Index funds offer broad market exposure with low fees, making them ideal for investors seeking passive, diversified growth. ESG funds prioritize environmental, social, and governance criteria, appealing to those who want to align investments with personal values while potentially managing risk. Comparing index funds and ESG funds involves balancing cost-efficiency and broad diversification against ethical impact and sustainability goals.

Table of Comparison

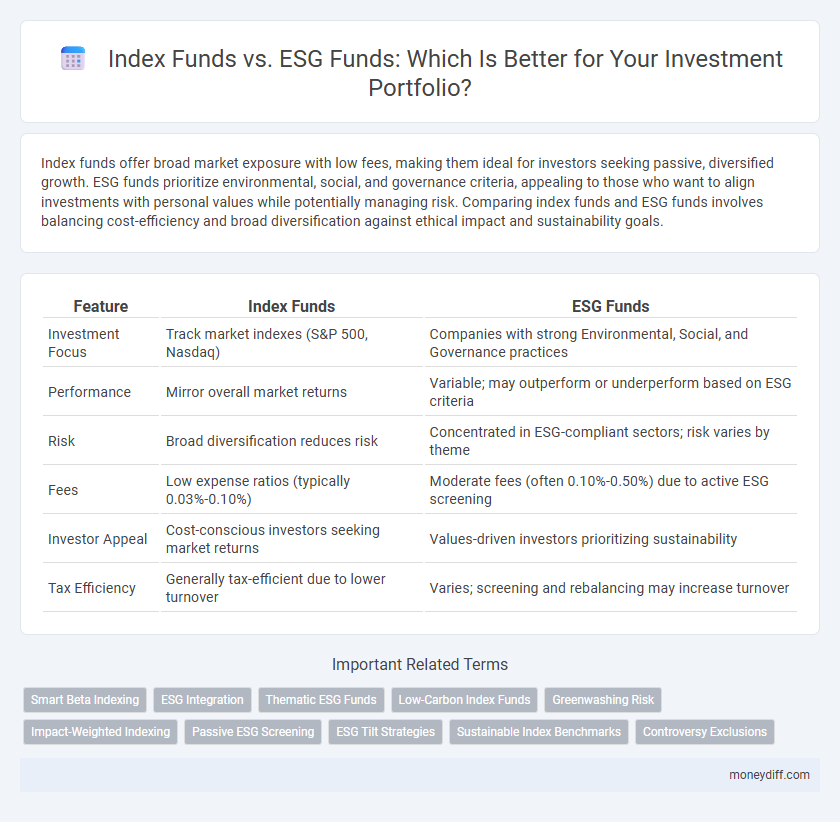

| Feature | Index Funds | ESG Funds |

|---|---|---|

| Investment Focus | Track market indexes (S&P 500, Nasdaq) | Companies with strong Environmental, Social, and Governance practices |

| Performance | Mirror overall market returns | Variable; may outperform or underperform based on ESG criteria |

| Risk | Broad diversification reduces risk | Concentrated in ESG-compliant sectors; risk varies by theme |

| Fees | Low expense ratios (typically 0.03%-0.10%) | Moderate fees (often 0.10%-0.50%) due to active ESG screening |

| Investor Appeal | Cost-conscious investors seeking market returns | Values-driven investors prioritizing sustainability |

| Tax Efficiency | Generally tax-efficient due to lower turnover | Varies; screening and rebalancing may increase turnover |

Introduction to Index Funds and ESG Funds

Index funds track a specific market index, offering broad market exposure, low operating costs, and passive management, making them a popular choice for long-term investment growth. ESG funds integrate environmental, social, and governance criteria into their investment decisions, appealing to socially conscious investors seeking to align portfolios with ethical values while pursuing financial returns. Both investment options provide distinct approaches, with index funds prioritizing market performance and ESG funds emphasizing sustainability and corporate responsibility.

