Choosing between a traditional 401(k) and an ESG 401(k) involves evaluating financial returns alongside personal values related to environmental, social, and governance criteria. ESG 401(k) plans integrate sustainable investment options aimed at promoting ethical business practices without sacrificing long-term growth potential. Investors seeking to align their retirement savings with social responsibility often find ESG 401(k) options appealing while maintaining tax advantages and diversification.

Table of Comparison

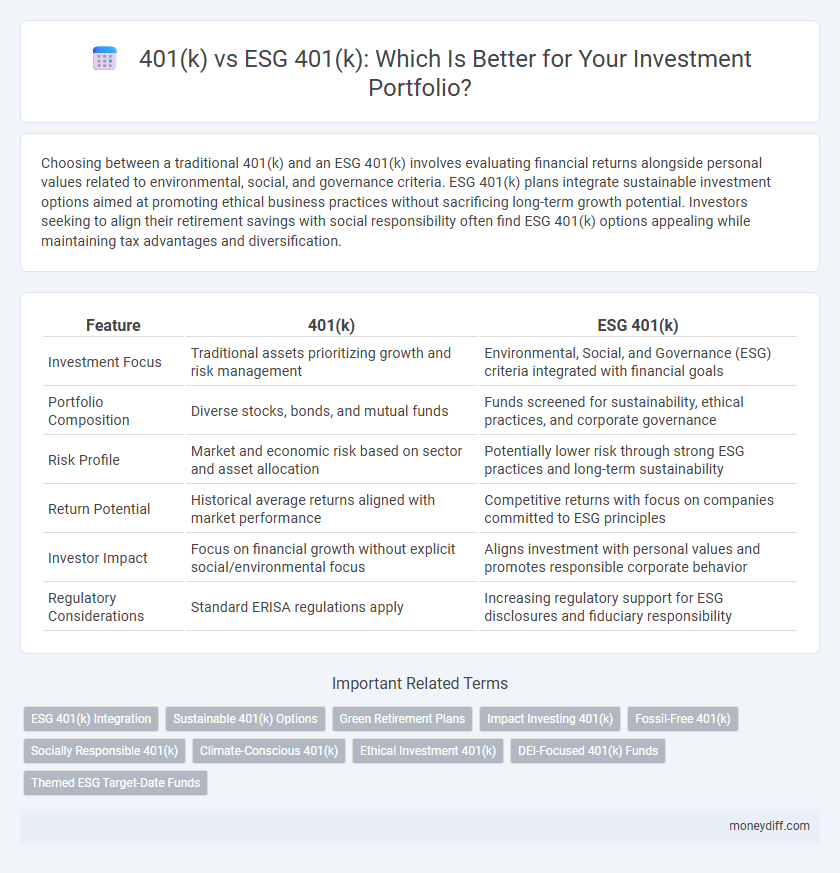

| Feature | 401(k) | ESG 401(k) |

|---|---|---|

| Investment Focus | Traditional assets prioritizing growth and risk management | Environmental, Social, and Governance (ESG) criteria integrated with financial goals |

| Portfolio Composition | Diverse stocks, bonds, and mutual funds | Funds screened for sustainability, ethical practices, and corporate governance |

| Risk Profile | Market and economic risk based on sector and asset allocation | Potentially lower risk through strong ESG practices and long-term sustainability |

| Return Potential | Historical average returns aligned with market performance | Competitive returns with focus on companies committed to ESG principles |

| Investor Impact | Focus on financial growth without explicit social/environmental focus | Aligns investment with personal values and promotes responsible corporate behavior |

| Regulatory Considerations | Standard ERISA regulations apply | Increasing regulatory support for ESG disclosures and fiduciary responsibility |

Understanding the Basics: What Is a 401(k)?

A 401(k) is a retirement savings plan sponsored by an employer that allows employees to save and invest a portion of their paycheck before taxes are taken out. ESG 401(k) plans incorporate environmental, social, and governance criteria, enabling investors to align their retirement savings with ethical and sustainable investment practices. Understanding the basic mechanics of 401(k) contributions, tax advantages, and employer matching can help differentiate traditional plans from ESG-focused options and guide suitable retirement strategies.

