Traditional brokerage offers personalized investment advice and direct communication with financial advisors, making it ideal for investors seeking tailored strategies and human expertise. Robo-advisors provide automated portfolio management using algorithms, often with lower fees and easy online access, appealing to cost-conscious and tech-savvy investors. Choosing between the two depends on your preference for customized guidance versus convenience and automation in managing investments.

Table of Comparison

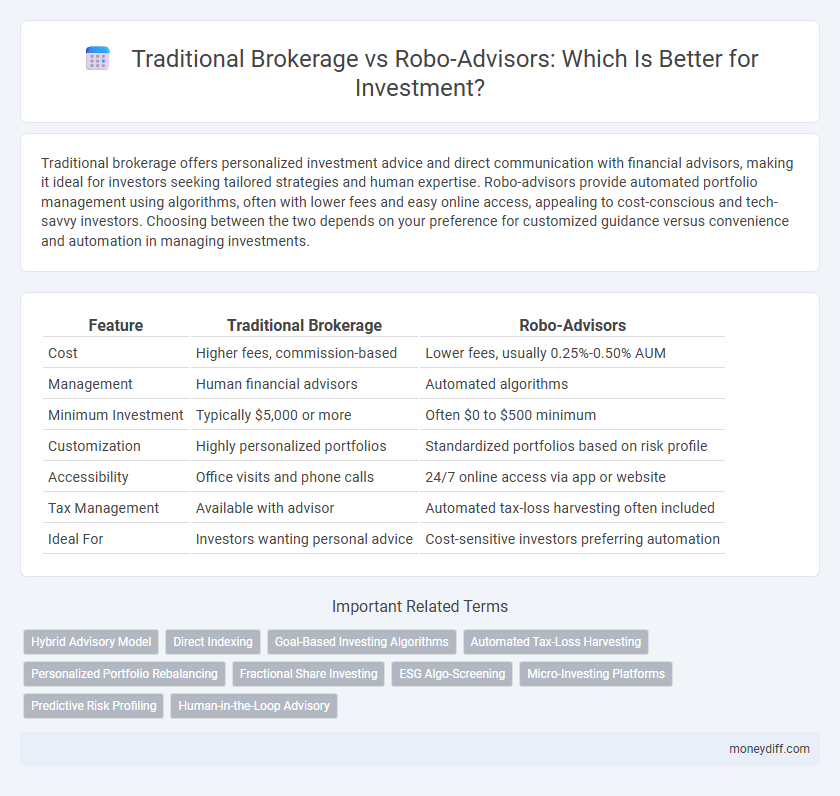

| Feature | Traditional Brokerage | Robo-Advisors |

|---|---|---|

| Cost | Higher fees, commission-based | Lower fees, usually 0.25%-0.50% AUM |

| Management | Human financial advisors | Automated algorithms |

| Minimum Investment | Typically $5,000 or more | Often $0 to $500 minimum |

| Customization | Highly personalized portfolios | Standardized portfolios based on risk profile |

| Accessibility | Office visits and phone calls | 24/7 online access via app or website |

| Tax Management | Available with advisor | Automated tax-loss harvesting often included |

| Ideal For | Investors wanting personal advice | Cost-sensitive investors preferring automation |

Introduction to Investment Platforms

Traditional brokerage firms offer personalized financial advice and access to a wide range of investment products through licensed human advisors, often involving higher fees and minimum account balances. Robo-advisors use algorithm-driven models to provide automated portfolio management and rebalancing at lower costs, making them accessible to beginners and those with smaller capital. Both platforms facilitate investment opportunities but differ significantly in cost structure, user experience, and level of customization.

What Are Traditional Brokerages?

Traditional brokerages are financial firms that provide personalized investment services through licensed brokers who offer expert advice and execute trades on behalf of clients. These brokerages typically charge commission fees or advisory fees based on assets under management, catering to investors seeking tailored strategies and direct human interaction. With decades of established market presence, traditional brokerages often provide a broad range of services including retirement planning, tax advice, and access to exclusive investment products.

Understanding Robo-Advisors

Robo-advisors utilize algorithm-driven financial planning services with minimal human intervention, offering cost-effective and automated portfolio management tailored to investors' risk tolerance and financial goals. By leveraging advanced technologies such as artificial intelligence and machine learning, robo-advisors efficiently rebalance portfolios and optimize asset allocation based on market trends and personal data analytics. These digital platforms provide 24/7 accessibility and real-time monitoring, making them attractive options for investors seeking low fees and convenience over traditional brokerage services.

Comparing Fees and Costs

Traditional brokerage firms typically charge higher fees, including commissions and account maintenance costs, which can reduce overall investment returns. Robo-advisors offer lower expense ratios and minimal or no commission fees by utilizing automated portfolio management, making them cost-effective for most investors. Comparing the fee structures reveals that robo-advisors provide a more affordable option for long-term, low-cost investment strategies, especially for small to medium account balances.

Accessibility and Ease of Use

Traditional brokerage firms often require higher minimum investments and involve more complex procedures, limiting accessibility for novice investors. Robo-advisors provide user-friendly platforms with low minimum investments and automated portfolio management, enhancing ease of use and accessibility. This democratization of investing allows broader participation regardless of financial expertise or capital available.

Customization and Investment Options

Traditional brokerage firms offer extensive customization and a broad range of investment options, including stocks, bonds, mutual funds, and alternative assets, catering to individual investor preferences and complex portfolio needs. Robo-advisors provide automated, algorithm-driven investment strategies with limited customization but typically focus on diversified portfolios of ETFs and index funds, appealing to investors seeking simplicity and low fees. Investors prioritizing tailored advice and diverse asset classes may prefer traditional brokers, while those valuing ease of use and cost-efficiency often opt for robo-advisors.