Key Differences Between Index Funds and ESG Funds

Index funds replicate the performance of a market benchmark by holding a broad range of assets, typically offering low fees and diversified exposure. ESG funds integrate environmental, social, and governance criteria into their investment selection, prioritizing sustainable and ethical companies, which may result in different risk and return profiles compared to traditional index funds. The key differences lie in investment strategy, portfolio composition, and impact objectives, with index funds focusing on market returns and ESG funds emphasizing responsible investment principles.

Performance Comparison: Index Funds vs ESG Funds

Index funds typically offer broad market exposure with lower fees, resulting in historically consistent, stable returns that closely track benchmark indices. ESG funds integrate environmental, social, and governance criteria, which may lead to variable performance influenced by sector biases and ethical constraints, sometimes outperforming traditional indexes during market downturns. Recent studies indicate that ESG funds can deliver competitive returns compared to index funds but may exhibit higher volatility depending on the underlying asset selection and fund management strategies.

Risk Factors in Index and ESG Investments

Index funds typically offer broad market exposure with inherently lower risk due to diversification across numerous sectors and companies, minimizing the impact of any single asset's poor performance. ESG funds, while focusing on companies with strong environmental, social, and governance practices, may face higher volatility and sector concentration risks as they exclude industries that do not meet sustainability criteria. Investors should consider that ESG funds can exhibit increased risk related to regulatory changes and evolving sustainability standards, potentially affecting portfolio stability compared to traditional index funds.

Costs and Fees: Which Fund Type Is More Affordable?

Index funds typically offer lower expense ratios, averaging around 0.03% to 0.10%, making them more affordable for cost-conscious investors compared to ESG funds, which often range from 0.15% to 0.50% due to additional research and screening processes. The lower fees in index funds stem from their passive management style, tracking broad market indices without frequent trading. Despite higher costs, ESG funds attract investors willing to pay a premium for socially responsible investment criteria, which may affect long-term net returns differently than traditional index funds.

Aligning Investments with Personal Values

Index funds offer broad market exposure with low fees but may include companies misaligned with personal ethics, while ESG funds prioritize environmental, social, and governance criteria to reflect investors' values in their portfolios. ESG investing integrates non-financial factors into decision-making, enabling alignment of capital with sustainability goals and social responsibility. Choosing between these options depends on balancing financial performance objectives with the desire for ethical impact and long-term value creation.

ESG Fund Ratings and Criteria Explained

ESG fund ratings assess environmental, social, and governance performance by analyzing factors such as carbon emissions, labor practices, and board diversity, providing investors with insights into sustainability and ethical impact. Unlike traditional index funds, ESG funds prioritize companies meeting stringent criteria on climate risk, social responsibility, and corporate governance standards, which can influence long-term financial returns and risk mitigation. These ratings, compiled by agencies like MSCI and Sustainalytics, guide investment decisions by quantifying a company's commitment to sustainable practices and ethical operations.

Long-Term Growth Potential: A Comparative Analysis

Index funds typically offer broad market exposure with lower expense ratios, driving steady long-term growth through diversified asset allocation. ESG funds prioritize companies with strong environmental, social, and governance practices, which may lead to sustainable returns and reduce long-term risks but often at slightly higher fees. Historical data shows that while index funds provide consistent growth aligned with market averages, ESG funds can outperform in sectors prioritizing sustainability, appealing to investors seeking both financial returns and ethical impact over the long term.

Diversification Strategies: Index Funds vs ESG Funds

Index funds offer broad market diversification by tracking large-cap or total-market indices, reducing individual security risk through extensive asset exposure. ESG funds, while incorporating environmental, social, and governance criteria, typically feature less diversification due to selective screening and exclusion of certain industries or companies. Investors seeking diversified portfolios must balance the comprehensive coverage of index funds against the values-driven, yet narrower, scope of ESG funds.