Introduction to ESG 401(k): Sustainable Investment Explained

ESG 401(k) plans integrate environmental, social, and governance factors into traditional 401(k) investment strategies, offering socially responsible options aligned with sustainability goals. These plans prioritize companies with strong ESG practices, potentially reducing risk and promoting long-term impact alongside financial returns. Investors seeking to align portfolios with ethical values find ESG 401(k)s increasingly popular compared to conventional 401(k) offerings.

Key Differences Between Traditional 401(k) and ESG 401(k)

Traditional 401(k) plans primarily focus on maximizing financial returns through investments in diversified asset classes without specific consideration of environmental, social, and governance (ESG) factors. In contrast, ESG 401(k) plans integrate sustainability criteria and ethical standards into investment decisions, prioritizing companies with strong ESG performance alongside financial growth. Key differences include the incorporation of ESG metrics, potential impact on risk management, and alignment with socially responsible investing goals.

Performance Comparison: ESG 401(k) vs Standard 401(k)

ESG 401(k) funds have demonstrated competitive performance compared to standard 401(k) portfolios, with some studies indicating comparable or even superior long-term returns driven by sustainable companies' resilience and growth potential. While traditional 401(k) investments typically focus on maximizing financial returns, ESG funds integrate environmental, social, and governance criteria, potentially reducing risk and enhancing portfolio stability. Performance variability exists depending on fund selection, but growing evidence suggests ESG 401(k)s can achieve similar risk-adjusted returns while aligning with ethical investment principles.

Fee Structures in 401(k) and ESG 401(k) Plans

401(k) plans typically feature a range of administrative and management fees, including expense ratios on mutual funds that average around 0.45%. ESG 401(k) plans often incur slightly higher fees due to the specialized screening and impact measurement processes, with expense ratios typically between 0.50% and 0.70%. Investors should carefully compare fee disclosures and net returns when evaluating traditional 401(k) versus ESG 401(k) options to optimize long-term investment growth.

Risk Factors: Assessing ESG and Traditional 401(k) Investments

ESG 401(k) investments integrate environmental, social, and governance criteria, potentially reducing exposure to risks related to regulatory changes, reputational damage, and sustainability challenges faced by traditional sectors. Traditional 401(k) portfolios often carry higher vulnerability to market volatility and industry-specific downturns without explicit consideration of ESG risks. Evaluating risk factors requires analyzing ESG fund performance data, sector allocations, and historical volatility relative to conventional investment options to optimize risk-adjusted returns.

Social and Environmental Impact: ESG 401(k) Benefits

ESG 401(k) plans integrate environmental, social, and governance criteria, enabling investors to align retirement savings with ethical and sustainable practices. These plans often invest in companies with strong environmental stewardship, social responsibility, and transparent governance, which can contribute to lower risk and long-term positive impact. By choosing ESG 401(k) options, investors support sustainable development while potentially benefiting from the growing demand for responsible business practices.

Tax Advantages and Implications for Both 401(k) Types

Traditional 401(k) plans offer tax-deferred contributions, allowing investors to reduce their taxable income in the contribution year and defer taxes until withdrawal, typically during retirement. ESG 401(k) options combine these tax advantages with investment choices focused on environmental, social, and governance criteria, potentially appealing to socially conscious investors without sacrificing tax benefits. Both 401(k) types benefit from tax-deferred growth, but ESG 401(k)s provide the added value of aligning investments with personal values, influencing long-term portfolio impact alongside favorable tax treatment.

Choosing the Right 401(k): Factors to Consider

When choosing the right 401(k), investors should evaluate their risk tolerance, investment goals, and alignment with personal values. ESG 401(k) plans integrate environmental, social, and governance criteria, appealing to those prioritizing sustainable and ethical investments. Assessing fee structures, fund performance, and employer matching contributions remains crucial for both traditional and ESG 401(k) options.

