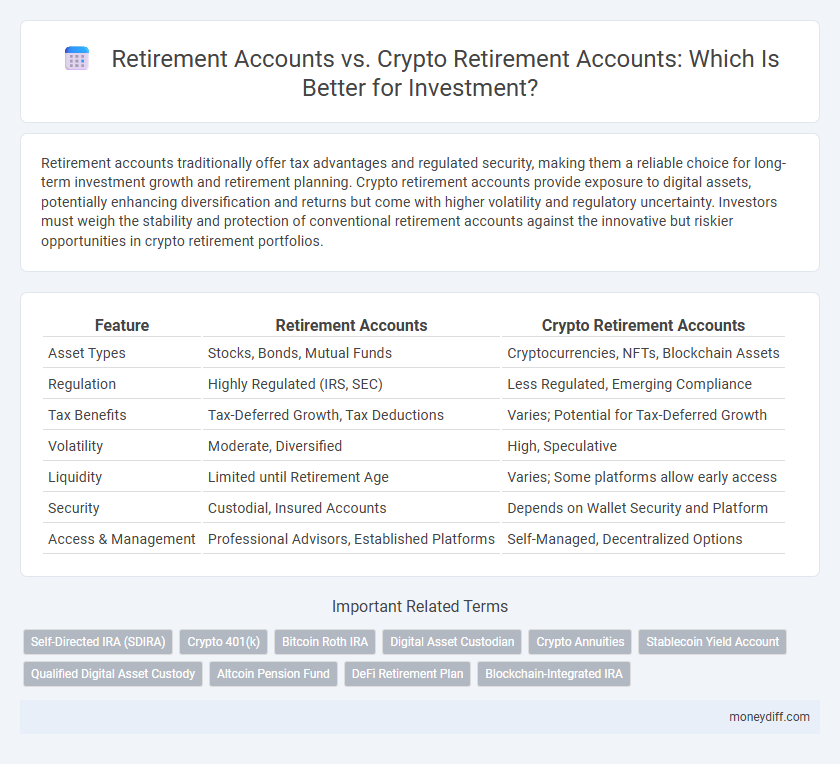

Retirement accounts traditionally offer tax advantages and regulated security, making them a reliable choice for long-term investment growth and retirement planning. Crypto retirement accounts provide exposure to digital assets, potentially enhancing diversification and returns but come with higher volatility and regulatory uncertainty. Investors must weigh the stability and protection of conventional retirement accounts against the innovative but riskier opportunities in crypto retirement portfolios.

Table of Comparison

| Feature | Retirement Accounts | Crypto Retirement Accounts |

|---|---|---|

| Asset Types | Stocks, Bonds, Mutual Funds | Cryptocurrencies, NFTs, Blockchain Assets |

| Regulation | Highly Regulated (IRS, SEC) | Less Regulated, Emerging Compliance |

| Tax Benefits | Tax-Deferred Growth, Tax Deductions | Varies; Potential for Tax-Deferred Growth |

| Volatility | Moderate, Diversified | High, Speculative |

| Liquidity | Limited until Retirement Age | Varies; Some platforms allow early access |

| Security | Custodial, Insured Accounts | Depends on Wallet Security and Platform |

| Access & Management | Professional Advisors, Established Platforms | Self-Managed, Decentralized Options |

Understanding Traditional Retirement Accounts

Traditional retirement accounts, such as 401(k) and IRA plans, offer tax advantages and regulated investment options including stocks, bonds, and mutual funds, which help investors accumulate savings for retirement with relative security. Contributions to traditional retirement accounts often provide immediate tax deductions, while earnings grow tax-deferred until withdrawal, creating a predictable growth environment. These accounts are governed by strict regulations and contribution limits set by the IRS, ensuring investor protection and compliance with retirement planning goals.

What Are Crypto Retirement Accounts?

