REITs offer liquidity and diversification by allowing investors to buy shares in professionally managed real estate portfolios, making them accessible for those seeking passive income with lower entry costs. Real estate syndication platforms enable investors to co-invest directly in specific properties, providing more control and potential for higher returns, but often require larger capital commitments and have less liquidity. Choosing between REITs and syndication depends on an investor's risk tolerance, desired involvement, and investment horizon.

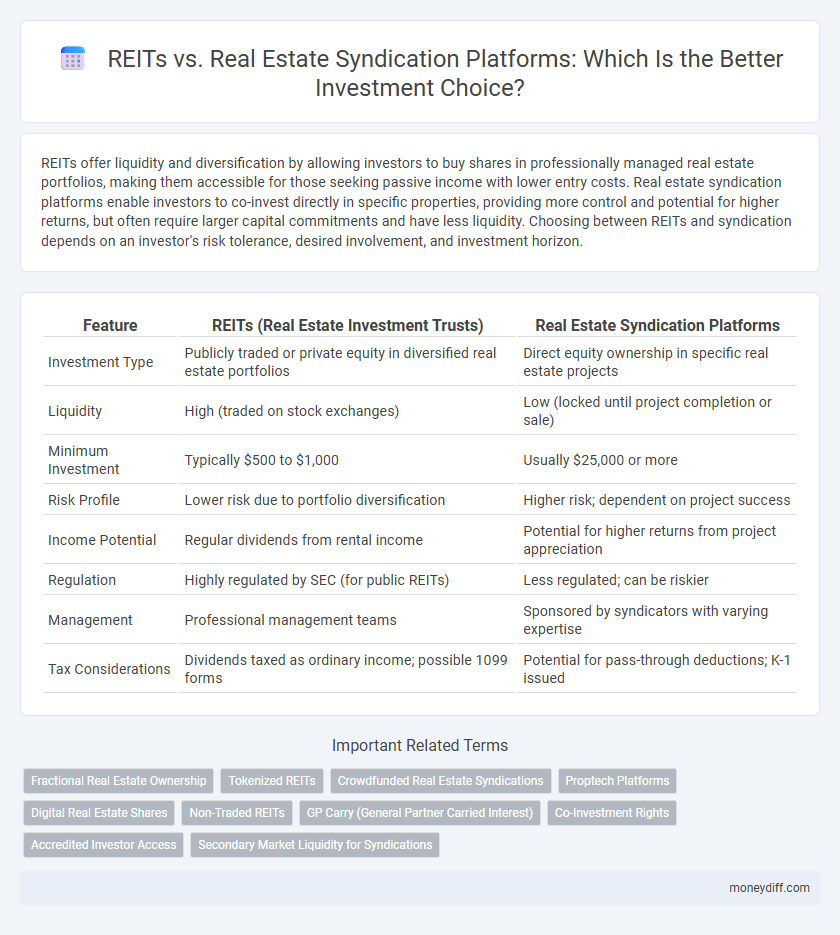

Table of Comparison

| Feature | REITs (Real Estate Investment Trusts) | Real Estate Syndication Platforms |

|---|---|---|

| Investment Type | Publicly traded or private equity in diversified real estate portfolios | Direct equity ownership in specific real estate projects |

| Liquidity | High (traded on stock exchanges) | Low (locked until project completion or sale) |

| Minimum Investment | Typically $500 to $1,000 | Usually $25,000 or more |

| Risk Profile | Lower risk due to portfolio diversification | Higher risk; dependent on project success |

| Income Potential | Regular dividends from rental income | Potential for higher returns from project appreciation |

| Regulation | Highly regulated by SEC (for public REITs) | Less regulated; can be riskier |

| Management | Professional management teams | Sponsored by syndicators with varying expertise |

| Tax Considerations | Dividends taxed as ordinary income; possible 1099 forms | Potential for pass-through deductions; K-1 issued |

Understanding REITs: Structure and Function

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-producing real estate, allowing investors to buy shares and earn dividends from property-generated revenue. REITs are publicly traded or private entities, providing liquidity and diversification by pooling resources to invest in various properties. Their structure requires distributing at least 90% of taxable income to shareholders, making them attractive for steady income and capital appreciation compared to direct real estate investments or syndication platforms.

