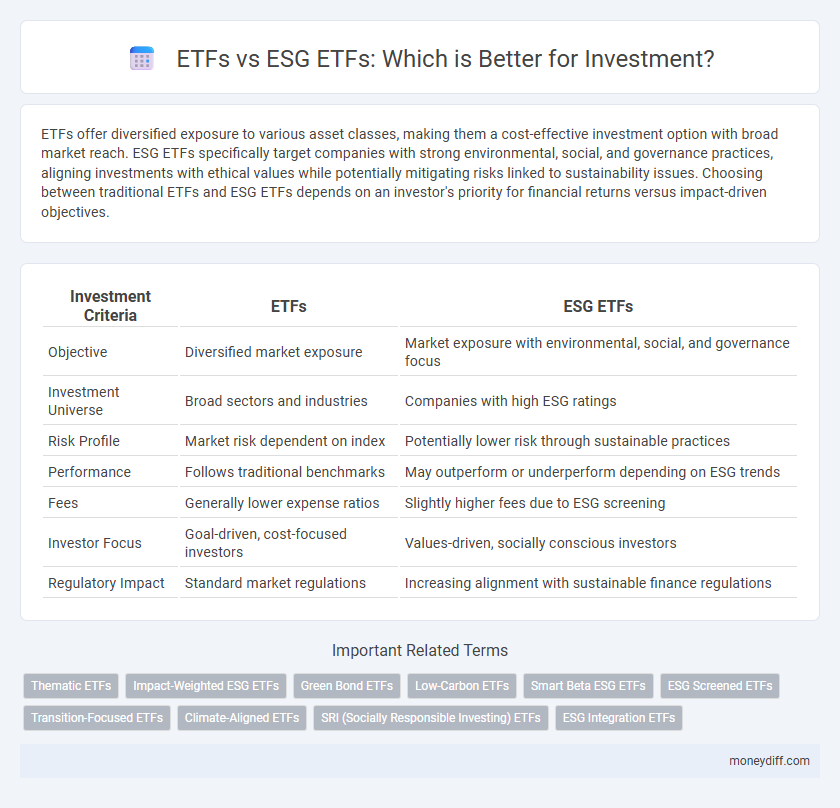

ETFs offer diversified exposure to various asset classes, making them a cost-effective investment option with broad market reach. ESG ETFs specifically target companies with strong environmental, social, and governance practices, aligning investments with ethical values while potentially mitigating risks linked to sustainability issues. Choosing between traditional ETFs and ESG ETFs depends on an investor's priority for financial returns versus impact-driven objectives.

Table of Comparison

| Investment Criteria | ETFs | ESG ETFs |

|---|---|---|

| Objective | Diversified market exposure | Market exposure with environmental, social, and governance focus |

| Investment Universe | Broad sectors and industries | Companies with high ESG ratings |

| Risk Profile | Market risk dependent on index | Potentially lower risk through sustainable practices |

| Performance | Follows traditional benchmarks | May outperform or underperform depending on ESG trends |

| Fees | Generally lower expense ratios | Slightly higher fees due to ESG screening |

| Investor Focus | Goal-driven, cost-focused investors | Values-driven, socially conscious investors |

| Regulatory Impact | Standard market regulations | Increasing alignment with sustainable finance regulations |

Understanding ETFs: A Foundation for Investors

Exchange-Traded Funds (ETFs) offer diversified exposure to various asset classes, providing investors with liquidity and cost-efficiency. ESG ETFs integrate environmental, social, and governance criteria into traditional ETF structures, aligning investment choices with sustainability values. Understanding the structural differences and performance implications between standard ETFs and ESG ETFs is crucial for informed investment decisions.

What Are ESG ETFs? Key Features and Principles

ESG ETFs are exchange-traded funds that invest in companies meeting environmental, social, and governance criteria, integrating sustainable practices into portfolio selection. Key features include rigorous screening processes, emphasis on ethical business conduct, and alignment with investor values focused on long-term sustainability and risk management. These funds prioritize transparency, active shareholder engagement, and adherence to global ESG standards, making them distinct from traditional ETFs that focus primarily on financial performance.

Core Differences: ETFs vs. ESG ETFs

ETFs (Exchange-Traded Funds) provide diversified exposure to a broad market or sector, optimizing cost efficiency and liquidity for investors. ESG ETFs specifically integrate Environmental, Social, and Governance criteria, selecting companies based on sustainable and ethical practices, which can impact portfolio risk and returns differently than traditional ETFs. The core difference lies in the investment mandate, with ESG ETFs prioritizing responsible investing alongside financial performance.

Performance Comparison: Traditional ETFs vs. ESG ETFs

Traditional ETFs often outperform ESG ETFs in short-term returns due to broader market exposure and fewer investment constraints. ESG ETFs prioritize environmental, social, and governance criteria, which can limit diversification but may enhance long-term risk-adjusted performance. Recent studies show ESG ETFs tend to exhibit lower volatility and better resilience during market downturns compared to traditional ETFs.

Risk and Return Profiles: Which Is Better for You?

ETFs generally offer broad market exposure with diversified risk and stable returns, while ESG ETFs focus on companies with strong environmental, social, and governance practices, potentially enhancing long-term sustainability but sometimes leading to higher volatility due to sector concentration. Risk profiles of ESG ETFs may vary depending on the specific ESG criteria and industries targeted, with returns closely linked to investor demand for socially responsible investments. Assessing personal risk tolerance and investment goals is crucial when choosing between traditional ETFs and ESG ETFs, as each presents distinct opportunities and challenges for portfolio performance.