Crypto retirement accounts are specialized investment vehicles that combine traditional retirement savings plans with cryptocurrency assets, allowing investors to hold digital currencies like Bitcoin and Ethereum within tax-advantaged accounts such as IRAs or 401(k)s. These accounts provide diversification benefits by incorporating blockchain-based assets, potentially enhancing long-term growth through exposure to the expanding crypto market. By leveraging tax-deferred or tax-free growth, crypto retirement accounts enable investors to balance retirement planning with innovative investment opportunities in decentralized finance.

Key Differences Between Traditional and Crypto Retirement Accounts

Traditional retirement accounts, such as 401(k)s and IRAs, offer regulated tax advantages and are backed by established financial institutions with predictable investment options like stocks and bonds. Crypto retirement accounts provide access to digital assets, enabling portfolio diversification but come with higher volatility, regulatory uncertainty, and differing tax treatments. Understanding these key differences helps investors balance growth potential against risk tolerance in their retirement planning.

Pros and Cons of Traditional Retirement Accounts

Traditional retirement accounts, such as 401(k)s and IRAs, offer tax-deferred growth and employer matching contributions, which enhance long-term investment potential. These accounts come with established regulatory protections and decades of market performance data, providing investors with a relatively stable and predictable retirement savings vehicle. However, traditional accounts impose contribution limits and mandatory required minimum distributions (RMDs) that can restrict flexibility and control over retirement funds.

Advantages and Risks of Crypto Retirement Accounts

Crypto retirement accounts offer advantages like higher potential returns through exposure to volatile digital assets and enhanced portfolio diversification beyond traditional stocks and bonds. They provide tax-advantaged growth similar to conventional retirement accounts but carry significant risks including price volatility, regulatory uncertainty, and potential security vulnerabilities such as hacking. Investors must weigh these benefits against the risks and consider factors like custodial services, fee structures, and the evolving legal landscape surrounding cryptocurrency investments.

Security Considerations for Retirement Investments

Retirement accounts traditionally offer regulated security measures such as FDIC insurance for cash holdings and strict oversight by financial authorities, reducing risks of fraud or loss. Crypto retirement accounts, while providing diversification and potential high returns, require investors to implement robust private key management and secure wallet storage to mitigate risks of hacking and theft. Comparing both, traditional accounts emphasize institutional security, whereas crypto accounts demand heightened personal security practices to protect retirement investments.

Tax Implications: Traditional vs Crypto Retirement Accounts

Traditional retirement accounts like IRAs and 401(k)s offer tax-deferred growth or tax-free withdrawals, depending on whether they are Roth or traditional types, which helps reduce taxable income during the contribution phase. Crypto retirement accounts combine the tax advantages of traditional plans with exposure to digital assets, but they may involve complex IRS reporting requirements and potential capital gains taxes upon asset conversion or sale. Investors should consider the regulatory landscape and tax treatment differences between stable, regulated investments and the volatile, evolving crypto space to optimize retirement savings.

Diversification Strategies for Retirement Savings

Diversification strategies for retirement savings emphasize balancing traditional retirement accounts, such as IRAs and 401(k)s, with crypto retirement accounts to mitigate risks and enhance growth potential. Crypto retirement accounts offer exposure to volatile digital assets like Bitcoin and Ethereum, which can complement the stability of stocks and bonds in traditional portfolios. Integrating both account types can create a more resilient portfolio by spreading investments across asset classes with differing risk-return profiles.

Future Trends in Retirement Investments

Retirement accounts are increasingly integrating digital assets, with crypto retirement accounts gaining traction due to blockchain's transparency and potential for high returns. Future trends indicate a growing adoption of decentralized finance (DeFi) protocols within retirement portfolios, allowing increased flexibility and diversification. Regulatory advancements and enhanced security measures will likely accelerate mainstream acceptance of crypto as a viable retirement investment option.

Making the Right Choice for Your Retirement Portfolio

Traditional retirement accounts such as 401(k)s and IRAs offer tax advantages and regulatory protections that support long-term growth and security, while crypto retirement accounts provide exposure to digital assets with higher growth potential but increased volatility and risk. Evaluating factors like risk tolerance, investment horizon, and diversification needs is crucial when integrating crypto into your retirement portfolio. Balancing established retirement vehicles with innovative crypto options can optimize wealth accumulation and hedge against market uncertainties.

