offers higher yields with greater volatility and complexity.

Regulatory Landscape and Legal Considerations

Cryptocurrency investments face evolving regulatory frameworks that vary significantly across jurisdictions, with increasing scrutiny on anti-money laundering (AML) and know-your-customer (KYC) compliance. DeFi yield farming operates in a largely decentralized, less regulated environment, presenting heightened legal risks such as lack of investor protections and regulatory ambiguity. Investors must assess the legal implications and potential regulatory changes impacting both cryptocurrency holdings and DeFi yield farming strategies to mitigate compliance risks and ensure secure investment outcomes.

Which Investment Strategy Suits Your Goals?

Cryptocurrency investment offers direct exposure to digital assets with potential long-term growth, ideal for investors seeking asset appreciation and willing to tolerate high volatility. DeFi yield farming provides opportunities for earning passive income through liquidity provision and staking, suited for risk-tolerant investors focused on income generation and active portfolio management. Evaluating your risk tolerance, investment horizon, and income needs will help determine whether direct cryptocurrency ownership or DeFi yield farming aligns better with your financial goals.

Related Important Terms

Liquid Staking Derivatives (LSDs)

Liquid Staking Derivatives (LSDs) offer a compelling alternative to traditional cryptocurrency and DeFi yield farming by combining liquidity with staking rewards, enabling investors to earn passive income without locking assets. LSDs enhance capital efficiency and reduce opportunity costs, making them a strategic choice for maximizing returns in the evolving decentralized finance landscape.

Real Yield

Cryptocurrency investments often rely on price appreciation, while DeFi yield farming generates real yield through interest, staking rewards, and liquidity provision fees. Evaluating risk-adjusted returns, DeFi yield farming offers consistent income streams by leveraging decentralized protocols, minimizing exposure to volatile market swings compared to traditional crypto holding strategies.

Impermanent Loss Protection

Cryptocurrency investments, particularly in DeFi yield farming, pose risks such as impermanent loss, which occurs when asset prices fluctuate during liquidity provision. Impermanent loss protection mechanisms in certain DeFi platforms, like Bancor and Thorchain, help safeguard investors by minimizing losses during volatile market conditions, enhancing yield farming stability compared to traditional cryptocurrency holdings.

Automated Market Maker (AMM) Aggregators

Automated Market Maker (AMM) aggregators enhance yield farming by optimizing liquidity provision across multiple decentralized exchanges, maximizing returns through efficient asset allocation and reduced slippage. Compared to direct cryptocurrency investment, AMM aggregators offer higher yield potential with automated portfolio management, leveraging liquidity mining incentives and real-time market data for optimized DeFi exposure.

Multi-Chain Yield Optimization

Multi-chain yield optimization in cryptocurrency investment leverages various blockchains to maximize returns by automatically allocating funds to the highest-yielding DeFi protocols. This strategy enhances portfolio diversification and risk management compared to traditional single-chain designs, driving superior yield farming efficiencies across Ethereum, Binance Smart Chain, and Polygon networks.

Flash Loan Arbitrage

Flash loan arbitrage exploits temporary, uncollateralized loans on DeFi platforms, enabling investors to capitalize on price discrepancies across multiple decentralized exchanges without initial capital. This strategy offers higher liquidity and faster returns compared to traditional cryptocurrency holding, but carries significant smart contract and market risks.

Layer 2 Yield Vaults

Layer 2 yield vaults in DeFi offer enhanced scalability and lower transaction fees compared to traditional cryptocurrency investments, enabling higher returns through optimized yield farming strategies. These vaults leverage advanced protocols on Ethereum's Layer 2 networks, providing secure, automated compounding of rewards, which significantly improves capital efficiency and risk management.

DeFi Option Vaults (DOVs)

DeFi Option Vaults (DOVs) offer a strategic advantage in yield farming by automating option-writing strategies that enhance returns while managing risk, making them an innovative alternative to traditional cryptocurrency investments. Investors benefit from diversified income streams through premiums collected by selling options, which can provide more predictable yields compared to volatile token staking.

Cross-Chain Liquidity Mining

Cross-chain liquidity mining enables investors to maximize returns by providing liquidity across multiple blockchain networks, reducing risks associated with single-chain exposure in DeFi yield farming. This innovative approach leverages interoperability protocols that optimize asset utilization and unlock higher APYs compared to traditional cryptocurrency staking.

Synthetic Asset Farming

Synthetic asset farming in DeFi offers investors exposure to diverse asset classes without direct ownership, leveraging blockchain protocols to create tokenized representations of real-world assets. Compared to traditional cryptocurrency investments, synthetic asset farming provides enhanced liquidity, automated yield generation, and mitigation of volatility risks through algorithmic mechanisms.

Cryptocurrency vs DeFi Yield Farming for investment. Infographic

moneydiff.com

moneydiff.com