What Are Real Estate Syndication Platforms?

Real estate syndication platforms are online marketplaces that connect investors with real estate developers or sponsors seeking capital for property acquisitions and developments. These platforms enable individuals to invest in large-scale real estate projects by pooling funds with other investors, often providing access to institutional-quality assets with lower minimum investments compared to REITs. Syndication deals typically offer direct ownership shares and potential for greater control over investment terms, unlike REITs which represent indirect ownership through publicly traded shares.

Key Differences Between REITs and Syndication Platforms

REITs offer liquidity through publicly traded shares, enabling investors to buy and sell easily, while real estate syndication platforms typically involve private offerings with limited liquidity and longer holding periods. REITs are regulated and must distribute at least 90% of taxable income as dividends, providing consistent income streams, whereas syndications allow direct ownership stakes and potentially higher returns from specific properties but with increased risk and less regulatory oversight. Fee structures also differ, as REITs commonly charge management fees within the fund expense ratio, whereas syndications often involve acquisition fees and profit-sharing arrangements with sponsors.

Accessibility: Minimum Investment and Requirements

REITs typically offer low minimum investments, often as little as $500, making them highly accessible for individual investors seeking diversified real estate exposure. Real estate syndication platforms usually require higher minimum investments, ranging from $5,000 to $50,000, and often limit participation to accredited investors who meet specific income or net worth criteria. These differences in accessibility influence the investor's ability to enter real estate markets based on capital availability and regulatory qualifications.

Liquidity Comparison: REITs vs. Syndicated Investments

REITs offer high liquidity as shares are often traded on public stock exchanges, enabling investors to buy or sell quickly with minimal transaction costs. Real estate syndication platforms typically involve longer lock-up periods and illiquid assets, requiring investors to commit capital for several years until property disposition or refinancing events occur. The liquidity disparity significantly impacts investment strategy, with REITs appealing to those needing flexible access to funds and syndications suiting investors seeking long-term growth and income stability.

Potential Returns and Risk Profiles

REITs typically offer stable, dividend-focused returns with lower risk due to their liquidity and regulatory oversight, attracting investors seeking steady income and diversified portfolio exposure. Real estate syndication platforms provide higher potential returns through direct property ownership and value-add strategies but carry increased risk from market volatility, illiquidity, and sponsor execution. Assessing risk tolerance and investment horizon is crucial when choosing between REITs' consistent yield and syndications' potential for substantial capital appreciation.

Diversification Benefits in Each Option

REITs offer broad diversification by pooling assets across numerous properties and geographic locations, reducing risk exposure for investors through publicly traded shares. Real estate syndication platforms typically concentrate on fewer, specific properties, providing targeted investment opportunities but with higher idiosyncratic risk. Diversification in syndications depends on an investor's ability to participate in multiple deals, whereas REITs inherently deliver professional management and automatic portfolio diversification.

Fees and Cost Structures Explained

REITs typically impose management fees ranging from 0.5% to 2% annually, along with potential performance fees, while real estate syndication platforms often charge acquisition fees between 1% and 5% plus ongoing asset management fees around 1%. Syndication investments may incur higher upfront costs but offer more direct ownership benefits, whereas REITs provide liquidity and lower minimum investments with a more standardized fee structure. Understanding these fee differences is crucial for investors to evaluate net returns and align costs with their investment strategy.

Tax Implications for Investors

REITs offer investors the advantage of pass-through taxation, allowing income to bypass corporate tax and be taxed directly at the individual level, often resulting in qualified dividends taxed at lower capital gains rates. Real estate syndication platforms typically distribute income as ordinary income, which may be subject to higher individual tax rates, but investors can benefit from depreciation deductions and other tax shields. Understanding the distinct tax treatments and potential for loss carryforwards is crucial for investors aiming to optimize after-tax returns in both investment vehicles.

How to Choose: REITs or Real Estate Syndication Platforms?