Choosing the Right Fund for Your Financial Goals

Index funds offer broad market exposure with low fees, making them ideal for investors seeking steady, long-term growth aligned with overall market performance. ESG funds prioritize environmental, social, and governance criteria, appealing to investors who want to align their investments with ethical values while potentially benefiting from sustainable business practices. Selecting the right fund depends on your financial goals, risk tolerance, and commitment to sustainability principles.

Related Important Terms

Smart Beta Indexing

Smart Beta Indexing combines passive and active investment strategies by weighting index components based on factors such as volatility, momentum, or value instead of market capitalization, offering a potential edge over traditional Index Funds and pure ESG Funds. Incorporating ESG criteria into Smart Beta Indexing allows investors to target sustainable investments while seeking enhanced risk-adjusted returns compared to conventional approaches.

ESG Integration

ESG funds incorporate environmental, social, and governance criteria directly into their investment selection, aiming to promote sustainable practices while seeking competitive returns. Index funds offer broad market exposure with low fees but typically lack the explicit ESG integration that aligns investments with ethical and sustainable values.

Thematic ESG Funds

Thematic ESG funds focus on specific environmental, social, and governance issues, targeting sectors like clean energy or sustainable agriculture, offering investors a way to support impactful initiatives while seeking financial returns. Index funds provide broad market exposure with lower fees and diversification, but may lack the targeted ethical and thematic focus that thematic ESG funds deliver for value-driven investment strategies.

Low-Carbon Index Funds

Low-carbon index funds offer a strategic investment opportunity by tracking portfolios that emphasize companies with reduced carbon emissions, aligning financial growth with sustainable environmental impact. ESG funds also consider environmental, social, and governance criteria but may include broader factors beyond carbon footprint, whereas low-carbon index funds specifically target firms demonstrating measurable low-carbon practices, optimizing both ethical investment and potential for long-term returns.

Greenwashing Risk

Index funds offer broad market exposure with lower fees but carry a higher risk of greenwashing compared to ESG funds, which integrate environmental, social, and governance criteria to minimize exposure to companies with misleading sustainability claims. Investors prioritizing authentic sustainable impact should carefully evaluate ESG funds' methodologies and transparency to mitigate greenwashing risks effectively.

Impact-Weighted Indexing

Impact-Weighted Indexing enhances traditional index funds by integrating environmental, social, and governance (ESG) metrics into performance evaluations, allowing investors to measure the social and environmental impact alongside financial returns. This approach positions ESG funds as more comprehensive investment vehicles, offering both impact-driven outcomes and competitive market performance compared to standard index funds.

Passive ESG Screening

Index funds offer diversified market exposure through passive investment strategies, while ESG funds apply passive ESG screening to exclude or weight companies based on environmental, social, and governance criteria, aligning investments with ethical standards without active management. Passive ESG screening in ESG funds enhances portfolios by integrating sustainability metrics to mitigate risks and capitalize on ethical growth opportunities.

ESG Tilt Strategies

ESG tilt strategies integrate environmental, social, and governance criteria into traditional index fund portfolios to enhance sustainable investing while aiming for competitive market returns. By selectively overweighting companies with strong ESG performance, these strategies balance financial goals with positive social impact, appealing to investors seeking both growth and ethical considerations.

Sustainable Index Benchmarks

Sustainable index benchmarks in ESG funds integrate environmental, social, and governance criteria to screen and select companies, promoting responsible investment while aiming for competitive returns. Index funds track broad market indices without explicit sustainability criteria, offering diversification but less alignment with investors' ethical or environmental values.

Controversy Exclusions

Index funds typically include broad market exposure without excluding companies based on ethical criteria, whereas ESG funds actively exclude controversial industries such as tobacco, fossil fuels, and weapons manufacturing to align with environmental, social, and governance principles. This exclusionary approach in ESG funds often sparks debate over potential trade-offs between financial returns and social responsibility.

Index Funds vs ESG Funds for investment. Infographic

moneydiff.com

moneydiff.com