Future Trends: The Growth of ESG Options in Retirement Plans

ESG 401(k) plans are rapidly gaining traction as more investors prioritize sustainable and socially responsible investing in their retirement portfolios. Future trends indicate a significant increase in ESG fund offerings due to growing demand from millennials and institutional investors seeking long-term value aligned with environmental, social, and governance criteria. Regulatory support and enhanced data transparency are expected to drive further adoption of ESG options within traditional 401(k) frameworks, reshaping retirement investment landscapes.

Related Important Terms

ESG 401(k) Integration

ESG 401(k) plans integrate environmental, social, and governance criteria into retirement portfolios, allowing investors to align their savings with sustainable and ethical practices. This integration enhances long-term value by prioritizing companies with strong ESG performance, potentially reducing risk and fostering positive societal impact compared to traditional 401(k) investments.

Sustainable 401(k) Options

Sustainable 401(k) options integrate Environmental, Social, and Governance (ESG) criteria into traditional retirement plans, allowing investors to align their portfolios with ethical and environmental values while pursuing long-term growth. ESG 401(k) funds often demonstrate competitive returns with reduced exposure to companies lacking sustainability practices, appealing to socially conscious investors seeking both financial performance and positive impact.

Green Retirement Plans

Green retirement plans like ESG 401(k) options prioritize investments in environmentally sustainable companies, offering investors a way to support green initiatives while saving for retirement. Traditional 401(k) plans may offer broader investment choices but often lack a specific focus on environmental, social, and governance criteria essential for socially responsible investing.

Impact Investing 401(k)

Impact investing 401(k) plans prioritize allocating retirement funds into ESG (Environmental, Social, Governance) compliant companies, aligning financial growth with positive societal and environmental outcomes. Compared to traditional 401(k)s, ESG 401(k)s offer investors the ability to support sustainable business practices while aiming for competitive long-term returns.

Fossil-Free 401(k)

Fossil-Free 401(k) plans prioritize investments in companies with strong environmental, social, and governance (ESG) criteria, excluding fossil fuel industries to align with sustainable and ethical investing goals. Compared to traditional 401(k) options, Fossil-Free 401(k) portfolios offer potential long-term growth by capitalizing on the rising demand for clean energy and environmentally responsible businesses.

Socially Responsible 401(k)

Socially Responsible 401(k) plans integrate Environmental, Social, and Governance (ESG) criteria, enabling investors to align their retirement savings with ethical values while potentially enhancing long-term returns. These ESG 401(k) options prioritize companies with sustainable practices, promoting positive social impact without sacrificing portfolio diversification or financial growth.

Climate-Conscious 401(k)

A Climate-Conscious 401(k) integrates environmental, social, and governance (ESG) criteria into traditional 401(k) plans, allowing investors to support sustainable companies while saving for retirement. These ESG 401(k) options emphasize investments in renewable energy, carbon reduction, and eco-friendly initiatives, aligning portfolios with climate-conscious values for long-term growth and impact.

Ethical Investment 401(k)

Ethical Investment 401(k) plans prioritize environmental, social, and governance (ESG) criteria, allowing investors to align their retirement savings with sustainable and socially responsible companies. These ESG 401(k) options often outperform traditional 401(k) funds by mitigating risks linked to unethical business practices while promoting positive societal impact.

DEI-Focused 401(k) Funds

DEI-focused 401(k) funds integrate environmental, social, and governance (ESG) criteria with a strong emphasis on diversity, equity, and inclusion, aligning retirement investments with social impact goals. These funds often outperform traditional 401(k) options by selecting companies with inclusive workplace policies and diverse leadership, potentially enhancing long-term returns through improved corporate governance and innovation.

Themed ESG Target-Date Funds

Themed ESG Target-Date Funds within 401(k) plans integrate environmental, social, and governance criteria with traditional retirement planning, offering investors a sustainable approach aligned with their retirement timeline. These funds dynamically adjust asset allocation to reduce risk as the target date approaches while emphasizing companies with strong ESG performance, potentially enhancing long-term value and social impact.

401(k) vs ESG 401(k) for Investment Infographic

moneydiff.com

moneydiff.com