Choosing between REITs and real estate syndication platforms depends on your investment goals, risk tolerance, and liquidity needs. REITs offer a more liquid, diversified investment with lower minimums and passive management, while real estate syndication platforms provide higher potential returns through direct ownership but require larger capital commitments and involve greater risk. Evaluate your preference for control, expected returns, investment horizon, and access to properties to determine the optimal investment vehicle.

Related Important Terms

Fractional Real Estate Ownership

Fractional real estate ownership through REITs offers liquidity and diversification with low entry costs, while real estate syndication platforms provide direct equity stakes and potential for higher returns but require larger capital commitments and longer lock-in periods. Investors seeking passive income might prefer REITs, whereas those aiming for active participation and greater control often select syndication platforms.

Tokenized REITs

Tokenized REITs offer increased liquidity and fractional ownership compared to traditional real estate syndication platforms, enabling investors to trade shares on blockchain-based exchanges with lower entry barriers and enhanced transparency. These digital securities combine the diversified portfolio benefits of REITs with the decentralized, automated features of blockchain technology, providing efficient, secure, and accessible real estate investment opportunities.

Crowdfunded Real Estate Syndications

Crowdfunded real estate syndications offer investors direct ownership stakes in specific properties, often providing higher potential returns and greater control compared to REITs, which pool investor money into diversified portfolios managed by professionals. These platforms democratize access to commercial real estate by lowering investment minimums and enabling passive income through equity or debt investments tailored to individual risk profiles.

Proptech Platforms

Proptech platforms for real estate investment offer increased transparency, lower entry costs, and greater liquidity compared to traditional REITs and real estate syndication platforms, leveraging technology to streamline asset management and investor access. These platforms typically provide real-time data analytics, automated compliance, and fractional ownership opportunities, enhancing scalability and portfolio diversification for individual investors.

Digital Real Estate Shares

Digital real estate shares in REITs offer liquidity and diversification by allowing investors to buy and sell shares on public exchanges with fractional ownership in large property portfolios. Real estate syndication platforms provide direct investment opportunities in specific properties, often requiring higher minimum investments but enabling more control and potentially higher returns through passive income and capital appreciation.

Non-Traded REITs

Non-traded REITs offer investors access to diversified commercial real estate portfolios with potentially lower volatility than public REITs but lack liquidity compared to real estate syndication platforms, which provide direct investment opportunities in specific properties with potentially higher returns and greater control. While non-traded REITs often involve higher fees and longer holding periods, real estate syndication platforms emphasize transparency and flexibility, making them suitable for investors seeking targeted exposure and active participation in property management.

GP Carry (General Partner Carried Interest)

Real Estate Syndication Platforms often offer GPs a carry interest typically ranging from 20% to 30%, directly incentivizing performance and aligning their interests with investors. In contrast, REITs rarely provide GP carry, as they operate under a corporate structure where returns are distributed primarily as dividends without the carried interest component.

Co-Investment Rights

REITs typically do not offer co-investment rights, limiting investors to passive ownership through shares, whereas real estate syndication platforms often provide co-investment opportunities that allow investors to directly participate in specific property deals. Co-investment rights enable investors on syndication platforms to have greater control and potential for higher returns by investing alongside sponsors in targeted real estate assets.

Accredited Investor Access

REITs offer accredited investors a liquid, publicly traded option with diversified real estate exposure, while real estate syndication platforms provide direct equity stakes in specific properties, often requiring higher minimum investments and offering potentially higher returns. Accredited investors benefit from syndications through exclusive access to niche markets and customized investment opportunities that are typically unavailable in traditional REIT structures.

Secondary Market Liquidity for Syndications

Real estate syndication platforms typically face limited secondary market liquidity compared to REITs, as syndication interests are often illiquid and subject to transfer restrictions. REITs provide investors with greater flexibility through publicly traded shares that can be easily bought or sold on major exchanges, enhancing portfolio diversification and exit opportunities.

REITs vs Real Estate Syndication Platforms for investment. Infographic

moneydiff.com

moneydiff.com