Human Advice vs Algorithmic Guidance

Traditional brokerage offers personalized human advice, providing tailored investment strategies based on individual goals and risk tolerance. Robo-advisors utilize algorithmic guidance to deliver automated, cost-effective portfolio management with real-time data analysis. Investors seeking customized emotional support and complex decision-making often prefer human advisors, while those prioritizing low fees and efficiency lean towards robo-advisory services.

Performance and Historical Returns

Traditional brokerage firms often deliver personalized investment strategies guided by experienced financial advisors, which can lead to higher returns during volatile markets due to active management and tailored portfolio adjustments. Robo-advisors leverage algorithm-driven models to optimize asset allocation with low fees, offering consistent historical returns aligned with market indices but may lack flexibility in dynamic market conditions. Studies show that while robo-advisors typically provide competitive performance in long-term passive investing, traditional brokers may outperform in periods requiring tactical intervention and market timing.

Security and Regulatory Oversight

Traditional brokerage firms are subject to stringent regulatory oversight by entities such as the SEC and FINRA, ensuring robust investor protection through established compliance frameworks and insured accounts via SIPC. Robo-advisors also operate under similar regulatory authorities but leverage automated algorithms, which may present unique cybersecurity risks that require continuous monitoring and advanced data encryption protocols. Both investment platforms prioritize security, but traditional brokerages often offer more personalized regulatory compliance support and fraud prevention measures.

Choosing the Right Platform for Your Goals

Traditional brokerage firms provide personalized financial advice and a broad range of investment options, ideal for investors seeking tailored strategies and human expertise. Robo-advisors offer automated portfolio management with lower fees, leveraging algorithms to optimize asset allocation based on investor goals and risk tolerance. Selecting the right platform depends on factors such as desired level of human interaction, investment complexity, cost sensitivity, and long-term financial objectives.

Related Important Terms

Hybrid Advisory Model

The Hybrid Advisory Model combines personalized guidance from traditional brokers with algorithm-driven strategies from robo-advisors, offering investors optimized portfolio management and cost efficiency. This approach leverages human expertise for complex decisions while utilizing automation for diversified asset allocation and real-time market analysis, enhancing investment outcomes.

Direct Indexing

Direct indexing through traditional brokerage offers personalized portfolio customization and tax-loss harvesting but often requires higher minimum investments and management fees. Robo-advisors provide automated direct indexing with lower costs and accessibility, leveraging AI algorithms to optimize asset allocation and tax efficiency for a broader range of investors.

Goal-Based Investing Algorithms

Traditional brokerage firms often rely on human advisors who tailor investment strategies based on clients' financial goals and risk tolerance, while robo-advisors utilize advanced goal-based investing algorithms to automatically allocate assets and rebalance portfolios. These algorithms analyze individual objectives, market conditions, and tax implications to optimize returns and reduce costs, providing efficient and personalized investment management.

Automated Tax-Loss Harvesting

Traditional brokerage firms typically rely on manual processes for tax-loss harvesting, limiting the frequency and precision of these strategies, while robo-advisors use automated algorithms to continuously monitor portfolios and trigger tax-loss harvesting in real-time, maximizing tax efficiency. Automated tax-loss harvesting through robo-advisors can enhance after-tax returns by systematically offsetting capital gains with realized losses, a feature often unavailable or less efficient in conventional brokerage accounts.

Personalized Portfolio Rebalancing

Traditional brokerage services offer personalized portfolio rebalancing through dedicated financial advisors who tailor adjustments based on individual risk tolerance, goals, and market conditions. Robo-advisors utilize advanced algorithms to automate portfolio rebalancing at regular intervals, optimizing tax efficiency and maintaining target asset allocation with minimal human intervention.

Fractional Share Investing

Traditional brokerage firms typically require investors to buy whole shares, limiting portfolio diversification for those with smaller capital, whereas robo-advisors commonly offer fractional share investing, enabling precise allocation of funds across diverse assets. Fractional share investing via robo-advisors enhances portfolio flexibility, lowers entry barriers, and allows consistent reinvestment of dividends, optimizing long-term investment growth.

ESG Algo-Screening

Traditional brokerage firms typically offer personalized ESG investing strategies through human advisors who integrate qualitative insights, while robo-advisors leverage advanced ESG algorithmic screening to provide scalable, data-driven portfolio management with real-time sustainability metrics. ESG-focused robo-advisors use machine learning and big data analytics to evaluate environmental, social, and governance factors systematically, enabling more consistent and transparent impact investing aligned with investor values.

Micro-Investing Platforms

Traditional brokerage firms offer personalized investment advice and a wide range of financial products but often require higher account minimums and charge substantial fees, making them less accessible for small investors. Micro-investing platforms, integrated with robo-advisors, enable users to invest low-dollar amounts automatically with minimal fees, leveraging algorithm-driven portfolio management to optimize diversification and returns for novice or budget-conscious investors.

Predictive Risk Profiling

Traditional brokerage firms rely on personalized consultations and historical data to create predictive risk profiles, while robo-advisors leverage advanced algorithms and real-time analytics to continuously update and optimize investment strategies. Robo-advisors offer scalable, data-driven predictive risk profiling that adjusts dynamically to market conditions and investor behavior, providing a more precise and adaptive investment approach.

Human-in-the-Loop Advisory

Traditional brokerage firms offer personalized investment strategies through human advisors who provide tailored guidance and nuanced market analysis, catering to complex financial goals and risk tolerances. Robo-advisors leverage algorithms and automation to deliver cost-effective portfolio management but may lack the adaptive decision-making and emotional insight inherent in human-in-the-loop advisory services.

Traditional Brokerage vs Robo-Advisors for investment Infographic

moneydiff.com

moneydiff.com