Related Important Terms

Self-Directed IRA (SDIRA)

Self-Directed IRAs (SDIRAs) offer investors the flexibility to diversify retirement portfolios with alternative assets, including cryptocurrencies, which traditional retirement accounts typically exclude. Integrating crypto assets into SDIRAs enables tax-advantaged growth while maintaining control over investment choices, appealing to investors seeking exposure to digital currencies within regulated retirement frameworks.

Crypto 401(k)

Crypto 401(k) plans offer tax-advantaged retirement savings by combining traditional 401(k) benefits with diversified cryptocurrency investments like Bitcoin and Ethereum, providing potential for high long-term growth compared to conventional retirement accounts. These accounts use blockchain technology to ensure security and transparency while allowing investors to hedge against inflation and gain exposure to digital assets within a regulated framework.

Bitcoin Roth IRA

Bitcoin Roth IRAs offer tax-free growth and withdrawals, combining the benefits of traditional Roth IRAs with exposure to Bitcoin's high-growth potential. Unlike conventional retirement accounts limited to stocks and bonds, Bitcoin Roth IRAs provide portfolio diversification and inflation hedge through cryptocurrency investment.

Digital Asset Custodian

Retirement accounts managed by traditional financial institutions offer stability but often lack access to diversified digital assets, whereas crypto retirement accounts leverage digital asset custodians specializing in securing cryptocurrencies and ensuring regulatory compliance. Digital asset custodians provide enhanced security protocols, private key management, and transparent auditing, making them essential for investors seeking to include crypto in their retirement portfolios.

Crypto Annuities

Crypto annuities within retirement accounts offer innovative investment opportunities by combining blockchain transparency with tax-advantaged growth, providing potential for higher returns compared to traditional retirement accounts. These digital asset-based annuities leverage decentralized finance to secure predictable income streams while maintaining compliance with retirement account regulations.

Stablecoin Yield Account

Stablecoin yield accounts in crypto retirement funds offer higher interest rates compared to traditional retirement accounts by leveraging decentralized finance platforms with annual yields often exceeding 8%. These crypto-based accounts provide enhanced liquidity and growth potential while maintaining tax-advantaged status under specific self-directed IRAs, making them a compelling alternative for retirement investors seeking stable income streams.

Qualified Digital Asset Custody

Qualified Digital Asset Custody ensures enhanced security and regulatory compliance for crypto retirement accounts, offering investors in digital assets a trusted framework compared to traditional retirement accounts. This custody model mitigates risks associated with private key management while providing seamless integration into tax-advantaged retirement investment vehicles.

Altcoin Pension Fund

Retirement accounts traditionally offer tax advantages and stability through diversified portfolios, whereas crypto retirement accounts, such as the Altcoin Pension Fund, provide exposure to high-growth potential altcoins within a regulated tax-advantaged framework. The Altcoin Pension Fund leverages blockchain technology to enable retirement investments in emerging cryptocurrencies, aiming for enhanced returns compared to conventional pension funds.

DeFi Retirement Plan

DeFi retirement plans offer decentralized finance options for retirement accounts, enabling direct access to yield farming, staking, and liquidity pools for potentially higher returns compared to traditional retirement accounts like IRAs or 401(k)s that rely on conventional asset management. Crypto retirement accounts within DeFi ecosystems provide enhanced transparency, lower fees, and 24/7 market accessibility, attracting investors seeking innovative, blockchain-based retirement strategies.

Blockchain-Integrated IRA

Blockchain-integrated IRAs offer enhanced security and transparency by leveraging decentralized ledger technology, providing investors with a diversified portfolio that includes both traditional assets and cryptocurrencies. Retirement accounts incorporating blockchain enable real-time transaction verification and reduced fees, optimizing long-term growth potential compared to conventional IRAs.

Retirement Accounts vs Crypto Retirement Accounts for investment Infographic

moneydiff.com

moneydiff.com