Costs and Fees: Analyzing Expense Ratios

Expense ratios for traditional ETFs typically range from 0.05% to 0.25%, making them cost-effective options for broad market exposure. ESG ETFs often carry higher expense ratios, averaging between 0.20% and 0.50%, due to the additional research and screening involved in aligning with environmental, social, and governance criteria. Investors should weigh these cost differences against their commitment to sustainable investing and potential long-term benefits.

ESG Screening: How ESG ETFs Select Companies

ESG ETFs use rigorous screening processes based on environmental, social, and governance criteria to select companies that meet specific sustainability and ethical standards. These funds incorporate data from ESG ratings agencies, corporate disclosures, and third-party audits to exclude firms involved in activities such as fossil fuels, tobacco, or poor labor practices. Traditional ETFs focus primarily on market capitalization and sector representation, whereas ESG ETFs prioritize companies demonstrating strong ESG performance to align investments with sustainable and responsible practices.

Impact Investing: Aligning Values with Portfolios

ESG ETFs integrate environmental, social, and governance criteria into traditional ETF structures, enabling investors to align portfolios with ethical values while pursuing financial returns. By selecting ESG ETFs, impact investors target companies with sustainable practices, fostering positive social and environmental outcomes alongside market performance. This alignment of values and investments enhances portfolio impact without sacrificing diversification or liquidity typically offered by standard ETFs.

Diversification Strategies Using ETFs and ESG ETFs

ETFs offer broad market exposure and sector diversification, enabling investors to spread risk across various asset classes efficiently. ESG ETFs integrate environmental, social, and governance criteria, providing diversification while aligning investments with sustainable and ethical standards. Combining ETFs with ESG ETFs in a portfolio enhances diversification by balancing traditional financial performance with values-driven investment goals.

Choosing the Right ETF: Factors Every Investor Should Consider

Choosing the right ETF involves evaluating expense ratios, liquidity, and historical performance to align with investment goals. ESG ETFs add an extra layer of consideration by integrating environmental, social, and governance criteria, appealing to investors prioritizing sustainable and ethical practices. Assessing the impact of ESG factors on risk-adjusted returns and portfolio diversification is crucial for making informed investment decisions.

Related Important Terms

Thematic ETFs

Thematic ETFs target specific sectors or trends, offering focused exposure to areas like technology, healthcare, or clean energy, while ESG ETFs integrate environmental, social, and governance criteria within these themes to align investments with sustainability goals. Choosing between traditional Thematic ETFs and ESG Thematic ETFs depends on investor priorities for impact alongside potential growth in specialized market niches.

Impact-Weighted ESG ETFs

Impact-weighted ESG ETFs integrate environmental, social, and governance criteria with financial metrics to measure real-world impact, offering investors a dual focus on returns and sustainability. These funds outperform traditional ETFs by aligning portfolio performance with measurable social and environmental outcomes, attracting capital that seeks both impact and profitability.

Green Bond ETFs

Green Bond ETFs offer focused exposure to environmentally sustainable projects by investing in fixed-income securities that fund renewable energy, clean water, and pollution reduction initiatives, aligning financial returns with positive environmental impact. Traditional ETFs provide broad market diversification but may lack the targeted environmental criteria embedded in Green Bond ETFs, making the latter a strategic choice for investors prioritizing ESG integration and climate-conscious portfolios.

Low-Carbon ETFs

Low-carbon ETFs represent a growing subset of ESG ETFs, focusing specifically on companies with reduced carbon footprints to align investment portfolios with climate-conscious goals. These ETFs often deliver competitive returns by targeting firms adopting sustainable practices, providing investors an opportunity to support environmental stewardship while benefiting from diversified market exposure.

Smart Beta ESG ETFs

Smart Beta ESG ETFs combine factor-based investment strategies with environmental, social, and governance criteria, offering a targeted approach to sustainable investing that aims to enhance returns while managing risk. These ETFs provide diversified exposure to companies demonstrating strong ESG performance, leveraging smart beta methodologies to optimize factor premiums such as value, momentum, and quality.

ESG Screened ETFs

ESG screened ETFs integrate environmental, social, and governance criteria to filter companies, ensuring investments align with sustainable and ethical standards while maintaining broad market exposure typical of traditional ETFs. These funds often attract investors seeking to balance financial performance with responsible investing principles, leveraging ESG factors to potentially mitigate risks and enhance long-term returns.

Transition-Focused ETFs

Transition-focused ETFs prioritize companies advancing sustainable energy, carbon reduction, and environmental innovations, offering investors targeted exposure to businesses driving the low-carbon economy shift. These ETFs balance financial performance with ESG criteria, integrating traditional investment metrics and environmental impact data to support long-term, responsible growth.

Climate-Aligned ETFs

Climate-aligned ETFs focus on companies with strong environmental performance and greenhouse gas reduction goals, appealing to investors prioritizing sustainable growth alongside financial returns. Conventional ETFs may offer broader market exposure but often lack the rigorous environmental, social, and governance (ESG) criteria that define climate-aligned investment strategies.

SRI (Socially Responsible Investing) ETFs

SRI ETFs prioritize investments in companies with strong environmental, social, and governance (ESG) criteria, offering investors a way to align portfolios with ethical values while pursuing competitive returns. Compared to traditional ETFs, SRI ETFs provide targeted exposure to socially responsible sectors, enhancing risk management by integrating ESG factors into investment decisions.

ESG Integration ETFs

ESG Integration ETFs incorporate environmental, social, and governance criteria into traditional investment strategies, offering a balanced approach that aligns with sustainable investing goals while maintaining market diversification. These ETFs leverage advanced screening methods and active management to mitigate risks associated with non-ESG compliant practices, providing investors with exposure to companies demonstrating strong ESG performance alongside financial returns.

ETFs vs ESG ETFs for Investment. Infographic

moneydiff.com

moneydiff.com